Market Brief 30/03/2023

VIETNAM STOCK MARKET

1,059.44

1D 0.29%

YTD 5.20%

1,067.24

1D 0.55%

YTD 6.17%

205.95

1D 0.18%

YTD 0.31%

76.49

1D -0.31%

YTD 6.76%

-416.18

1D 0.00%

YTD 0.00%

12,400.01

1D 32.52%

YTD 43.92%

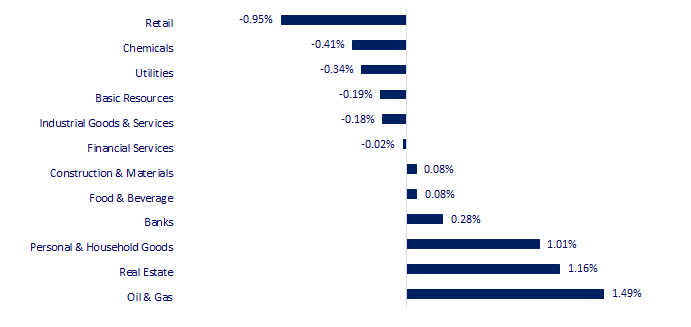

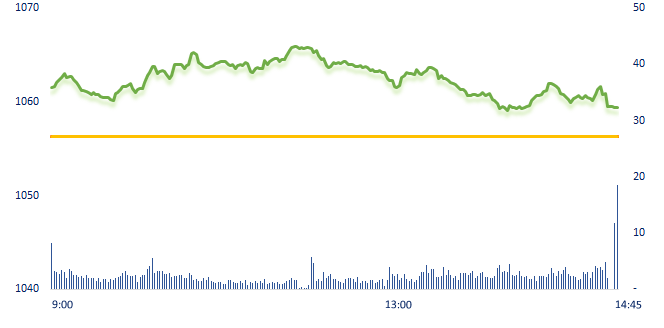

At the beginning of the morning session, VNIndex opened a gap up by 5 points, mainly driven by some government spending and banking stocks. However, the upward momentum gradually narrowed after 11am, many government spending stocks such as VCG, KSB, FCN, etc. ended the session with a sharp drop. Oil and gas was the industry with the strongest gain today, however, the positivity was mainly contributed by PLX.

ETF & DERIVATIVES

18,220

1D 1.05%

YTD 5.14%

12,620

1D 0.96%

YTD 5.87%

13,020

1D 0.15%

YTD 4.33%

15,020

1D -2.66%

YTD 6.90%

15,960

1D 1.27%

YTD 11.22%

22,290

1D 0.13%

YTD -0.49%

13,450

1D 0.22%

YTD 3.86%

1,060

1D 1.50%

YTD 0.00%

1,059

1D 1.16%

YTD 0.00%

1,062

1D 1.38%

YTD 0.00%

1,065

1D 1.24%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

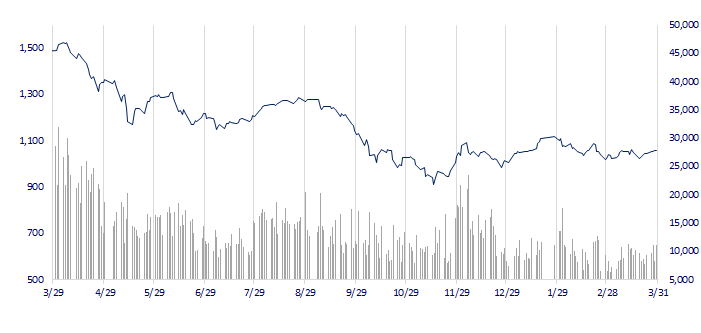

VNINDEX (12M)

GLOBAL MARKET

27,782.93

1D -0.36%

YTD 6.47%

3,261.25

1D 0.65%

YTD 5.57%

2,453.16

1D 0.38%

YTD 9.69%

20,309.13

1D 0.58%

YTD 2.67%

3,257.18

1D -0.16%

YTD 0.18%

1,605.42

1D -0.32%

YTD -3.89%

78.34

1D 1.03%

YTD -8.81%

1,987.85

1D 0.58%

YTD 8.85%

A steadier tone in Asian stocks continued on Thursday as investors hoped the banking sector had turned a corner on its recent turmoil to help markets end the quarter on a positive note. Stronger Chinese-led emerging markets growth will likely buffer the stocks, bonds and currencies of many developing nations as markets in the United States and Europe are whipped around by banking turmoil.

VIETNAM ECONOMY

1.00%

1D (bps) -5

YTD (bps) -397

7.40%

3.47%

1D (bps) -12

YTD (bps) -132

3.57%

1D (bps) -10

YTD (bps) -133

23,695

1D (%) 0.19%

YTD (%) -0.27%

25,952

1D (%) -0.81%

YTD (%) 1.14%

3,482

1D (%) 0.09%

YTD (%) -0.09%

The downward trend of interbank interest rates has not stopped because the liquidity of the banking system is quite redundant. Although the State Bank has allocated a credit room for banks, the demand for credit is growing very slowly. As of March 20, 2023, the credit growth of the economy was only 1.61%, while the figure for the same period in 2022 was 4.03%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The GSO explained the reason why more than 60,000 enterprises withdrew from the market;

- Cai Mep- Thi Vai port welcomes the largest container ship ever;

- Ho Chi Minh City develops golf tourism to attract tourists;

- Bloomberg: The US is paying the price for being overbanked;

- A USD3 trillion threat to global financial markets looms in Japan;

- The UBS takeover of Credit Suisse comes with a huge amount of risk, UBS chairman Colm Kelleher admitted.

VN30

BANK

92,700

1D 0.43%

5D 2.21%

Buy Vol. 617,037

Sell Vol. 917,268

46,200

1D 0.00%

5D 0.65%

Buy Vol. 1,119,165

Sell Vol. 1,635,949

29,000

1D 0.00%

5D 1.05%

Buy Vol. 2,576,115

Sell Vol. 4,286,350

27,700

1D -1.07%

5D 5.73%

Buy Vol. 7,649,613

Sell Vol. 11,491,910

20,900

1D 0.00%

5D -0.71%

Buy Vol. 26,678,917

Sell Vol. 31,666,668

18,250

1D -0.27%

5D 4.89%

Buy Vol. 19,090,332

Sell Vol. 22,264,741

18,700

1D 3.31%

5D 5.95%

Buy Vol. 12,058,552

Sell Vol. 12,500,990

22,150

1D 1.14%

5D 0.45%

Buy Vol. 6,087,724

Sell Vol. 5,907,460

26,000

1D 2.56%

5D 4.00%

Buy Vol. 75,433,030

Sell Vol. 72,973,358

21,350

1D 0.47%

5D 3.39%

Buy Vol. 9,608,923

Sell Vol. 9,743,484

24,600

1D 0.82%

5D 0.41%

Buy Vol. 4,155,260

Sell Vol. 5,419,906

TCB: Techcombank has just released the document of the General Meeting of Shareholders in 2023. Accordingly, Techcombank sets a plan for consolidated pre-tax profit of VND22,000 billion, down 14% compared to 2022. TCB sets a target for a credit balance of VND511,297 billion. NPL ratio is lower than 1.5%. Accordingly, this year is the 12th consecutive year that Techcombank has not paid a cash dividend.

REAL ESTATE

12,800

1D 1.99%

5D 14.80%

Buy Vol. 48,125,286

Sell Vol. 50,787,704

82,300

1D 0.12%

5D 0.49%

Buy Vol. 182,131

Sell Vol. 141,054

12,400

1D 0.00%

5D 3.33%

Buy Vol. 7,710,725

Sell Vol. 10,988,114

PDR: PDR has received shares transferred from the founding shareholders of Phat Dat Industrial Park Investment and Development JSC.

OIL & GAS

102,400

1D -0.39%

5D -0.10%

Buy Vol. 267,165

Sell Vol. 574,040

13,200

1D -1.12%

5D 0.00%

Buy Vol. 12,340,742

Sell Vol. 15,454,491

36,900

1D 2.50%

5D 2.93%

Buy Vol. 2,374,858

Sell Vol. 2,891,149

PLX: Petrolimex announced the cancellation of the record date, which is March 31, and postponed the time of holding the Annual General Meeting of Shareholders.

VINGROUP

53,700

1D 0.37%

5D 1.70%

Buy Vol. 1,844,123

Sell Vol. 2,186,809

49,550

1D 3.23%

5D 3.23%

Buy Vol. 3,048,725

Sell Vol. 3,337,777

29,900

1D 2.22%

5D 2.05%

Buy Vol. 11,522,992

Sell Vol. 13,425,342

VHM: VHM led the gain of real estate group on March 30, and was also the stock that contributed the most to VNIndex's gain.

FOOD & BEVERAGE

75,000

1D 0.13%

5D -0.40%

Buy Vol. 1,438,745

Sell Vol. 2,495,003

79,200

1D 0.51%

5D 0.25%

Buy Vol. 1,924,649

Sell Vol. 2,039,589

185,000

1D -0.22%

5D -1.60%

Buy Vol. 115,745

Sell Vol. 116,405

MSN: MSN has just announced that it has successfully disbursed the first phase of USD375 million, under the guarantee of a USD650 million syndicated loan signed in February 2023.

OTHERS

48,450

1D 0.31%

5D -0.92%

Buy Vol. 335,260

Sell Vol. 364,984

106,300

1D 0.09%

5D 0.57%

Buy Vol. 294,382

Sell Vol. 347,062

79,100

1D 0.13%

5D 1.41%

Buy Vol. 1,117,991

Sell Vol. 1,185,877

38,600

1D -0.26%

5D 2.12%

Buy Vol. 4,435,291

Sell Vol. 5,120,060

14,700

1D -0.34%

5D 1.38%

Buy Vol. 3,715,383

Sell Vol. 4,073,687

20,950

1D -0.48%

5D 2.95%

Buy Vol. 41,560,885

Sell Vol. 54,270,655

20,800

1D 0.00%

5D 1.96%

Buy Vol. 33,725,366

Sell Vol. 51,761,821

HPG: Chairman Tran Dinh Long pointed out four factors that caused HPG's business results to decline, including (i)the real estate industry faced difficulties since Q2/2022 (ii)the price of coking coal tripled, making HPG's gross profit margin dropped sharply (iii)USD price increased continuously during the year, causing HPG's net exchange rate loss of VND1,858 billion, (iv)interest rate increased sharply in the last 6 months of the year.

Market by numbers

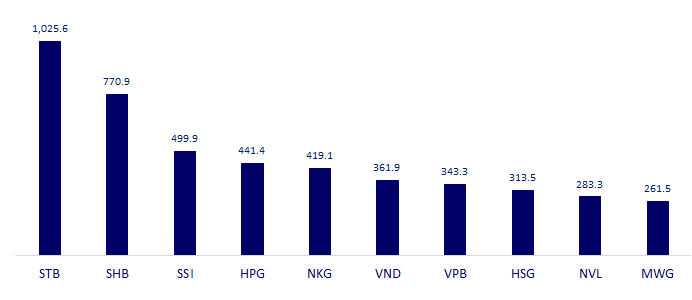

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

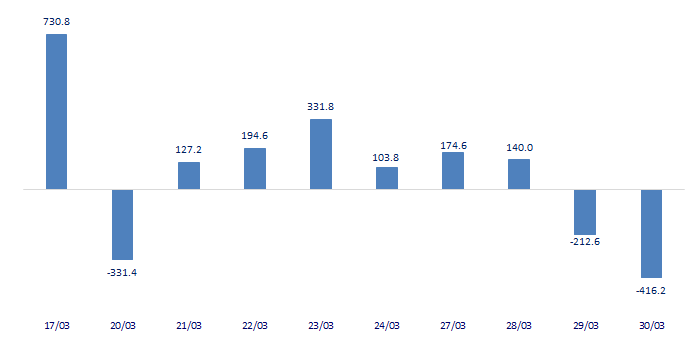

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

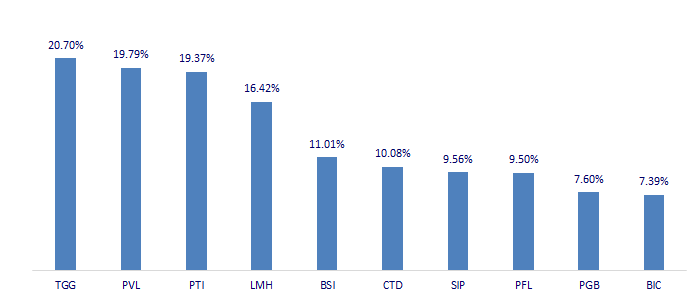

TOP INCREASES 3 CONSECUTIVE SESSIONS

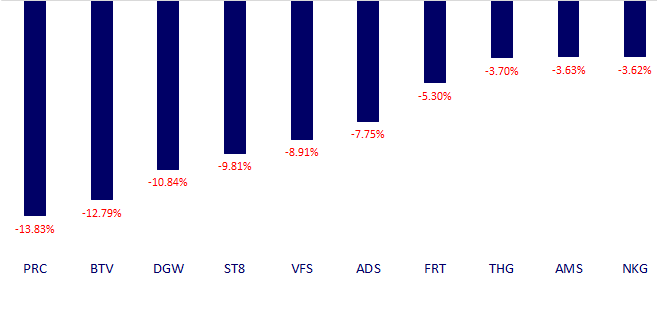

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.