Market Brief 14/06/2021

VIETNAM STOCK MARKET

1,361.72

1D 0.74%

YTD 23.85%

1,495.51

1D 0.53%

YTD 41.30%

319.01

1D 0.73%

YTD 61.85%

88.83

1D -0.11%

YTD 20.32%

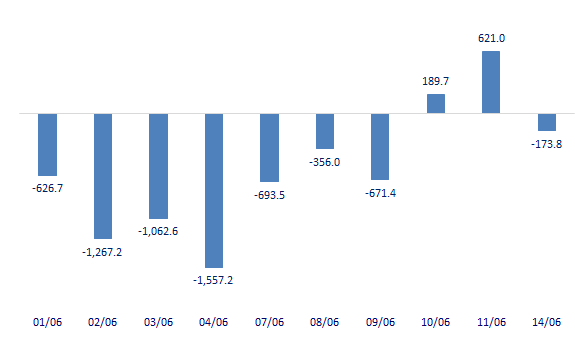

-173.78

1D 0.00%

YTD 0.00%

31,611.25

1D 8.39%

YTD 84.29%

- Foreign investors turned negative again when they bought 41.3m shares worth 1,826b dong, while selling 51.8m shares worth 1,991.6 billion dong. Total net selling volume was at 10.6m shares, equivalent to a net selling value of VND 173b. On HoSE alone, foreign investors net sold 77b dong, equivalent to a volume of nearly 7m shares.

ETF & DERIVATIVES

25,100

1D 0.48%

YTD 33.51%

17,400

1D 0.00%

YTD 38.87%

21,800

1D 1.40%

YTD 37.97%

22,500

1D 0.49%

YTD 64.84%

24,900

1D -0.28%

YTD 44.77%

18,800

1D 1.08%

YTD 34.77%

1,478

1D 0.93%

YTD 0.00%

1,484

1D 0.95%

YTD 0.00%

1,491

1D 0.79%

YTD 0.00%

1,498

1D 0.29%

YTD 0.00%

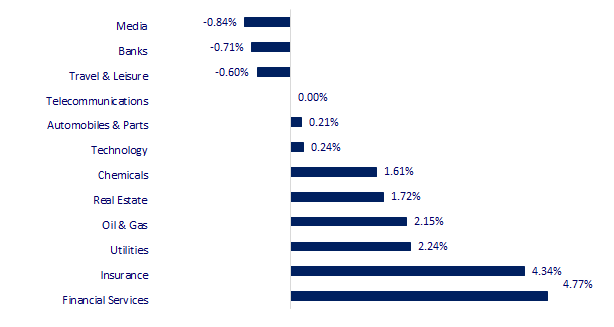

CHANGE IN PRICE BY SECTOR

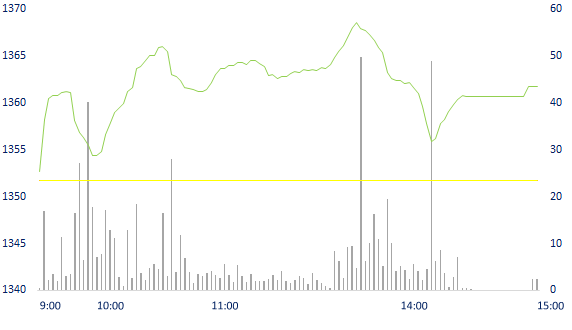

INTRADAY VNINDEX

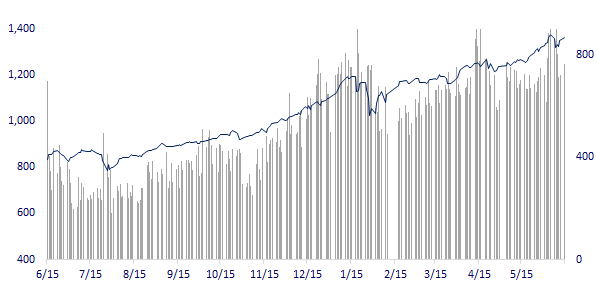

VNINDEX (12M)

GLOBAL MARKET

29,161.80

1D 0.74%

YTD 6.26%

3,589.75

1D 0.00%

YTD 5.13%

3,252.13

1D 0.09%

YTD 13.18%

28,842.13

1D -0.10%

YTD 6.24%

3,153.47

1D 0.00%

YTD 9.91%

1,633.06

1D -0.21%

YTD 12.68%

71.25

1D 0.20%

YTD 47.52%

1,856.15

1D -0.63%

YTD -2.50%

- Asian stocks mixed, Chinese markets holiday. In Japan, Nikkei 225 gained 0.74% while Topix gained 0.29%. South Korea's Kospi index rose 0.09%. Mainland China, Hong Kong and Australia markets are on holiday.

VIETNAM ECONOMY

0.96%

1D (bps) -5

YTD (bps) 83

5.60%

YTD (bps) -20

1.17%

1D (bps) -4

YTD (bps) -5

2.03%

1D (bps) -20

23,048

1D (%) 0.01%

YTD (%) -0.56%

28,612

1D (%) 0.14%

YTD (%) -1.69%

3,656

1D (%) 0.00%

YTD (%) 2.32%

- Interest rates on bank bonds are often much lower than those of real estate, securities, etc. However, the bank's bond interest rates are even lower than savings deposit rates but the issuance of the bank with the scale of trillions of dong each period was successful.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Banks continue to race to issue bonds, the interest rate is only 3.5-4.2%/year for 2-3 year term still "sold out".

- The State Bank of Vietnam amends the content on gold business management

- Open market has its first trade after almost 4 months of inactivity

- Food prices rose to the highest level in 10 years, causing Asian users and businesses to suffer

- China congests ports, cargo ships skip stop in Singapore

- US challenges China's vaccine diplomacy

VN30

BANK

102,000

1D -0.78%

5D -0.97%

Buy Vol. 2,752,200

Sell Vol. 2,309,100

44,900

1D -0.66%

5D -4.06%

Buy Vol. 4,842,700

Sell Vol. 5,490,300

52,500

1D -0.76%

5D 0.96%

Buy Vol. 18,664,600

Sell Vol. 27,794,700

52,700

1D 0.19%

5D 0.57%

Buy Vol. 25,843,100

Sell Vol. 30,193,000

70,900

1D -1.12%

5D -1.53%

Buy Vol. 49,206,800

Sell Vol. 60,601,900

39,300

1D -0.25%

5D -1.13%

Buy Vol. 33,478,300

Sell Vol. 41,397,800

34,100

1D -1.02%

5D -1.59%

Buy Vol. 6,989,100

Sell Vol. 7,823,400

36,300

1D -0.82%

5D -2.42%

Buy Vol. 4,572,700

Sell Vol. 7,079,600

30,800

1D 0.98%

5D 0.33%

Buy Vol. 41,555,500

Sell Vol. 48,050,100

- The last trading week recorded 25/26 bank tickers down, of which PGB dropped the most with 11.5%. VPB shares continued to lead in terms of liquidity with more than 238m shares traded during the week, equivalent to over 16,900b dong. In addition, VCB's capitalization decreased by nearly 8,000b, MB decreased by nearly 6,000b. In which, VPB owns the highest trading volume in the industry with more than 238m shares. In terms of transaction value, VPB also ranked first in the industry with more than 16,900b dong.

REAL ESTATE

103,900

1D -0.95%

5D 1.70%

Buy Vol. 1,938,300

Sell Vol. 2,161,000

22,200

1D 1.37%

5D -1.77%

Buy Vol. 15,953,700

Sell Vol. 11,588,300

36,900

1D 0.27%

5D 4.61%

Buy Vol. 4,474,800

Sell Vol. 3,871,800

91,400

1D 4.58%

5D 9.72%

Buy Vol. 9,603,100

Sell Vol. 9,364,700

- KDH: private issuance up to 400 billion dong of non-convertible bonds, no collateral. The bond has a term of 4 years with a fixed interest rate of 12%/year. Release time at the latest in the third quarter of this year

OIL & GAS

89,500

1D 2.87%

5D -1.32%

Buy Vol. 2,621,500

Sell Vol. 2,750,800

12,200

1D 1.24%

5D -5.43%

Buy Vol. 18,950,000

Sell Vol. 21,987,700

55,000

1D 1.85%

5D -2.83%

Buy Vol. 13,722,300

Sell Vol. 8,253,500

- PLX: continued to be net bought by foreign investors in today's session with the value of 55.2 billion dong.

VINGROUP

120,000

1D 1.69%

5D -2.44%

Buy Vol. 3,106,500

Sell Vol. 2,859,400

109,900

1D 3.68%

5D 3.68%

Buy Vol. 10,810,700

Sell Vol. 11,886,300

31,950

1D 1.43%

5D -4.20%

Buy Vol. 9,444,400

Sell Vol. 11,208,400

- In the last trading week, while foreign investors net sold 966 billion dong VIC, VRE was net bought 353 billion dong.

FOOD & BEVERAGE

92,500

1D 0.54%

5D 3.47%

Buy Vol. 6,669,800

Sell Vol. 9,025,400

106,900

1D 0.85%

5D 2.30%

Buy Vol. 2,107,200

Sell Vol. 3,175,900

21,300

1D 0.00%

5D 1.91%

Buy Vol. 3,444,500

Sell Vol. 5,464,300

- MSN: On June 14, Masan Group completed the issuance of 5.5% new shares of The CrownX to the investor group Alibaba and BPEA.

OTHERS

115,700

1D 0.17%

5D 3.49%

Buy Vol. 858,100

Sell Vol. 853,200

115,700

1D 0.17%

5D 3.49%

Buy Vol. 858,100

Sell Vol. 853,200

83,800

1D 0.36%

5D 1.33%

Buy Vol. 3,816,100

Sell Vol. 4,016,100

138,100

1D 0.80%

5D 1.47%

Buy Vol. 1,732,300

Sell Vol. 1,228,500

97,000

1D 0.10%

5D -2.61%

Buy Vol. 553,800

Sell Vol. 766,600

55,500

1D 1.09%

5D -0.54%

Buy Vol. 1,211,400

Sell Vol. 1,280,600

53,000

1D 7.83%

5D 14.57%

Buy Vol. 32,130,300

Sell Vol. 27,990,700

53,600

1D 0.94%

5D 1.71%

Buy Vol. 44,067,100

Sell Vol. 49,130,000

- REE: Platinum Victory Pte. Ltd registered to buy nearly 13m shares to increase its holdings to nearly 108.2m shares, equivalent to 34.99% of capital. The transaction is expected to be carried out from June 17 to July 16 - VJC: Deputy General Director To Viet Thang registered to sell 70,000 shares to reduce the holding amount to 206,000 units (0.04%). Transactions are carried out by order matching and agreement methods from June 17 to July 10.

Market by numbers

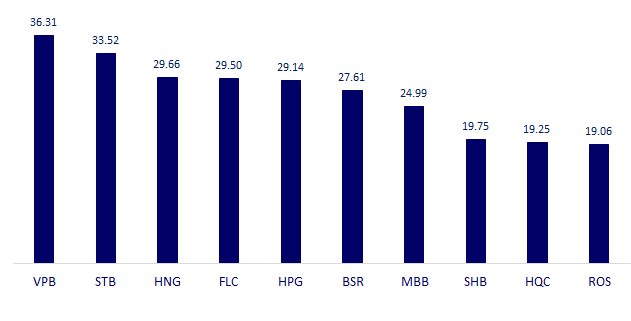

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

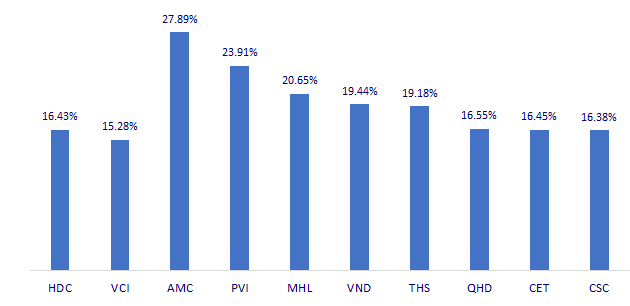

TOP INCREASES 3 CONSECUTIVE SESSIONS

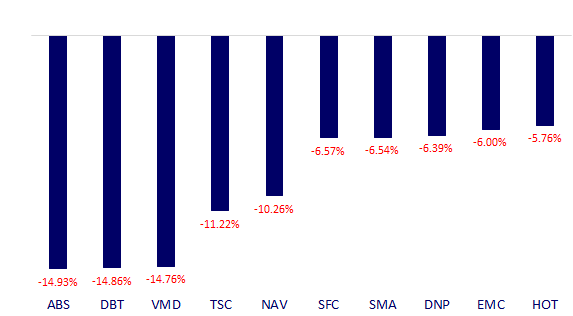

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.