Market brief 22/11/2022

VIETNAM STOCK MARKET

952.12

1D -0.89%

YTD -36.45%

945.54

1D -1.19%

YTD -38.43%

194.66

1D 1.17%

YTD -58.93%

68.41

1D 1.14%

YTD -39.29%

264.32

1D 0.00%

YTD 0.00%

18,268.34

1D 83.41%

YTD -41.21%

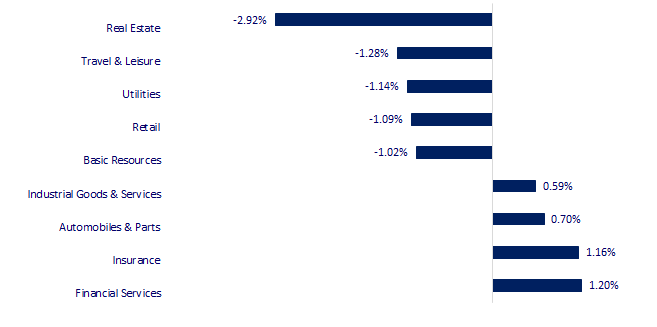

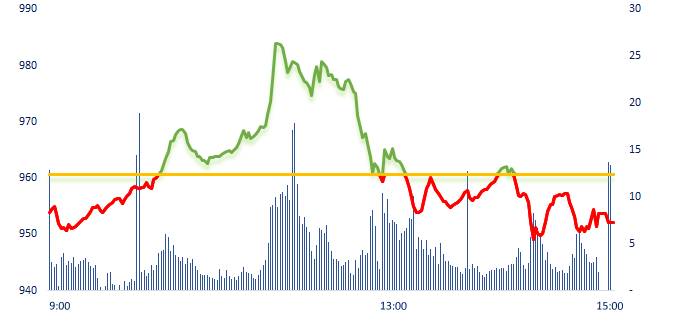

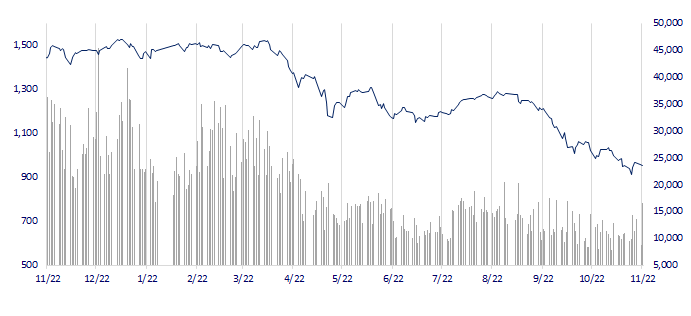

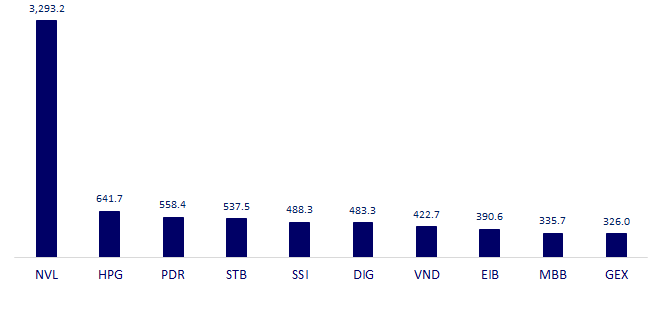

Leading industries such as Real Estate, Banking, and Securities all dropped before the pressure of profit realization. The improved liquidity contributed significantly from the sudden transaction of nearly 129 million shares of NVL, with a trading value of VND3.3 trillion, accounting for 21% of matched liquidity on HoSE. However, this stock still fell to the floor for the 14th session in a row.

ETF & DERIVATIVES

16,120

1D -1.04%

YTD -37.59%

11,240

1D -0.09%

YTD -37.87%

11,650

1D -1.02%

YTD -38.68%

11,780

1D 6.99%

YTD -48.56%

12,390

1D 0.41%

YTD -44.88%

20,350

1D 0.10%

YTD -27.45%

11,930

1D 0.42%

YTD -44.46%

918

1D -1.26%

YTD 0.00%

921

1D -1.63%

YTD 0.00%

923

1D -1.25%

YTD 0.00%

926

1D -1.30%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,115.74

1D 0.61%

YTD -2.35%

3,088.94

1D 0.13%

YTD -15.13%

2,405.27

1D -0.59%

YTD -19.22%

17,424.41

1D -1.31%

YTD -25.53%

3,263.82

1D 0.41%

YTD 4.49%

1,614.46

1D -0.27%

YTD -2.60%

87.97

1D 0.46%

YTD 14.99%

1,745.70

1D 0.10%

YTD -4.12%

At the end of the session, Asian stocks were mixed on the possibility of tightening Zero-Covid policy of China. Nikkei 225 (Japan) and Shanghai Composite (China) had a slight increase, up 0.61% and 0.13% respectively. In contrast, Hong Kong stocks mostly fell in Asia, decreasing 1.31%.

VIETNAM ECONOMY

5.69%

1D (bps) 9

YTD (bps) 488

7.40%

YTD (bps) 180

4.90%

1D (bps) 2

YTD (bps) 389

4.94%

1D (bps) 3

YTD (bps) 294

24,858

1D (%) 0.00%

YTD (%) 8.36%

26,251

1D (%) 0.36%

YTD (%) -0.82%

3,550

1D (%) 0.37%

YTD (%) -2.95%

Recently, the Ministry of Finance announced to hold a meeting to discuss the stock market and corporate bonds on the morning of November 23 under the chairman of Minister of Finance Ho Duc Phuoc. The meeting will be attended by Deputy Minister of Finance Nguyen Duc Chi, leaders of the State Securities Commission, VNX, VSD, HNX, HoSE and leaders of securities companies and bond issuers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Binh Dinh signed a cooperation agreement to invest in wind power projects of more than USD4.6 billion;

- Ho Chi Minh City collected more than VND1,500 billion of seaport fees after 7 months;

- Interbank interest rates increased, the State Bank returned to a slight net injection;

- Coinbase exchange market capitalization from USD85 billion decreased to less than USD10 billion after more than 1 year;

- Qatar has just signed an agreement to supply gas to China for 27 years;

- Major countries are in a battle for LNG supplies.

VN30

BANK

73,500

1D -2.00%

5D -2.00%

Buy Vol. 2,696,761

Sell Vol. 3,081,680

36,450

1D 2.68%

5D 9.13%

Buy Vol. 3,540,799

Sell Vol. 4,179,812

23,900

1D -0.83%

5D 2.14%

Buy Vol. 12,762,548

Sell Vol. 13,766,493

21,850

1D -1.80%

5D 5.56%

Buy Vol. 11,978,711

Sell Vol. 13,700,540

15,500

1D 0.00%

5D 5.80%

Buy Vol. 27,492,718

Sell Vol. 29,674,550

15,800

1D 0.64%

5D 11.66%

Buy Vol. 31,327,495

Sell Vol. 24,224,202

14,650

1D -1.01%

5D 4.64%

Buy Vol. 2,638,633

Sell Vol. 3,608,490

20,650

1D 0.24%

5D 3.77%

Buy Vol. 8,953,188

Sell Vol. 8,331,193

16,900

1D 1.20%

5D 11.92%

Buy Vol. 53,539,441

Sell Vol. 50,586,524

18,200

1D -1.62%

5D 7.06%

Buy Vol. 6,817,531

Sell Vol. 7,951,297

20,350

1D -1.21%

5D 6.54%

Buy Vol. 7,925,747

Sell Vol. 6,641,205

VPB: VPBank has just implemented a new deposit interest rate schedule for individual customers from November 22. Thus, in less than 10 days, VPBank raised interest rates twice. With terms from 12 months to 36 months, VPBank mobilizes deposits with interest rates of 9.1-9.3% in the form of over-the-counter deposit and 9.2-9.4% in the form of online deposit. In which, the highest interest rate of 9.4% is applied by the bank to online deposits with terms of 18 months, 24 months and 36 months, with a minimum deposit of VND10 billion.

REAL ESTATE

25,350

1D -6.97%

5D -30.07%

Buy Vol. 142,260,893

Sell Vol. 187,185,576

22,450

1D 0.22%

5D 15.72%

Buy Vol. 7,554,608

Sell Vol. 5,835,097

15,950

1D -6.73%

5D -29.74%

Buy Vol. 34,923,372

Sell Vol. 259,353,236

NVL: After 13 consecutive floor sessions with low liquidity, NVL shares were matched with a record of more than 128 million shares today.

OIL & GAS

109,200

1D -1.89%

5D -2.06%

Buy Vol. 580,019

Sell Vol. 565,489

10,350

1D 0.49%

5D 8.04%

Buy Vol. 20,178,625

Sell Vol. 25,580,266

26,200

1D 3.56%

5D 6.29%

Buy Vol. 3,157,760

Sell Vol. 2,715,925

POW: Nhon Trach 2 Petroleum Power Joint Stock Company, a subsidiary of PV Power, reported October revenue 5.8 times higher than the plan.

VINGROUP

61,000

1D -4.69%

5D 7.02%

Buy Vol. 2,100,968

Sell Vol. 2,951,612

45,300

1D -3.51%

5D 4.38%

Buy Vol. 3,208,239

Sell Vol. 4,064,735

26,150

1D -0.57%

5D 4.81%

Buy Vol. 3,015,968

Sell Vol. 2,908,167

VIC: VinES and Gotion invest USD275 million to build LFP Battery Factory.

FOOD & BEVERAGE

79,500

1D 2.05%

5D 3.25%

Buy Vol. 3,225,740

Sell Vol. 5,222,591

91,800

1D -3.47%

5D 2.68%

Buy Vol. 2,135,515

Sell Vol. 2,518,921

181,200

1D -0.77%

5D -2.84%

Buy Vol. 188,436

Sell Vol. 287,064

MSN: Masan wants to privately issue VND1,700 billion of bonds to refinancing. This is a non-convertible, unwarranted and unsecured bond.

OTHERS

48,150

1D 0.94%

5D 8.69%

Buy Vol. 1,394,705

Sell Vol. 1,262,158

98,100

1D -2.49%

5D -3.63%

Buy Vol. 486,522

Sell Vol. 481,307

70,500

1D 0.57%

5D 6.98%

Buy Vol. 1,918,046

Sell Vol. 2,517,676

40,200

1D -1.11%

5D 6.21%

Buy Vol. 6,294,883

Sell Vol. 6,018,316

12,600

1D -3.08%

5D 26.00%

Buy Vol. 5,888,344

Sell Vol. 5,668,369

16,350

1D 1.55%

5D 17.63%

Buy Vol. 51,906,232

Sell Vol. 51,524,652

14,800

1D -1.00%

5D 18.40%

Buy Vol. 71,649,331

Sell Vol. 68,593,613

HPG: The joint venture between Hop Nghia Investment Corporation Joint Stock Company - Hoa Phat Urban Development and Construction Joint Stock Company, a member of Hoa Phat Group, is the only investor to apply for a residential project implementation of Cao Xa ecological rural area, Lam Thao district, Phu Tho province with a total investment of 5,622 billion VND.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

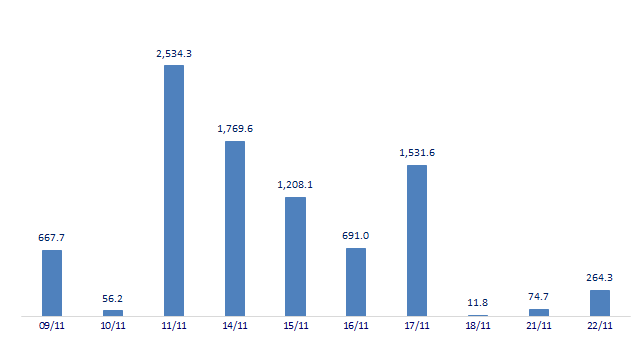

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

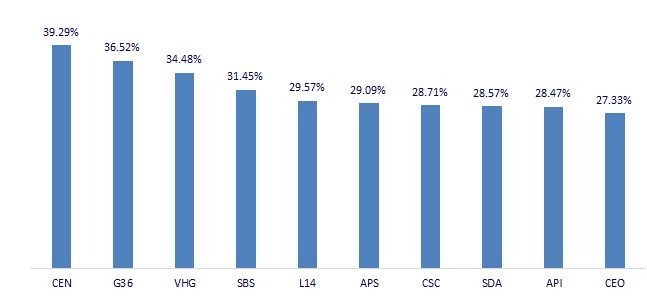

TOP INCREASES 3 CONSECUTIVE SESSIONS

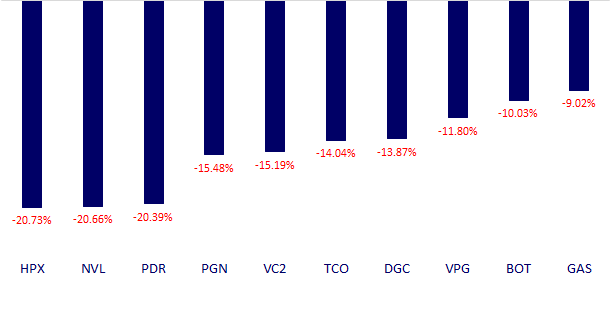

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.