Market Brief 16/04/2021

VIETNAM STOCK MARKET

1,238.71

1D -0.68%

YTD 12.66%

1,276.87

1D -0.57%

YTD 20.64%

293.11

1D -1.02%

YTD 48.71%

81.79

1D -1.10%

YTD 10.78%

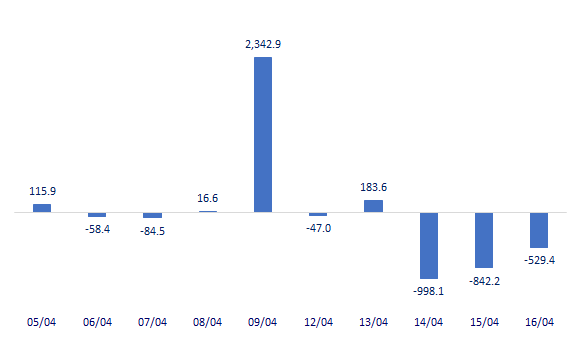

-529.37

1D 0.00%

YTD 0.00%

27,044.39

1D 9.52%

YTD 57.66%

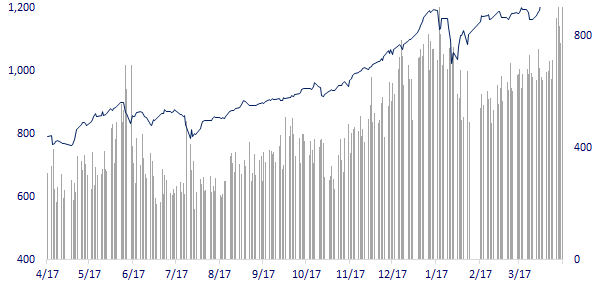

- Average liquidity on both exchanges increased during the week. Average matching volume on HOSE reached nearly 874 million shares/session, up 34.13% from the previous trading week. The HNX averaged over 188 million shares/session, up 12.76%.

ETF & DERIVATIVES

21,500

1D -0.42%

YTD 14.36%

15,250

1D 1.80%

YTD 21.71%

15,950

1D -0.93%

YTD 19.65%

18,600

1D -0.53%

YTD 17.72%

16,800

1D -2.10%

YTD 23.08%

20,980

1D -0.57%

YTD 21.98%

16,560

1D -0.84%

YTD 18.71%

1,275

1D -0.53%

YTD 0.00%

1,280

1D -0.08%

YTD 0.00%

1,274

1D -0.52%

YTD 0.00%

1,284

1D 0.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,683.37

1D 0.00%

YTD 8.16%

3,426.62

1D 0.81%

YTD 0.36%

3,198.62

1D 0.13%

YTD 11.32%

29,009.00

1D 0.84%

YTD 6.86%

3,201.76

1D 0.53%

YTD 11.59%

1,548.96

1D 0.51%

YTD 6.87%

63.70

1D 0.50%

YTD 31.88%

1,771.70

1D 0.54%

YTD -6.93%

- Although, China's GDP in the first quarter did not meet expectations, Asian stocks still increased. In the Chinese market, the Shanghai Composite increased 0.81%. Hong Kong's Hang Seng increased by 0.84%. The South Korea's Kospi increased by 0.13%.

VIETNAM ECONOMY

0.41%

YTD (bps) 28

5.60%

YTD (bps) -20

1.39%

1D (bps) 3

YTD (bps) 17

2.23%

YTD (bps) 20

23,170

1D (%) 0.00%

YTD (%) -0.03%

28,333

1D (%) 0.14%

YTD (%) -2.65%

3,607

1D (%) 0.00%

YTD (%) 0.95%

- In the first quarter of 2021, the Customs sector collected nearly 89,000 billion VND from the state budget. According to preliminary statistics, as of March 31, 2021, the total state budget revenues (state budget) in the whole industry reached 88,458 billion VND, equaling 28.1% of the assigned estimate, equal to 26.7% of the target, up 9,595 billion dong, equivalent to 12.17% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first quarter of 2021, the Customs sector had state budget revenue of nearly 89,000 billion VND

- 50% reduction in animal breed fees by the end of 2021

- Deploy the $1.5 billion power plant project in Ca Mau

- China declared GDP growth of 18.3% in Q1/2021 but still lower than expected

- The US economy boomed in March

- The US and Europe lack steel supplies, export opportunities for Asia

VN30

BANK

96,300

1D -1.23%

5D -1.23%

Buy Vol. 2,368,700

Sell Vol. 3,144,400

42,000

1D -2.44%

5D -5.19%

Buy Vol. 7,318,900

Sell Vol. 8,333,200

42,000

1D -0.47%

5D -1.18%

Buy Vol. 36,378,700

Sell Vol. 42,895,300

40,450

1D -1.10%

5D -2.76%

Buy Vol. 26,834,600

Sell Vol. 25,312,700

48,950

1D -2.10%

5D 3.71%

Buy Vol. 9,838,000

Sell Vol. 13,327,600

30,200

1D -1.31%

5D -3.67%

Buy Vol. 30,108,500

Sell Vol. 30,244,100

26,650

1D -2.56%

5D -4.82%

Buy Vol. 7,617,700

Sell Vol. 10,867,100

27,700

1D -3.82%

5D -3.82%

Buy Vol. 14,682,900

Sell Vol. 16,276,000

22,100

1D -1.12%

5D -2.64%

Buy Vol. 78,478,500

Sell Vol. 78,887,300

- CTG: In 2021, VietinBank aims to increase total assets by 6-10%; 7.5% maximum growth. Capital mobilization grew by 8-12%, adjusted in accordance with credit growth, and ensured prudential ratios as prescribed by the State Bank. NPL ratio controlled below 1.5%. Expected to pay dividends in 2020 in both cash and stock

REAL ESTATE

108,000

1D 5.37%

5D 20.00%

Buy Vol. 7,281,900

Sell Vol. 5,481,300

22,950

1D -4.18%

5D -13.07%

Buy Vol. 16,106,000

Sell Vol. 17,323,400

31,400

1D 0.96%

5D -1.41%

Buy Vol. 3,355,700

Sell Vol. 3,787,200

71,000

1D 5.03%

5D 3.50%

Buy Vol. 7,272,400

Sell Vol. 5,452,300

- NVL: After restructuring, Novaland Group (NVL) is the focus of the Nova Group ecosystem. Nova Service Group, Nova Consumer Group will provide services and products to add value to the real estate projects of the group.

OIL & GAS

86,000

1D 0.00%

5D -3.15%

Buy Vol. 1,486,400

Sell Vol. 1,546,600

13,200

1D -1.49%

5D -4.35%

Buy Vol. 45,543,800

Sell Vol. 44,478,600

52,800

1D -2.94%

5D -5.55%

Buy Vol. 2,498,000

Sell Vol. 2,637,700

- POW: PV Power submitted a project investment of $1.5b in Ca Mau, expected to be completed in 2026. After putting into operation, electricity output reached 9 billion kWh/year

VINGROUP

143,000

1D 1.49%

5D 14.49%

Buy Vol. 4,617,700

Sell Vol. 4,289,600

101,000

1D -0.20%

5D 2.12%

Buy Vol. 10,162,000

Sell Vol. 12,760,900

33,950

1D -0.15%

5D -3.00%

Buy Vol. 12,116,200

Sell Vol. 12,749,500

- VinFast has just increased its capital by 4,481 billion dong to increase its charter to 42,497 billion dong. Vingroup is considering raising capital for VinFast.

FOOD & BEVERAGE

96,900

1D -2.22%

5D -2.91%

Buy Vol. 7,852,300

Sell Vol. 10,057,800

100,100

1D 0.10%

5D 8.69%

Buy Vol. 5,199,300

Sell Vol. 5,421,300

22,000

1D 0.00%

5D -3.08%

Buy Vol. 4,428,000

Sell Vol. 5,019,400

- MSN: A subsidiary, Masan High-Tech Materials wants to privately offer shares, up to 35% of capital after the issue

OTHERS

129,000

1D -2.05%

5D -2.12%

Buy Vol. 668,800

Sell Vol. 1,216,400

129,000

1D -2.05%

5D -2.12%

Buy Vol. 668,800

Sell Vol. 1,216,400

79,700

1D -0.38%

5D -2.92%

Buy Vol. 3,292,500

Sell Vol. 3,852,000

134,000

1D 0.22%

5D 0.53%

Buy Vol. 1,542,400

Sell Vol. 1,496,100

90,900

1D -1.20%

5D 0.66%

Buy Vol. 1,186,800

Sell Vol. 1,399,200

51,000

1D -1.35%

5D -4.67%

Buy Vol. 1,046,700

Sell Vol. 1,131,400

34,000

1D -2.44%

5D -3.55%

Buy Vol. 29,647,000

Sell Vol. 37,860,700

54,600

1D 0.18%

5D 10.19%

Buy Vol. 45,399,500

Sell Vol. 55,256,900

- HPG: Exceeding Formosa, Hoa Phat became the largest steel producer in Vietnam. Particularly in March, Hoa Phat reached 700,000 tons of crude steel, up 56% over the same period and is the highest level ever. Market share of construction steel, steel pipes Hoa Phat holds the No. 1 position in Vietnam, 33.8% and 30.19%, respectively. Ton Hoa Phat is also in the Top 5 companies with the largest market share with nearly 6%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

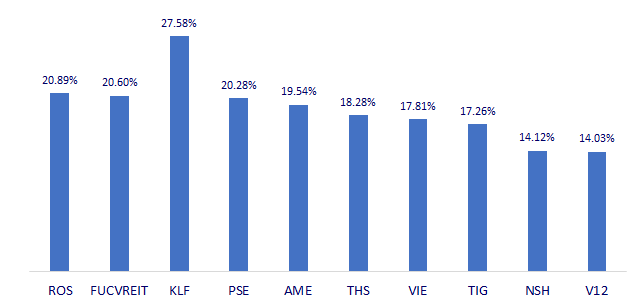

TOP INCREASES 3 CONSECUTIVE SESSIONS

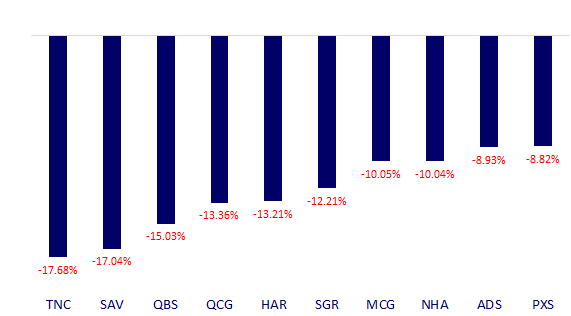

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.