Market brief 29/07/2022

VIETNAM STOCK MARKET

1,206.33

1D -0.15%

YTD -19.49%

1,232.00

1D -0.33%

YTD -19.78%

288.61

1D -0.42%

YTD -39.11%

89.61

1D 0.12%

YTD -20.47%

4.67

1D 0.00%

YTD 0.00%

17,051.24

1D -6.71%

YTD -45.12%

During the session on July 29, Foreign investors turned negative again when buying 46.3 million shares, worth 1,560 billion VND, while selling 40 million shares, worth 1,602 billion VND. Total net buying volume was more than 6 million shares, however, in terms of value, this capital flow sold 42 billion VND. On HoSE alone, foreign investors ended a series of 6 consecutive net buying sessions with a net selling of 34 billion VND.

ETF & DERIVATIVES

20,950

1D 0.14%

YTD -18.89%

14,570

1D 0.14%

YTD -19.46%

15,060

1D -15.44%

YTD -20.74%

17,480

1D 0.17%

YTD -23.67%

16,850

1D -0.24%

YTD -25.04%

26,400

1D 1.23%

YTD -5.88%

15,890

1D -0.69%

YTD -26.02%

1,228

1D -0.27%

YTD 0.00%

1,229

1D -0.20%

YTD 0.00%

1,230

1D -0.15%

YTD 0.00%

1,231

1D -0.07%

YTD 0.00%

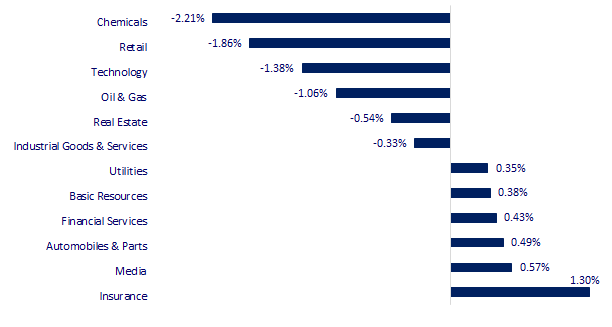

CHANGE IN PRICE BY SECTOR

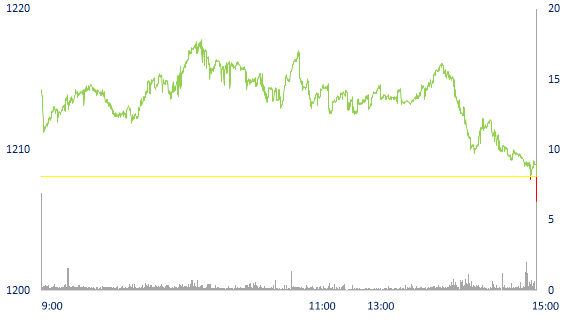

INTRADAY VNINDEX

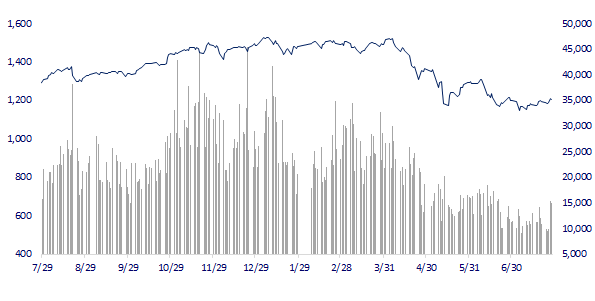

VNINDEX (12M)

GLOBAL MARKET

27,801.64

1D -0.28%

YTD -3.44%

3,253.24

1D -0.89%

YTD -10.62%

2,451.50

1D 0.67%

YTD -17.67%

20,156.51

1D -2.26%

YTD -13.85%

3,211.56

1D -0.28%

YTD 2.81%

1,576.41

1D 0.00%

YTD -4.90%

98.38

1D 0.85%

YTD 28.60%

1,757.90

1D 0.24%

YTD -3.45%

Asian stocks mixed after Wall Street rallied. In Japan, the Nikkei 225 index fell 0.28%. The Kospi (South Korea) index rose 0.67%. Chinese stocks fell. The Shanghai Composite Index fell 0.89%. China's leaders on July 28 signaled that Beijing would not immediately launch a large rescue package to support the economy, and at the same time do not attach great importance to the goal of completing the growth target of 5.5. % in this year.

VIETNAM ECONOMY

4.68%

1D (bps) -45

YTD (bps) 387

5.60%

3.05%

1D (bps) -3

YTD (bps) 204

3.58%

1D (bps) -8

YTD (bps) 158

23,475

1D (%) -0.11%

YTD (%) 2.33%

24,539

1D (%) 0.00%

YTD (%) -7.29%

3,534

1D (%) 0.06%

YTD (%) -3.39%

On July 29, the General Statistics Office announced that the consumer price index (CPI) in July 2022 increased by 0.4% compared to the previous month. The reason for the increase in CPI in the first 7 months of 2022 according to the General Statistics Office is due to high pork prices, increased demand for electricity and domestic water due to hot weather, increased prices of essential consumer goods and services. according to the cost of input materials and transportation costs.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Food, petroleum push July CPI up slightly

- Industrial production index increased by nearly 9% in 7 months

- Hot growth in domestic tourism: Service quality is disproportionate

- The signal that the Fed is about to stop raising interest rates opens the door to recovery for Asia's emerging markets

- Russia vowed to respond symmetrically to Sweden and Finland's accession to NATO

- Austrian Prime Minister criticizes EU for failing to buy gas for its members

VN30

BANK

74,700

1D -0.80%

5D 3.03%

Buy Vol. 1,786,300

Sell Vol. 2,796,100

37,300

1D 2.19%

5D 5.07%

Buy Vol. 6,244,400

Sell Vol. 8,448,200

27,200

1D -1.45%

5D 1.12%

Buy Vol. 12,656,900

Sell Vol. 11,423,900

37,900

1D 1.61%

5D 2.16%

Buy Vol. 7,413,100

Sell Vol. 9,317,200

28,700

1D 1.06%

5D 1.95%

Buy Vol. 19,614,900

Sell Vol. 24,485,700

25,650

1D 0.39%

5D 0.39%

Buy Vol. 16,997,700

Sell Vol. 14,534,200

24,150

1D -1.02%

5D 1.47%

Buy Vol. 3,441,900

Sell Vol. 3,701,500

26,600

1D -2.21%

5D -5.17%

Buy Vol. 6,948,900

Sell Vol. 4,044,400

24,700

1D 1.02%

5D 7.39%

Buy Vol. 33,011,500

Sell Vol. 35,158,600

24,600

1D 0.61%

5D 1.03%

Buy Vol. 5,079,900

Sell Vol. 7,646,200

MBB: profit before tax of the consolidated bank reached nearly VND 11,900 billion in the first 6 months, up 49% compared to the same period in 2021. Accordingly, MBBank's net interest income increased to VND 4,840 billion (equivalent to VND 4,840 billion). 39% over the same period) to VND 17,355 billion. Other business segments of the bank also recorded growth of 2% - 570% in the first 6 months of the year. However, the bank's total bad debt as of June 30, 2022 reached VND 4,975 billion, an increase of 52.3% compared to the beginning of the year. Notably, potentially losing debt increased by 123%, from VND 819 billion to VND 1,826 billion.

REAL ESTATE

74,500

1D 0.68%

5D 0.81%

Buy Vol. 3,893,000

Sell Vol. 3,914,700

37,500

1D -1.32%

5D 2.74%

Buy Vol. 1,225,500

Sell Vol. 1,776,400

52,600

1D -1.13%

5D 0.77%

Buy Vol. 1,632,800

Sell Vol. 1,690,900

NVL: Novaland joint venture and Dat Tam company propose 2 project components in Dien Khanh and Khanh Vinh districts with a total area of nearly 3,500 ha.

OIL & GAS

107,500

1D 1.13%

5D -0.28%

Buy Vol. 966,800

Sell Vol. 1,493,200

13,350

1D -1.48%

5D 1.52%

Buy Vol. 33,637,900

Sell Vol. 31,677,900

41,100

1D -0.96%

5D -1.67%

Buy Vol. 769,500

Sell Vol. 897,700

GAS: The accumulated profit of the first 6 months of 2022 before tax reached 10.7 trillion, up 93.5% over the same period last year mainly due to the high oil price in the second quarter.

VINGROUP

64,000

1D -4.48%

5D -3.76%

Buy Vol. 3,766,800

Sell Vol. 3,523,900

59,900

1D 1.87%

5D 2.04%

Buy Vol. 4,835,300

Sell Vol. 5,686,100

28,000

1D -0.36%

5D 7.69%

Buy Vol. 3,688,900

Sell Vol. 3,905,100

VIC: Pre-tax income in the first half year is VND3,334 billion, down 52% over the same period last year mainly because real estate projects are under construction and will be handed over at the end of the year.

FOOD & BEVERAGE

72,800

1D 0.28%

5D 1.11%

Buy Vol. 3,925,000

Sell Vol. 5,087,200

106,100

1D -3.46%

5D -2.21%

Buy Vol. 1,157,100

Sell Vol. 1,600,700

180,000

1D 4.05%

5D 8.43%

Buy Vol. 425,800

Sell Vol. 355,500

MSN: pre-tax income reached VND3,334 billion, up 104% over the same period last year thanks to the consumer segment and high-tech materials.

OTHERS

125,700

1D -1.33%

5D 0.08%

Buy Vol. 702,800

Sell Vol. 654,400

125,700

1D -1.33%

5D 0.08%

Buy Vol. 702,800

Sell Vol. 654,400

83,500

1D -1.65%

5D -1.88%

Buy Vol. 4,081,600

Sell Vol. 3,180,300

61,000

1D -1.61%

5D -5.43%

Buy Vol. 6,145,700

Sell Vol. 5,493,500

114,000

1D 0.88%

5D -0.44%

Buy Vol. 3,389,700

Sell Vol. 1,590,100

23,900

1D -0.21%

5D 1.70%

Buy Vol. 3,526,300

Sell Vol. 4,968,700

21,350

1D 0.95%

5D 2.15%

Buy Vol. 36,036,900

Sell Vol. 42,977,400

21,500

1D 0.47%

5D -3.15%

Buy Vol. 33,213,900

Sell Vol. 38,041,000

MWG: announced first half revenue of VND70,804 billion, up 13% and fulfilling 51% of the year plan. Profit after tax is 2,576 billion dong, almost flat and fulfilling 41% of the year plan. The business said that it has closed 251 Bach Hoa Xanh stores in May and June, but the revenue has not decreased and is expected to reach the target of 1.3 billion VND/store in the third quarter (earlier than planned). end of the year).

Market by numbers

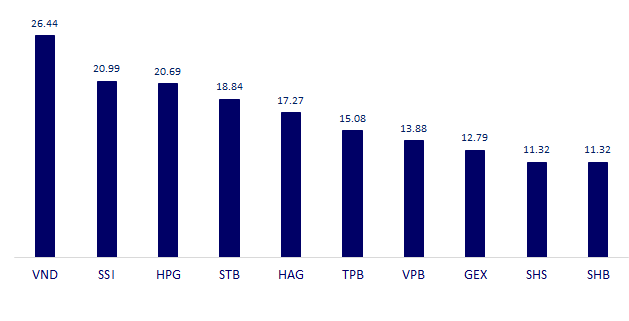

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

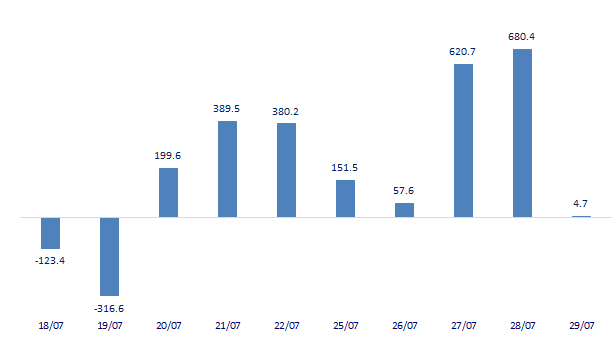

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

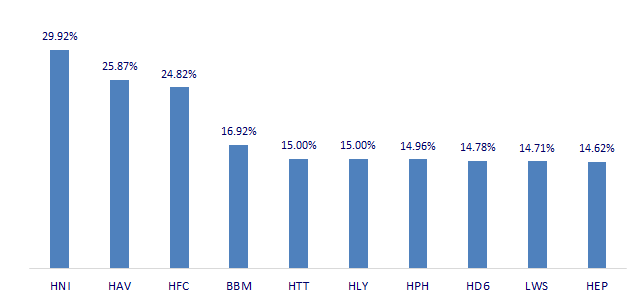

TOP INCREASES 3 CONSECUTIVE SESSIONS

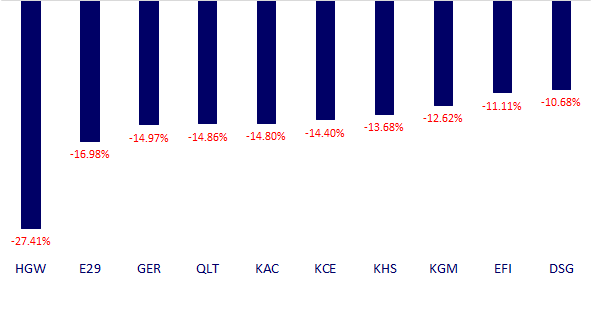

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.