Market brief 19/01/2023

VIETNAM STOCK MARKET

1,108.08

1D 0.89%

YTD 10.03%

1,121.92

1D 0.56%

YTD 11.61%

219.87

1D 0.98%

YTD 7.09%

73.98

1D 0.60%

YTD 3.25%

818.39

1D 0.00%

YTD 0.00%

13,137.52

1D 10.26%

YTD 52.48%

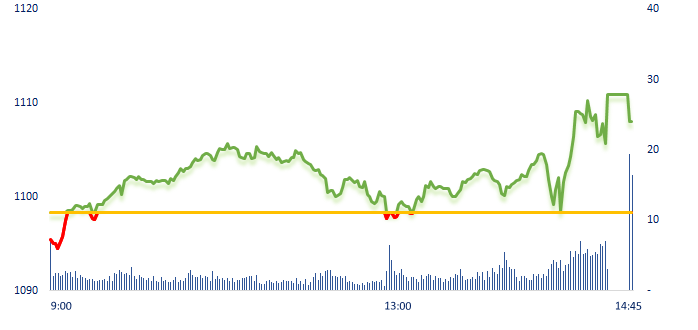

VN-Index continued to gain in the last session before Tet. The market was shaken right from the beginning of the session when VN-Index dropped more than 3 points due to the situation of investors taking profits for Tet and bad results from the US market yesterday. However, the gaining momentum quickly returned with the green color spreading to many sectors, especially banking, real estate and some large cap stocks.

ETF & DERIVATIVES

19,400

1D 2.11%

YTD 11.94%

13,280

1D 0.99%

YTD 11.41%

13,800

1D -0.14%

YTD 10.58%

15,740

1D 1.94%

YTD 12.03%

16,210

1D 0.87%

YTD 12.96%

23,800

1D -0.42%

YTD 6.25%

14,320

1D 0.14%

YTD 10.58%

1,102

1D 0.66%

YTD 0.00%

1,119

1D 0.70%

YTD 0.00%

1,121

1D 0.36%

YTD 0.00%

1,121

1D 0.33%

YTD 0.00%

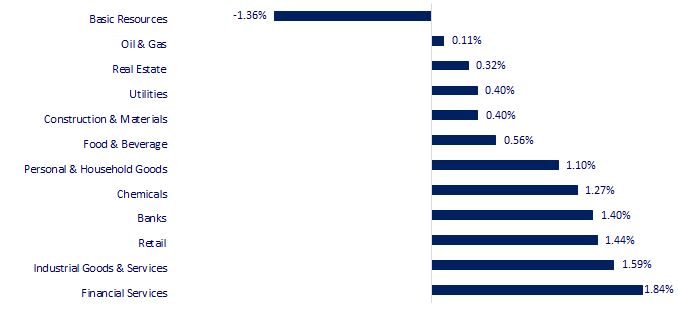

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

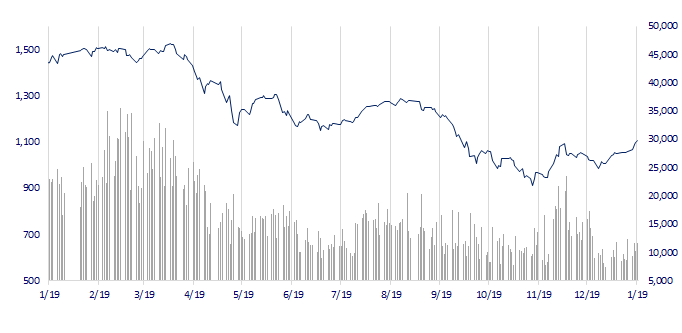

VNINDEX (12M)

GLOBAL MARKET

26,405.23

1D -1.44%

YTD 1.19%

3,240.28

1D 0.49%

YTD 4.89%

2,380.34

1D 0.51%

YTD 6.44%

21,650.98

1D -0.12%

YTD 9.45%

3,276.18

1D -0.41%

YTD 0.76%

1,688.48

1D 0.18%

YTD 1.08%

84.20

1D 0.01%

YTD -1.99%

1,909.75

1D 0.32%

YTD 4.58%

Stocks and oil prices dipped on Thursday after weak U.S. consumer data rekindled global recession worries, while Japan's yen reared up again as traders took fresh punts that the Bank of Japan will soon be tightening policy.

VIETNAM ECONOMY

6.32%

1D (bps) 26

YTD (bps) 135

7.40%

4.56%

YTD (bps) -23

4.58%

1D (bps) -1

YTD (bps) -32

23,630

1D (%) 0.08%

YTD (%) -0.55%

26,125

1D (%) 0.34%

YTD (%) 1.82%

3,528

1D (%) -0.48%

YTD (%) 1.23%

USD reversed up against major currencies but traded in a precarious position as demand for risk assets plunged when FED expressed the view to continue to maintain the tight monetary policy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Khanh Hoa's economy recovers impressively, being highest in the country;

- Credit growth orientation in 2023 is about 14-15%;

- Vietnamese spend 1.1 billion USD on food ordering apps;

- American investors are increasing their cash holdings and waiting for opportunities;

- Apple partners expand production in Southeast Asia;

- Moody's forecasts a change in its international business strategy.

VN30

BANK

93,000

1D 3.33%

5D 9.67%

Buy Vol. 2,420,625

Sell Vol. 2,336,943

45,950

1D 1.88%

5D 10.86%

Buy Vol. 4,272,690

Sell Vol. 2,613,822

31,100

1D 1.14%

5D 7.61%

Buy Vol. 7,369,722

Sell Vol. 7,953,017

29,100

1D 0.00%

5D 4.49%

Buy Vol. 7,085,032

Sell Vol. 8,082,213

19,500

1D -0.76%

5D 4.28%

Buy Vol. 27,975,324

Sell Vol. 32,335,637

19,600

1D 0.26%

5D 7.40%

Buy Vol. 18,857,301

Sell Vol. 18,971,162

17,500

1D 0.29%

5D 5.42%

Buy Vol. 4,487,692

Sell Vol. 5,212,635

24,000

1D 1.69%

5D 7.14%

Buy Vol. 23,299,691

Sell Vol. 17,593,527

26,800

1D 0.00%

5D 7.41%

Buy Vol. 25,460,240

Sell Vol. 19,957,775

22,900

1D 0.00%

5D 5.05%

Buy Vol. 8,241,978

Sell Vol. 7,840,397

26,000

1D 1.96%

5D 6.12%

Buy Vol. 11,729,750

Sell Vol. 9,358,959

VIB: In 2022, VIB main source of income increased 27% over the previous year, earning nearly VND 14,963 billion. Non-interest income also increased compared to the previous year. Profit from services reached over VND3,188 billion, up 16%, thanks to an increase in payment service revenue (+69%) and a reduction in insurance commission service costs (-90%).

REAL ESTATE

14,050

1D -0.71%

5D -6.02%

Buy Vol. 24,504,345

Sell Vol. 25,361,656

27,600

1D -0.72%

5D 2.99%

Buy Vol. 1,914,729

Sell Vol. 2,810,905

14,150

1D -1.05%

5D -3.41%

Buy Vol. 9,327,702

Sell Vol. 10,420,603

KDH: In Q4, KDH recorded consolidated net revenue of VND1,234 billion, up 109% y/y, KDH's gross profit reached VND298.2 billion.

OIL & GAS

104,500

1D 0.19%

5D -0.48%

Buy Vol. 449,515

Sell Vol. 493,402

12,200

1D 0.41%

5D 3.83%

Buy Vol. 19,236,202

Sell Vol. 16,526,344

38,000

1D 0.00%

5D 2.43%

Buy Vol. 1,071,398

Sell Vol. 1,068,706

According to data from the Ministry of Industry and Trade, the price of A95 gasoline imported from Singapore has increased to nearly 101 USD/barrel.

VINGROUP

57,400

1D 1.23%

5D 4.36%

Buy Vol. 3,130,203

Sell Vol. 3,602,282

52,200

1D -0.57%

5D 1.36%

Buy Vol. 2,749,622

Sell Vol. 3,616,768

29,650

1D 1.19%

5D 3.31%

Buy Vol. 3,783,341

Sell Vol. 4,688,675

VHM: On January 12, the Department of Construction of HCMC issued a document confirming the eligibility to sell 3,620 apartments in the residential area and Phuoc Thien project.

FOOD & BEVERAGE

81,300

1D 0.00%

5D 1.63%

Buy Vol. 3,468,807

Sell Vol. 4,618,253

102,000

1D 2.10%

5D 9.32%

Buy Vol. 1,565,963

Sell Vol. 1,605,345

185,700

1D -0.70%

5D 3.28%

Buy Vol. 362,379

Sell Vol. 359,794

MSN: Masan MEATLife was fined and collected nearly VND1 billion in tax.

OTHERS

49,900

1D 3.10%

5D 1.63%

Buy Vol. 2,150,665

Sell Vol. 1,584,123

114,500

1D 1.96%

5D 4.28%

Buy Vol. 702,120

Sell Vol. 702,110

83,900

1D 0.60%

5D 3.97%

Buy Vol. 1,923,735

Sell Vol. 2,430,910

45,600

1D 1.45%

5D 8.31%

Buy Vol. 4,859,792

Sell Vol. 6,665,420

16,300

1D 1.88%

5D 10.14%

Buy Vol. 4,516,385

Sell Vol. 4,895,919

21,200

1D 3.16%

5D 9.84%

Buy Vol. 45,784,062

Sell Vol. 43,877,839

21,150

1D -2.53%

5D 5.49%

Buy Vol. 69,847,604

Sell Vol. 76,630,140

HPG: In the fourth quarter of 2022, HPG achieved a revenue of VND 26,000 billion, down 42% compared to the same period last year, a record net loss of more than VND2,000 billion, continued to plunge to a new bottom after the third quarter. Accumulated in 2022, HPG achieved revenue of VND142,000 billion, down 5% compared to 2021. PAT for the whole year reached more than VND8,400 billion, only 24% compared to 2021.

Market by numbers

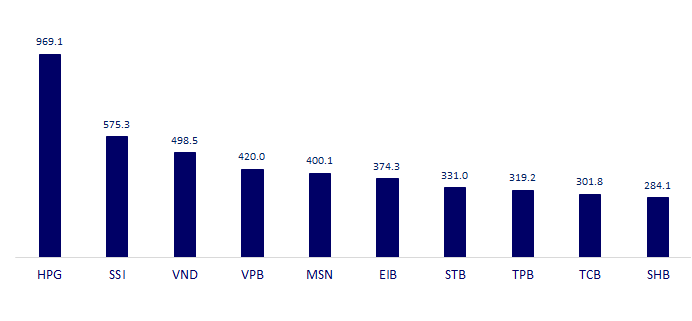

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

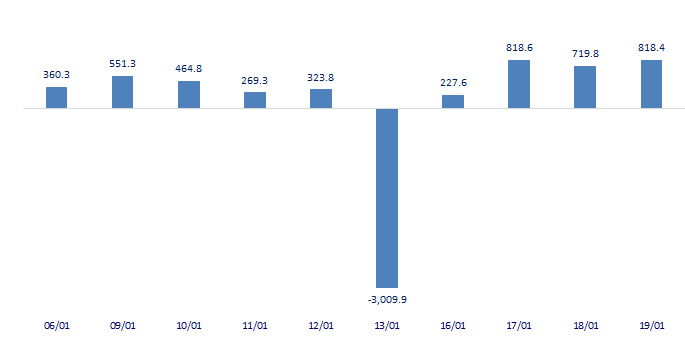

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

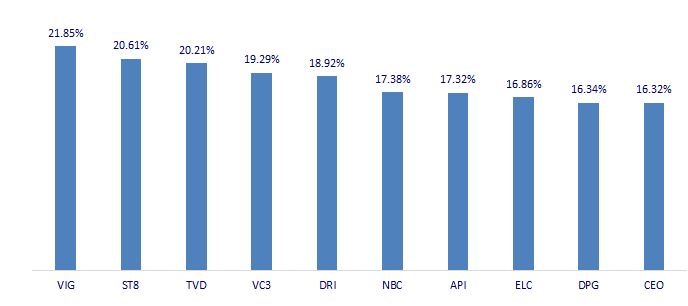

TOP INCREASES 3 CONSECUTIVE SESSIONS

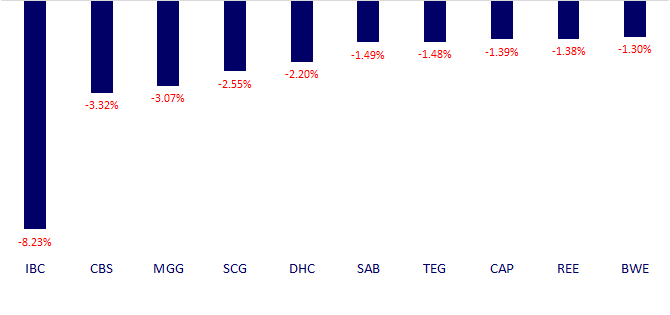

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.