Market brief 03/06/2022

VIETNAM STOCK MARKET

1,287.98

1D -0.05%

YTD -14.04%

1,327.40

1D 0.14%

YTD -13.56%

310.48

1D -0.41%

YTD -34.50%

94.17

1D -0.16%

YTD -16.43%

-182.93

1D 0.00%

YTD 0.00%

16,178.27

1D -18.15%

YTD -47.93%

Foreign investors reduced their net selling on June 3 to 183 billion dong. HPG topped the list of net sellers on HoSE with 38 billion dong. GAS and VCB were net sold 38 billion dong and 21 billion dong respectively. Meanwhile, CTD was bought the most with 19 billion dong. DPM and SAB were net bought 11 billion dong and 10.6 billion dong respectively.

ETF & DERIVATIVES

22,100

1D -0.90%

YTD -14.44%

15,650

1D 0.19%

YTD -13.49%

16,600

1D -6.79%

YTD -12.63%

19,420

1D 2.21%

YTD -15.20%

17,400

1D -0.57%

YTD -22.60%

28,900

1D 1.65%

YTD 3.03%

17,050

1D 0.24%

YTD -20.62%

1,313

1D -0.04%

YTD 0.00%

1,316

1D 0.33%

YTD 0.00%

1,317

1D 0.24%

YTD 0.00%

1,319

1D 0.27%

YTD 0.00%

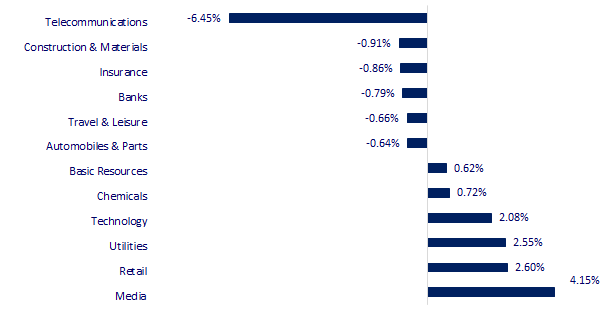

CHANGE IN PRICE BY SECTOR

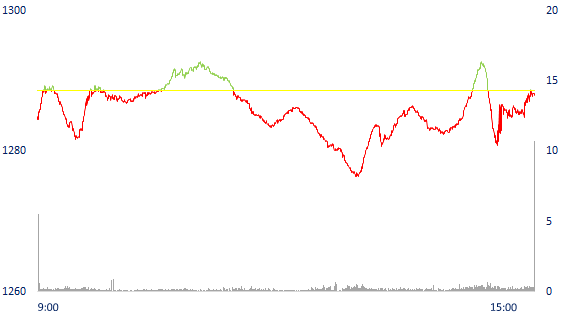

INTRADAY VNINDEX

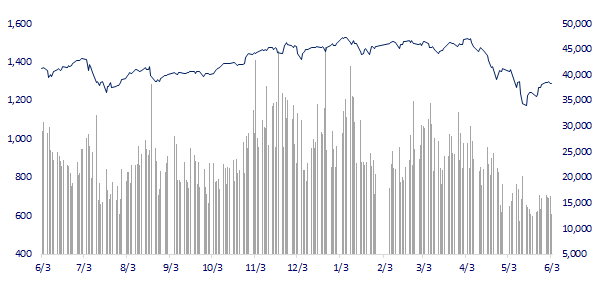

VNINDEX (12M)

GLOBAL MARKET

27,761.57

1D 0.28%

YTD -3.58%

3,195.46

1D 0.00%

YTD -12.21%

2,670.65

1D 0.44%

YTD -10.31%

21,082.13

1D 0.00%

YTD -9.90%

3,231.97

1D 0.16%

YTD 3.47%

1,647.67

1D 0.00%

YTD -0.60%

116.17

1D -0.42%

YTD 51.86%

1,867.80

1D -0.37%

YTD 2.58%

Asian stocks all rallied after a rally in the US. Investors in the region are also waiting for the May jobs data to have a better view of the "health" of the world's No. 1 economy. In Japan, the Nikkei 225 index rose 0.28%. The Kospi (South Korea) index rose 0.44%. Stocks in China, Hong Kong and Taiwan were closed for a holiday.

VIETNAM ECONOMY

0.45%

1D (bps) -3

YTD (bps) -36

5.60%

2.50%

1D (bps) -7

YTD (bps) 149

3.07%

1D (bps) -6

YTD (bps) 107

23,410

1D (%) 0.32%

YTD (%) 2.05%

25,348

1D (%) -1.28%

YTD (%) -4.23%

3,552

1D (%) -0.03%

YTD (%) -2.90%

From the beginning of the year until now, the Asian Development Bank (ADB) forecasts that Vietnam's economic growth will recover at 6.5% in 2022 and reach 6.7% in 2023. Meanwhile, the World Bank The World Bank (WB) forecasts that Vietnam's GDP growth in 2022 will reach 5.3%, then stabilize around 6.5%. According to the forecast of the International Monetary Fund (IMF), Vietnam will achieve economic growth of 6.0% in 2022, among the countries with the highest growth rates in the world.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is among the countries forecasted to have the highest growth in 2022

- Block cash flow of hundreds of trillions from corporate bonds

- Deputy Prime Minister Le Minh Khai: The 350,000 billion package will be implemented well in the near future

- The UK and the Netherlands are intensifying their search for alternative sources of Russian gas

- World oil prices jumped 1% despite OPEC+ agreeing to pump more oil

- China claims success with its "Zero- Covid" strategy

VN30

BANK

77,500

1D -1.90%

5D 0.13%

Buy Vol. 935,700

Sell Vol. 1,146,800

34,350

1D -1.01%

5D -2.69%

Buy Vol. 1,070,400

Sell Vol. 1,180,600

27,400

1D -1.26%

5D 1.48%

Buy Vol. 3,936,500

Sell Vol. 5,155,300

36,450

1D 0.14%

5D -2.67%

Buy Vol. 5,403,700

Sell Vol. 6,021,100

30,750

1D 1.65%

5D -1.13%

Buy Vol. 14,868,100

Sell Vol. 10,517,700

27,400

1D 0.74%

5D -2.14%

Buy Vol. 9,729,400

Sell Vol. 9,539,500

25,400

1D -2.31%

5D -1.55%

Buy Vol. 2,104,900

Sell Vol. 2,923,900

31,850

1D -0.47%

5D -1.39%

Buy Vol. 1,946,700

Sell Vol. 2,970,900

21,150

1D -1.86%

5D -4.94%

Buy Vol. 21,629,900

Sell Vol. 20,677,600

25,300

1D -0.20%

5D -0.55%

Buy Vol. 2,140,400

Sell Vol. 4,280,900

VCB: Vietcombank was upgraded by S&P Credit Rating from "BB-" to "BB". This is also the highest and only rating among Vietnamese banks. Specifically, S&P ranks Vietcombank's long-term issuer rating at BB; short-term issuer rating of B and stable credit outlook.

REAL ESTATE

77,500

1D -1.77%

5D -1.15%

Buy Vol. 3,752,700

Sell Vol. 4,016,400

40,800

1D -0.49%

5D -4.11%

Buy Vol. 1,086,100

Sell Vol. 1,141,800

53,700

1D -0.92%

5D -1.10%

Buy Vol. 2,306,800

Sell Vol. 2,566,600

NVL: additionally listed more than 19.3 million shares from June 3, bringing the listed securities from 1,930.4 million shares to 1,949.7 million shares.

OIL & GAS

124,200

1D 4.46%

5D 12.91%

Buy Vol. 3,569,500

Sell Vol. 3,981,400

13,500

1D -0.37%

5D 1.12%

Buy Vol. 24,720,800

Sell Vol. 22,225,500

43,500

1D 0.00%

5D 2.11%

Buy Vol. 2,402,500

Sell Vol. 2,375,500

GAS: Korean, Singaporean and Thai investors want to cooperate with PV GAS in taking advantage of cold heat in the regasification process from LNG by smart refrigeration technology.

VINGROUP

78,800

1D -0.13%

5D 1.03%

Buy Vol. 2,233,100

Sell Vol. 2,604,700

69,400

1D -0.14%

5D 2.48%

Buy Vol. 4,059,000

Sell Vol. 5,702,900

29,950

1D 0.00%

5D 0.50%

Buy Vol. 2,048,200

Sell Vol. 3,256,800

The fund with the lowest yield so far this year is VanEck Vietnam ETF (-24.7%). In which VIC and VHM accounted for the largest proportion.

FOOD & BEVERAGE

70,300

1D -1.13%

5D -3.70%

Buy Vol. 2,064,900

Sell Vol. 2,384,800

112,800

1D -1.31%

5D 2.55%

Buy Vol. 712,300

Sell Vol. 850,500

155,200

1D 1.44%

5D 0.78%

Buy Vol. 439,400

Sell Vol. 432,700

SAB: The whole market still maintains 17 enterprises with a market capitalization of over VND 100,000 billion, but Sabeco has officially been surpassed by FPT.

OTHERS

127,000

1D -1.32%

5D 0.00%

Buy Vol. 860,400

Sell Vol. 880,200

127,000

1D -1.32%

5D 0.00%

Buy Vol. 860,400

Sell Vol. 880,200

114,000

1D 2.24%

5D 1.97%

Buy Vol. 2,918,000

Sell Vol. 4,165,400

153,200

1D 3.72%

5D 4.43%

Buy Vol. 3,165,700

Sell Vol. 3,332,400

123,200

1D 0.00%

5D 0.74%

Buy Vol. 2,286,600

Sell Vol. 2,700,100

25,000

1D -3.10%

5D -1.96%

Buy Vol. 2,749,300

Sell Vol. 3,396,300

29,250

1D 0.86%

5D -2.17%

Buy Vol. 34,344,300

Sell Vol. 31,882,000

33,400

1D 0.75%

5D -5.78%

Buy Vol. 28,778,800

Sell Vol. 25,054,900

MWG: On June 17th, the list of shareholders will be finalised, with the ratio of 1:1, which means that shareholders owning 1 share will receive 1 additional share. The company currently has a charter capital of more than 7,320 billion VND and after the issuance, the company's capital will increase to 14,640 billion VND.

Market by numbers

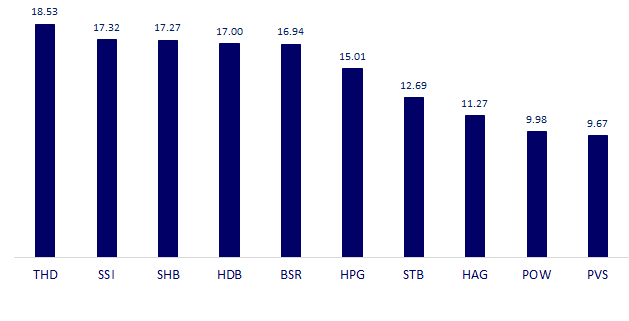

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

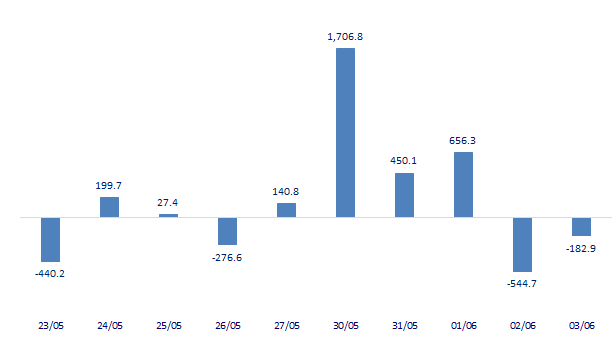

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

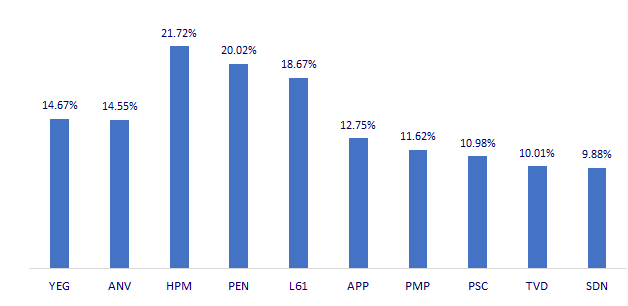

TOP INCREASES 3 CONSECUTIVE SESSIONS

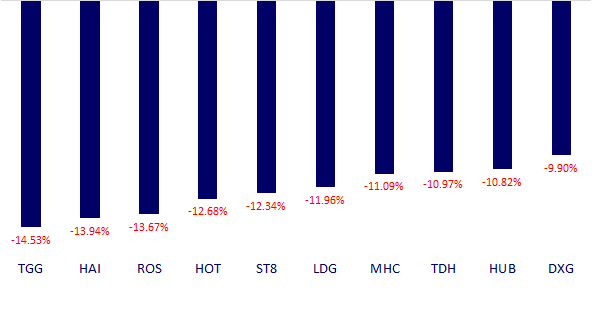

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.