Market brief 02/12/2022

VIETNAM STOCK MARKET

1,080.01

1D 4.22%

YTD -27.92%

1,092.99

1D 4.83%

YTD -28.83%

215.96

1D 2.35%

YTD -54.44%

72.21

1D 1.12%

YTD -35.92%

2,208.93

1D 0.00%

YTD 0.00%

20,386.98

1D -16.25%

YTD -34.39%

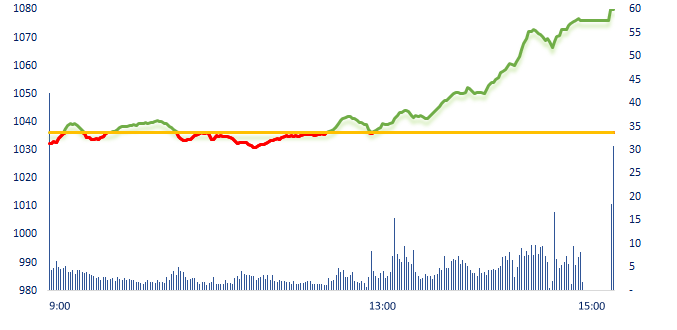

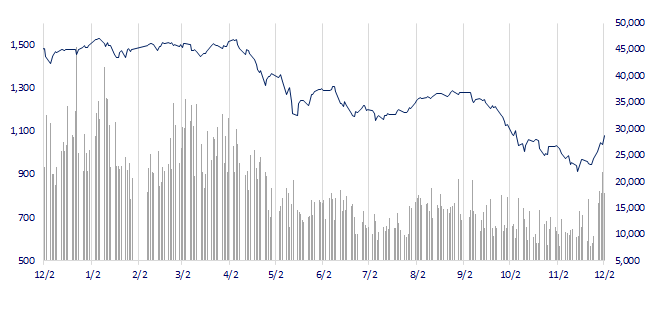

Ending the first trading week of December, the market was positive both in terms of volume and scores. At the end of the last session of the week, the market recorded the highest liquidity since the beginning of 2022, accompanied by a growth of more than 12% for the whole week.

ETF & DERIVATIVES

18,500

1D 2.21%

YTD -28.38%

12,900

1D 4.03%

YTD -28.69%

13,700

1D 2.24%

YTD -27.89%

15,030

1D 6.90%

YTD -34.37%

14,700

1D 1.38%

YTD -34.61%

23,260

1D 2.97%

YTD -17.08%

13,510

1D 3.29%

YTD -37.10%

1,079

1D 5.78%

YTD 0.00%

1,082

1D 5.97%

YTD 0.00%

1,100

1D 6.99%

YTD 0.00%

1,101

1D 7.00%

YTD 0.00%

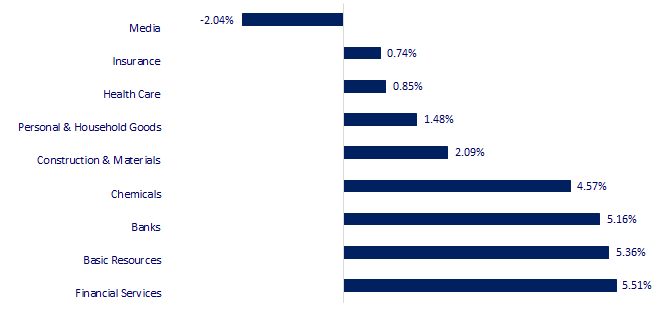

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,777.90

1D -1.59%

YTD -3.52%

3,156.14

1D -0.29%

YTD -13.29%

2,434.33

1D -1.84%

YTD -18.25%

18,675.35

1D -0.33%

YTD -20.18%

3,259.14

1D -1.02%

YTD 4.34%

1,641.63

1D -0.41%

YTD -0.96%

86.94

1D 0.31%

YTD 13.65%

1,815.25

1D 0.10%

YTD -0.30%

Asian stock markets fell on the afternoon of December 2 before the US jobs data was released. Investors are also watching developments in China amid signs that the country is moving towards easing strict COVID-19 prevention measures that have caused the country's economy to slow down in growth for the year.

VIETNAM ECONOMY

5.38%

1D (bps) 26

YTD (bps) 457

7.40%

YTD (bps) 180

4.84%

1D (bps) -6

YTD (bps) 383

4.88%

1D (bps) -5

YTD (bps) 288

24,350

1D (%) -1.18%

YTD (%) 6.15%

25,863

1D (%) -2.30%

YTD (%) -2.29%

3,508

1D (%) -1.04%

YTD (%) -4.10%

The USD exchange rate today at banks suddenly dropped sharply, the USD buying and selling price decreased by about 500 VND/USD compared to the previous session, the free market went down with the downward trend. Similar to the development of the international market, the USD fell sharply before the statement of the Fed Chairman that the interest rate increase may slow down in December.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- T3 terminal of Tan Son Nhat Airport expected to start work from December 15;

- There are many changes in salary policy from 2023;

- Ba Ria - Vung Tau: Basics and initial steps to form Cai Mep Ha free trade zone;

- U.S. to drop fraud charges against top Huawei executive;

- Financial Times: Japan couldn't survive without Russia oil and gas;

- Credit Suisse flags hefty loss as rich clients pull out.

VN30

BANK

85,000

1D 6.25%

5D 16.28%

Buy Vol. 1,824,869

Sell Vol. 1,967,281

41,200

1D 5.64%

5D 3.00%

Buy Vol. 3,751,684

Sell Vol. 2,687,521

27,950

1D 6.88%

5D 8.33%

Buy Vol. 17,334,079

Sell Vol. 12,396,804

28,800

1D 5.11%

5D 25.22%

Buy Vol. 17,890,724

Sell Vol. 15,412,137

17,300

1D 2.98%

5D 11.61%

Buy Vol. 45,032,054

Sell Vol. 38,732,926

18,800

1D 5.62%

5D 16.05%

Buy Vol. 32,352,059

Sell Vol. 28,793,044

16,500

1D 3.45%

5D 10.37%

Buy Vol. 4,053,065

Sell Vol. 3,987,131

22,800

1D 4.59%

5D 12.32%

Buy Vol. 16,525,048

Sell Vol. 12,448,691

20,850

1D 6.92%

5D 10.32%

Buy Vol. 75,846,287

Sell Vol. 38,956,396

21,400

1D 7.00%

5D 16.94%

Buy Vol. 16,374,078

Sell Vol. 12,167,895

23,500

1D 4.44%

5D 9.30%

Buy Vol. 8,157,024

Sell Vol. 6,983,209

BID: BIDV - Saigon West Branch (BIDV) recently announced the auction of the debt of Trieu Du Bon Plastic Production Joint Stock Company. Specifically, the debt is worth over VND211 billion as of November 25, including principal balance of nearly VND194 billion, outstanding interest of more than VND17.5 billion.

REAL ESTATE

23,800

1D 1.93%

5D 16.38%

Buy Vol. 92,741,469

Sell Vol. 92,414,689

29,100

1D 6.99%

5D 29.62%

Buy Vol. 7,276,971

Sell Vol. 3,366,456

15,600

1D 6.85%

5D 20.93%

Buy Vol. 94,561,939

Sell Vol. 71,879,849

KDH: Chairman of KDH, Mrs. Mai Tran Thanh Trang has completed the purchase of 100% of the registered shares of 10 million shares.

OIL & GAS

111,200

1D 4.41%

5D 6.11%

Buy Vol. 1,149,915

Sell Vol. 1,087,482

11,700

1D 4.46%

5D 7.83%

Buy Vol. 24,801,141

Sell Vol. 19,072,202

31,450

1D 1.45%

5D 11.33%

Buy Vol. 1,914,436

Sell Vol. 1,820,070

After increasing discharge the Petroleum Price Stabilization Fund on December 1, the Petroleum Price Stabilization Fund of Petrolimex has increased by VND70 billion.

VINGROUP

68,800

1D 4.24%

5D 5.85%

Buy Vol. 5,216,633

Sell Vol. 4,574,258

57,200

1D 6.92%

5D 21.70%

Buy Vol. 8,125,413

Sell Vol. 7,825,786

31,550

1D 5.17%

5D 15.15%

Buy Vol. 4,340,121

Sell Vol. 4,673,392

Software company with a market capitalization of USD50 billion - Dassault Systèmes is a partner to help implement digital transformation for business blocks of VinFast and Vinhomes.

FOOD & BEVERAGE

84,000

1D 1.94%

5D 2.19%

Buy Vol. 3,587,392

Sell Vol. 4,182,137

103,900

1D 4.95%

5D 10.53%

Buy Vol. 1,955,906

Sell Vol. 1,877,149

177,000

1D 0.91%

5D -1.67%

Buy Vol. 489,475

Sell Vol. 443,823

VNM: Vinamilk plans to pay the second dividend in 2022 at the rate of 14% in cash and will pay at the end of February next year.

OTHERS

48,200

1D 0.84%

5D 2.77%

Buy Vol. 1,649,742

Sell Vol. 1,480,089

106,500

1D 3.20%

5D 4.41%

Buy Vol. 1,100,920

Sell Vol. 1,366,105

77,400

1D 3.61%

5D 7.50%

Buy Vol. 4,178,802

Sell Vol. 4,107,672

47,000

1D 6.70%

5D 24.34%

Buy Vol. 9,911,611

Sell Vol. 8,830,247

15,500

1D 4.73%

5D 14.81%

Buy Vol. 4,896,420

Sell Vol. 3,904,976

19,450

1D 6.87%

5D 13.74%

Buy Vol. 64,754,975

Sell Vol. 43,871,291

19,450

1D 6.87%

5D 27.12%

Buy Vol. 82,642,606

Sell Vol. 65,674,023

FPT: December 1, 2022 - Within the framework of the online event Awards ceremony of the ASEAN Corporate Governance Scorecard Project (ACGS) 2021, FPT is the only technology company honored in the Top 3 Vietnamese enterprises has the best corporate governance scores in the ASEAN region. This is the second year that FPT has been named in this list.

Market by numbers

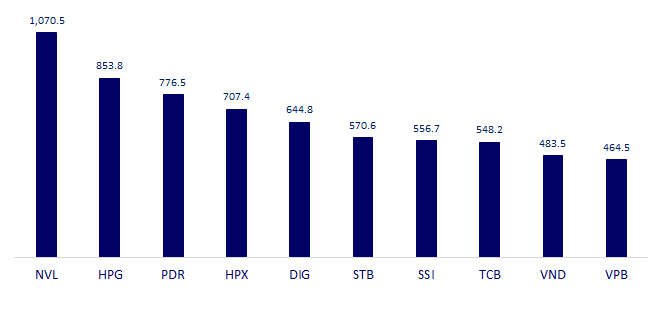

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

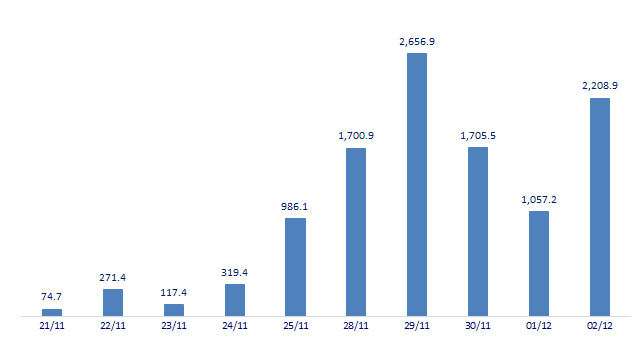

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

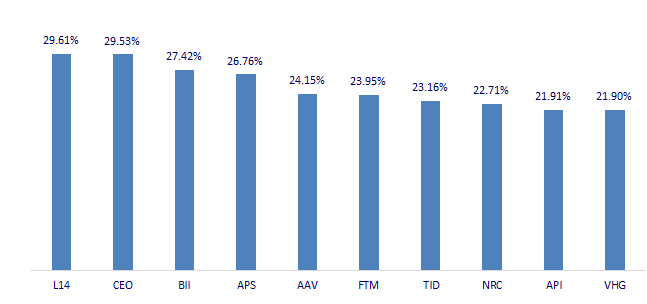

TOP INCREASES 3 CONSECUTIVE SESSIONS

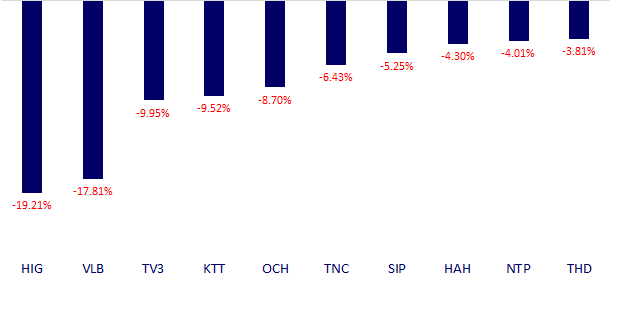

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.