Market brief 18/01/2023

VIETNAM STOCK MARKET

1,098.28

1D 0.92%

YTD 9.05%

1,115.72

1D 1.09%

YTD 11.00%

217.73

1D 1.20%

YTD 6.05%

73.54

1D 0.78%

YTD 2.64%

714.14

1D 0.00%

YTD 0.00%

11,914.51

1D -9.70%

YTD 38.28%

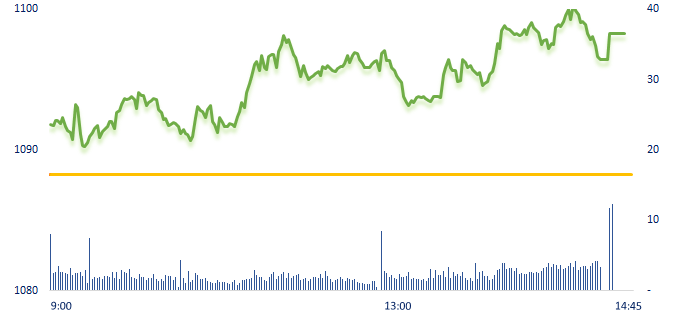

VN-Index continued to have an increase following the explosive momentum from yesterday. The market gained at the beginning of the morning and maintained the positive movement as the indexes gradually extended their gain until the end of the session thanks to the increase of Large Cap stocks, such as MWG(+4.4%), KDH(+3.7%), VIC(+2.7%),….

ETF & DERIVATIVES

19,000

1D 1.17%

YTD 9.64%

13,150

1D 1.15%

YTD 10.32%

13,820

1D 2.22%

YTD 10.74%

15,440

1D 0.72%

YTD 9.89%

16,070

1D 1.07%

YTD 11.99%

23,900

1D 1.57%

YTD 6.70%

14,300

1D 2.07%

YTD 10.42%

1,095

1D 0.95%

YTD 0.00%

1,111

1D 1.10%

YTD 0.00%

1,117

1D 0.18%

YTD 0.00%

1,117

1D 0.93%

YTD 0.00%

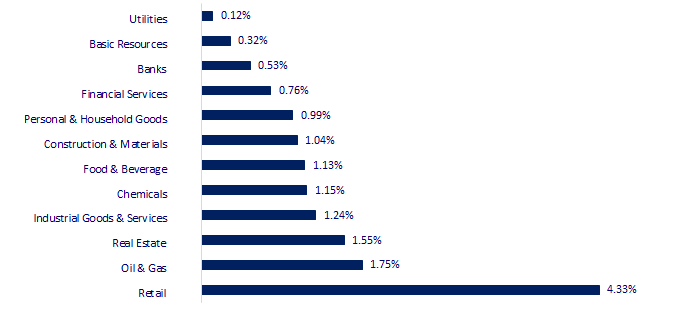

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

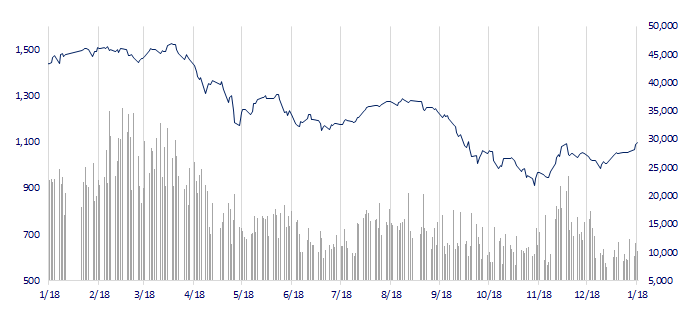

VNINDEX (12M)

GLOBAL MARKET

26,791.12

1D 2.50%

YTD 2.67%

3,224.41

1D 0.01%

YTD 4.37%

2,368.32

1D -0.47%

YTD 5.90%

21,678.00

1D 0.47%

YTD 9.59%

3,289.55

1D 0.28%

YTD 1.18%

1,685.44

1D 0.26%

YTD 0.90%

86.94

1D 0.39%

YTD 1.20%

1,915.70

1D 0.30%

YTD 4.90%

At the end of the session, the Asian markets mostly gained, still stemming from the optimism of investors about the world economy after China opened. Meanwhile, Kospi fell again today as investors worried about the risk of massive foreign capital outflow from Korea even if the BOJ soon raises interest rates.

VIETNAM ECONOMY

6.06%

1D (bps) -22

YTD (bps) 109

7.40%

4.56%

1D (bps) -1

YTD (bps) -23

4.59%

1D (bps) -2

YTD (bps) -31

23,608

1D (%) 0.06%

YTD (%) -0.64%

26,215

1D (%) 0.79%

YTD (%) 2.17%

3,542

1D (%) 0.34%

YTD (%) 1.64%

The pound rose by the most against the dollar in the past session, hitting a five-week high, after data showed wage growth accelerated again in the UK - an issue tracked by the Bank of England closely to determine how much to raise interest rates.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The SBV appointed a new Director of Credit Department;

- The "door" to increase the bank capital is ajar;

- Agricultural product exports 2023: Expectation of key products;

- Goldman Sachs profit fell sharply in the fourth quarter;

- The Bank of Japan kept the basic interest rates unchanged;

- China opened up, expected to lead the performance of global stocks.

VN30

BANK

90,000

1D 0.67%

5D 5.76%

Buy Vol. 1,309,658

Sell Vol. 1,452,460

45,100

1D 0.33%

5D 9.33%

Buy Vol. 2,842,391

Sell Vol. 3,104,341

30,750

1D 0.49%

5D 5.67%

Buy Vol. 4,070,627

Sell Vol. 6,664,885

29,100

1D 0.34%

5D 5.24%

Buy Vol. 5,334,284

Sell Vol. 6,852,390

19,650

1D 0.26%

5D 6.50%

Buy Vol. 29,984,241

Sell Vol. 32,726,074

19,550

1D 0.77%

5D 7.12%

Buy Vol. 19,450,738

Sell Vol. 18,019,831

17,450

1D 1.16%

5D 4.49%

Buy Vol. 3,893,125

Sell Vol. 4,647,815

23,600

1D 2.61%

5D 5.12%

Buy Vol. 17,840,660

Sell Vol. 14,473,306

26,800

1D 0.94%

5D 8.50%

Buy Vol. 19,062,558

Sell Vol. 16,326,425

22,900

1D 0.00%

5D 8.02%

Buy Vol. 6,004,436

Sell Vol. 6,304,369

25,500

1D 0.79%

5D 5.37%

Buy Vol. 8,605,559

Sell Vol. 8,331,802

VIB: At the end of 2022, VIB achieved a pre-tax income of more than VND10,580 billion, an increase of 32% compared to the previous year. Impressive profit growth results from core businesses, especially retail banking. Specifically, total revenue grew by 21%, continuing to be higher than the growth rate of operating expenses of 17%, contributing to reducing VIB cost to income (CIR) ratio to 34%, belonging to the group of retail banking has the best cost management efficiency.

REAL ESTATE

14,150

1D 1.07%

5D -5.03%

Buy Vol. 19,358,675

Sell Vol. 20,431,201

27,800

1D 3.73%

5D -1.07%

Buy Vol. 1,575,818

Sell Vol. 1,216,082

14,300

1D 1.42%

5D -3.38%

Buy Vol. 8,503,675

Sell Vol. 10,958,831

PDR: Phat Dat Real Estate Development Joint Stock Company announced the early settlement of bond lots with a total value of nearly VND900 billion.

OIL & GAS

104,300

1D 0.10%

5D 0.10%

Buy Vol. 280,600

Sell Vol. 495,355

12,150

1D 0.00%

5D 4.29%

Buy Vol. 21,265,060

Sell Vol. 14,472,394

38,000

1D 1.74%

5D 2.01%

Buy Vol. 1,448,703

Sell Vol. 1,313,730

GAS: PV GAS Trading has imported the first refrigerated LPG shipment in 2023.

VINGROUP

56,700

1D 2.72%

5D 2.90%

Buy Vol. 2,305,709

Sell Vol. 2,801,972

52,500

1D 0.96%

5D 3.35%

Buy Vol. 1,936,288

Sell Vol. 2,305,611

29,300

1D -1.84%

5D 2.81%

Buy Vol. 1,854,860

Sell Vol. 4,058,840

VIC: VinFast Canada announced to attend the Montreal International Motor Show from January 20-29 with a diverse range of electric vehicles, including VF 6, VF 7, VF 8 and VF 9.

FOOD & BEVERAGE

81,300

1D 0.49%

5D 2.39%

Buy Vol. 1,678,663

Sell Vol. 3,365,738

99,900

1D 2.46%

5D 4.06%

Buy Vol. 884,405

Sell Vol. 1,095,860

187,000

1D 0.00%

5D 3.31%

Buy Vol. 165,974

Sell Vol. 246,561

MSN: Masan bonds distributed by Pinetree are currently listed on the HNX with stock code MSN12003 to provide loans to Masan Consumer Holdings.

OTHERS

48,400

1D -0.41%

5D -0.41%

Buy Vol. 889,583

Sell Vol. 892,755

112,300

1D 1.54%

5D 2.00%

Buy Vol. 644,839

Sell Vol. 571,146

83,400

1D 1.71%

5D 3.09%

Buy Vol. 1,491,463

Sell Vol. 1,542,543

44,950

1D 4.41%

5D 5.64%

Buy Vol. 6,179,996

Sell Vol. 5,759,481

16,000

1D 1.59%

5D 10.34%

Buy Vol. 4,585,157

Sell Vol. 5,219,953

20,550

1D 0.74%

5D 6.48%

Buy Vol. 29,746,933

Sell Vol. 37,802,642

21,700

1D 0.23%

5D 7.43%

Buy Vol. 43,679,336

Sell Vol. 48,179,164

HPG: Hoa Phat Group has just announced that in 2022, the Group has paid nearly 11,200 billion VND to the State budget. In which, the member companies that contribute the most budget are Hoa Phat Dung Quat Steel, Hoa Phat Hai Duong Steel, Hoa Phat Steel Pipe.

Market by numbers

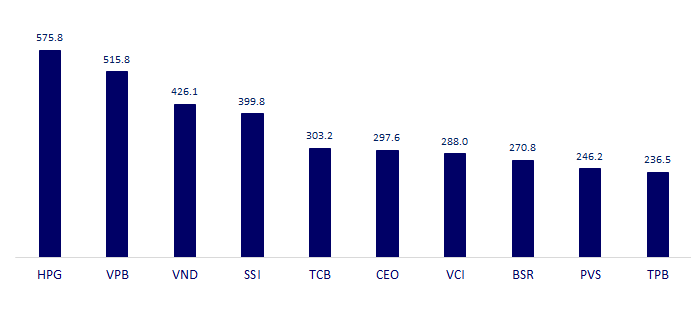

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

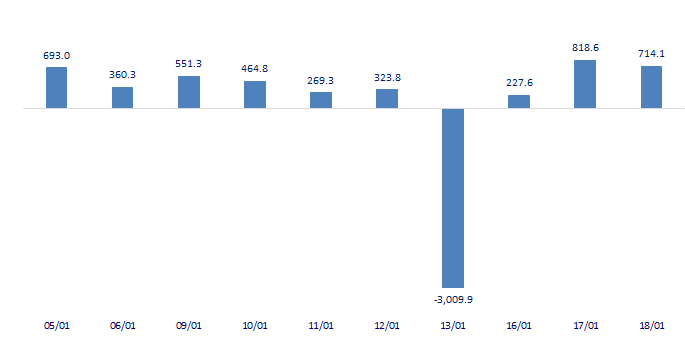

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

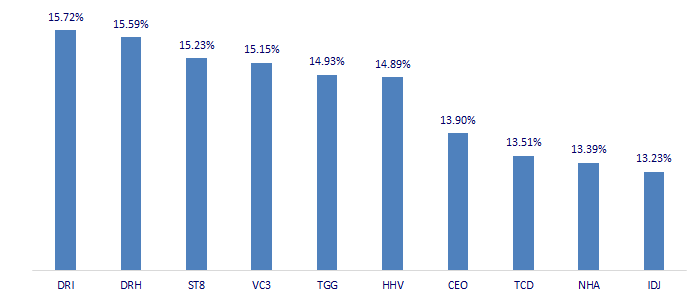

TOP INCREASES 3 CONSECUTIVE SESSIONS

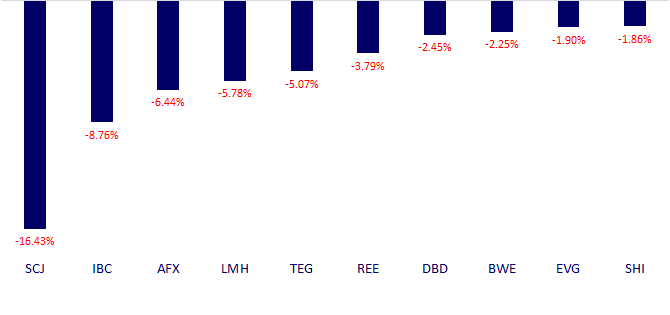

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.