Market Brief 19/09/2022

VIETNAM STOCK MARKET

1,205.43

1D -2.32%

YTD -19.55%

1,229.88

1D -1.83%

YTD -19.91%

264.25

1D -3.16%

YTD -44.25%

88.34

1D -1.25%

YTD -21.60%

139.29

1D 0.00%

YTD 0.00%

19,382.64

1D 9.05%

YTD -37.62%

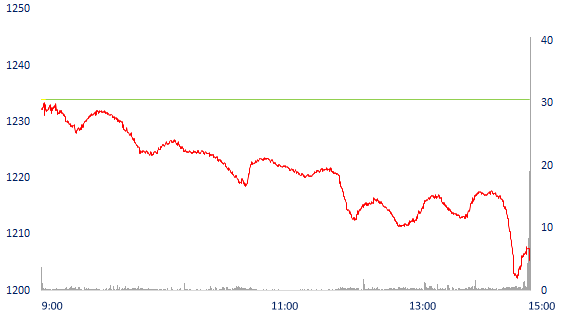

The negative sentiment in the last session of last week did not seem to have been cleared, so VN-Index was red at the beginning, the pressure from large stocks caused VN-Index to drop nearly 29 points. At the end of the session, the decline was somewhat narrow, but the number of losers was 768, nearly 4 times higher than gainers. The market shook strongly, so the liquidity on HOSE also increased to over 16,500 billion dong.

ETF & DERIVATIVES

20,950

1D -0.48%

YTD -18.89%

14,540

1D -1.22%

YTD -19.62%

15,240

1D -14.43%

YTD -19.79%

20,560

1D -0.68%

YTD -10.22%

16,190

1D -4.14%

YTD -27.98%

26,200

1D -1.80%

YTD -6.60%

15,860

1D -1.92%

YTD -26.16%

1,221

1D -0.83%

YTD 0.00%

1,224

1D -1.01%

YTD 0.00%

1,222

1D -1.20%

YTD 0.00%

1,224

1D -3.07%

YTD 0.00%

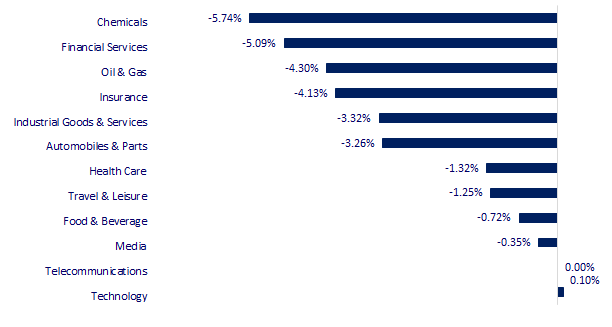

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

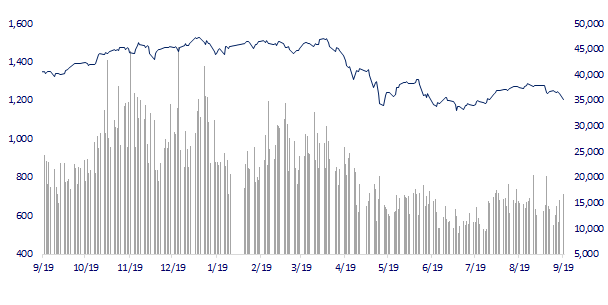

VNINDEX (12M)

GLOBAL MARKET

27,567.65

1D 0.00%

YTD -4.25%

3,115.60

1D -0.35%

YTD -14.40%

2,355.66

1D -1.14%

YTD -20.89%

18,565.97

1D -0.58%

YTD -20.65%

3,256.31

1D -0.37%

YTD 4.25%

1,631.57

1D 0.07%

YTD -1.57%

83.31

1D -2.65%

YTD 8.90%

1,672.05

1D -0.51%

YTD -8.17%

Asian stocks all fell on the first trading day of the week ahead of some important central bank meetings next week. The Hang Seng Index fell 0.58% to 18,565.97 points. The Hang Seng Tech Index fell 2.19% to 3,774.08 points. In South Korea, the Kospi index fell 1.14% to 2,355.66 points. The Kosdaq index fell 2.35% to 751.91 points.

VIETNAM ECONOMY

4.25%

1D (bps) 4

YTD (bps) 344

5.60%

3.37%

1D (bps) 9

YTD (bps) 236

3.71%

1D (bps) 10

YTD (bps) 171

23,814

1D (%) 0.02%

YTD (%) 3.81%

24,342

1D (%) -0.32%

YTD (%) -8.03%

3,443

1D (%) -0.26%

YTD (%) -5.88%

8M/2022, Vietnam has 75 projects granted new investment registration certificates, with a total registered capital of over 344.8million USD, an increase of 2.3 times over the same period. 15 projects were adjusted capital with the total additional investment capital of over 50.9million USD, equal to 12% over the same period last year. There are 24 countries and territories receiving investment from Vietnam. The country receiving the most investment from Vietnam is Laos with total capital of 66.4m USD

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Imported DAP and MAP fertilizers are not subject to safeguard duty from September 7

- Hanoi plans detailed construction of Ring Road 4 - Capital Region

- Studying and submitting a plan to reduce petrol and oil tax at the 4th session of the 15th National Assembly

- The rapid increase in bank interest rates caused the housing market in the world to fall into crisis

- Which Asian countries benefit and lose after India's rice export ban

- Russia's largest oil company borrows a record in yuan

VN30

BANK

78,800

1D -1.50%

5D -0.38%

Buy Vol. 1,327,300

Sell Vol. 1,835,300

34,200

1D -3.66%

5D -7.32%

Buy Vol. 2,178,500

Sell Vol. 2,279,700

25,500

1D -2.67%

5D -5.73%

Buy Vol. 3,953,600

Sell Vol. 4,594,900

35,050

1D -2.64%

5D -6.53%

Buy Vol. 4,967,900

Sell Vol. 6,131,200

29,900

1D -2.13%

5D -1.81%

Buy Vol. 21,161,900

Sell Vol. 27,198,600

21,000

1D -3.67%

5D -7.08%

Buy Vol. 13,829,700

Sell Vol. 14,613,800

24,500

1D -2.00%

5D -4.48%

Buy Vol. 2,192,500

Sell Vol. 3,424,200

25,000

1D -4.94%

5D -7.24%

Buy Vol. 2,018,200

Sell Vol. 2,429,000

21,600

1D -3.79%

5D -6.49%

Buy Vol. 19,550,800

Sell Vol. 18,452,700

22,050

1D -3.08%

5D -5.57%

Buy Vol. 3,565,000

Sell Vol. 3,894,500

22,850

1D -1.30%

5D -3.79%

Buy Vol. 4,591,700

Sell Vol. 4,346,900

VPB: On September 29, VPBank closed the list of bonus shares for shareholders with the ratio 2:1. According to the plan, VPBank plans to issue more than 2,237 billion shares to shareholders to increase capital. The exercise ratio is 2:1, which means that shareholders owning two common shares at the closing date will receive one new share. Issuing source from undistributed profit after tax is VND 21,002 billion and reserve fund to supplement charter capital is VND 1,374 billion. After the issuance, VPBank's charter capital will reach VND 67,433 billion, becoming the bank with the largest charter capital in the system.

REAL ESTATE

85,000

1D -1.62%

5D 1.31%

Buy Vol. 4,167,000

Sell Vol. 6,079,700

33,650

1D -0.74%

5D -6.01%

Buy Vol. 1,756,000

Sell Vol. 1,718,600

51,000

1D -4.67%

5D -4.85%

Buy Vol. 2,486,200

Sell Vol. 3,355,400

KDH: Member Fund Venner Group Limited divested 400,000 shares of KDH, bringing Dragon Capital's ownership from 43.3 million shares (ratio 6.04%) to 42.9 million shares (ratio 5.98%)

OIL & GAS

108,000

1D -2.70%

5D -5.01%

Buy Vol. 668,800

Sell Vol. 1,085,100

13,500

1D -5.26%

5D -4.26%

Buy Vol. 40,463,700

Sell Vol. 45,271,000

38,000

1D -2.94%

5D -5.59%

Buy Vol. 1,805,800

Sell Vol. 2,301,900

PLX: PLX and HDB launch payment service with HDB co-branded super card - PLX "4 in 1", expected to help boost the growth rate of payment through the retail system to 40% - 50%

VINGROUP

62,900

1D 0.64%

5D -1.72%

Buy Vol. 1,264,500

Sell Vol. 1,842,800

58,400

1D -2.01%

5D -4.89%

Buy Vol. 2,755,900

Sell Vol. 3,104,300

29,100

1D -2.51%

5D 1.22%

Buy Vol. 2,426,900

Sell Vol. 3,634,400

VIC: VinFast cooperates with Ahamove to launch a pioneering electric vehicle transportation service - AhaFast. Ahamove's goal is to put 10,000 electric motorbikes into operation by 2025

FOOD & BEVERAGE

75,200

1D -1.05%

5D -0.13%

Buy Vol. 2,062,500

Sell Vol. 2,577,500

112,500

1D -0.27%

5D -2.17%

Buy Vol. 859,600

Sell Vol. 934,600

185,300

1D 0.00%

5D -4.97%

Buy Vol. 245,000

Sell Vol. 310,000

VNM: VNM stock went upstream, foreign investors saw a strong net buying of nearly 119 billion dong. In terms of both volume and value, this is the largest net buying level in 3 weeks from 24/8

OTHERS

115,000

1D -0.61%

5D -2.13%

Buy Vol. 495,300

Sell Vol. 594,000

115,000

1D -0.61%

5D -2.13%

Buy Vol. 495,300

Sell Vol. 594,000

83,100

1D 0.73%

5D -1.77%

Buy Vol. 3,424,000

Sell Vol. 2,972,500

70,500

1D -2.08%

5D -4.73%

Buy Vol. 7,952,300

Sell Vol. 6,628,200

22,900

1D -6.91%

5D -8.40%

Buy Vol. 4,978,900

Sell Vol. 5,334,600

19,900

1D -5.91%

5D -8.92%

Buy Vol. 34,416,100

Sell Vol. 38,421,700

22,650

1D -1.52%

5D -4.83%

Buy Vol. 36,174,700

Sell Vol. 46,054,400

FPT: 8M/2022 revenue reached more than 27,000 billion, up 24% over the same period. The parent company's shareholder profit reached VND 3,409billion, up nearly 30%. The software export segment had revenue of 11,731 billion VND, up 35%. Technology segment, revenue and profit before tax reached VND 15,481 billion and VND 2,256billion, respectively, up 24.1% and 25% respectively.

Market by numbers

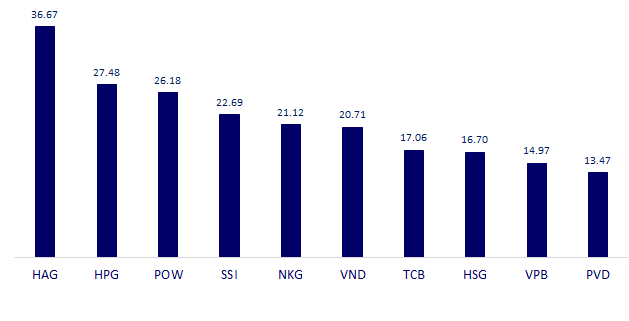

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

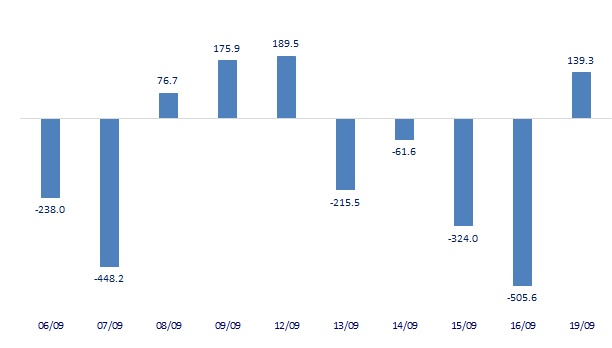

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

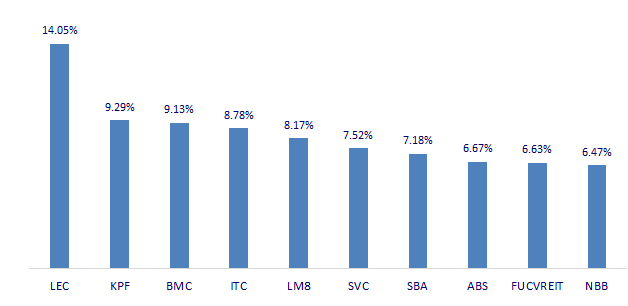

TOP INCREASES 3 CONSECUTIVE SESSIONS

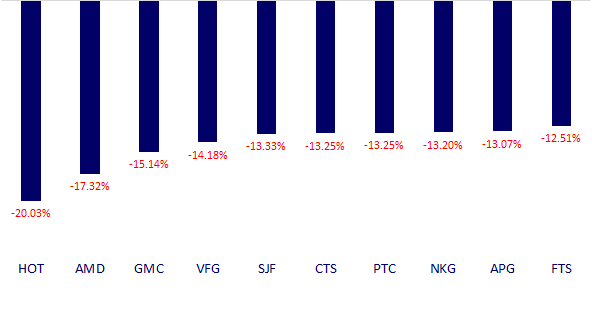

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.