Market brief 16/01/2023

VIETNAM STOCK MARKET

1,066.68

1D 0.61%

YTD 5.92%

1,075.71

1D 0.55%

YTD 7.02%

210.88

1D -0.18%

YTD 2.71%

72.22

1D 0.18%

YTD 0.80%

226.76

1D 0.00%

YTD 0.00%

10,430.26

1D -23.85%

YTD 21.06%

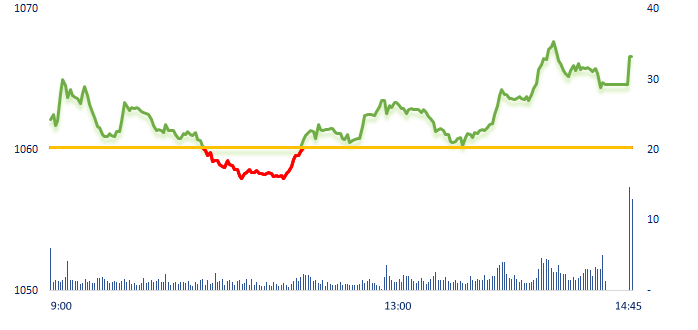

The market struggled around the reference level in the morning when the demand was quite weak. The banking sector with the green color appeared in some stocks, helping the market avoid a sharp decline. The market only prospered after 1:30pm with a boom in banking stocks, typically BID, EIB, ACB, and steel stocks like HPG, NKG and HSG.

ETF & DERIVATIVES

18,250

1D -0.60%

YTD 5.31%

12,680

1D 0.24%

YTD 6.38%

13,260

1D 0.99%

YTD 6.25%

15,010

1D 1.21%

YTD 6.83%

15,480

1D 1.04%

YTD 7.87%

23,280

1D 0.87%

YTD 3.93%

13,910

1D 1.83%

YTD 7.41%

1,053

1D 1.07%

YTD 0.00%

1,063

1D 0.43%

YTD 0.00%

1,072

1D 0.63%

YTD 0.00%

1,075

1D 0.57%

YTD 0.00%

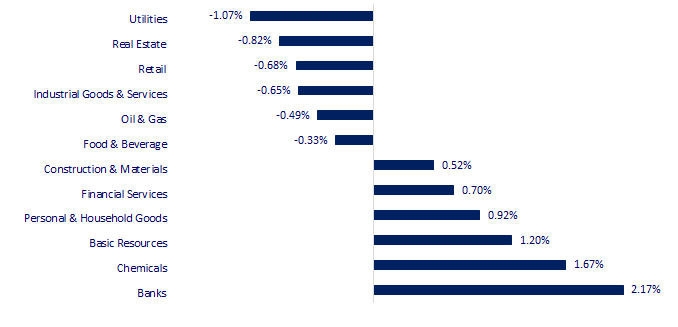

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

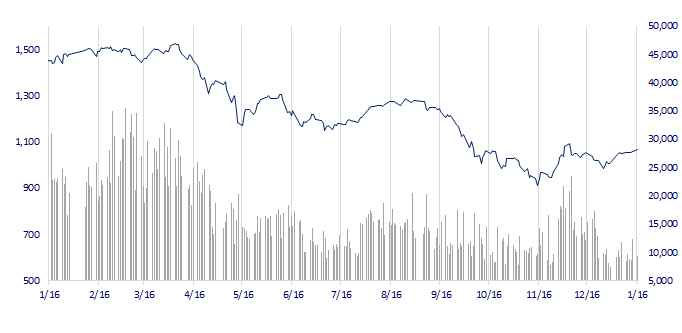

VNINDEX (12M)

GLOBAL MARKET

25,822.32

1D -1.14%

YTD -1.04%

3,227.59

1D 1.01%

YTD 4.48%

2,399.86

1D 0.58%

YTD 7.31%

21,746.72

1D 0.04%

YTD 9.94%

3,283.60

1D -0.31%

YTD 0.99%

1,684.86

1D 0.19%

YTD 0.87%

85.00

1D 0.07%

YTD -1.06%

1,920.00

1D -0.22%

YTD 5.14%

Asian markets mostly gained in the first session of the week after positive developments from the US market. The Chinese market continued to gain with positive investor confidence about economic growth after reopening. The Japanese market, on the other hand, fell on the back of stronger-than-expected annual wholesale price data.

VIETNAM ECONOMY

6.48%

1D (bps) 46

YTD (bps) 151

7.40%

4.58%

1D (bps) 2

YTD (bps) -21

4.62%

1D (bps) -3

YTD (bps) -28

23,625

1D (%) 0.09%

YTD (%) -0.57%

25,809

1D (%) -1.31%

YTD (%) 0.58%

3,551

1D (%) -0.45%

YTD (%) 1.89%

The USD price in the international market in the past week (January 9-13, 2023) turned to decrease after the US announced a decrease in December CPI data, raising expectations that the US Federal Reserve (Fed) will reduce "hawks" with interest rate hikes.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The retail industry achieved business performance exceeded the result before the COVID-19 pandemic;

- Prime Minister Pham Minh Chinh surveyed infrastructure projects in Cao Bang province;

- Banking sector profit growth may slow down in 2023;

- China committed to tighten supervision of iron ore prices;

- Credit Suisse plans to cut 10% of its investment banking staff in Europe;

- Real estate price will fall by more than 25% in overheated markets.

VN30

BANK

87,300

1D 1.75%

5D 0.46%

Buy Vol. 1,771,337

Sell Vol. 1,490,649

44,700

1D 6.94%

5D 9.02%

Buy Vol. 8,926,441

Sell Vol. 6,805,223

30,000

1D 3.09%

5D 3.09%

Buy Vol. 9,061,100

Sell Vol. 9,079,769

28,100

1D 1.08%

5D 1.26%

Buy Vol. 4,352,222

Sell Vol. 4,686,586

19,400

1D 0.00%

5D 2.92%

Buy Vol. 28,385,462

Sell Vol. 39,366,225

18,500

1D 1.37%

5D 1.37%

Buy Vol. 14,274,547

Sell Vol. 12,415,126

16,900

1D 1.50%

5D 0.90%

Buy Vol. 3,772,371

Sell Vol. 5,196,771

22,000

1D -1.79%

5D -2.22%

Buy Vol. 4,558,634

Sell Vol. 5,201,382

25,500

1D 0.79%

5D 3.45%

Buy Vol. 22,414,149

Sell Vol. 17,288,223

22,300

1D 1.13%

5D 5.44%

Buy Vol. 5,831,683

Sell Vol. 5,183,400

25,000

1D 3.52%

5D 8.23%

Buy Vol. 7,343,550

Sell Vol. 5,672,832

BID: In the session 16/1, the momentum hit the ceiling, helping BID continue to surpass VHM, thereby becoming the second largest enterprise by market capitalization. At the market price of 44,700 VND/share, the market capitalization of BID reached nearly VND226,116 billion, increasing more than VND5,300 billion in the past 1 year. Even if compared to the short-term bottom in October 2022, the stock's momentum has pushed BIDV's capitalization to increase by nearly VND82,000 billion.

REAL ESTATE

13,650

1D -4.55%

5D -1.44%

Buy Vol. 30,001,782

Sell Vol. 31,743,157

26,350

1D 0.57%

5D -5.72%

Buy Vol. 1,364,577

Sell Vol. 1,513,040

13,700

1D -2.14%

5D -3.86%

Buy Vol. 11,396,200

Sell Vol. 10,648,296

According to the aggregated data of the VBMA, the real estate bonds ranked second with VND51,979 billion, accounting for about 20.4% of the total issuance value in 2022.

OIL & GAS

103,000

1D -1.44%

5D -1.44%

Buy Vol. 346,501

Sell Vol. 588,085

11,850

1D 0.00%

5D 2.16%

Buy Vol. 10,819,819

Sell Vol. 13,330,154

36,800

1D -0.67%

5D 3.66%

Buy Vol. 993,834

Sell Vol. 1,840,409

PLX: In 2023, Petrolimex synchronously deploys groups of solutions to contribute to stabilizing the petroleum market and ensuring national energy security.

VINGROUP

54,800

1D -0.36%

5D -0.36%

Buy Vol. 2,293,931

Sell Vol. 3,187,978

51,300

1D -1.35%

5D 2.19%

Buy Vol. 1,377,336

Sell Vol. 1,727,007

28,500

1D -0.35%

5D -3.06%

Buy Vol. 1,547,891

Sell Vol. 1,810,503

VIC: VinFast and NXP Semiconductors announce cooperation to develop next-generation smart electric vehicles.

FOOD & BEVERAGE

79,400

1D -1.49%

5D -1.61%

Buy Vol. 988,232

Sell Vol. 2,191,185

94,900

1D -0.11%

5D -1.66%

Buy Vol. 585,615

Sell Vol. 730,106

188,500

1D 1.40%

5D 4.96%

Buy Vol. 149,211

Sell Vol. 219,287

MSN: Masan Group Joint Stock Company issues a lot of corp bonds worth VND700 billion, in order to restructure debts.

OTHERS

48,150

1D -1.53%

5D 0.52%

Buy Vol. 702,047

Sell Vol. 650,060

107,300

1D -0.37%

5D -1.74%

Buy Vol. 297,961

Sell Vol. 361,852

80,800

1D 1.00%

5D 0.62%

Buy Vol. 1,185,482

Sell Vol. 1,195,703

41,900

1D -0.36%

5D -0.24%

Buy Vol. 2,013,943

Sell Vol. 2,996,794

15,200

1D 4.47%

5D 5.56%

Buy Vol. 7,596,290

Sell Vol. 5,666,460

19,400

1D 1.04%

5D 2.11%

Buy Vol. 15,051,098

Sell Vol. 18,396,110

20,250

1D 1.50%

5D 3.32%

Buy Vol. 49,406,654

Sell Vol. 38,220,743

HPG: Hoa Phat Group will continue to upgrade the specialized port in Dung Quat area to increase the exploitation capacity for Dung Quat 2 project including: dredging ports and adding new berths. Besides, this group is also building a general port to serve the Complex and Dung Quat Economic Zone - Quang Ngai.

Market by numbers

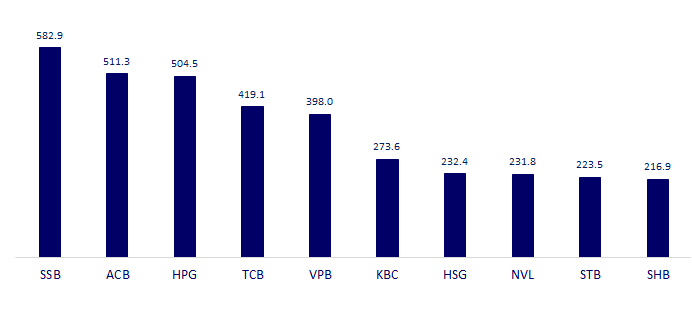

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

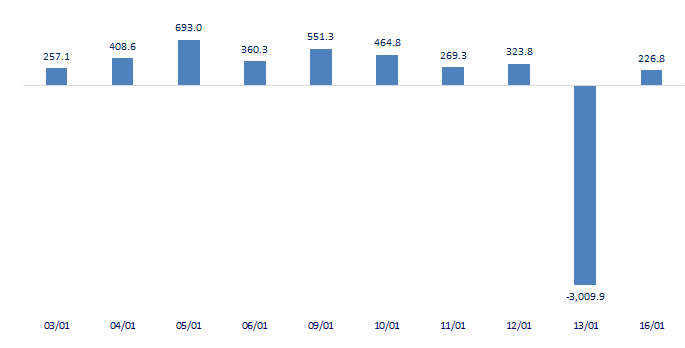

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

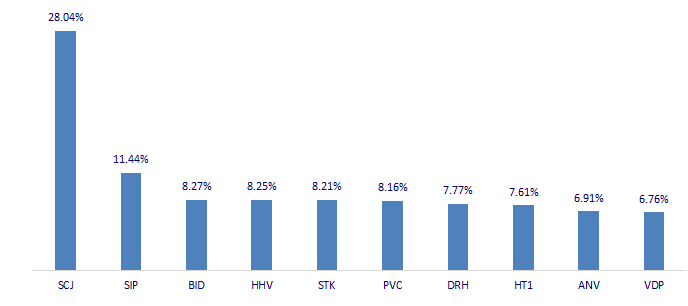

TOP INCREASES 3 CONSECUTIVE SESSIONS

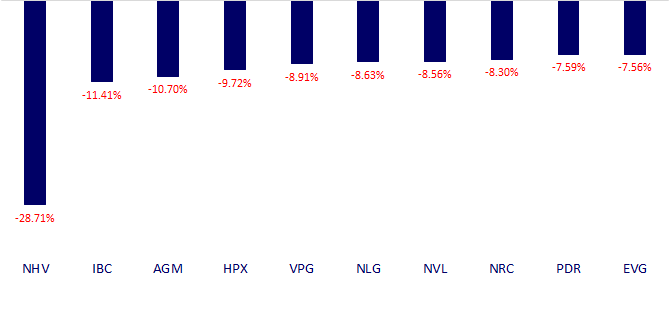

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.