Market brief 21/09/2022

VIETNAM STOCK MARKET

1,210.55

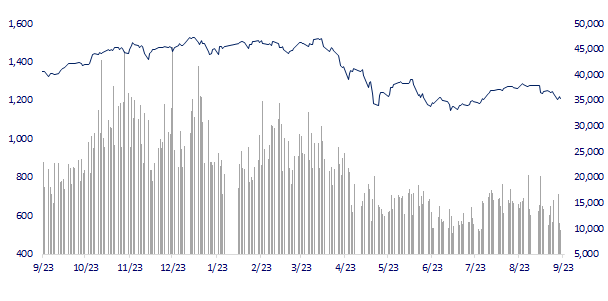

1D -0.69%

YTD -19.20%

1,228.20

1D -1.04%

YTD -20.02%

265.09

1D -0.68%

YTD -44.07%

88.23

1D -0.32%

YTD -21.70%

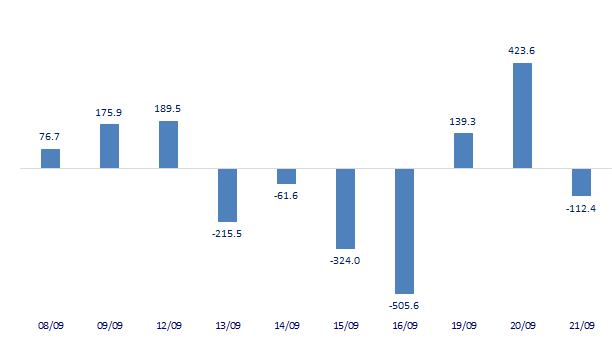

-112.43

1D 0.00%

YTD 0.00%

11,250.63

1D -12.21%

YTD -63.79%

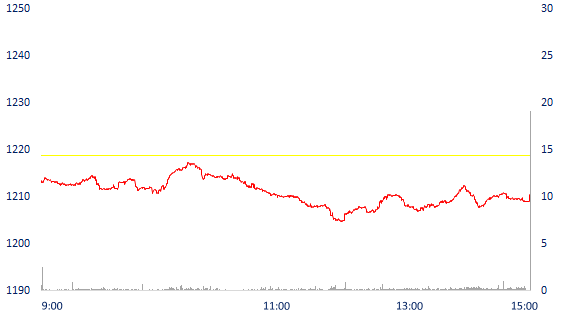

Today's session, VN-Index dropped more than 8 points, the total matched value reached 8,714 billion dong, down 22% compared to the previous session, in which, the matched value on HoSE decreased by 21.3% and stood at 7,523 billions dong. This is the session with the lowest matching value since November 13,2020. Foreign investors net sold about 112 billion dong.

ETF & DERIVATIVES

20,720

1D -1.00%

YTD -19.78%

14,500

1D -0.82%

YTD -19.85%

15,300

1D -14.09%

YTD -19.47%

20,250

1D 0.50%

YTD -11.57%

16,480

1D 0.43%

YTD -26.69%

26,130

1D -0.76%

YTD -6.84%

15,790

1D -0.69%

YTD -26.49%

1,216

1D -1.01%

YTD 0.00%

1,217

1D -1.06%

YTD 0.00%

1,218

1D -1.10%

YTD 0.00%

1,220

1D -1.06%

YTD 0.00%

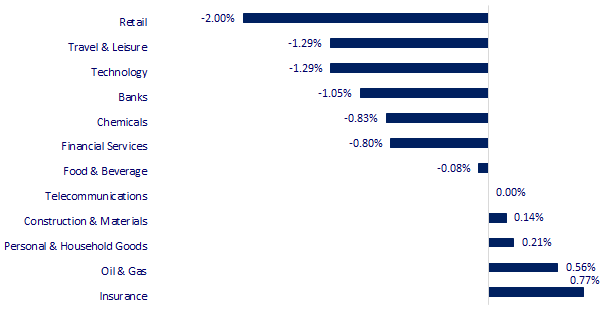

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,313.13

1D -0.02%

YTD -5.14%

3,117.18

1D -0.17%

YTD -14.36%

2,347.21

1D -0.87%

YTD -21.17%

18,444.62

1D -0.38%

YTD -21.17%

3,261.79

1D -0.16%

YTD 4.42%

1,633.45

1D -0.31%

YTD -1.46%

86.03

1D 2.76%

YTD 12.46%

1,683.85

1D 0.66%

YTD -7.52%

Fed is expected to raise interest rates sharply, Asian stocks all fell. In Japan, the Nikkei 225 index fell 0.02%. In South Korea, the Kospi index fell 0.87% to 2,347.21 points. The Shanghai Composite Index fell 0.17%. The Hang Seng Index fell 0.38% to 18,444.62 points.

VIETNAM ECONOMY

4.61%

1D (bps) 35

YTD (bps) 380

5.60%

3.54%

1D (bps) 13

YTD (bps) 253

3.90%

1D (bps) 16

YTD (bps) 190

23,915

1D (%) 0.42%

YTD (%) 4.25%

23,966

1D (%) -1.48%

YTD (%) -9.45%

3,434

1D (%) -0.09%

YTD (%) -6.12%

According to the latest data from the GDS, accumulated from the beginning of the year to the middle of September, the export value reached 265.34b USD, up 17.8% over the same period in 2021; imports reached 260.7b USD, up 13.2%. Total import-export turnover in the period reached more than 526b USD, up 15.4%. Thus, in the first half of September, Vietnam's trade balance continued to have a deficit of about 840m USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- ADB: Vietnam's economy recovers faster than expected

- Exports fell sharply, Vietnam had a trade deficit in the first half of September

- Vietnam - Laos border gate reopens after 2 years of hiatus

- China contributes over 30% to global economic growth in the period 2013-2021

- Consumer inflation has spread to Asian restaurants

- ADB: For the first time in 30 years, developing Asian economies will grow faster than China

VN30

BANK

78,900

1D -0.38%

5D 0.77%

Buy Vol. 913,400

Sell Vol. 1,031,900

34,750

1D -1.14%

5D -4.79%

Buy Vol. 1,149,800

Sell Vol. 959,400

25,550

1D -1.73%

5D -5.37%

Buy Vol. 2,535,000

Sell Vol. 2,279,000

34,500

1D -1.57%

5D -6.25%

Buy Vol. 3,398,300

Sell Vol. 3,801,200

29,500

1D -1.67%

5D -2.64%

Buy Vol. 23,826,900

Sell Vol. 26,416,900

21,200

1D -0.70%

5D -5.36%

Buy Vol. 9,291,000

Sell Vol. 6,825,700

24,700

1D -0.40%

5D -1.98%

Buy Vol. 2,098,800

Sell Vol. 2,080,700

25,250

1D -0.59%

5D -4.90%

Buy Vol. 1,270,000

Sell Vol. 1,176,800

21,750

1D -1.81%

5D -5.64%

Buy Vol. 11,339,100

Sell Vol. 6,977,900

22,000

1D -1.35%

5D -4.97%

Buy Vol. 2,013,100

Sell Vol. 1,536,700

22,600

1D -1.31%

5D -3.83%

Buy Vol. 2,605,100

Sell Vol. 2,625,000

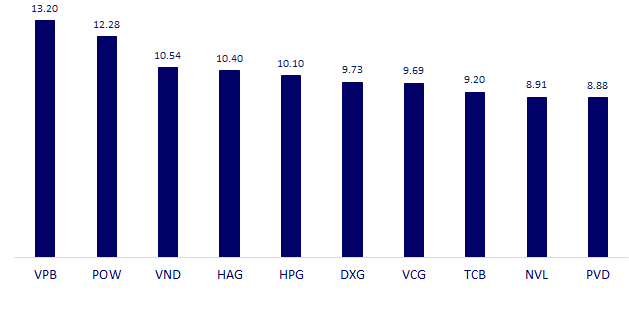

VPB: Vietnam Prosperity Commercial Joint Stock Bank (VPBank) today was honored by Brand Finance, the world's leading brand valuation company based in the UK, in the ceremony to announce the ranking of Top 50 most valuable brands. Vietnam 2022, ranked 1 rank compared to 2021, ranked 11th.

REAL ESTATE

84,600

1D 0.00%

5D 1.32%

Buy Vol. 3,394,900

Sell Vol. 2,947,300

31,450

1D -5.84%

5D -11.90%

Buy Vol. 2,399,800

Sell Vol. 2,638,200

51,600

1D -0.19%

5D 1.38%

Buy Vol. 1,769,400

Sell Vol. 1,786,700

NVL: As of June 30, 2022, NVL recorded a prepayment of VND 12,562 billion, up 51% from the beginning of the year and accounting for 5% of total capital.

OIL & GAS

109,000

1D -0.09%

5D -3.11%

Buy Vol. 685,500

Sell Vol. 425,000

13,450

1D -1.82%

5D -4.95%

Buy Vol. 23,936,600

Sell Vol. 21,024,700

37,900

1D -0.26%

5D -3.81%

Buy Vol. 1,263,400

Sell Vol. 1,173,000

The Government proposes to continue maintaining the Petroleum Price Stabilization Fund because it is necessary and makes it a separate article in the draft law.

VINGROUP

63,100

1D -1.25%

5D -0.47%

Buy Vol. 1,087,300

Sell Vol. 1,097,600

58,300

1D -1.02%

5D -2.83%

Buy Vol. 2,395,800

Sell Vol. 2,937,000

28,600

1D -1.55%

5D 0.35%

Buy Vol. 1,099,400

Sell Vol. 1,379,500

VHM: In the first half of the year, VHM has launched more than 10,000 low-rise buildings under the project Vinhomes Ocean Park 2 - The Empire (Hung Yen), earning about 49,000 billion VND in sales.

FOOD & BEVERAGE

76,900

1D 1.45%

5D 3.92%

Buy Vol. 5,103,700

Sell Vol. 4,488,600

112,000

1D -1.15%

5D 0.00%

Buy Vol. 482,300

Sell Vol. 763,800

188,000

1D 0.27%

5D 2.17%

Buy Vol. 159,200

Sell Vol. 129,000

MSN: WinMart +/WinMart said that it always maintains the proportion of Vietnamese products reaching over 90% of the quantity and types of goods.

OTHERS

115,000

1D -0.95%

5D -1.03%

Buy Vol. 502,900

Sell Vol. 565,700

115,000

1D -0.95%

5D -1.03%

Buy Vol. 502,900

Sell Vol. 565,700

82,300

1D -1.32%

5D -2.02%

Buy Vol. 1,427,000

Sell Vol. 1,521,600

70,000

1D -2.37%

5D -5.02%

Buy Vol. 5,605,600

Sell Vol. 5,634,500

23,250

1D -1.06%

5D -7.00%

Buy Vol. 2,125,300

Sell Vol. 2,341,100

20,550

1D -0.72%

5D -6.38%

Buy Vol. 21,150,000

Sell Vol. 18,654,500

22,900

1D -0.43%

5D -3.38%

Buy Vol. 20,784,900

Sell Vol. 16,541,400

PNJ: In 8 months, PNJ's net revenue reached VND 23,049 billion, up 87.6% compared to 8 months of 2021; profit after tax is 1,246 billion dong, up 66.1%. The profit in 8 months is even higher than the record of the whole 2019. As of the end of August, the PNJ system has 353 stores nationwide.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

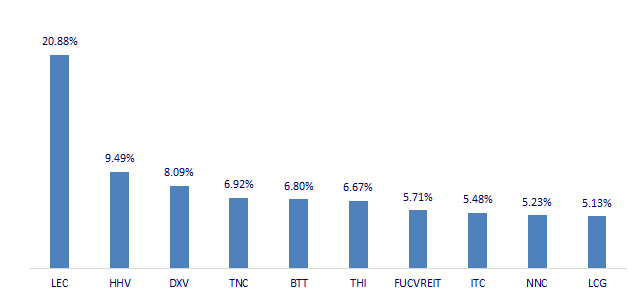

TOP INCREASES 3 CONSECUTIVE SESSIONS

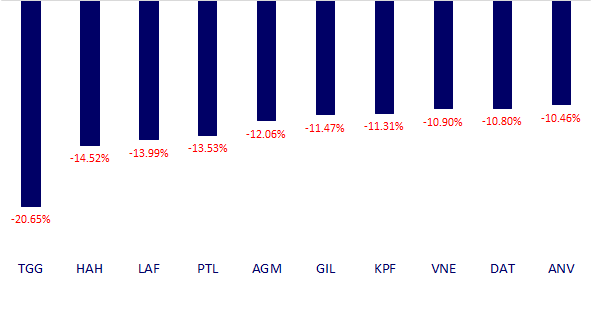

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.