Market Brief 18/04/2023

VIETNAM STOCK MARKET

1,055.02

1D 0.11%

YTD 4.76%

1,064.55

1D -0.04%

YTD 5.91%

208.25

1D 0.78%

YTD 1.43%

78.73

1D 0.45%

YTD 9.88%

148.05

1D 0.00%

YTD 0.00%

11,392.48

1D 23.61%

YTD 32.23%

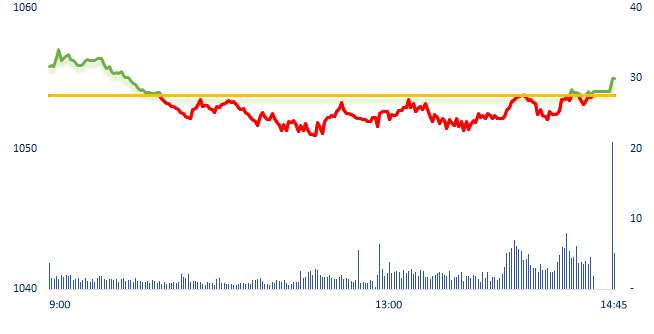

Although the gloomy business results in Q1, today's brokerage stocks traded the most actively in the market. BSI, FTS and PSI hit the ceiling, while MBS, HCM, ORS, VCI and many others gained more than 3%. VNM is the gaining stock with the biggest influence on VNIndex today, followed by VHM and SAB. On the other side, BID was the leading stock in the drop, putting pressure on the general index, followed by VCB.

ETF & DERIVATIVES

18,170

1D -0.16%

YTD 4.85%

12,570

1D 0.00%

YTD 5.45%

13,080

1D 0.93%

YTD 4.81%

15,510

1D -1.15%

YTD 10.39%

16,010

1D -0.56%

YTD 11.57%

22,630

1D -0.26%

YTD 1.03%

13,600

1D 0.07%

YTD 5.02%

1,056

1D -0.09%

YTD 0.00%

1,058

1D -0.14%

YTD 0.00%

1,061

1D -0.32%

YTD 0.00%

1,063

1D -0.14%

YTD 0.00%

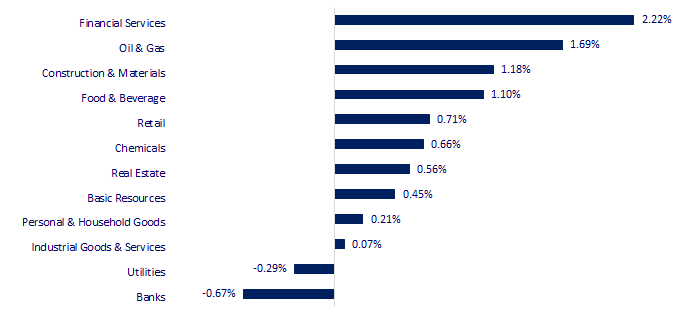

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

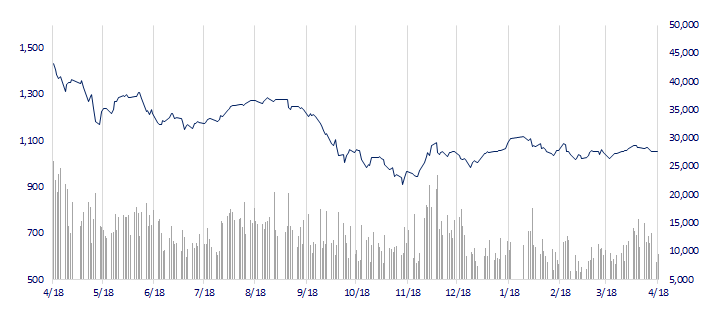

VNINDEX (12M)

GLOBAL MARKET

28,658.83

1D 0.51%

YTD 9.83%

3,393.33

1D 0.23%

YTD 9.84%

2,571.09

1D -0.19%

YTD 14.97%

20,650.51

1D -0.63%

YTD 4.39%

3,309.56

1D -0.29%

YTD 1.79%

1,593.85

1D -0.41%

YTD -4.58%

84.49

1D -0.48%

YTD -1.65%

2,015.75

1D 0.36%

YTD 10.38%

Gold prices rose on Tuesday, buoyed by a weaker dollar, while investors looked for more clarity on the U.S. Federal Reserve's rate hike path ahead. "Gold's near-10% year-to-date climb has been largely predicated on its role as a safe haven as markets kept a wary eye over recession and financial instability risks," said Han Tan, chief market analyst at Exinity.

VIETNAM ECONOMY

5.13%

1D (bps) -20

YTD (bps) 16

7.40%

3.09%

YTD (bps) -170

3.28%

1D (bps) 4

YTD (bps) -162

23,685

1D (%) 0.13%

YTD (%) -0.32%

26,538

1D (%) 0.56%

YTD (%) 3.43%

3,489

1D (%) 0.14%

YTD (%) 0.11%

The survey of interest rates listed on the morning of April 18 showed that, at some banks, interest rates for 6-month tenor were higher than for 36-month terms. The fact that the short-term deposit interest rate is higher than the long-term deposit interest rate, shows that these banks have a liquidity imbalance, short-term liquidity shortages and long-term liquidity is redundant.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank has just had a meeting on debt structure, HoREA proposes to issue a Circular soon;

- VCCI proposes abolishing excise tax on gasoline;

- The Ministry of Finance said that the amount of support for businesses and people in 3 years reached more than VND500 trillion;

- Apple launches its savings account with 4.15% of interest rate;

- China is a creditor of many countries, even accounting for more than 20% of the public debt of some countries;

- Denmark rejects interaction with Russia in Nord Stream investigation – Ambassador.

VN30

BANK

88,000

1D -0.45%

5D -0.23%

Buy Vol. 1,255,296

Sell Vol. 1,140,235

44,600

1D -0.89%

5D 0.45%

Buy Vol. 1,324,802

Sell Vol. 1,278,257

29,100

1D -0.34%

5D -1.69%

Buy Vol. 1,737,309

Sell Vol. 2,504,359

29,150

1D -1.02%

5D -4.11%

Buy Vol. 4,752,210

Sell Vol. 5,062,389

20,250

1D -0.98%

5D -3.57%

Buy Vol. 17,436,846

Sell Vol. 18,858,721

18,150

1D -0.55%

5D -3.20%

Buy Vol. 11,895,761

Sell Vol. 14,134,940

19,350

1D 0.26%

5D -1.02%

Buy Vol. 3,824,177

Sell Vol. 3,907,799

22,800

1D -0.87%

5D -1.30%

Buy Vol. 3,006,752

Sell Vol. 5,032,036

25,900

1D 0.00%

5D -0.19%

Buy Vol. 20,348,370

Sell Vol. 21,843,830

20,650

1D 0.00%

5D -2.13%

Buy Vol. 4,494,833

Sell Vol. 4,213,888

24,750

1D -1.00%

5D -0.80%

Buy Vol. 3,474,523

Sell Vol. 5,070,939

VPB: In 2023, VPBank aims to increase pre-tax profit by 13% to more than VND24 trillion, a profit growth of 53% based on core business activities. Total assets are expected to increase by 39% to VND877 trillion. Customer deposits and valuable papers are expected to increase by 41% to VND518 trillion. Credit balance is expected to increase by 33% to VND636 trillion.

REAL ESTATE

14,850

1D 0.34%

5D 4.58%

Buy Vol. 72,121,995

Sell Vol. 59,694,962

79,500

1D 0.13%

5D -0.87%

Buy Vol. 103,785

Sell Vol. 144,144

13,900

1D 0.00%

5D 2.96%

Buy Vol. 15,930,760

Sell Vol. 16,863,972

NVL: As of April 17, Novaland has been getting a mortgage lien release by banks for VND2,498 billion.

OIL & GAS

96,800

1D -0.41%

5D -3.10%

Buy Vol. 394,101

Sell Vol. 599,695

13,500

1D 1.12%

5D 0.75%

Buy Vol. 24,105,755

Sell Vol. 12,368,585

36,800

1D 1.94%

5D -0.41%

Buy Vol. 840,679

Sell Vol. 1,100,888

World crude oil prices were mixed today, after plunging about 2% in the previous session as investors focused on the possibility of the Fed raising interest rates in May.

VINGROUP

52,800

1D -0.19%

5D -1.49%

Buy Vol. 3,410,708

Sell Vol. 2,994,516

50,800

1D 0.99%

5D -1.36%

Buy Vol. 2,386,961

Sell Vol. 4,217,620

28,500

1D 0.71%

5D -1.89%

Buy Vol. 3,479,019

Sell Vol. 3,233,061

VRE: Vincom Retail expects a record profit of nearly VND4,700 billion in 2023.

FOOD & BEVERAGE

73,000

1D 1.81%

5D -1.88%

Buy Vol. 2,055,397

Sell Vol. 1,640,278

78,200

1D 0.13%

5D 0.39%

Buy Vol. 1,098,112

Sell Vol. 1,213,045

165,800

1D 1.10%

5D -5.26%

Buy Vol. 465,412

Sell Vol. 371,327

MSN: Mrs. Chae Rhan Chun will be elected as a member of the Board of Directors of Masan, replacing Mr. Ji Han Yoo - the previous representative of SK Group.

OTHERS

47,000

1D -0.42%

5D -4.37%

Buy Vol. 520,799

Sell Vol. 506,616

99,000

1D -0.60%

5D -3.23%

Buy Vol. 445,364

Sell Vol. 285,937

79,400

1D -0.25%

5D -1.12%

Buy Vol. 847,968

Sell Vol. 811,898

39,950

1D 0.25%

5D -1.84%

Buy Vol. 5,413,882

Sell Vol. 5,547,636

15,500

1D 0.65%

5D -4.62%

Buy Vol. 3,272,729

Sell Vol. 3,635,439

21,750

1D 1.87%

5D -3.76%

Buy Vol. 32,562,049

Sell Vol. 34,226,709

20,950

1D 0.48%

5D 0.72%

Buy Vol. 21,087,849

Sell Vol. 26,094,975

HPG: In March, HPG supplied the market with about 282,000 tons of high-quality construction steel and coil, equivalent to February but down 45% over the same period last year. In terms of market share, HPG continues to lead in construction steel, accounting for nearly 33.1% of the country's construction steel consumption, but this figure is on a slight downward trend compared to previous months.

Market by numbers

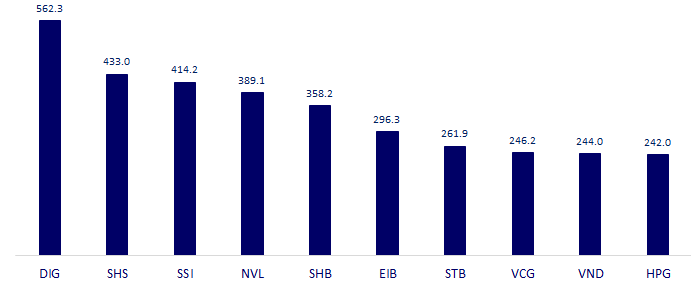

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

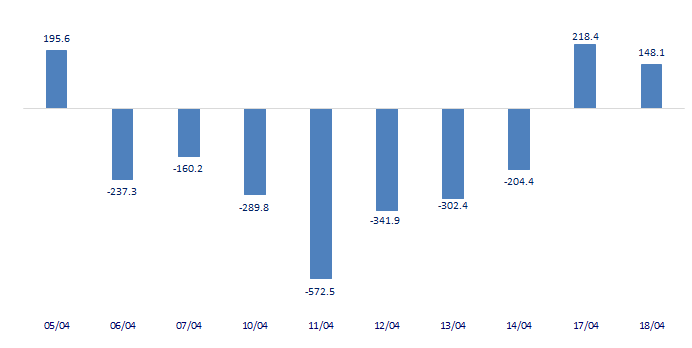

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

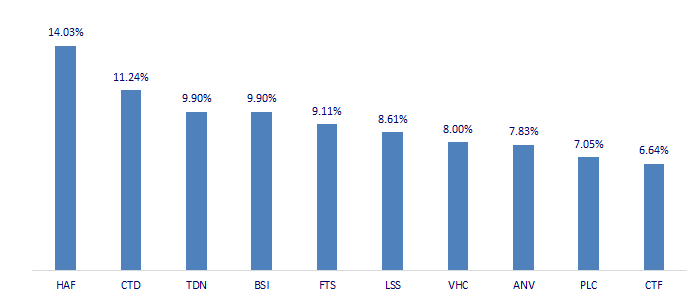

TOP INCREASES 3 CONSECUTIVE SESSIONS

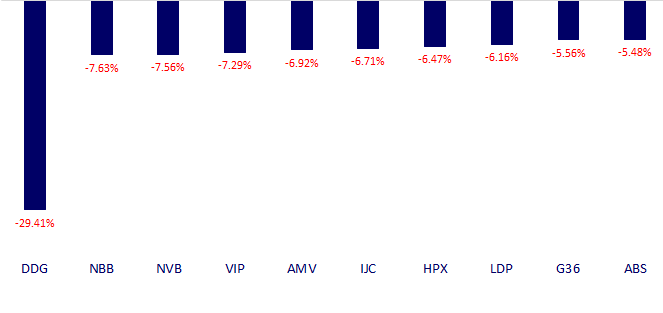

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.