Market brief 10/03/2023

VIETNAM STOCK MARKET

1,053.00

1D -0.28%

YTD 4.56%

1,047.20

1D -0.29%

YTD 4.18%

207.86

1D -0.56%

YTD 1.24%

76.83

1D 0.30%

YTD 7.23%

417.08

1D 0.00%

YTD 0.00%

10,285.22

1D -14.02%

YTD 19.37%

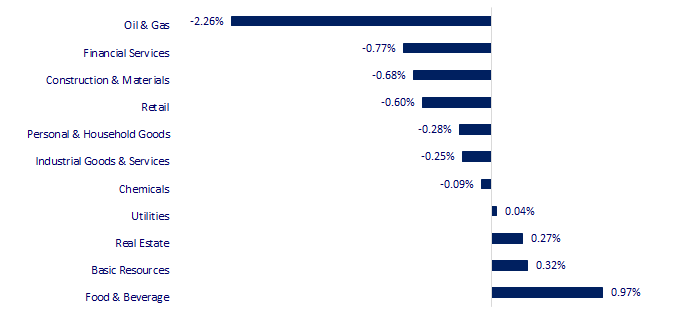

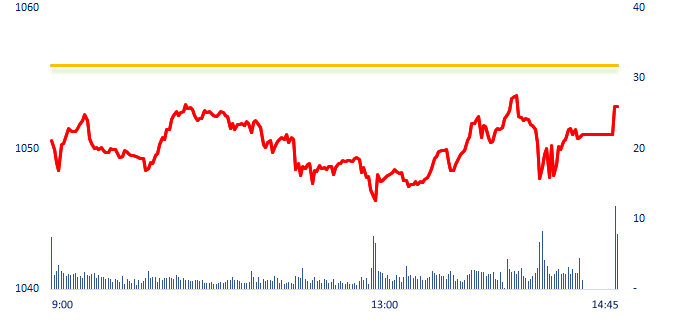

At the beginning of the session, VN-Index dropped 6 points and struggled strongly below reference with low liquidity before recovering slightly at the end of the session. Oil and gas, banking, financial services were the three most negative sectors in the market today with some typical stocks such as PLX, PVD, PVS, TCB, TPB, etc. On the contrary, F&B and basic resources were among the rare groups that gained today.

ETF & DERIVATIVES

17,850

1D -0.45%

YTD 3.00%

12,370

1D -0.32%

YTD 3.78%

12,710

1D -0.86%

YTD 1.84%

15,700

1D 0.64%

YTD 11.74%

15,310

1D 0.13%

YTD 6.69%

22,100

1D -1.12%

YTD -1.34%

13,220

1D -0.60%

YTD 2.08%

1,039

1D -0.54%

YTD 0.00%

1,040

1D -0.37%

YTD 0.00%

1,042

1D -0.57%

YTD 0.00%

1,050

1D -0.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

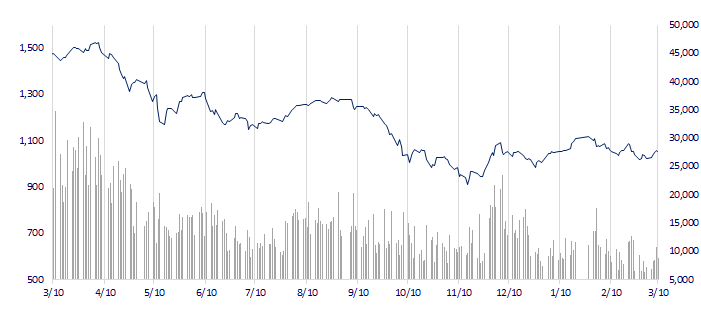

VNINDEX (12M)

GLOBAL MARKET

28,143.97

1D -1.67%

YTD 7.85%

3,230.08

1D -1.40%

YTD 4.56%

2,394.59

1D -1.01%

YTD 7.07%

19,319.92

1D -3.04%

YTD -2.33%

3,175.15

1D -1.22%

YTD -2.34%

1,599.37

1D -0.92%

YTD -4.25%

81.31

1D -0.47%

YTD -5.35%

1,839.85

1D 0.23%

YTD 0.75%

Asian stocks slumped, with financials leading a region-wide selloff, as investors fretted over the risks to broader markets from troubles emanating at a Silicon Valley-based lender. A key gauge of Chinese stocks erased all its gains for 2023, weighed down by uncertainty over the economic outlook and a lack of fresh catalysts from the ongoing National People’s Congress.

VIETNAM ECONOMY

6.20%

1D (bps) -8

YTD (bps) 123

7.40%

4.00%

1D (bps) -1

YTD (bps) -79

4.20%

1D (bps) -7

YTD (bps) -70

23,846

1D (%) -0.04%

YTD (%) 0.36%

25,800

1D (%) -0.07%

YTD (%) 0.55%

3,471

1D (%) 0.00%

YTD (%) -0.40%

In the first two months of the year, the State Bank of Vietnam (SBV) bought a large amount of foreign currency up to USD3.5 billion, creating an abundant amount in the liquidity system and making the national foreign exchange reserve quickly replenished significantly, after many days of stabilizing the exchange rate market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- New development impetus from Dung Quat Economic Zone;

- Aviation expects Chinese passengers;

- Tien Giang accelerates disbursement of public investment;

- Japan: BoJ kept monetary policy unchanged, controlling "interest rate curve";

- Mr. Xi Jinping was re-elected president of China;

- CFO Grab sells USD1.1 million of shares to cover tax liability.

VN30

BANK

92,100

1D -0.97%

5D 1.32%

Buy Vol. 1,194,236

Sell Vol. 1,428,800

47,150

1D -1.05%

5D 2.72%

Buy Vol. 1,530,058

Sell Vol. 1,788,663

29,200

1D -0.68%

5D 5.04%

Buy Vol. 3,085,067

Sell Vol. 4,243,448

27,150

1D -2.34%

5D 1.31%

Buy Vol. 4,229,048

Sell Vol. 5,207,270

18,300

1D 0.55%

5D 7.65%

Buy Vol. 27,944,220

Sell Vol. 28,322,894

17,750

1D -0.28%

5D 3.50%

Buy Vol. 12,542,920

Sell Vol. 12,438,546

18,500

1D 0.00%

5D 3.93%

Buy Vol. 2,636,434

Sell Vol. 3,788,033

24,000

1D -2.04%

5D 2.56%

Buy Vol. 5,166,360

Sell Vol. 6,298,073

26,000

1D -1.89%

5D 4.00%

Buy Vol. 46,151,238

Sell Vol. 46,932,421

20,950

1D -1.18%

5D 1.45%

Buy Vol. 4,491,981

Sell Vol. 4,120,040

24,900

1D -1.78%

5D 1.63%

Buy Vol. 4,684,843

Sell Vol. 5,110,721

TPB: Tien Phong Commercial Joint Stock Bank (TPBank) has just announced the Resolution of the Board of Directors (BOD) related to the contents, the last registration date and the expected time to hold the 2023 Annual General Meeting of Shareholders.

REAL ESTATE

10,650

1D -2.74%

5D 2.90%

Buy Vol. 19,694,893

Sell Vol. 18,377,813

83,800

1D -0.24%

5D 0.36%

Buy Vol. 258,949

Sell Vol. 246,675

11,750

1D -2.08%

5D 11.90%

Buy Vol. 7,452,475

Sell Vol. 9,588,297

NVL: After the incident, the ownership in Novaland of Mr. Bui Thanh Nhon's family was close to the threshold of 51%.

OIL & GAS

107,000

1D 0.19%

5D 2.39%

Buy Vol. 480,311

Sell Vol. 514,790

12,950

1D -0.38%

5D 4.86%

Buy Vol. 23,690,079

Sell Vol. 18,394,199

38,150

1D -2.18%

5D -1.68%

Buy Vol. 1,531,232

Sell Vol. 1,164,851

GAS: PV GAS is looking to purchase the first batch of liquefied natural gas (LNG) from Vietnam.

VINGROUP

53,100

1D 0.19%

5D 0.76%

Buy Vol. 1,584,821

Sell Vol. 2,363,120

42,850

1D 1.06%

5D 4.64%

Buy Vol. 3,766,723

Sell Vol. 4,323,881

28,000

1D 3.70%

5D 7.69%

Buy Vol. 3,923,156

Sell Vol. 3,644,446

VIC: GSM JSC with charter capital of VND3,000 billion was founded by Chairman of Vingroup, operating in main areas: car, motorbike and electric taxi rental.

FOOD & BEVERAGE

76,900

1D 0.52%

5D 1.18%

Buy Vol. 2,504,871

Sell Vol. 3,274,452

83,900

1D 3.84%

5D 10.39%

Buy Vol. 2,594,886

Sell Vol. 2,279,806

185,600

1D -0.48%

5D -0.75%

Buy Vol. 394,962

Sell Vol. 393,135

MSN: Masan borrowed VND15,000 billion more syndicated, interest rate 8%/year.

OTHERS

49,200

1D -0.51%

5D 1.55%

Buy Vol. 401,098

Sell Vol. 327,789

100,600

1D -1.18%

5D -0.59%

Buy Vol. 512,133

Sell Vol. 495,743

79,500

1D -1.36%

5D 1.27%

Buy Vol. 1,384,355

Sell Vol. 1,507,680

39,750

1D -0.63%

5D 0.89%

Buy Vol. 2,689,466

Sell Vol. 2,784,811

15,000

1D -0.99%

5D 6.38%

Buy Vol. 5,892,863

Sell Vol. 5,648,655

19,800

1D 0.00%

5D 7.32%

Buy Vol. 27,744,782

Sell Vol. 27,012,666

21,300

1D 0.47%

5D 4.67%

Buy Vol. 42,762,510

Sell Vol. 44,247,970

FPT: The CEO of FPT receives a salary of more than VND4 billion in 2022, but the income from receiving ESOP shares is 16 times higher.

Market by numbers

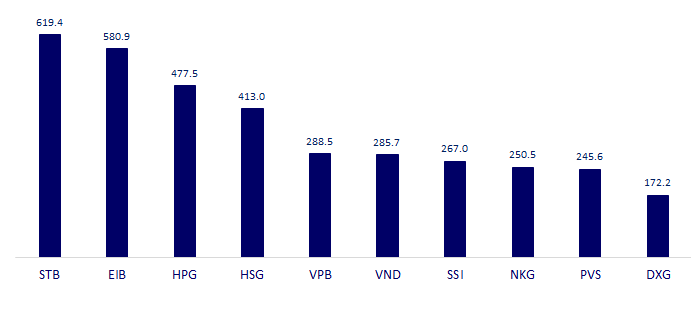

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

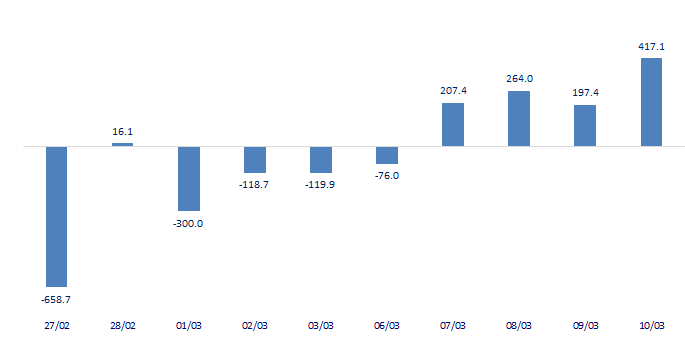

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

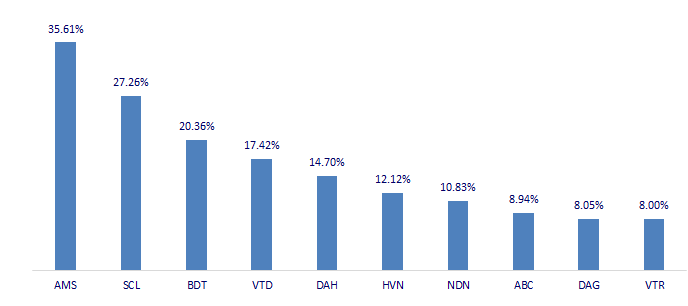

TOP INCREASES 3 CONSECUTIVE SESSIONS

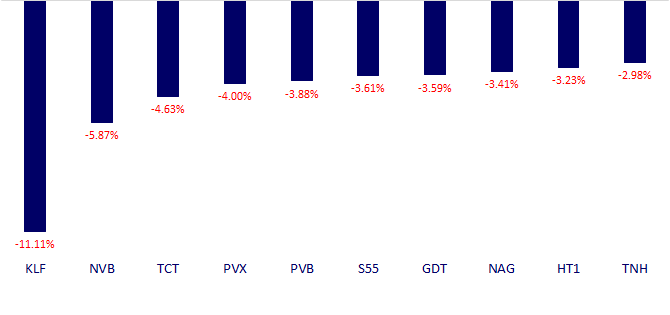

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.