Market brief 14/04/2022

VIETNAM STOCK MARKET

1,472.12

1D -0.34%

YTD -1.75%

1,518.01

1D -0.48%

YTD -1.15%

423.69

1D -0.88%

YTD -10.61%

113.41

1D 0.10%

YTD 0.65%

-225.30

1D 0.00%

YTD 0.00%

21,134.98

1D -18.77%

YTD -31.98%

Session 14/4: The strongest net buying was DGC with 93 billion dong. DPM and GEX were net bought at 64 billion dong and 58 billion dong, respectively. Meanwhile, HPG was sold the most with 171 billion dong. VND and VHM were net sold 90 billion dong and 41 billion dong respectively.

ETF & DERIVATIVES

25,520

1D -1.47%

YTD -1.20%

17,860

1D -0.50%

YTD -1.27%

18,560

1D 4.21%

YTD -2.32%

22,060

1D -3.20%

YTD -3.67%

22,150

1D 0.45%

YTD -1.47%

31,080

1D 0.91%

YTD 10.80%

19,910

1D -0.10%

YTD -7.31%

1,504

1D -0.48%

YTD 0.00%

1,511

1D -0.28%

YTD 0.00%

1,511

1D -0.46%

YTD 0.00%

1,513

1D -0.47%

YTD 0.00%

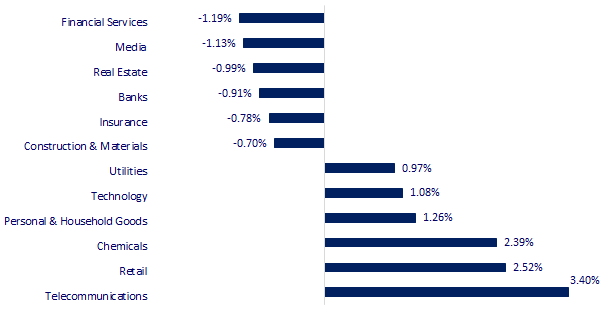

CHANGE IN PRICE BY SECTOR

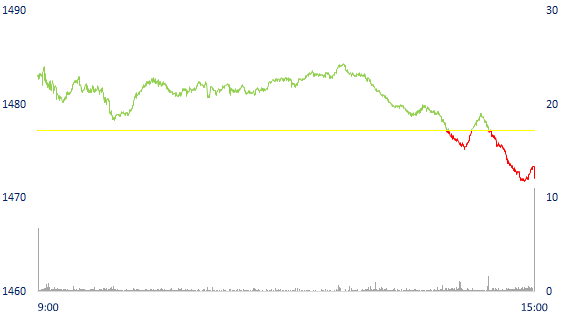

INTRADAY VNINDEX

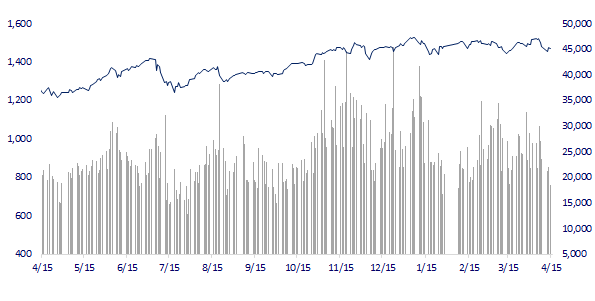

VNINDEX (12M)

GLOBAL MARKET

27,172.00

1D 1.22%

YTD -5.63%

3,225.64

1D 1.22%

YTD -11.38%

2,716.71

1D 0.01%

YTD -8.76%

21,518.08

1D 0.67%

YTD -8.03%

3,335.85

1D -0.19%

YTD 6.79%

1,674.34

1D 0.00%

YTD 1.01%

102.83

1D 0.24%

YTD 34.42%

1,970.20

1D -0.39%

YTD 8.21%

South Korea raised interest rates, Asian stocks mixed. In Japan, Nikkei 225 gained 1.22%, Topix gained 0.95%. The Chinese market went up with Shanghai Composite up 1.22%, Shenzhen Component up 1.266%. Hong Kong's Hang Seng rose 0.57%. The Chinese government on April 13 announced that the reserve requirement ratio would be used "at the right time to raise credit input of banks".

VIETNAM ECONOMY

2.11%

YTD (bps) 130

5.60%

2.36%

1D (bps) 8

YTD (bps) 135

2.98%

1D (bps) 16

YTD (bps) 98

-

1D (%) -

YTD (%) -

25,721

1D (%) 0.70%

YTD (%) -2.82%

3,664

1D (%) -0.03%

YTD (%) 0.16%

Quang Tri Industrial Park is located in Dien Sanh town, Hai Lam commune and Hai Truong commune, Hai Lang district, Quang Tri with a total area of 481.2 hectares. Quang Tri Development Joint Venture Company Limited is the investor for this project with a total investment of 2,074 billion VND with a project operation period of 50 years.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The whole country welcomes 3 million tourists on the occasion of Hung King's death anniversary

- According to the Government: Strictly control cash flow into speculative fields

- Quang Tri establishes an industrial park of VND 2,000 billion

- Korea raises interest rates to 3-year high

- Russia's external debt is at its lowest level in 13 years

- Germany could lose nearly $240 billion if Russia cuts off gas

VN30

BANK

81,000

1D -1.70%

5D -2.41%

Buy Vol. 2,313,000

Sell Vol. 1,613,200

40,500

1D -0.98%

5D -5.92%

Buy Vol. 2,870,200

Sell Vol. 3,580,600

31,200

1D -0.95%

5D -4.15%

Buy Vol. 5,404,800

Sell Vol. 6,919,600

47,300

1D -1.46%

5D -4.06%

Buy Vol. 12,554,700

Sell Vol. 12,472,200

39,500

1D 1.28%

5D -0.75%

Buy Vol. 39,471,300

Sell Vol. 43,994,000

32,300

1D -0.92%

5D -4.15%

Buy Vol. 13,637,300

Sell Vol. 16,142,300

27,300

1D -2.50%

5D -5.54%

Buy Vol. 8,574,100

Sell Vol. 6,529,700

39,050

1D -2.38%

5D -4.76%

Buy Vol. 3,863,600

Sell Vol. 5,660,700

30,800

1D -1.75%

5D -3.45%

Buy Vol. 10,516,300

Sell Vol. 13,869,700

33,800

1D 0.45%

5D 0.60%

Buy Vol. 7,251,100

Sell Vol. 10,837,200

VPB: VPBank plans to continue to increase its charter capital into 2 phases: Maximum issuance of nearly 2.24 billion shares to increase share capital from equity, corresponding to the rate of 50% and private placement for investors. foreign ownership up to 15% of charter capital, bringing the total foreign ownership ratio to a maximum of 30% of charter capital. If the two phases are completed, VPBank's charter capital is expected to increase to VND 79,334 billion.

REAL ESTATE

85,000

1D -1.73%

5D 0.47%

Buy Vol. 8,782,600

Sell Vol. 10,115,400

50,100

1D -0.99%

5D -1.96%

Buy Vol. 1,404,100

Sell Vol. 1,746,200

89,500

1D -1.65%

5D -3.35%

Buy Vol. 3,416,300

Sell Vol. 3,724,300

PDR: Announcement of dividend payment for 2021 in shares at the ratio of 1000:363, the last registration date is April 21, 2022 and the ex-execution date is April 20, 2022.

OIL & GAS

111,600

1D 1.36%

5D -1.06%

Buy Vol. 662,900

Sell Vol. 964,000

15,550

1D -0.96%

5D -6.61%

Buy Vol. 11,889,600

Sell Vol. 13,189,400

54,700

1D 0.00%

5D -3.36%

Buy Vol. 1,712,600

Sell Vol. 2,157,800

POW: Set a target of total electricity output of 13.9 billion kWh, total revenue of VND 24,242 billion, profit before tax of the Corporation at VND 865 billion

VINGROUP

81,700

1D -0.61%

5D 2.77%

Buy Vol. 2,693,500

Sell Vol. 3,708,400

72,300

1D -1.09%

5D -3.60%

Buy Vol. 5,551,200

Sell Vol. 5,761,600

31,850

1D 0.00%

5D -2.45%

Buy Vol. 4,284,900

Sell Vol. 4,405,000

VIC: VinFast and Electrify America announce charging agreement and mobile app integration for electric vehicles

FOOD & BEVERAGE

76,300

1D -1.17%

5D -2.80%

Buy Vol. 3,209,800

Sell Vol. 3,516,500

125,700

1D -0.95%

5D -0.10%

Buy Vol. 1,318,200

Sell Vol. 1,337,500

166,900

1D 2.08%

5D 0.24%

Buy Vol. 387,700

Sell Vol. 170,000

VNM: Expected to submit to shareholders a business plan with total revenue of VND 64,070 billion, up 5%. Expected profit after tax is 9,770 billion VND, down 8% compared to 2021

OTHERS

136,900

1D -0.87%

5D -0.07%

Buy Vol. 768,900

Sell Vol. 904,900

136,900

1D -0.87%

5D -0.07%

Buy Vol. 768,900

Sell Vol. 904,900

116,600

1D 1.30%

5D 2.91%

Buy Vol. 5,169,100

Sell Vol. 6,880,100

159,500

1D 2.11%

5D 2.90%

Buy Vol. 4,822,900

Sell Vol. 5,607,300

117,000

1D 0.86%

5D 1.65%

Buy Vol. 2,002,400

Sell Vol. 3,414,300

34,550

1D 0.14%

5D -4.82%

Buy Vol. 2,537,100

Sell Vol. 3,141,800

42,000

1D -1.29%

5D -4.65%

Buy Vol. 7,233,900

Sell Vol. 10,034,400

44,900

1D -0.66%

5D -3.54%

Buy Vol. 20,901,500

Sell Vol. 19,966,000

MWG: Announced the resolution of the Board of Directors on the establishment of a subsidiary, Bach Hoa Xanh Investment and Technology Joint Stock Company, with a charter capital of 10 billion VND. At the same time, MWG's Board of Directors also revised and supplemented the report submitted to the 2022 Annual General Meeting of Shareholders on the restructuring of Bach Hoa Xanh Trading Joint Stock Company (BHX).

Market by numbers

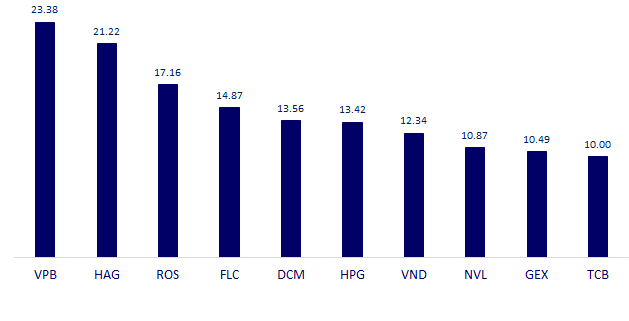

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

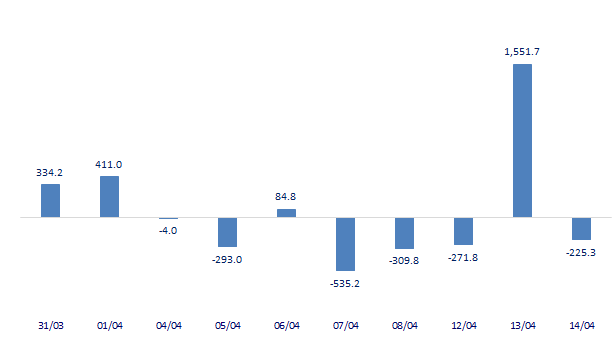

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

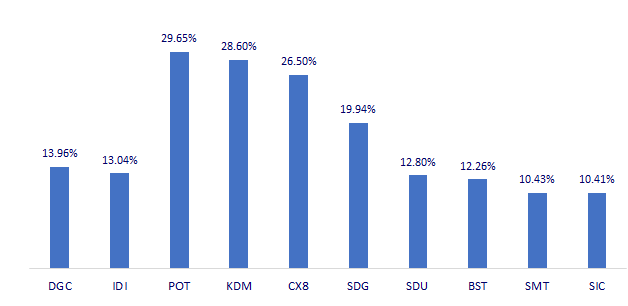

TOP INCREASES 3 CONSECUTIVE SESSIONS

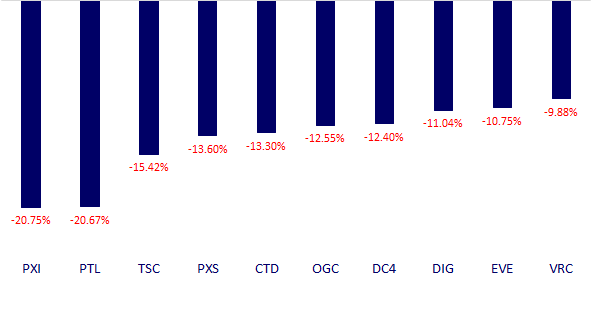

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.