Market Brief 31/10/2022

VIETNAM STOCK MARKET

1,027.94

1D 0.06%

YTD -31.39%

1,026.84

1D -0.26%

YTD -33.14%

210.43

1D -1.54%

YTD -55.60%

76.29

1D 0.26%

YTD -32.29%

227.97

1D 0.00%

YTD 0.00%

12,525.36

1D -13.86%

YTD -59.69%

The beginning of the session on October 31 was quite negative, but VN-Index reversed strongly in the afternoon thanks to bottom-fishing in large-cap stocks. At the end of the session, VCB, GAS, BID and CTG contributed 5.3 points to the VN-Index, helping to balance the decline of HPG (-6.85%), NVL (-3.4%), EIB (-6.1%)…

ETF & DERIVATIVES

17,580

1D 0.46%

YTD -31.94%

11,850

1D -2.23%

YTD -34.49%

12,910

1D 2.14%

YTD -32.05%

15,790

1D 4.22%

YTD -31.05%

13,110

1D 0.15%

YTD -41.68%

22,250

1D -1.20%

YTD -20.68%

13,080

1D -0.23%

YTD -39.11%

1,010

1D 0.02%

YTD 0.00%

1,014

1D 0.47%

YTD 0.00%

1,016

1D 0.26%

YTD 0.00%

1,024

1D 0.79%

YTD 0.00%

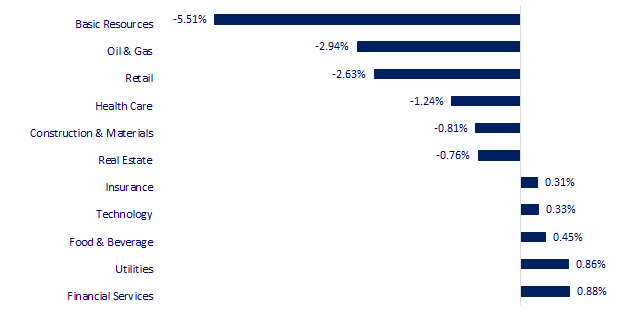

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,587.46

1D 1.78%

YTD -4.18%

2,893.48

1D -0.77%

YTD -20.50%

2,293.61

1D 1.11%

YTD -22.97%

14,687.02

1D -1.18%

YTD -37.23%

3,093.11

1D 1.11%

YTD -0.98%

1,608.76

1D 0.17%

YTD -2.95%

92.39

1D -1.66%

YTD 20.77%

1,640.40

1D -0.26%

YTD -9.91%

In Japan, the Nikkei 225 index rose 1.78% to 27,587.46 points. South Korea's Kospi index rose 1.11% to 2,293.61 points. In China, Hong Kong's Hang Seng index fell 1.18% to 14,687.02 points.

VIETNAM ECONOMY

5.23%

1D (bps) 73

YTD (bps) 442

7.40%

YTD (bps) 180

4.81%

1D (bps) 1

YTD (bps) 380

4.78%

YTD (bps) 278

24,880

1D (%) 0.01%

YTD (%) 8.46%

25,132

1D (%) -1.30%

YTD (%) -5.05%

3,476

1D (%) -0.52%

YTD (%) -4.98%

The USD price at the beginning of the week was almost unchanged as investors waited for the meeting from the US Federal Reserve (Fed) in early November. In the morning of October 31, the central exchange rate announced by the State Bank was 23,695 dong, up 2 dong compared to last week.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam sees fastest growth in Southeast Asia for two years

- Nghe An has 2 more FDI projects of 275 million USD

- Vietnam posted a trade surplus of 9.4 billion USD in the first 10 months of 2022

- Italy's economy grows stronger than expected 0.5% in Q3

- Goldman Sachs sees Fed rates peaking at 5% in March 2023

- IMF: Asia would be the biggest loser if the global economy splits up

VN30

BANK

73,500

1D 2.65%

5D 8.09%

Buy Vol. 1,066,301

Sell Vol. 1,027,904

34,550

1D 2.22%

5D 13.84%

Buy Vol. 4,326,685

Sell Vol. 4,053,443

24,600

1D 2.29%

5D 17.14%

Buy Vol. 16,683,134

Sell Vol. 17,501,971

24,600

1D 0.82%

5D 15.49%

Buy Vol. 12,110,417

Sell Vol. 13,033,894

16,350

1D 0.00%

5D 6.17%

Buy Vol. 18,447,568

Sell Vol. 21,171,842

17,700

1D 0.28%

5D 13.46%

Buy Vol. 20,798,544

Sell Vol. 20,717,665

16,400

1D -0.61%

5D 2.82%

Buy Vol. 2,315,351

Sell Vol. 3,097,533

20,700

1D -0.72%

5D 2.73%

Buy Vol. 4,364,669

Sell Vol. 5,074,120

16,150

1D 0.00%

5D 8.75%

Buy Vol. 34,894,211

Sell Vol. 29,459,785

19,600

1D -0.51%

5D 3.98%

Buy Vol. 2,504,300

Sell Vol. 2,703,880

22,400

1D 0.45%

5D 14.87%

Buy Vol. 5,687,103

Sell Vol. 6,393,810

BID: In Q3/2022, net interest income and income from foreign exchange operation increased sharply, accompanied by a decrease in provison expense by 28%, helping BIDV to collect VND 6,673 billion in pre-interest tax, 2.5 times higher than the same period. In the first 9 months of the year, BIDV deducted VND 19,266 billion for provision expense, down 17%, thus earning nearly VND 17,677 billion in pre-tax profit, up 65% over the same period.

REAL ESTATE

70,000

1D -3.45%

5D -5.91%

Buy Vol. 2,707,404

Sell Vol. 3,339,786

22,700

1D -1.30%

5D 2.25%

Buy Vol. 2,606,181

Sell Vol. 2,641,892

43,700

1D -2.02%

5D -7.02%

Buy Vol. 1,805,616

Sell Vol. 2,108,589

KDH: KDH announced its consolidated financial statements for Q3/2022 with revenue of more than VND 805 billion, down 33% compared to the same period in 2021.

OIL & GAS

111,100

1D 1.93%

5D 3.64%

Buy Vol. 450,178

Sell Vol. 334,546

10,350

1D 0.00%

5D 4.76%

Buy Vol. 16,224,424

Sell Vol. 17,817,072

28,500

1D -1.72%

5D -2.73%

Buy Vol. 1,530,961

Sell Vol. 1,596,788

GAS: According to the consolidated financial statements of Q3/2022, 42% of PV GAS's assets are in bank deposits, helping PV Gas make a profit of 888 billion in the first 9 months of the year.

VINGROUP

55,400

1D -0.54%

5D -1.95%

Buy Vol. 1,586,582

Sell Vol. 1,802,441

45,000

1D 0.22%

5D 0.90%

Buy Vol. 4,309,680

Sell Vol. 5,146,121

24,600

1D 3.80%

5D 10.07%

Buy Vol. 2,106,540

Sell Vol. 2,430,668

VIC: In 9 months, Vingroup achieved a profit after tax of VND 1,571 billion. As of September 30, Vingroup's total assets reached VND 555,571 billion, an increase of 30% compared to December 31, 2021.

FOOD & BEVERAGE

78,500

1D 0.64%

5D 6.08%

Buy Vol. 2,157,074

Sell Vol. 2,786,425

85,500

1D 1.91%

5D 17.45%

Buy Vol. 1,992,475

Sell Vol. 2,265,189

185,300

1D -0.43%

5D 2.38%

Buy Vol. 225,767

Sell Vol. 183,904

MSN: Masan MEATLife (MML) recorded Q3/2022 net revenue of VND 1,291 billion, only 26% of net revenue in the same period last year because of selling off the animal feed segment.

OTHERS

52,500

1D 0.00%

5D 9.60%

Buy Vol. 1,496,710

Sell Vol. 1,426,046

107,600

1D -0.19%

5D 0.56%

Buy Vol. 208,658

Sell Vol. 323,442

75,600

1D 0.80%

5D 6.33%

Buy Vol. 2,067,925

Sell Vol. 1,824,679

51,600

1D -3.01%

5D 1.98%

Buy Vol. 5,568,944

Sell Vol. 7,078,173

14,400

1D -0.69%

5D 2.49%

Buy Vol. 2,386,174

Sell Vol. 2,294,963

16,300

1D 2.52%

5D 7.95%

Buy Vol. 31,064,544

Sell Vol. 33,495,060

15,650

1D -6.85%

5D -4.57%

Buy Vol. 76,498,815

Sell Vol. 106,966,626

VJC: VJC's net revenue in Q3/2022 reached VND 11,600 billion, 4.4 times higher than the same period last year. This revenue increased slightly compared to Q2/2022, in the context that the aviation industry is gradually recovering. Airline ancillary revenue reached more than 4,100 billion VND, higher than both domestic passenger revenue (3,418 billion VND) and international passenger revenue (1,182 billion VND).

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.