Market Brief 11/07/2022

VIETNAM STOCK MARKET

1,155.29

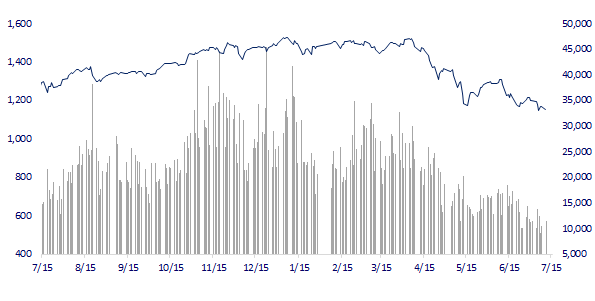

1D -1.37%

YTD -22.89%

1,209.02

1D -1.83%

YTD -21.27%

276.93

1D -0.31%

YTD -41.57%

86.25

1D -0.82%

YTD -23.46%

4.07

1D 0.00%

YTD 0.00%

13,094.97

1D 8.79%

YTD -57.86%

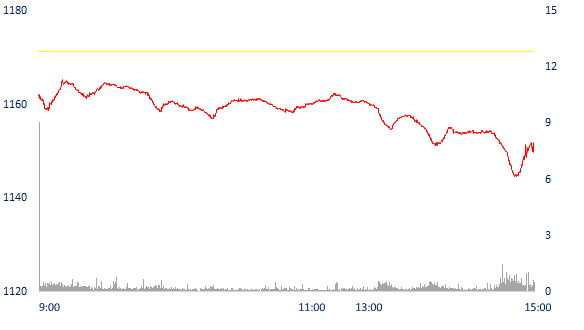

A series of large stocks plunged, VN-Index dropped more than 16 points. Market liquidity increased slightly compared to the last session of last week. The total matched value reached 11,755 billion dong, up 8%, of which, the matched value on HoSE alone increased by 8.6% to 10,148 billion dong. Foreign investors only net bought about 4 billion dong.

ETF & DERIVATIVES

20,370

1D -2.49%

YTD -21.14%

14,200

1D -2.41%

YTD -21.50%

15,100

1D -15.22%

YTD -20.53%

17,850

1D 0.00%

YTD -22.05%

16,560

1D 0.98%

YTD -26.33%

25,640

1D -1.76%

YTD -8.59%

15,400

1D -2.16%

YTD -28.31%

1,190

1D -2.62%

YTD 0.00%

1,199

1D -2.14%

YTD 0.00%

1,210

1D -1.10%

YTD 0.00%

1,201

1D -1.98%

YTD 0.00%

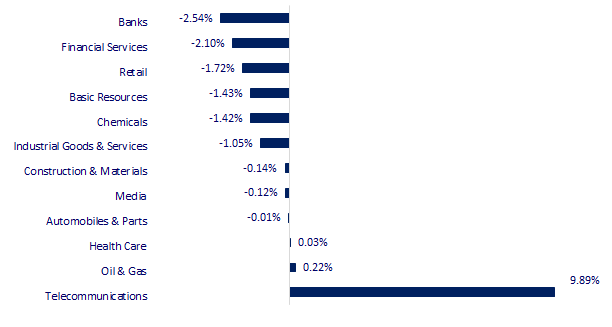

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,812.30

1D -0.38%

YTD -6.87%

3,313.58

1D -1.27%

YTD -8.96%

2,340.27

1D -0.44%

YTD -21.41%

21,124.20

1D -1.01%

YTD -9.72%

3,131.26

1D 0.00%

YTD 0.24%

1,557.40

1D -0.03%

YTD -6.05%

102.28

1D -1.95%

YTD 33.70%

1,733.55

1D -0.21%

YTD -4.79%

Asian stocks fell in the first session of the week. Hong Kong's Hang Seng Index fell 1.01% after it was reported that China sanctioned two technology groups Tencent and Alibaba. The Shanghai Composite Index fell 1.27%. In South Korea, the Kospi index fell 0.44%.

VIETNAM ECONOMY

0.68%

1D (bps) -14

YTD (bps) -13

5.60%

2.68%

1D (bps) 1

YTD (bps) 167

3.32%

YTD (bps) 132

23,570

1D (%) 0.30%

YTD (%) 2.75%

24,040

1D (%) -1.54%

YTD (%) -9.17%

3,551

1D (%) -0.11%

YTD (%) -2.93%

In the week from July 4 to July 8, the SBV continued to withdraw nearly VND 100,000 billion from the market through the T-bill channel, however, interbank VND lending rates still fell deeply. The SBV sells bills in the form of interest rate bidding, but the winning interest rate is lower than the lending rate of the same term in the interbank market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank withdrew nearly 100,000 billion VND

- Import and export of Vietnam - Japan reached more than 20 billion USD

- Prime Minister: Supporting people and businesses with more than VND 225 trillion in taxes and fees this year

- Russian economy: Foreign currency reserves increase again, inflation decreases

- Central banks will raise interest rates in the last 6 months of 2022

- Chinese factories suffer as demand in the US and Europe declines

VN30

BANK

72,000

1D -2.70%

5D -2.83%

Buy Vol. 1,255,400

Sell Vol. 1,667,000

34,500

1D -1.43%

5D -1.57%

Buy Vol. 3,655,900

Sell Vol. 3,660,100

25,500

1D -1.54%

5D -4.14%

Buy Vol. 4,583,100

Sell Vol. 4,722,600

35,600

1D -5.19%

5D -2.06%

Buy Vol. 13,005,800

Sell Vol. 12,750,200

27,500

1D -3.85%

5D -5.82%

Buy Vol. 11,892,700

Sell Vol. 11,774,500

24,400

1D -2.59%

5D -0.81%

Buy Vol. 11,623,900

Sell Vol. 13,594,800

22,900

1D -3.38%

5D -6.72%

Buy Vol. 2,207,000

Sell Vol. 2,265,700

26,000

1D -4.06%

5D -4.76%

Buy Vol. 2,113,400

Sell Vol. 2,323,600

22,050

1D -2.00%

5D -1.34%

Buy Vol. 41,766,600

Sell Vol. 32,372,400

23,500

1D -2.08%

5D -3.09%

Buy Vol. 2,286,400

Sell Vol. 3,158,200

CTG: Recently, VietinBank announced to sell secured debt of Industrial Construction Joint Stock Company (Descon) to handle debt recovery. Total outstanding loans as of July 6, 2022 are nearly VND 509 billion. In which, the principal balance is nearly 329 billion dong, and the balance of interest and penalty interest is more than 180 billion dong. Descon's entire outstanding balance at VietinBank is secured by 23 security contracts signed in the period from 2015-2019.

REAL ESTATE

73,400

1D -0.54%

5D -0.81%

Buy Vol. 1,201,900

Sell Vol. 1,789,900

35,000

1D -2.91%

5D -2.23%

Buy Vol. 1,016,100

Sell Vol. 1,617,200

52,300

1D -0.95%

5D 1.36%

Buy Vol. 1,502,300

Sell Vol. 1,429,800

NVL: The Board of Directors approved the cancellation of the plan to issue bonds to the public and withdrew the bond offering file to the public.

OIL & GAS

94,900

1D -0.73%

5D -12.62%

Buy Vol. 1,178,800

Sell Vol. 1,035,800

12,500

1D -3.85%

5D -7.41%

Buy Vol. 37,072,400

Sell Vol. 25,465,400

39,500

1D 0.38%

5D -2.11%

Buy Vol. 698,500

Sell Vol. 633,100

Petrol prices simultaneously dropped sharply by more than 3,000 VND/liter from 0:00 on 11/7. After adjustment, the price of E5 RON 92 gasoline has a maximum selling price of 27,788 VND / liter...

VINGROUP

70,000

1D 0.00%

5D -3.71%

Buy Vol. 3,125,300

Sell Vol. 4,486,500

60,500

1D -0.82%

5D -0.82%

Buy Vol. 6,445,400

Sell Vol. 7,367,700

26,000

1D -3.70%

5D -8.77%

Buy Vol. 5,612,300

Sell Vol. 6,154,600

VIC: The Ministry of Public Security denied the information that "Mr. Pham Nhat Vuong, Chairman of Vingroup, was banned from leaving the country".

FOOD & BEVERAGE

73,000

1D 0.00%

5D 0.57%

Buy Vol. 4,029,200

Sell Vol. 5,300,600

102,500

1D -2.29%

5D -4.83%

Buy Vol. 872,400

Sell Vol. 1,514,100

155,100

1D 0.00%

5D 1.04%

Buy Vol. 111,200

Sell Vol. 147,400

VNM: In the coming time, Vinamilk does not plan to buy treasury shares but focuses on sustainable development, growth with profit and revenue.

OTHERS

127,400

1D -0.31%

5D -1.70%

Buy Vol. 570,300

Sell Vol. 636,500

127,400

1D -0.31%

5D -1.70%

Buy Vol. 570,300

Sell Vol. 636,500

82,800

1D -0.96%

5D -4.50%

Buy Vol. 1,867,100

Sell Vol. 2,473,400

64,500

1D -0.77%

5D -4.87%

Buy Vol. 2,466,900

Sell Vol. 2,548,600

115,500

1D -0.43%

5D -6.70%

Buy Vol. 2,006,500

Sell Vol. 1,445,000

20,950

1D -1.18%

5D -6.47%

Buy Vol. 1,754,400

Sell Vol. 2,117,400

20,650

1D 1.23%

5D 2.23%

Buy Vol. 43,751,500

Sell Vol. 41,745,600

22,050

1D -1.78%

5D 0.23%

Buy Vol. 20,923,700

Sell Vol. 23,081,300

HPG: Last month's construction steel consumption grew well thanks to the strong growth in the southern market and exports, by 200% and 60% respectively over the same period in 2021. The Government's promotion of the progress of projects Public investment projects, especially key infrastructure projects, including the North-South expressway, have helped improve the demand in the building materials market compared to the previous year.

Market by numbers

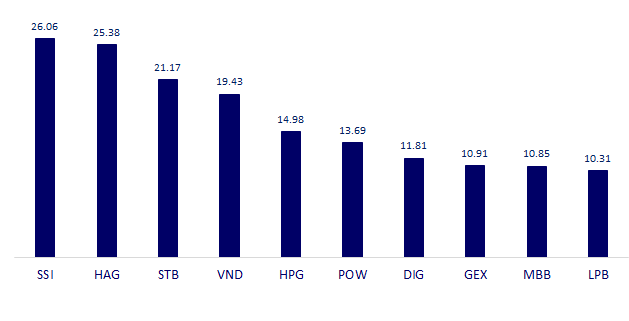

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

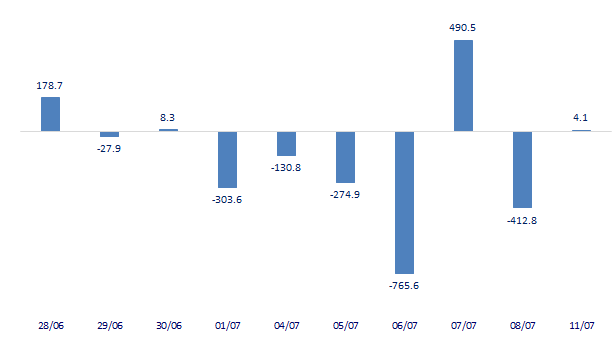

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

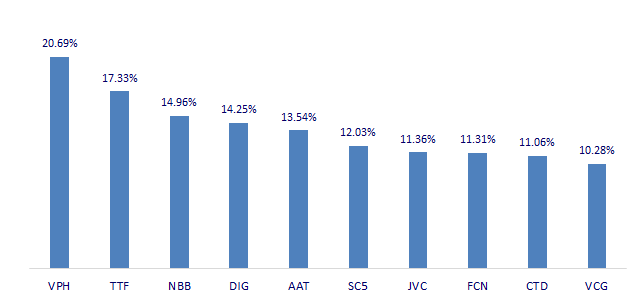

TOP INCREASES 3 CONSECUTIVE SESSIONS

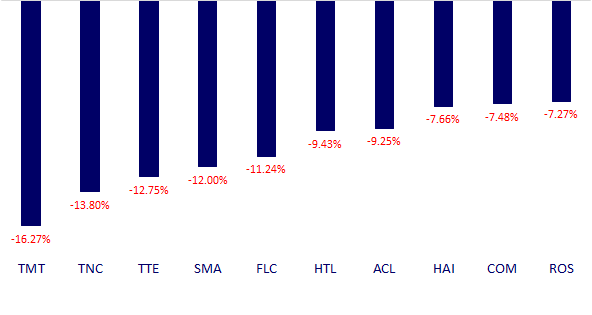

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.