Market brief 04/01/2023

VIETNAM STOCK MARKET

1,046.35

1D 0.23%

YTD 3.90%

1,050.15

1D 0.28%

YTD 4.47%

213.06

1D 0.24%

YTD 3.77%

72.76

1D 0.50%

YTD 1.55%

393.07

1D 0.00%

YTD 0.00%

12,198.69

1D 15.77%

YTD 41.58%

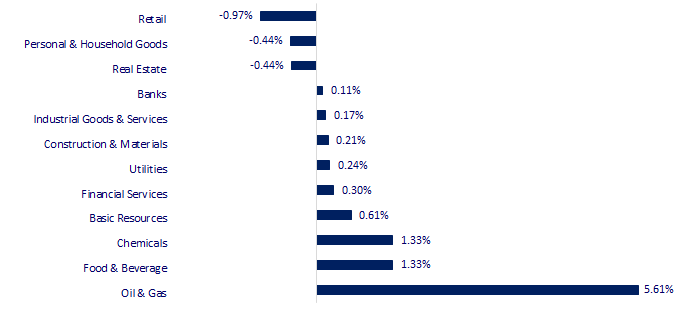

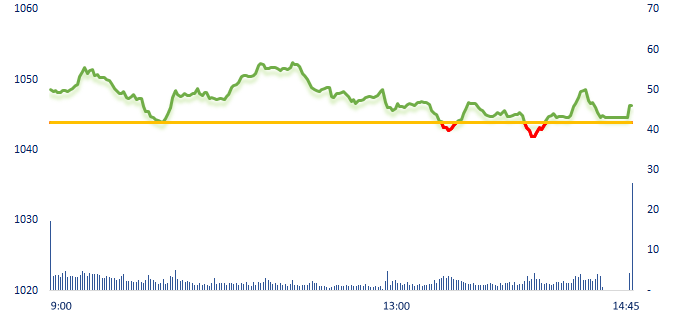

The market was quieter after a strong breakout session. The divergence covered the whole market so VN-Index traded in a narrow range. Oil and gas stocks became the focus of the session when simultaneously gained strongly. PVC, PLX, PVB were pulled to the full range, PVD, BSR, and PVS also remained in green with impressive gain.

ETF & DERIVATIVES

17,900

1D 1.13%

YTD 3.29%

12,400

1D 0.49%

YTD 4.03%

12,830

1D 2.07%

YTD 2.80%

14,880

1D 5.46%

YTD 5.91%

14,900

1D 2.76%

YTD 3.83%

22,950

1D 0.57%

YTD 2.46%

13,420

1D 0.22%

YTD 3.63%

1,020

1D 0.44%

YTD 0.00%

1,028

1D 0.00%

YTD 0.00%

1,039

1D -0.51%

YTD 0.00%

1,043

1D -0.27%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

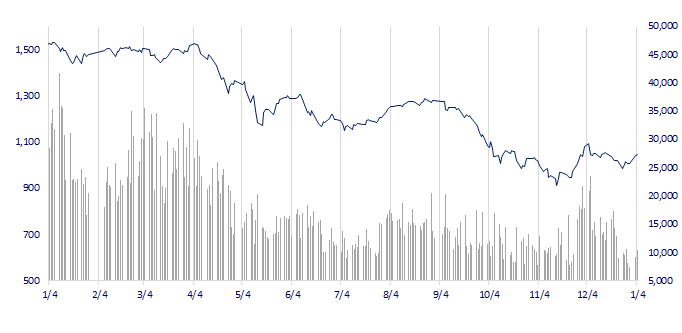

VNINDEX (12M)

GLOBAL MARKET

25,716.86

1D -1.45%

YTD -1.45%

3,123.52

1D 0.22%

YTD 1.11%

2,255.98

1D 1.68%

YTD 0.88%

20,793.11

1D 3.22%

YTD 5.11%

3,242.46

1D -0.10%

YTD -0.27%

1,674.17

1D -0.29%

YTD 0.23%

80.56

1D -1.97%

YTD -6.23%

1,866.80

1D 1.13%

YTD 2.22%

Asian markets mostly gained, especially China and Hong Kong markets due to the positive expectations of investors in the near future. Alibaba shares skyrocketed after the announcement of approval of a $1.5 billion capital increase from Ant Group.

VIETNAM ECONOMY

5.07%

1D (bps) 7

YTD (bps) 10

7.40%

4.72%

1D (bps) -6

YTD (bps) -7

4.83%

1D (bps) -6

YTD (bps) -7

23,673

1D (%) -0.07%

YTD (%) -0.37%

25,713

1D (%) 0.52%

YTD (%) 0.21%

3,487

1D (%) 0.40%

YTD (%) 0.06%

The domestic gold price this morning (January 4) increased slightly, the brands in turn adjusted to increase from 100,000 to 200,000 VND compared to the previous day. Meanwhile, the USD/VND selling rate decreased slightly compared to yesterday.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SCMP: Vietnam has become the most potential center of attracting foreign capital in the region;

- About VND170,000 billion will be pumped into the economy by banks in the last 10 days of 2022;

- Mong Cai is ready to completely restore import and export activities;

- Most major Wall Street banks forecast US recession, Fed pivot in 2023;

- Global trade remains fragile in 2023;

- Chevron will ship 500,000 barrels of oil from Venezuela to the US.

VN30

BANK

82,800

1D 0.24%

5D 3.50%

Buy Vol. 1,304,848

Sell Vol. 1,466,474

40,800

1D -0.97%

5D -2.63%

Buy Vol. 3,235,458

Sell Vol. 6,472,913

28,500

1D 1.79%

5D 4.97%

Buy Vol. 9,302,905

Sell Vol. 13,785,335

27,300

1D -0.55%

5D 4.40%

Buy Vol. 5,613,330

Sell Vol. 7,417,796

18,900

1D 2.16%

5D 4.13%

Buy Vol. 74,453,813

Sell Vol. 73,380,205

17,950

1D -0.28%

5D 2.87%

Buy Vol. 11,941,370

Sell Vol. 19,101,032

16,350

1D -0.91%

5D 0.93%

Buy Vol. 2,568,295

Sell Vol. 3,815,916

22,000

1D 0.46%

5D 2.80%

Buy Vol. 6,898,722

Sell Vol. 7,870,582

23,300

1D -0.85%

5D 1.75%

Buy Vol. 35,285,000

Sell Vol. 41,872,447

19,900

1D 0.00%

5D 4.74%

Buy Vol. 4,951,288

Sell Vol. 5,779,378

22,650

1D -0.22%

5D 2.95%

Buy Vol. 3,022,081

Sell Vol. 3,784,223

VCB: Mr. Nguyen Thanh Tung - Deputy General Director of Vietcombank said that the bank will reduce the lending interest rate by 0.5%/year for all loans of individual and corporate customers. existing and new outstanding loans at Vietcombank. The discount period is from January 1 to the end of April 30.

REAL ESTATE

14,000

1D -4.44%

5D -2.44%

Buy Vol. 27,029,523

Sell Vol. 36,774,412

27,850

1D -0.54%

5D 2.96%

Buy Vol. 2,654,324

Sell Vol. 3,052,077

15,000

1D 3.09%

5D 11.52%

Buy Vol. 24,061,628

Sell Vol. 21,343,512

NVL: NovaGroup has just announced to sell nearly 98 mil shares of NVL out of a total of 150 mil registered units from November 30 to December 29, thereby reducing its ownership rate to 29.4%.

OIL & GAS

105,000

1D 0.00%

5D 1.94%

Buy Vol. 492,859

Sell Vol. 480,978

11,000

1D -0.45%

5D 3.29%

Buy Vol. 19,669,864

Sell Vol. 13,465,493

35,250

1D 6.98%

5D 11.90%

Buy Vol. 3,751,453

Sell Vol. 2,131,248

PLX: As of January 1, Petrolimex's petrol price stabilization fund has increased from VND1,766 billion (adjusted on December 21, 2022) to VND1,989 billion.

VINGROUP

56,000

1D -1.41%

5D 4.67%

Buy Vol. 3,223,324

Sell Vol. 3,680,669

49,000

1D -0.81%

5D 2.73%

Buy Vol. 1,627,297

Sell Vol. 2,637,631

28,600

1D 1.78%

5D 6.32%

Buy Vol. 3,781,109

Sell Vol. 4,377,213

VIC: Vingroup - Techcombank only arranged VND16,000 billion for Gia Nghia - Chon Thanh expressway - a project with a total expected investment of nearly VND30,000 billion.

FOOD & BEVERAGE

79,300

1D 1.02%

5D 2.99%

Buy Vol. 1,921,866

Sell Vol. 2,538,145

99,300

1D 3.44%

5D 6.77%

Buy Vol. 854,346

Sell Vol. 942,948

171,500

1D 1.48%

5D -2.83%

Buy Vol. 339,692

Sell Vol. 199,468

MSN: Masan High-Tech Materials will expand its recycling capacity, especially in e-waste recycling, bringing the original minerals back into the production cycle.

OTHERS

47,700

1D 0.00%

5D 2.14%

Buy Vol. 1,028,177

Sell Vol. 1,163,526

110,400

1D -1.16%

5D -0.09%

Buy Vol. 419,234

Sell Vol. 310,132

80,000

1D 0.00%

5D 4.30%

Buy Vol. 1,264,996

Sell Vol. 1,986,078

43,500

1D -1.02%

5D 1.16%

Buy Vol. 3,085,806

Sell Vol. 4,098,383

14,850

1D 1.71%

5D 4.58%

Buy Vol. 3,846,252

Sell Vol. 4,498,749

19,000

1D 0.53%

5D 4.68%

Buy Vol. 21,061,353

Sell Vol. 24,571,804

19,400

1D 0.78%

5D 6.59%

Buy Vol. 34,934,926

Sell Vol. 43,510,351

HPG: After the success in producing steel coils for car tires, Hoa Phat Dung Quat Steel recently continued to test and successfully produce British standard DBIC coiled rebar.

Market by numbers

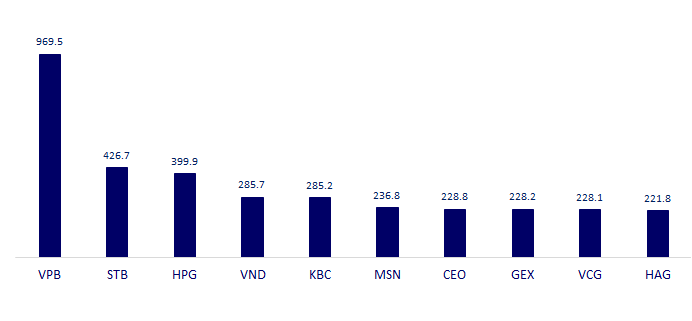

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

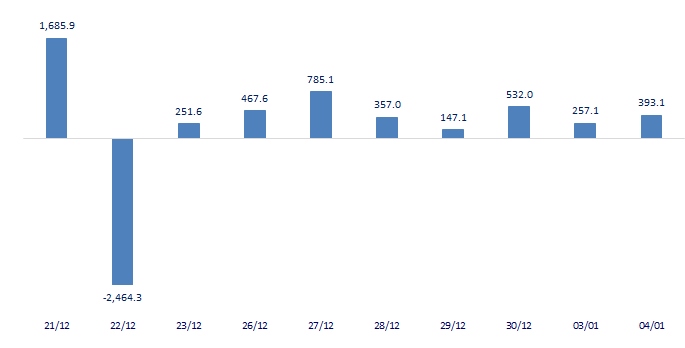

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

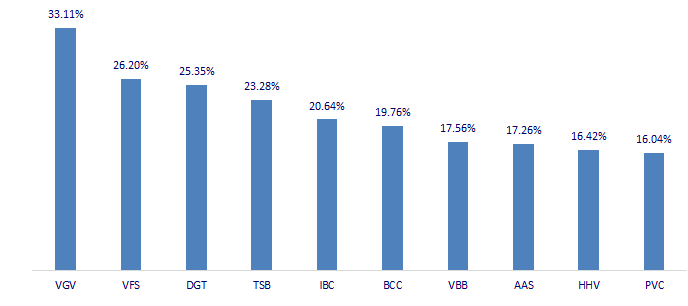

TOP INCREASES 3 CONSECUTIVE SESSIONS

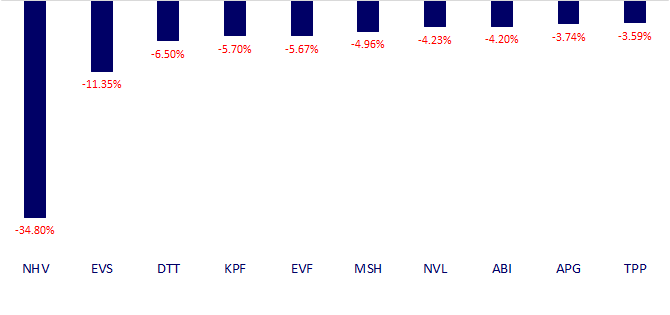

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.