Market Brief 16/12/2022

VIETNAM STOCK MARKET

1,052.48

1D -0.27%

YTD -29.75%

1,064.07

1D -0.38%

YTD -30.71%

212.99

1D 0.02%

YTD -55.06%

72.19

1D -0.55%

YTD -35.93%

287.47

1D 0.00%

YTD 0.00%

17,350.83

1D 24.88%

YTD -44.16%

Today, V.N.M ETF and FTSE Vietnam ETF reconstituted portfolio structure of Q4/2022. The basket of MVIS Vietnam Index of V.N.M ETF has excluded 4 Vietnamese stocks from the list, including THD, ITA, BCG, DXG. The highlight of today's fund reconstituting session was steel stocks with strong gain of HPG, HSG, NKG and sudden liquidity.

ETF & DERIVATIVES

18,180

1D -0.66%

YTD -29.62%

12,580

1D -0.40%

YTD -30.46%

13,130

1D 0.92%

YTD -30.89%

14,250

1D -4.49%

YTD -37.77%

15,260

1D 0.07%

YTD -32.12%

23,160

1D -0.26%

YTD -17.43%

13,580

1D 0.74%

YTD -36.78%

1,033

1D -1.12%

YTD 0.00%

1,047

1D -1.12%

YTD 0.00%

1,056

1D -1.71%

YTD 0.00%

1,060

1D -0.98%

YTD 0.00%

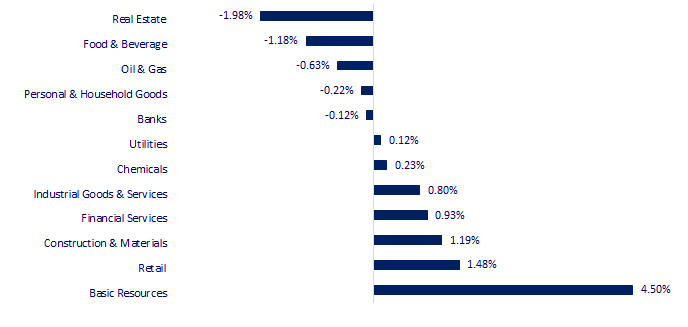

CHANGE IN PRICE BY SECTOR

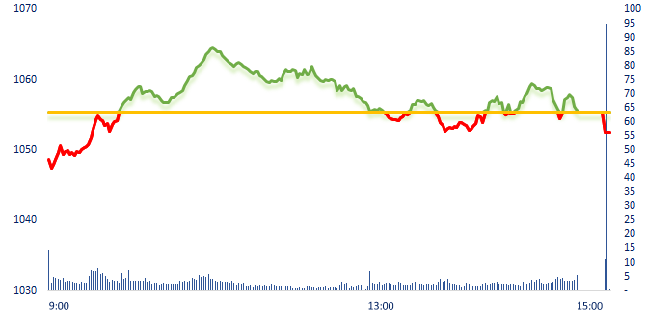

INTRADAY VNINDEX

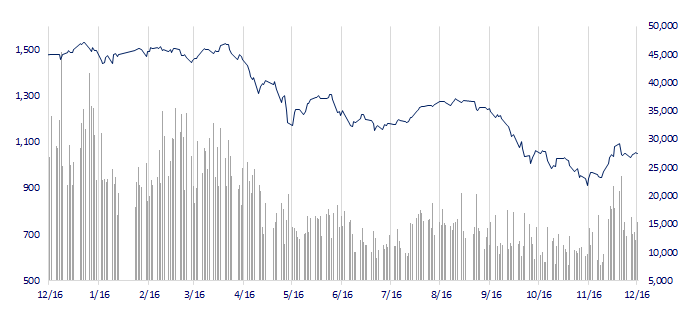

VNINDEX (12M)

GLOBAL MARKET

27,527.12

1D -1.87%

YTD -4.39%

3,167.86

1D -0.02%

YTD -12.97%

2,360.02

1D -0.04%

YTD -20.74%

19,450.67

1D 0.42%

YTD -16.87%

3,240.81

1D -1.01%

YTD 3.75%

1,619.01

1D -0.08%

YTD -2.33%

79.03

1D -3.10%

YTD 3.31%

1,789.60

1D 0.12%

YTD -1.71%

Asian equity capital markets activity, languishing at three-year lows now, is set to get a much needed boost in 2023 from China's expected re-opening to the rest of the world after a spate of COVID-19 lockdowns, dealmakers said. An easing of China's two-year tech sector crackdown, coupled with a breakthrough for the U.S. audit watchdog to get access to financial accounts of mainland firms, is also seen as a positive for equity capital markets activity, encompassing initial public offerings (IPOs), secondary listings and follow-on equity sales.

VIETNAM ECONOMY

4.49%

1D (bps) -54

YTD (bps) 368

7.40%

YTD (bps) 180

4.82%

1D (bps) 1

YTD (bps) 381

4.88%

1D (bps) 1

YTD (bps) 288

23,800

1D (%) 0.55%

YTD (%) 3.75%

25,517

1D (%) -0.97%

YTD (%) -3.59%

3,453

1D (%) 0.26%

YTD (%) -5.60%

After commercial banks simultaneously raised deposit interest rates since the end of September until now, the deposit value of individual customers began to increase strongly again. SBV recently announced customer deposit data into the credit institution system until the end of October 2022. Accordingly, total deposits in the banking system have reached more than VND11.42 million billion, an increase of VND5,766 billion compared to the end of September.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 2022, HCM City receives USD6.8 billion of remittances;

- New industrial parks will help attract FDI projects back to Da Nang;

- Rooftop solar energy lacks legal foundation;

- OPEC cautiously cuts oil demand forecast in the first quarter of 2023;

- China’s new iron ore buyer sets off biggest shakeup in years;

- Goldman says commodities will gain 43% in 2023 as supply shortages bite.

VN30

BANK

79,700

1D 0.25%

5D 3.10%

Buy Vol. 5,138,557

Sell Vol. 4,027,097

38,900

1D -0.26%

5D -0.77%

Buy Vol. 2,813,264

Sell Vol. 2,146,858

28,050

1D -0.71%

5D 0.00%

Buy Vol. 6,992,416

Sell Vol. 9,766,115

29,150

1D -1.19%

5D 3.19%

Buy Vol. 11,624,060

Sell Vol. 12,318,942

18,500

1D 1.65%

5D 9.47%

Buy Vol. 46,051,079

Sell Vol. 54,085,744

18,800

1D -0.79%

5D 3.30%

Buy Vol. 23,315,725

Sell Vol. 25,345,098

17,300

1D 3.28%

5D 2.98%

Buy Vol. 11,469,276

Sell Vol. 10,836,886

23,000

1D 0.00%

5D 2.22%

Buy Vol. 9,071,759

Sell Vol. 9,336,864

22,800

1D -1.94%

5D 1.79%

Buy Vol. 54,170,577

Sell Vol. 45,874,647

20,800

1D -0.95%

5D -0.72%

Buy Vol. 7,965,709

Sell Vol. 8,195,513

23,000

1D -0.86%

5D -0.22%

Buy Vol. 4,682,843

Sell Vol. 4,943,287

VPB: VPBank has just announced a program to reduce lending interest rates to support difficult businesses – especially SMEs, which currently account for nearly 90% of total businesses operating nationwide. Accordingly, the loan package worth VND7,000 billion was officially deployed throughout VPBank's system from December 15, 2022.

REAL ESTATE

18,200

1D 1.68%

5D 9.31%

Buy Vol. 48,164,208

Sell Vol. 47,784,289

27,500

1D -2.48%

5D -8.49%

Buy Vol. 7,360,373

Sell Vol. 4,792,920

14,500

1D 1.05%

5D -12.12%

Buy Vol. 21,410,421

Sell Vol. 23,864,579

On December 17, Khang Dien Group will organize to give the "house ownership certificate" to residents of The Classia just over a month since the customer received the house.

OIL & GAS

106,400

1D 0.09%

5D 0.38%

Buy Vol. 576,849

Sell Vol. 577,106

11,450

1D 0.44%

5D 2.23%

Buy Vol. 17,428,335

Sell Vol. 16,955,484

31,000

1D -0.80%

5D 1.97%

Buy Vol. 1,601,932

Sell Vol. 2,010,255

Despite recent declines, U.S. government agency says 2023 gasoline, diesel prices will remain higher than pre-pandemic levels.

VINGROUP

58,400

1D -3.63%

5D -13.86%

Buy Vol. 6,927,574

Sell Vol. 5,118,573

49,300

1D -2.76%

5D -8.87%

Buy Vol. 5,442,985

Sell Vol. 4,908,516

26,200

1D -6.09%

5D -9.34%

Buy Vol. 13,097,106

Sell Vol. 11,411,969

VIC: On December 15, the US - ASEAN Business Council (USABC) announced that VinFast US became the newest member of the US - ASEAN Business Council as a member of the Chairman's Council.

FOOD & BEVERAGE

78,000

1D 0.52%

5D -2.50%

Buy Vol. 4,943,860

Sell Vol. 4,586,644

93,500

1D -4.79%

5D -3.61%

Buy Vol. 3,791,711

Sell Vol. 3,229,102

177,100

1D -1.06%

5D -0.51%

Buy Vol. 604,178

Sell Vol. 627,341

VNM: Vinamilk was selected for the second time in the Top 3 Vietnamese listed companies with the highest corporate governance score announced by the ACGS2021.

OTHERS

49,600

1D 0.20%

5D 3.55%

Buy Vol. 1,857,110

Sell Vol. 2,243,647

113,000

1D 0.09%

5D 1.35%

Buy Vol. 797,300

Sell Vol. 903,150

77,900

1D 0.26%

5D -0.13%

Buy Vol. 1,694,498

Sell Vol. 1,865,119

47,850

1D 1.81%

5D 3.57%

Buy Vol. 5,943,898

Sell Vol. 5,615,478

15,800

1D 1.28%

5D 4.98%

Buy Vol. 7,983,934

Sell Vol. 8,411,619

20,500

1D 1.23%

5D 1.23%

Buy Vol. 36,171,286

Sell Vol. 43,969,826

20,400

1D 5.43%

5D 6.25%

Buy Vol. 95,363,840

Sell Vol. 101,211,123

BVH: The Ministry of Industry and Trade held a ceremony to announce products that achieved Vietnam National Brand 2022. Products of Baoviet Life Corporation were confirmed as National Brands in 2022, this is also the only unit. in the life insurance industry received this title.

Market by numbers

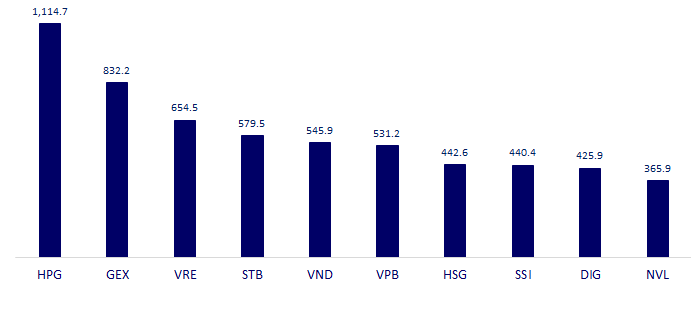

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

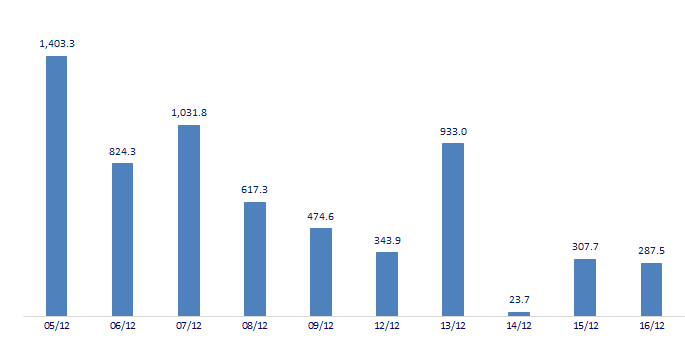

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

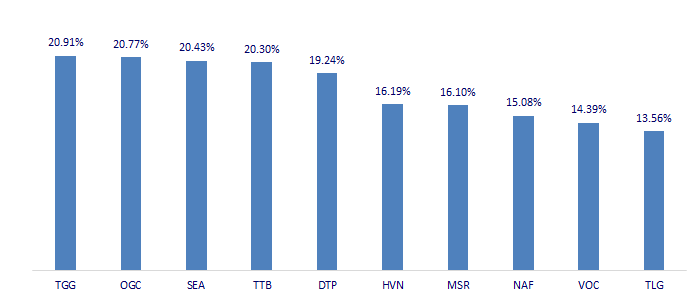

TOP INCREASES 3 CONSECUTIVE SESSIONS

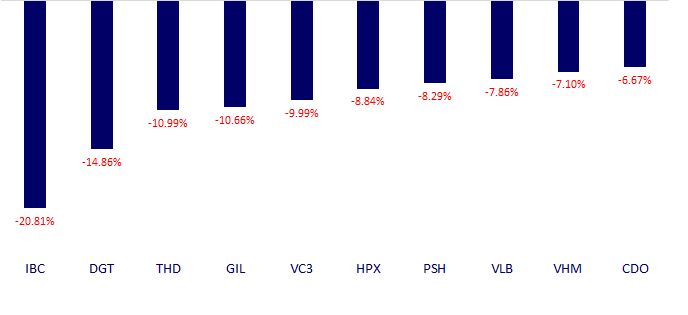

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.