Market brief 23/12/2022

VIETNAM STOCK MARKET

1,020.34

1D -0.22%

YTD -31.90%

1,034.13

1D -0.41%

YTD -32.66%

205.30

1D -0.24%

YTD -56.69%

71.01

1D 0.25%

YTD -36.98%

99.99

1D 0.00%

YTD 0.00%

10,189.85

1D -28.31%

YTD -67.21%

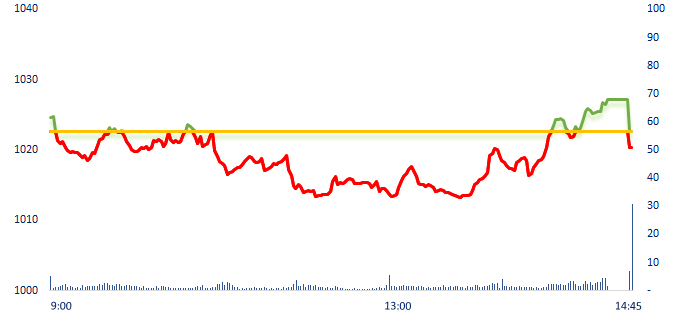

After slight increase at the previous session, VN-Index reversed to decrease again. The weak demand caused the index to narrow its gain before correcting slightly at the end of the session. Notably, the liquidity dropped sharply by 30% compared to the previous session when the trading value on HOSE was just over VND9,000 billion.

ETF & DERIVATIVES

17,700

1D 0.00%

YTD -31.48%

12,300

1D -0.24%

YTD -32.01%

12,680

1D -0.94%

YTD -33.26%

14,000

1D -0.14%

YTD -38.86%

14,880

1D 0.54%

YTD -33.81%

23,140

1D 1.05%

YTD -17.50%

13,590

1D 2.33%

YTD -36.73%

1,015

1D 0.08%

YTD 0.00%

1,030

1D 0.64%

YTD 0.00%

1,036

1D 0.05%

YTD 0.00%

1,035

1D -0.28%

YTD 0.00%

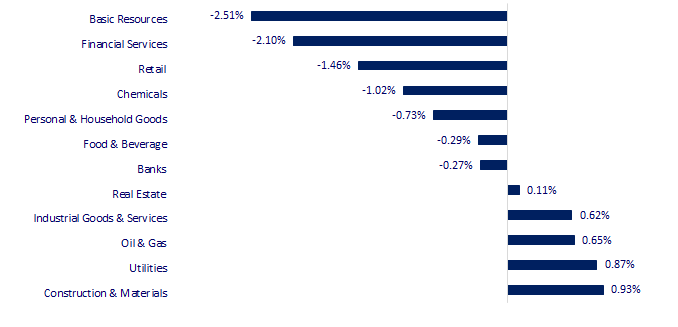

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

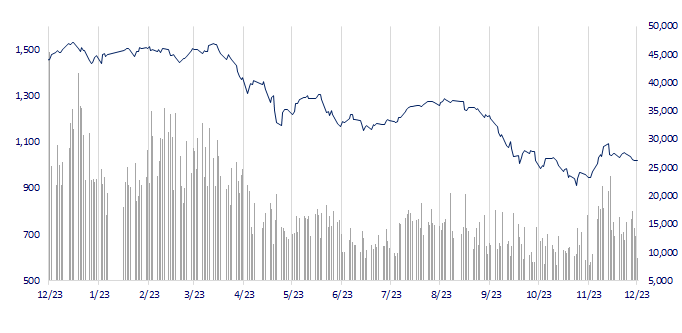

VNINDEX (12M)

GLOBAL MARKET

26,235.25

1D -1.03%

YTD -8.88%

3,045.87

1D -0.28%

YTD -16.32%

2,313.69

1D -1.83%

YTD -22.30%

19,593.06

1D -0.44%

YTD -16.26%

3,255.86

1D -0.42%

YTD 4.23%

1,619.12

1D 0.15%

YTD -2.32%

82.67

1D 0.35%

YTD 8.07%

1,804.65

1D 0.23%

YTD -0.89%

At the end of the session, the Asian market simultaneously dropped due to investors' concerns about the tightening monetary policy of central banks around the world, which will push the economy into recession.

VIETNAM ECONOMY

3.50%

1D (bps) -20

YTD (bps) 269

7.40%

YTD (bps) 180

4.84%

1D (bps) 6

YTD (bps) 383

4.92%

1D (bps) 6

YTD (bps) 292

23,763

1D (%) -0.01%

YTD (%) 3.59%

25,760

1D (%) 0.07%

YTD (%) -2.67%

3,447

1D (%) -0.17%

YTD (%) -5.77%

The Governor of the State Bank of Vietnam requires credit institutions to strictly control credit risks for investment activities in corporate bonds and potentially risky fields such as securities, real estate sector, especially credit granting for the purpose of real estate investment and business.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- It is expected to operate the No.1 metro line by the end of 2023;

- Economy 2022 - 2023: A 'busy' year for the transport sector;

- Lack of orders, many businesses in Ho Chi Minh City still try to maintain the labor source;

- Shopee's parent company stopped raising wages, cutting bonuses right before the holiday;

- Indonesia raised interest rates to the highest level in more than 3 years;

- The world gold price may rise to 4,000 USD/oz in 2023.

VN30

BANK

79,100

1D -0.25%

5D -0.75%

Buy Vol. 2,320,176

Sell Vol. 1,871,038

39,000

1D 0.00%

5D 0.26%

Buy Vol. 1,592,535

Sell Vol. 2,346,401

27,650

1D 0.18%

5D -1.43%

Buy Vol. 5,539,869

Sell Vol. 6,557,372

27,600

1D -0.36%

5D -5.32%

Buy Vol. 6,388,479

Sell Vol. 5,536,223

18,350

1D -0.54%

5D -0.81%

Buy Vol. 38,690,095

Sell Vol. 35,392,645

17,750

1D -1.39%

5D -5.59%

Buy Vol. 11,764,199

Sell Vol. 11,751,436

17,000

1D 0.89%

5D -1.73%

Buy Vol. 2,956,484

Sell Vol. 3,138,921

22,000

1D -1.57%

5D -4.35%

Buy Vol. 3,733,634

Sell Vol. 4,855,648

23,500

1D 0.43%

5D 3.07%

Buy Vol. 28,065,959

Sell Vol. 27,914,837

19,650

1D -1.50%

5D -5.53%

Buy Vol. 3,580,499

Sell Vol. 3,305,076

22,900

1D 0.00%

5D -0.43%

Buy Vol. 3,401,232

Sell Vol. 3,705,037

TPB: Responding to the policy of reducing lending interest rates of the State Bank of Vietnam, TPBank deployed a credit package of VND5,000 billion with special preferential interest rates, of which up to VND2,000 billion is for green development enterprises, export enterprises, and women-owned enterprises from the WSME program.

REAL ESTATE

15,100

1D -2.58%

5D -17.03%

Buy Vol. 25,915,060

Sell Vol. 28,962,487

26,250

1D -2.23%

5D -4.55%

Buy Vol. 1,990,995

Sell Vol. 1,940,919

13,050

1D 1.95%

5D -10.00%

Buy Vol. 21,347,251

Sell Vol. 18,601,932

PDR: Mr. Nguyen Van Dat, Chairman of Phat Dat has just announced that he has been mortgaged 3.5 million PDR shares by a securities company.

OIL & GAS

101,500

1D 0.30%

5D -4.61%

Buy Vol. 576,272

Sell Vol. 521,607

10,950

1D 2.34%

5D -4.37%

Buy Vol. 27,494,930

Sell Vol. 18,997,214

30,900

1D 0.82%

5D -0.32%

Buy Vol. 1,072,939

Sell Vol. 1,106,493

GAS: PetroVietnam Gas Corporation approved the plan to terminate a branch in Ba Ria - Vung Tau.

VINGROUP

55,100

1D 0.18%

5D -5.65%

Buy Vol. 3,462,084

Sell Vol. 3,038,628

49,800

1D 1.63%

5D 1.01%

Buy Vol. 2,277,706

Sell Vol. 2,421,115

25,800

1D -0.77%

5D -1.53%

Buy Vol. 3,028,996

Sell Vol. 4,305,452

VIC: VinFast claims to have enough licenses to sell the first VF8 electric cars in the US.

FOOD & BEVERAGE

76,200

1D -1.04%

5D -0.56%

Buy Vol. 2,515,210

Sell Vol. 2,957,181

95,000

1D 0.64%

5D 1.60%

Buy Vol. 1,043,618

Sell Vol. 903,943

175,000

1D -0.17%

5D 0.25%

Buy Vol. 194,408

Sell Vol. 201,423

SAB: Favorable business, SABECO plans to spend VND640 billion to advance dividend for the second period of 2022 for shareholders.

OTHERS

47,900

1D -0.62%

5D -3.43%

Buy Vol. 1,059,975

Sell Vol. 877,187

111,500

1D 0.18%

5D -1.33%

Buy Vol. 418,277

Sell Vol. 440,625

78,000

1D 1.04%

5D 0.13%

Buy Vol. 2,082,393

Sell Vol. 2,041,689

45,800

1D -1.51%

5D -4.28%

Buy Vol. 2,869,814

Sell Vol. 4,003,436

14,350

1D -1.03%

5D -9.18%

Buy Vol. 2,264,333

Sell Vol. 2,614,545

18,300

1D -4.19%

5D -10.73%

Buy Vol. 22,236,258

Sell Vol. 21,912,768

18,350

1D -2.91%

5D -10.05%

Buy Vol. 48,514,684

Sell Vol. 51,630,759

SSI: SSI plans to issue a maximum of 10 million shares with the par value of 10,000 VND/share to members of the Board of Directors, key personnel of SSI and its subsidiaries. If the issuance is successful, it is estimated that SSI can collect VND100 billion. The release time is expected in the fourth quarter of 2022 to the end of 2023.

Market by numbers

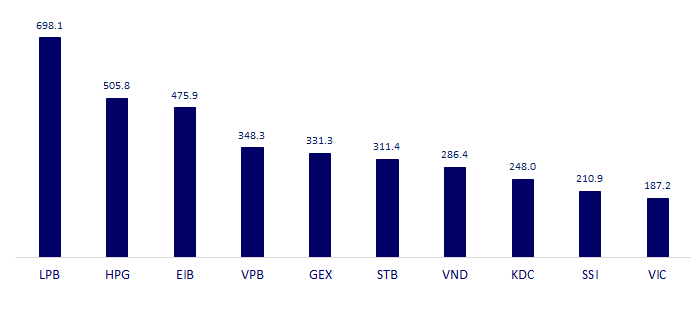

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

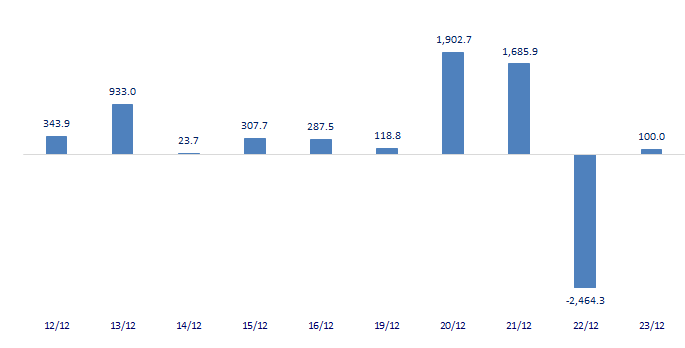

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

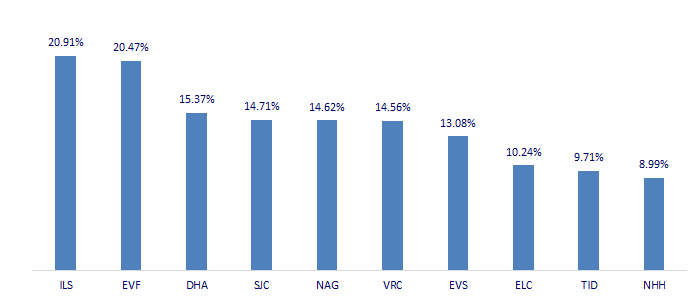

TOP INCREASES 3 CONSECUTIVE SESSIONS

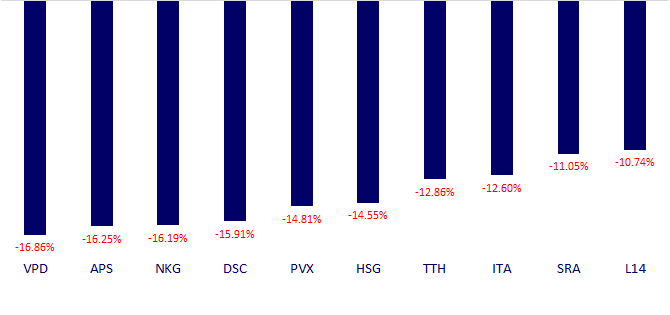

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.