Market Brief 09/04/2021

VIETNAM STOCK MARKET

1,231.66

1D -0.26%

YTD 12.02%

1,253.26

1D 0.12%

YTD 18.41%

293.79

1D 0.01%

YTD 49.06%

83.01

1D -0.07%

YTD 12.43%

2,342.93

1D 0.00%

YTD 0.00%

22,039.89

1D 18.15%

YTD 28.49%

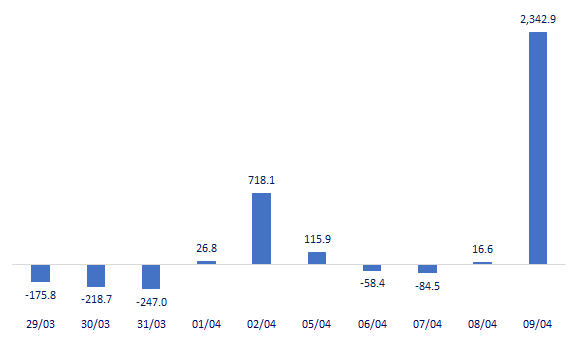

- Foreign investors turned to a net buying of nearly 2,343 billion dong in the whole market today. In which, the purchasing power focused mainly on VHM (VND 2,159 billion), VRE (VND 93.5 billion), HPG (VND 66.2 billion) …

ETF & DERIVATIVES

21,000

1D 0.48%

YTD 11.70%

14,760

1D -0.14%

YTD 17.80%

15,600

1D -0.57%

YTD 17.03%

18,200

1D -0.27%

YTD 15.19%

17,160

1D -0.06%

YTD 25.71%

20,770

1D 0.58%

YTD 20.76%

16,150

1D -0.74%

YTD 15.77%

1,247

1D 0.69%

YTD 0.00%

1,250

1D 0.72%

YTD 0.00%

1,249

1D 0.61%

YTD 0.00%

1,252

1D 0.70%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

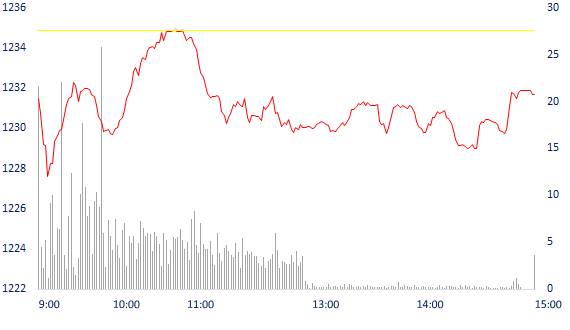

INTRADAY VNINDEX

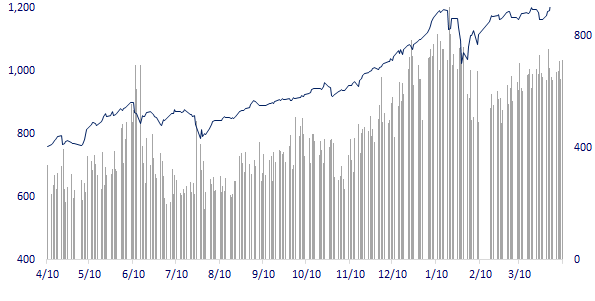

VNINDEX (12M)

GLOBAL MARKET

29,768.06

1D -0.32%

YTD 8.47%

3,450.68

1D -0.92%

YTD 1.06%

3,131.88

1D -0.36%

YTD 8.99%

28,678.00

1D -0.57%

YTD 5.64%

3,184.54

1D -0.06%

YTD 10.99%

1,566.34

1D 0.48%

YTD 8.07%

59.62

1D 0.51%

YTD 23.44%

1,744.35

1D -0.14%

YTD -8.37%

- Asian stocks fell after the S&P 500 set a new high. In Japan, the Nikkei 225 increased by 0.32%. The Chinese market fell from the beginning with the Shanghai Composite down 0.92%. Hong Kong's Hang Seng decreased 0.57%. The South Korea's Kospi decreased by 0.36%.

VIETNAM ECONOMY

0.30%

1D (bps) 1

YTD (bps) 17

5.60%

YTD (bps) -20

1.20%

1D (bps) -17

YTD (bps) -2

2.28%

1D (bps) 7

YTD (bps) 25

23,166

1D (%) -0.06%

YTD (%) -0.05%

28,139

1D (%) -0.28%

YTD (%) -3.31%

3,588

1D (%) -0.14%

YTD (%) 0.42%

- IMF forecasts that Vietnam's economy can achieve a growth rate of 6.5% this year, 0.5 percentage points higher than the world average. This year's unemployment rate is forecast at 2.7%, 0.6 percentage points lower than 2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- IMF: Vietnam's economy could grow by 6.5% this year

- Thanh Hoa paved the way for economic development, nearly 35,000 billion VND is pouring into 43 traffic projects

- LG wants to sell a smartphone factory in Hai Phong for $ 90 million

- Chinese corporate bonds default to a record high, mainly due to real estate

- The US lists seven Chinese supercomputing organizations on the blacklist

- USD dropped the most this week since the beginning of the year; euro, yen and yuan increased sharply

VN30

BANK

97,500

1D -2.50%

5D -0.31%

Buy Vol. 3,114,200

Sell Vol. 3,475,500

44,300

1D -1.12%

5D -1.56%

Buy Vol. 7,314,600

Sell Vol. 7,063,800

42,500

1D -0.23%

5D 2.91%

Buy Vol. 24,118,200

Sell Vol. 24,365,700

41,600

1D -0.83%

5D 0.85%

Buy Vol. 16,225,000

Sell Vol. 14,448,300

47,200

1D 1.07%

5D 2.16%

Buy Vol. 11,302,400

Sell Vol. 9,348,300

31,350

1D 0.48%

5D 5.91%

Buy Vol. 38,386,900

Sell Vol. 28,965,700

28,000

1D -0.18%

5D 2.75%

Buy Vol. 5,506,400

Sell Vol. 10,023,600

28,800

1D -0.35%

5D 1.77%

Buy Vol. 5,330,100

Sell Vol. 7,196,300

22,700

1D 2.25%

5D 0.44%

Buy Vol. 61,697,400

Sell Vol. 49,921,500

- VPB: Profit before tax in 2021 increases by 28%, wants to offer 15 million treasury shares as ESOP - With the plans to increase capital strongly of many banks, the chart of charter capital this year will have a strong disturbance, especially in the top banks.

REAL ESTATE

90,000

1D 1.35%

5D 9.76%

Buy Vol. 3,494,800

Sell Vol. 3,172,000

26,400

1D 1.54%

5D 9.09%

Buy Vol. 38,278,400

Sell Vol. 34,479,200

31,850

1D 1.43%

5D 1.76%

Buy Vol. 3,421,500

Sell Vol. 3,533,500

68,600

1D -0.15%

5D 6.19%

Buy Vol. 3,265,000

Sell Vol. 3,412,400

- NVL: VietinBank and Novaland have signed a Strategic Cooperation Memorandum to meet the capital needs of individual customers wishing to borrow houses for the projects invested and developed by Novaland.

OIL & GAS

88,800

1D -0.22%

5D -1.66%

Buy Vol. 743,800

Sell Vol. 1,439,800

13,800

1D 0.00%

5D 1.47%

Buy Vol. 22,784,200

Sell Vol. 35,483,500

55,900

1D 0.00%

5D -1.06%

Buy Vol. 1,336,600

Sell Vol. 2,166,900

- Closing session 8/4, WTI oil futures rose 17 cents, or 0.28%, to $59.77/barrel.

VINGROUP

124,900

1D -0.40%

5D 1.54%

Buy Vol. 2,474,300

Sell Vol. 2,629,200

98,900

1D -0.80%

5D -1.79%

Buy Vol. 3,193,000

Sell Vol. 4,114,400

35,000

1D -0.85%

5D 3.40%

Buy Vol. 6,816,200

Sell Vol. 11,813,000

- VHM and VRE were both among the top stocks that were bought the most by foreign investors today with the value of VND 2,159 billion and VND 93.54 billion respectively.

FOOD & BEVERAGE

99,800

1D -0.10%

5D -2.82%

Buy Vol. 4,877,600

Sell Vol. 5,571,600

92,100

1D -0.97%

5D -0.65%

Buy Vol. 1,625,800

Sell Vol. 2,748,000

22,700

1D 0.22%

5D -0.87%

Buy Vol. 5,361,500

Sell Vol. 7,418,800

OTHERS

131,800

1D -0.90%

5D -0.38%

Buy Vol. 619,800

Sell Vol. 1,228,300

131,800

1D -0.90%

5D -0.38%

Buy Vol. 619,800

Sell Vol. 1,228,300

82,100

1D 3.14%

5D 2.88%

Buy Vol. 7,521,800

Sell Vol. 7,222,600

133,300

1D -0.52%

5D -1.11%

Buy Vol. 812,000

Sell Vol. 910,400

90,300

1D 2.03%

5D 1.80%

Buy Vol. 1,338,100

Sell Vol. 1,146,900

53,500

1D 1.33%

5D -0.37%

Buy Vol. 1,472,000

Sell Vol. 1,219,600

35,250

1D 0.14%

5D 2.77%

Buy Vol. 20,199,000

Sell Vol. 23,454,700

49,550

1D 0.41%

5D 1.02%

Buy Vol. 31,409,300

Sell Vol. 28,683,500

- PNJ: The stock increased by nearly 80% after 8 months, PNJ wanted to issue 15 million shares privately, serving the factory expansion at PNJ Jewelry Processing and Trading Company to increase production capacity, for retail segment. - HPG: Dragon Capital bought 1.2 million HPG shares. This activity caused the HPG share volume owned by the Dragon Capital group increased from 198.7 million to 199.92 million shares, equivalent to an increase of 5.99% to 6.03%.

Market by numbers

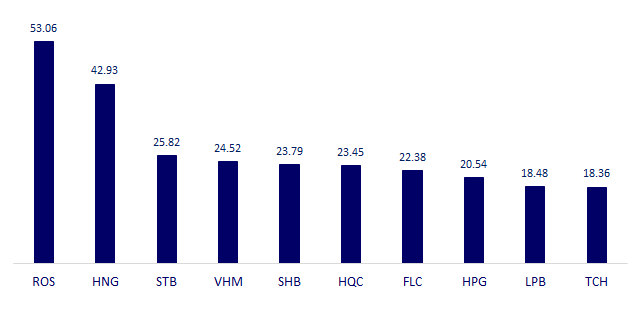

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

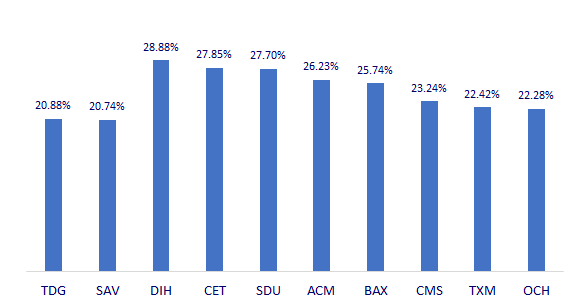

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.