Market brief 13/06/2022

VIETNAM STOCK MARKET

1,227.04

1D -4.44%

YTD -18.10%

1,260.85

1D -4.89%

YTD -17.90%

288.37

1D -5.90%

YTD -39.16%

90.53

1D -3.40%

YTD -19.66%

-177.11

1D 0.00%

YTD 0.00%

22,801.69

1D 7.17%

YTD -26.62%

Foreign investors ended the chain of 5 net buying sessions on HoSE. Foreign investors on HoSE were very net sellers of ETF FUEVFVND with 245 billion dong. The second place on the list of foreign investors' net selling was DGC with 42 billion dong. Meanwhile, GAS was bought the most with 71 billion dong. GMD and DCM were net bought 57 billion dong and 52 billion dong respectively.

ETF & DERIVATIVES

21,740

1D -2.95%

YTD -15.83%

14,810

1D -5.49%

YTD -18.13%

15,580

1D -12.52%

YTD -18.00%

18,740

1D -1.47%

YTD -18.17%

16,480

1D -5.72%

YTD -26.69%

27,150

1D -5.73%

YTD -3.21%

16,280

1D -4.24%

YTD -24.21%

1,260

1D -4.00%

YTD 0.00%

1,262

1D -3.73%

YTD 0.00%

1,258

1D -3.97%

YTD 0.00%

1,260

1D -3.88%

YTD 0.00%

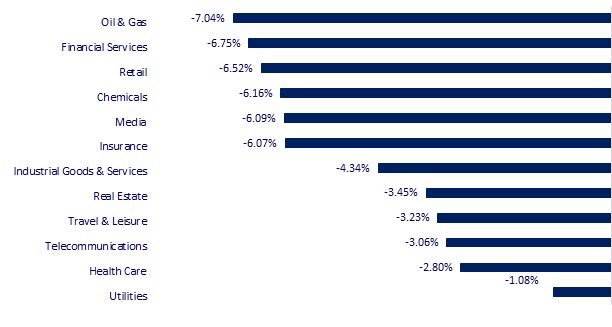

CHANGE IN PRICE BY SECTOR

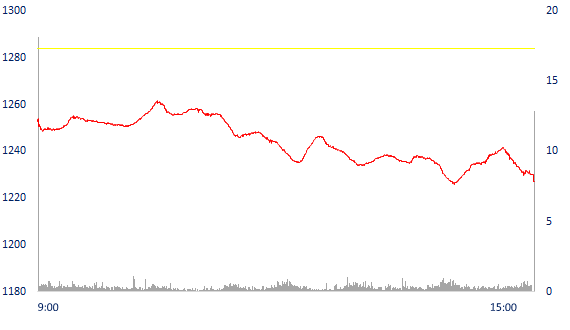

INTRADAY VNINDEX

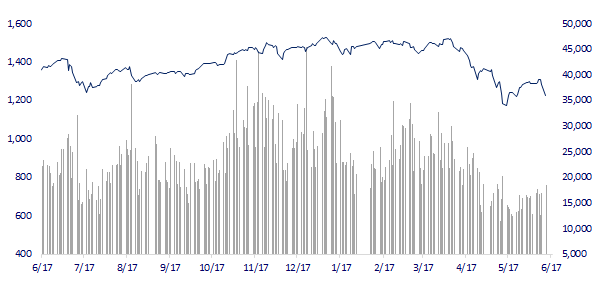

VNINDEX (12M)

GLOBAL MARKET

26,987.44

1D -0.21%

YTD -6.27%

3,255.55

1D -0.89%

YTD -10.56%

2,504.51

1D -3.52%

YTD -15.89%

21,067.58

1D -0.41%

YTD -9.96%

3,139.35

1D -1.33%

YTD 0.50%

1,600.06

1D -1.99%

YTD -3.47%

119.08

1D 2.43%

YTD 55.66%

1,860.70

1D -0.54%

YTD 2.19%

Asian stocks all dropped on June 13 in the context of many technology stocks being sold off at the same time. In Japan, the Nikkei 225 index fell 0.21%. South Korea's Kospi index fell 3.52%. Chinese stocks are also not out of the downtrend. The Shanghai Composite Index fell 0.89%. The Hang Seng Index (Hong Kong) fell 0.41%.

VIETNAM ECONOMY

0.38%

YTD (bps) -43

5.60%

2.54%

1D (bps) -6

YTD (bps) 153

3.12%

1D (bps) 1

YTD (bps) 112

23,420

1D (%) 0.43%

YTD (%) 2.09%

24,728

1D (%) -1.21%

YTD (%) -6.57%

3,515

1D (%) -0.28%

YTD (%) -3.91%

The US put Vietnam back on the currency monitoring list. Vietnam was added to the monitoring list because it no longer meets all three criteria of bilateral trade surplus, current account surplus and prolonged one-way foreign exchange market intervention. In 2021, the US Treasury Department concluded that there were no major partners manipulating currencies in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam increases 9 places in the ranking of budget transparency

- The US put Vietnam back on the currency monitoring list

- Transportation industry studies to reduce fees and charges, due to increase in fuel prices

- Inflation is heating up, it is difficult for the US economy to get out of recession

- China imposes restrictions again

- Japanese yen falls to 24-year low

VN30

BANK

76,400

1D -1.67%

5D -4.14%

Buy Vol. 2,103,100

Sell Vol. 1,947,700

31,950

1D -5.47%

5D -6.58%

Buy Vol. 2,129,300

Sell Vol. 2,359,600

25,250

1D -6.83%

5D -7.17%

Buy Vol. 9,048,400

Sell Vol. 11,883,900

36,000

1D -5.14%

5D -0.14%

Buy Vol. 10,851,100

Sell Vol. 10,982,000

28,750

1D -6.96%

5D -6.05%

Buy Vol. 32,693,400

Sell Vol. 29,861,800

25,650

1D -6.73%

5D -5.87%

Buy Vol. 21,860,700

Sell Vol. 23,976,100

24,550

1D -5.21%

5D -2.96%

Buy Vol. 3,356,400

Sell Vol. 3,902,800

27,650

1D -6.90%

5D -9.93%

Buy Vol. 4,369,500

Sell Vol. 5,924,100

20,600

1D -5.94%

5D 0.49%

Buy Vol. 31,850,400

Sell Vol. 26,595,900

23,900

1D -5.16%

5D -5.53%

Buy Vol. 6,392,000

Sell Vol. 6,001,400

TCB: Techcombank may get a better credit line than other banks this year thanks to the highest CAR in the industry. Techcombank still has room to increase personal lending thanks to a low LDR rate (75%) by the end of 2021 and a moderate personal loan portfolio (47% of total outstanding loans).

REAL ESTATE

76,000

1D -1.30%

5D -0.39%

Buy Vol. 2,933,800

Sell Vol. 3,428,300

39,900

1D -2.56%

5D -1.85%

Buy Vol. 1,073,300

Sell Vol. 1,387,400

50,000

1D -5.12%

5D -6.89%

Buy Vol. 2,559,100

Sell Vol. 2,941,000

PDR: officially kicked off the project of a commercial complex of hotels and resorts on Ngo May beach (Quy Nhon, Binh Dinh)

OIL & GAS

118,000

1D -0.59%

5D -9.16%

Buy Vol. 3,241,300

Sell Vol. 2,974,700

15,250

1D 1.67%

5D 10.51%

Buy Vol. 83,021,300

Sell Vol. 72,896,500

42,000

1D -6.67%

5D -6.46%

Buy Vol. 2,922,300

Sell Vol. 2,941,300

GAS: Many items of the 1 MMTPA Thi Vai LNG storage project (the capacity of phase 1 is 1m tons/year) have been closely following the progress, in which many work items are ahead of schedule.

VINGROUP

76,400

1D -2.05%

5D -2.68%

Buy Vol. 3,381,700

Sell Vol. 3,042,100

66,000

1D -3.37%

5D -4.76%

Buy Vol. 4,825,900

Sell Vol. 5,540,100

29,000

1D -4.92%

5D -3.17%

Buy Vol. 4,453,500

Sell Vol. 4,938,600

VIC: VinFast announced to keep the battery subscription price unchanged for all customers buying electric cars in 2022 and 2023 instead of adjusting it up according to petrol and electricity.

FOOD & BEVERAGE

66,400

1D -4.46%

5D -6.21%

Buy Vol. 3,745,900

Sell Vol. 3,644,300

109,000

1D -6.84%

5D -6.84%

Buy Vol. 1,523,400

Sell Vol. 1,688,400

153,000

1D -2.98%

5D -3.47%

Buy Vol. 243,700

Sell Vol. 298,300

VNM: There is a shadow of Thai billionaire Charoen Sirivadhanabhakdi when members of F&N are holding a total of more than 20% VNM shares, just behind State shareholders (36%).

OTHERS

124,900

1D -2.19%

5D -2.12%

Buy Vol. 732,700

Sell Vol. 934,000

124,900

1D -2.19%

5D -2.12%

Buy Vol. 732,700

Sell Vol. 934,000

86,200

1D -5.11%

5D -7.63%

Buy Vol. 5,693,800

Sell Vol. 6,167,900

140,000

1D -6.67%

5D -8.91%

Buy Vol. 4,999,800

Sell Vol. 4,855,200

112,300

1D -6.96%

5D -10.16%

Buy Vol. 3,419,000

Sell Vol. 3,461,700

24,300

1D -6.90%

5D -3.38%

Buy Vol. 4,424,900

Sell Vol. 4,990,800

25,950

1D -6.82%

5D -10.52%

Buy Vol. 27,830,100

Sell Vol. 40,437,100

31,800

1D -5.36%

5D -4.50%

Buy Vol. 30,956,800

Sell Vol. 36,216,300

FPT: Da Nang City People's Committee decided to allocate more than 3.3 hectares of cleared land to FPT Da Nang Urban Joint Stock Company (belonging to FPT Corporation) at the FPT Technology Urban Area project, Ngu Hanh Son district. Of which, 2.97 ha of land without land use levy for traffic, trees, water surface, technical infrastructure, cultural houses, and public primary schools.

Market by numbers

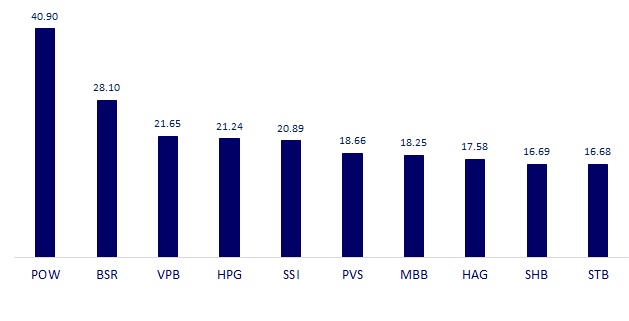

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

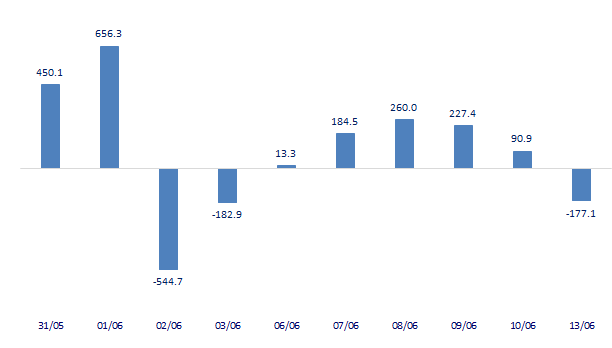

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

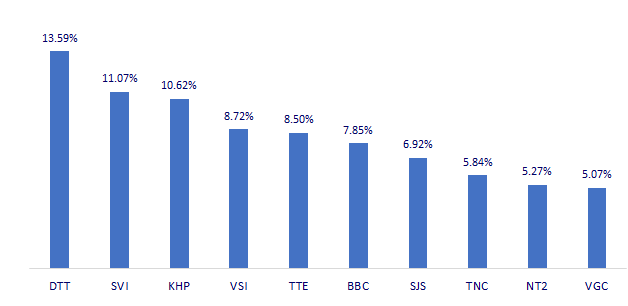

TOP INCREASES 3 CONSECUTIVE SESSIONS

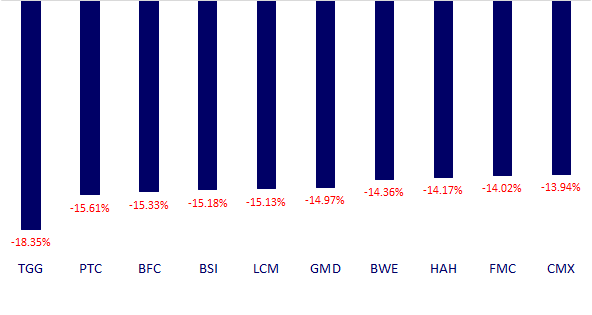

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.