Market Brief 14/09/2021

VIETNAM STOCK MARKET

1,339.70

1D -0.13%

YTD 21.85%

1,438.16

1D -0.47%

YTD 35.88%

347.86

1D -0.34%

YTD 76.49%

95.01

1D -0.26%

YTD 28.69%

-598.76

1D 0.00%

YTD 0.00%

24,608.21

1D -15.15%

YTD 43.46%

- Session 14/9: Foreign investors net sold 598 billion dong. The selling force on HoSE focused on Bluechips such as HPG, VCB, MSN, STB, VHM… On HNX and UPCoM, foreign investors were more active when net buying was 156 billion dong and 31 billion dong, respectively.

ETF & DERIVATIVES

24,200

1D -0.41%

YTD 28.72%

16,980

1D -0.82%

YTD 35.51%

18,050

1D 1.35%

YTD 35.71%

21,200

1D 0.00%

YTD 34.18%

20,340

1D -0.34%

YTD 49.01%

25,650

1D -0.74%

YTD 49.13%

18,300

1D -0.27%

YTD 31.18%

1,433

1D -0.35%

YTD 0.00%

1,436

1D 0.06%

YTD 0.00%

1,436

1D -0.26%

YTD 0.00%

1,437

1D -0.38%

YTD 0.00%

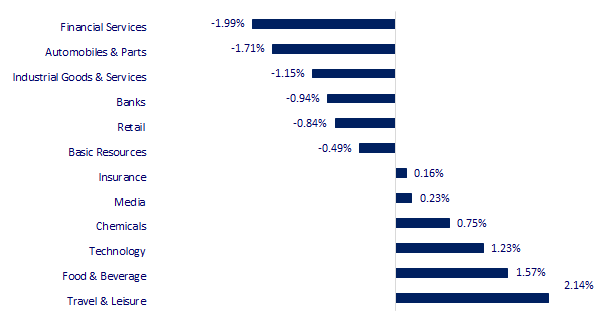

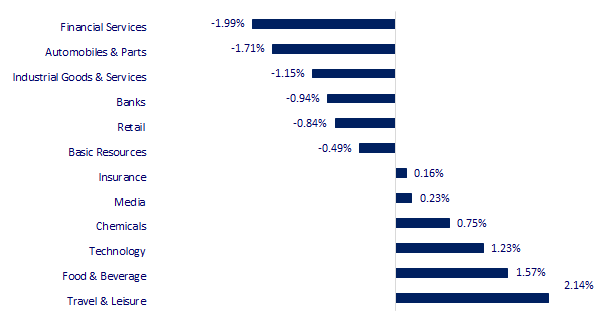

CHANGE IN PRICE BY SECTOR

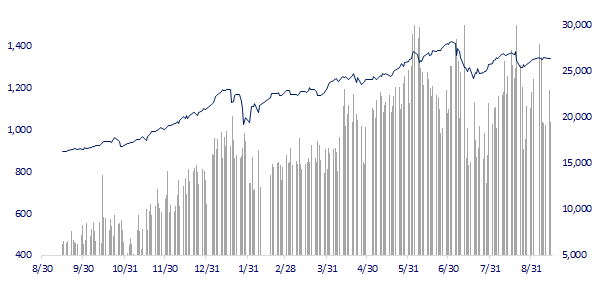

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

30,670.10

1D 0.00%

YTD 11.75%

3,662.60

1D -1.42%

YTD 7.27%

3,148.83

1D 0.67%

YTD 9.58%

25,502.23

1D -1.17%

YTD -6.06%

3,080.37

1D 0.20%

YTD 7.36%

1,623.84

1D -0.61%

YTD 12.04%

70.81

1D 0.17%

YTD 46.60%

1,788.55

1D -0.21%

YTD -6.05%

- Asian stocks mixed, investors await US inflation data. The Chinese market fell with the Shanghai Composite down 1.42% and the Shenzhen Component down 0.542%. Hong Kong's Hang Seng fell 1.17%, following a deep drop in the previous session. South Korea's Kospi index rose 0.67%.

VIETNAM ECONOMY

0.64%

1D (bps) 1

YTD (bps) 51

5.60%

YTD (bps) -20

0.95%

1D (bps) -15

YTD (bps) -27

1.91%

1D (bps) 9

YTD (bps) -12

22,860

1D (%) -0.02%

YTD (%) -1.37%

27,490

1D (%) -0.04%

YTD (%) -5.54%

3,601

1D (%) 0.08%

YTD (%) 0.78%

- After recalculating, the Ministry of Planning and Investment forecasts GDP may increase by 3.5-4% this year. To achieve the growth rate of 3.5-4% as mentioned above, the Ministry of Planning and Investment believes that it requires great efforts and more drastic efforts of both the political system and the locality.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Planning and Investment forecasts GDP growth of 3.5-4% this year

- Banks will reduce interest rates for homebuyers

- Imposing anti-dumping tax on polyester fiber products originating from China, India, Indonesia, Malaysia into Vietnam

- The risk of global financial markets falling into chaos if the US defaults on its debt

- China's new move pushes iron ore price forecasts down nearly 30%

- IMF allocates more than 1 billion USD for special drawing rights of Lebanon

VN30

BANK

98,300

1D 0.20%

5D -1.70%

Buy Vol. 2,066,900

Sell Vol. 1,847,800

38,700

1D -1.15%

5D -2.52%

Buy Vol. 2,815,300

Sell Vol. 3,518,000

31,200

1D -2.04%

5D -4.44%

Buy Vol. 14,567,600

Sell Vol. 16,778,800

48,500

1D -0.92%

5D -2.32%

Buy Vol. 9,392,800

Sell Vol. 10,605,300

63,900

1D -1.39%

5D 0.63%

Buy Vol. 10,053,400

Sell Vol. 11,763,900

27,600

1D -1.08%

5D -3.50%

Buy Vol. 16,283,600

Sell Vol. 20,152,600

24,800

1D -1.59%

5D -7.12%

Buy Vol. 3,617,300

Sell Vol. 3,211,600

37,600

1D -1.31%

5D 3.30%

Buy Vol. 8,583,400

Sell Vol. 12,282,200

26,650

1D -0.93%

5D -4.48%

Buy Vol. 17,181,100

Sell Vol. 21,364,800

31,500

1D -1.25%

5D -3.08%

Buy Vol. 7,230,100

Sell Vol. 8,488,800

- MBB: In the first 6 months of 2021, the bank added 2.5 million new customers and is expected to reach 4-5 million new customers in 2021. Currently, including member companies, MB is serving about 10 million customers

REAL ESTATE

103,000

1D 0.00%

5D -1.72%

Buy Vol. 2,656,500

Sell Vol. 2,859,200

41,250

1D 0.00%

5D 1.60%

Buy Vol. 3,410,400

Sell Vol. 4,633,700

80,500

1D 0.00%

5D -3.01%

Buy Vol. 4,011,100

Sell Vol. 3,585,200

- KDH was among the top stocks that were net bought by foreign investors in today's session with a value of 27 billion dong.

OIL & GAS

89,000

1D 0.45%

5D 0.34%

Buy Vol. 941,100

Sell Vol. 1,589,900

11,500

1D -2.95%

5D -4.56%

Buy Vol. 25,238,000

Sell Vol. 30,938,600

50,100

1D -0.40%

5D -0.60%

Buy Vol. 2,845,800

Sell Vol. 1,476,000

- POW: power output in August reached 963.8 million kWh, fulfilling 73% of the monthly plan and down 20% compared to the same period last year.

VINGROUP

92,000

1D 0.00%

5D -2.02%

Buy Vol. 6,151,100

Sell Vol. 3,126,700

107,000

1D 0.00%

5D -2.37%

Buy Vol. 18,374,600

Sell Vol. 19,436,500

28,300

1D 1.43%

5D 4.04%

Buy Vol. 10,242,900

Sell Vol. 14,291,800

- VIC: VinFast sold 2,310 cars in August, LuxSA2.0 only delivered 8 units due to lack of chips globally

FOOD & BEVERAGE

87,000

1D -0.23%

5D 0.81%

Buy Vol. 4,133,500

Sell Vol. 5,124,000

135,500

1D 3.75%

5D 4.39%

Buy Vol. 4,132,500

Sell Vol. 3,956,900

166,000

1D 2.79%

5D 11.63%

Buy Vol. 740,200

Sell Vol. 680,800

- MSN: GIC fund group sold 19.5 million MSN shares on September 1, estimated to collect more than 2,500 billion dong

OTHERS

125,800

1D -1.72%

5D 0.96%

Buy Vol. 1,066,700

Sell Vol. 1,172,000

125,800

1D -1.72%

5D 0.96%

Buy Vol. 1,066,700

Sell Vol. 1,172,000

93,800

1D 0.86%

5D 0.32%

Buy Vol. 4,529,700

Sell Vol. 5,788,200

124,500

1D -0.40%

5D 12.87%

Buy Vol. 1,723,300

Sell Vol. 2,137,900

89,000

1D -3.26%

5D 3.25%

Buy Vol. 1,377,500

Sell Vol. 1,380,800

38,000

1D 0.80%

5D -2.19%

Buy Vol. 7,837,000

Sell Vol. 6,728,300

42,500

1D -2.52%

5D 2.71%

Buy Vol. 13,428,900

Sell Vol. 14,424,800

50,300

1D -0.98%

5D -0.79%

Buy Vol. 36,187,100

Sell Vol. 36,970,900

- HPG: Hoa Phat is actively promoting procedures to bring the Roper Valley iron ore mine (RVIM) into operation by the end of 2021. With a positive scenario, the average iron ore price in 2022 could be up to 160 USD/ton, RVIM will contribute about 4,635 billion dong, equivalent to 22.1% of Hoa Phat's pre-tax profit.

Market by numbers

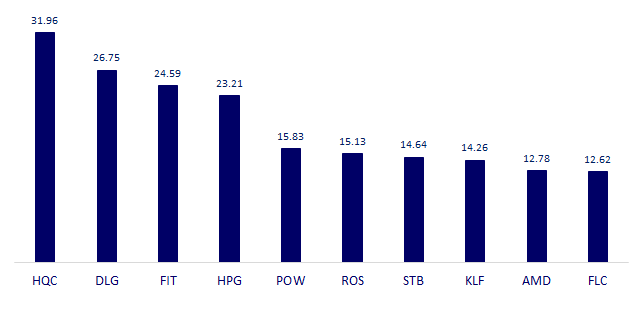

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

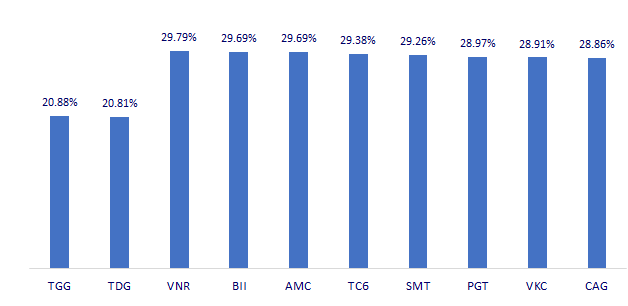

TOP INCREASES 3 CONSECUTIVE SESSIONS

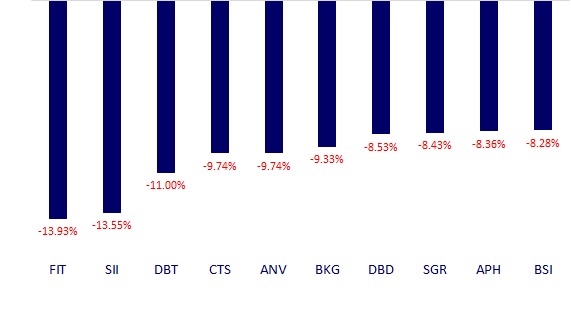

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.