Morning Brief 28/11/2022

GLOBAL MARKET

34,347.03

1D 0.45%

YTD -5.64%

4,026.12

1D -0.03%

YTD -15.75%

11,226.36

1D -0.52%

YTD -28.68%

20.50

1D 0.39%

7,486.67

1D 0.27%

YTD 1.13%

14,541.38

1D 0.01%

YTD -8.46%

6,712.48

1D 0.08%

YTD -6.42%

82.18

1D -3.88%

YTD 7.42%

1,749.10

1D -0.40%

YTD -3.94%

U.S. retail stocks held steady on Friday as investors watched holiday spending to gauge consumer confidence at a time when inflation and rising interest rates are weighing heavily on Main Street. Consumer discretionary stocks, measured by the S&P 500 Consumer Discretionary sector which benefits from spending on retail, restaurants and vacations, edged up less than 0.1%. Stocks were muted as crowds were thin on what has historically been the busiest shopping day of the year.

VIETNAM ECONOMY

5.97%

1D (bps) 1

YTD (bps) 516

7.40%

YTD (bps) 180

4.88%

1D (bps) -3

YTD (bps) 387

4.91%

1D (bps) -7

YTD (bps) 291

24,852

1D (%) -0.01%

YTD (%) 8.33%

26,546

1D (%) -0.15%

YTD (%) 0.29%

3,526

1D (%) -0.45%

YTD (%) -3.61%

DXY-Index opened the first session of the week at a low level due to the effect of the decline at the end of last week after the dovish signals of the Fed. However, the selling force is currently slowing down (updated at 9am Vietnam time), waiting for the release of US growth and employment data this week to consider the effects interest rate movement.

VIETNAM STOCK MARKET

971.46

1D 2.51%

YTD -35.16%

967.49

1D 2.84%

YTD -37.00%

196.77

1D 2.90%

YTD -58.49%

68.41

1D 1.33%

YTD -39.29%

986.06

10,717.71

1D 14.95%

YTD -65.51%

At the end of the session, the proprietary traders net bought nearly VND160 billion. DGC continued to be net bought with a value of more than VND30 billion, followed by VNM. In contrast, FUEVFVND was sold the most with VND69.3 billion, followed by VPI with VND51.6 billion.

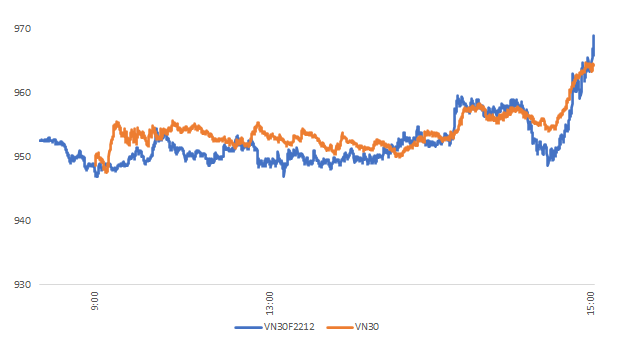

INTRADAY

VN30 (12M)

SELECTED NEWS

- Da Nang start working on port project of VND3,400 billion;;

- Disbursement of public investment capital in 11 months only reached 52.43% of the plan;

- Shrimp exports to the US and EU fell deeply in October;

- Ukraine wants lower cap on Russian oil, at $30-$40 per barrel;

- Russia has the fourth largest foreign exchange reserves in the world;

- The US deals a new blow to Chinese tech giants.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.