Market brief 08/08/2023

VIETNAM STOCK MARKET

1,242.23

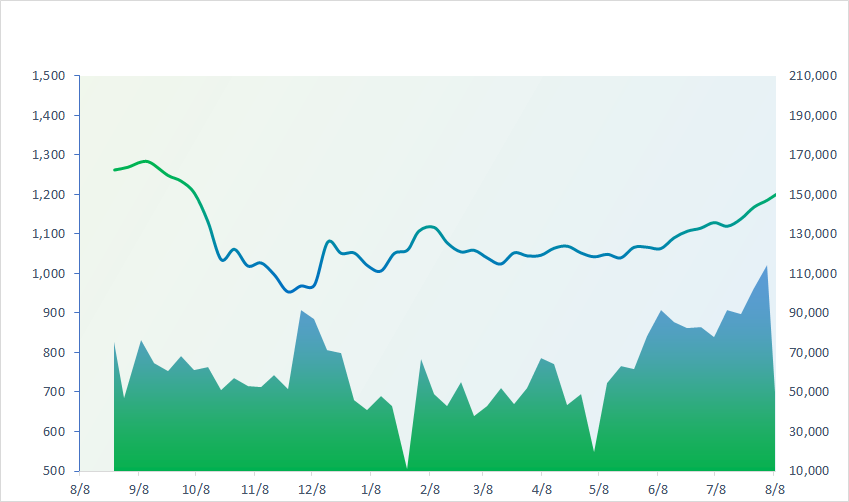

1D 0.07%

YTD 23.35%

1,247.81

1D -0.23%

YTD 24.14%

246.07

1D 0.16%

YTD 19.85%

93.64

1D 1.16%

YTD 30.69%

804.24

1D 0.00%

YTD 0.00%

28,567.93

1D -4.52%

YTD 231.57%

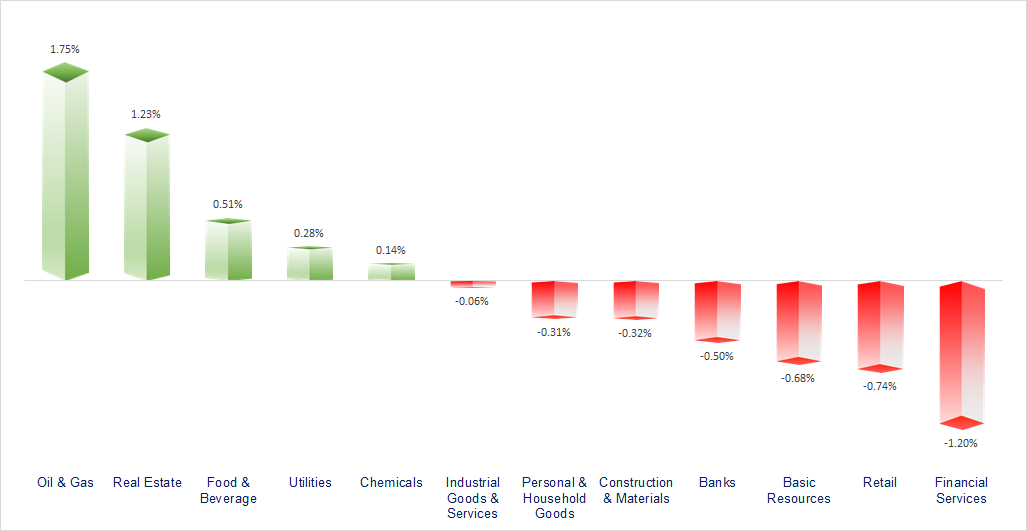

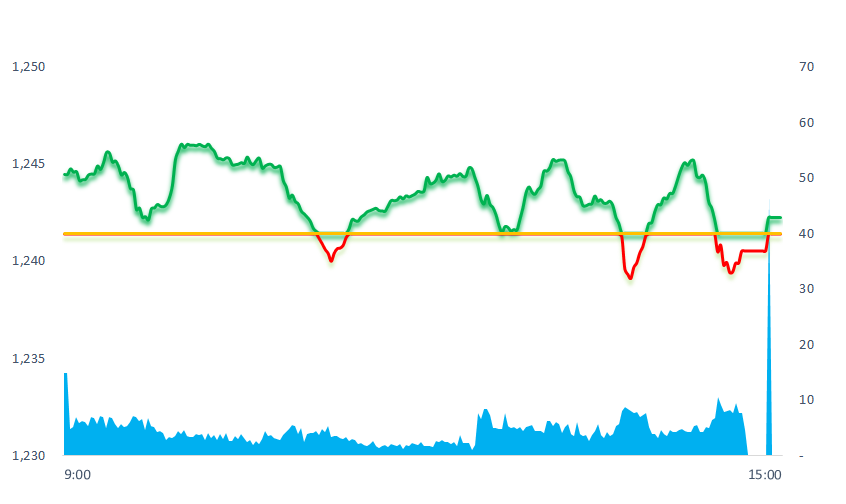

After 2 strong gaining sessions, today the stock market recorded transactions in a narrow range, around the reference level. However, market liquidity continued to remain high when the trading value on HOSE still reached USD1 billion. Oil and gas stocks gained strongly such as PVB (+2.23%); PVC (+2.63%); PVD (0.77%); PVS (+4.96%).

ETF & DERIVATIVES

21,380

1D -0.05%

YTD 23.37%

14,730

1D -0.14%

YTD 23.57%

15,350

1D 0.26%

YTD 23.00%

19,500

1D 3.01%

YTD 38.79%

19,240

1D -0.36%

YTD 34.08%

26,500

1D -0.93%

YTD 18.30%

16,250

1D -0.06%

YTD 25.48%

1,248

1D 0.00%

YTD 0.00%

1,250

1D 0.00%

YTD 0.00%

1,243

1D 0.00%

YTD 0.00%

1,237

1D 0.00%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,353.50

1D 0.27%

YTD 23.99%

3,260.62

1D -0.25%

YTD 5.55%

11,098.45

1D -0.42%

YTD 0.75%

19,539.46

1D 0.00%

YTD -1.22%

2,573.98

1D -0.26%

YTD 15.09%

65,862.13

1D -0.14%

YTD 8.25%

3,313.79

1D 0.12%

YTD 1.92%

1,518.44

1D -0.92%

YTD -9.10%

86.03

1D 1.18%

YTD 0.14%

1,926.61

1D -0.36%

YTD 5.50%

Asian stock markets were mixed on August 8. Chinese stocks were among the worst performers today due to weaker-than-expected import and export data. The Hang Seng Index fell 1.82% as large real estate stocks suffered heavy losses.

VIETNAM ECONOMY

0.22%

1D (bps) -4

YTD (bps) -475

6.30%

YTD (bps) -110

1.82%

YTD (bps) -297

2.44%

1D (bps) 2

YTD (bps) -246

23,905

1D (%) 0.02%

YTD (%) 0.61%

26,753

1D (%) -0.22%

YTD (%) 4.26%

3,358

1D (%) -0.33%

YTD (%) -3.64%

The total value of private corporate bond issuances in July 2023 was VND5,180 billion, while the total value of 7 issuances to the public was VND7,500 billion. Thus, a total of nearly VND12.7trillion of corporate bonds were issued in July. The issuances have an average interest rate of 9.4%/year, the average term is nearly 6 years.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam spends USD5 billion to import petroleum;

- VBMA: Nearly VND12.7 trillion of corporate bonds issued in July, buying back more than VND20.5 trillion;

- Government bond mobilizing interest rate continued to decrease in July;

- Inflation tends to decrease gradually, many forecast at 3%;

- Moody's downgraded the credit ratings of a series of US banks;

- Chinese enterprises race to reduce prices to survive;

- JPMorgan no longer believes the US will be in a recession in 2023.

VN30

BANK

90,700

1D -0.11%

5D -0.55%

Buy Vol. 1,564,237

Sell Vol. 1,772,055

48,650

1D -0.41%

5D 0.93%

Buy Vol. 3,397,904

Sell Vol. 4,444,965

32,600

1D 0.00%

5D 7.24%

Buy Vol. 13,619,443

Sell Vol. 16,923,801

34,000

1D -1.02%

5D 0.00%

Buy Vol. 8,327,566

Sell Vol. 11,140,213

22,200

1D -1.99%

5D 1.14%

Buy Vol. 22,191,252

Sell Vol. 29,788,205

19,200

1D -0.78%

5D 1.86%

Buy Vol. 18,977,535

Sell Vol. 21,708,905

17,350

1D 0.00%

5D -1.14%

Buy Vol. 6,016,399

Sell Vol. 6,708,651

19,000

1D -1.55%

5D 1.06%

Buy Vol. 10,029,690

Sell Vol. 12,878,369

29,800

1D -0.83%

5D 2.94%

Buy Vol. 26,698,296

Sell Vol. 38,213,173

21,200

1D -0.93%

5D 2.66%

Buy Vol. 6,504,961

Sell Vol. 8,879,071

23,400

1D -1.47%

5D 2.41%

Buy Vol. 25,106,581

Sell Vol. 34,443,209

13,250

1D -1.49%

5D 5.58%

Buy Vol. 37,759,045

Sell Vol. 52,508,868

30,300

1D 0.17%

5D 1.17%

Buy Vol. 5,555,979

Sell Vol. 5,529,047

MBB and VPB have recently been assigned a credit limit up to 24% higher than the bank group thanks to their participation in restructuring weak banks.

OIL & GAS

101,200

1D 0.30%

5D 0.50%

Buy Vol. 945,704

Sell Vol. 1,100,582

14,100

1D 2.92%

5D 4.83%

Buy Vol. 55,190,985

Sell Vol. 52,176,320

40,900

1D 0.99%

5D -0.24%

Buy Vol. 4,955,283

Sell Vol. 5,392,936

POW: Q2/2023, financial income increased sharply to VND130 billion, twice the same period last year, mainly thanks to interest on bank deposits.

VINGROUP

67,000

1D 4.85%

5D 13.75%

Buy Vol. 18,990,506

Sell Vol. 17,516,069

62,800

1D -0.16%

5D 0.00%

Buy Vol. 7,101,956

Sell Vol. 8,456,702

31,000

1D 4.73%

5D 6.53%

Buy Vol. 28,935,896

Sell Vol. 29,136,424

VIC: This coming August 25, 2023 will be the last registration date to exercise the right to participate in collecting written opinions of shareholders to approve the ESOP issuance plan.

FOOD & BEVERAGE

74,500

1D -0.53%

5D 1.29%

Buy Vol. 5,712,949

Sell Vol. 7,308,443

89,200

1D 1.13%

5D 2.88%

Buy Vol. 3,202,889

Sell Vol. 3,947,305

161,600

1D 0.37%

5D 2.02%

Buy Vol. 296,806

Sell Vol. 435,568

SAB: As of June 30, total assets reached VND33,647 billion, a decrease of VND818 billion compared to the beginning year. Cash and bank deposits are more than VND22,380 billion.

OTHERS

47,550

1D -0.94%

5D 0.63%

Buy Vol. 1,589,059

Sell Vol. 2,490,854

47,550

1D -0.94%

5D 0.63%

Buy Vol. 1,589,059

Sell Vol. 2,490,854

103,000

1D 1.08%

5D 1.78%

Buy Vol. 1,277,763

Sell Vol. 1,208,770

84,200

1D -0.36%

5D -0.36%

Buy Vol. 1,213,033

Sell Vol. 1,368,787

53,600

1D -0.37%

5D 3.68%

Buy Vol. 8,358,479

Sell Vol. 10,694,122

22,600

1D -0.44%

5D 2.73%

Buy Vol. 4,464,011

Sell Vol. 5,397,851

29,100

1D -2.02%

5D 1.04%

Buy Vol. 19,160,652

Sell Vol. 25,824,669

27,200

1D -1.27%

5D -1.09%

Buy Vol. 42,795,722

Sell Vol. 60,024,546

MWG: As soon as Apple Pay was available in Vietnam, MWG announced it was one of the first units in Vietnam to support this form of payment. Specifically, from August 8, users can use Apple Pay to pay at 2,040 Dien May Xanh, Mobile World and TopZone stores nationwide.

Market by numbers

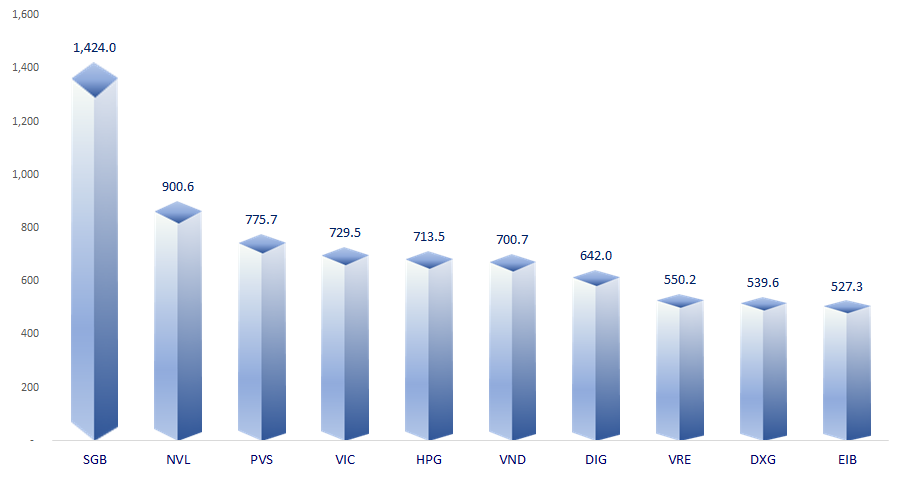

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

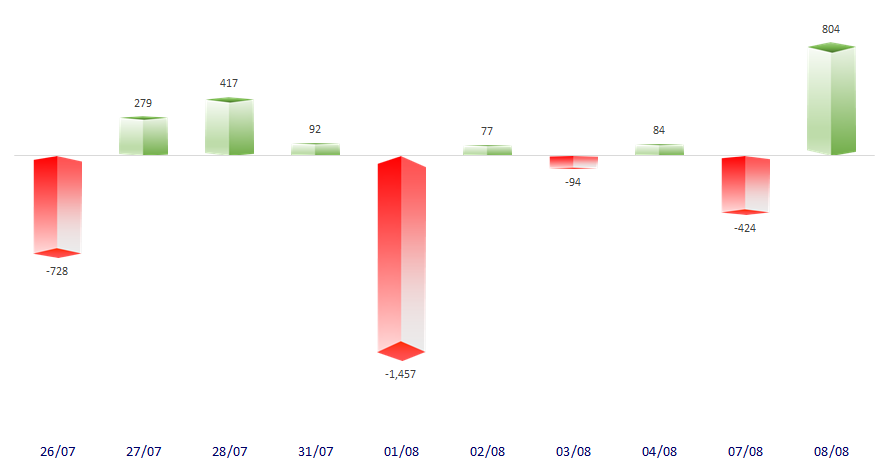

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

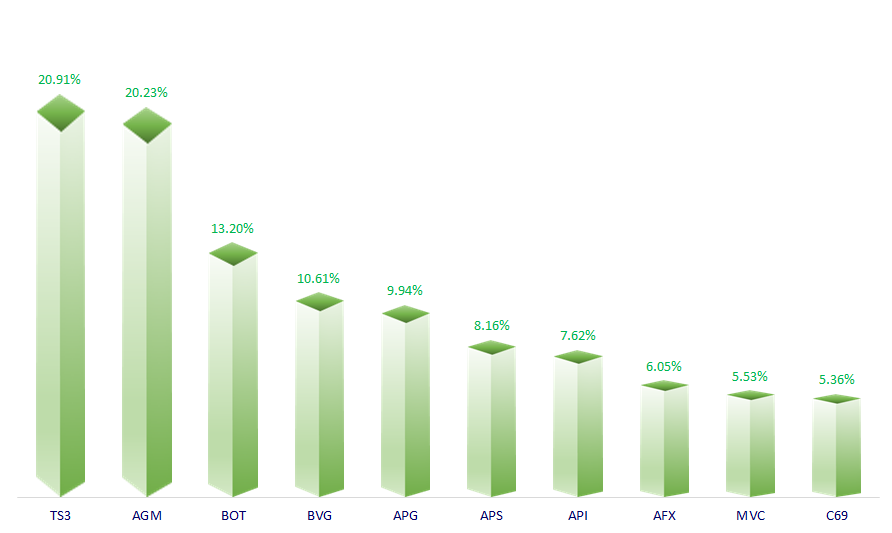

TOP INCREASES 3 CONSECUTIVE SESSIONS

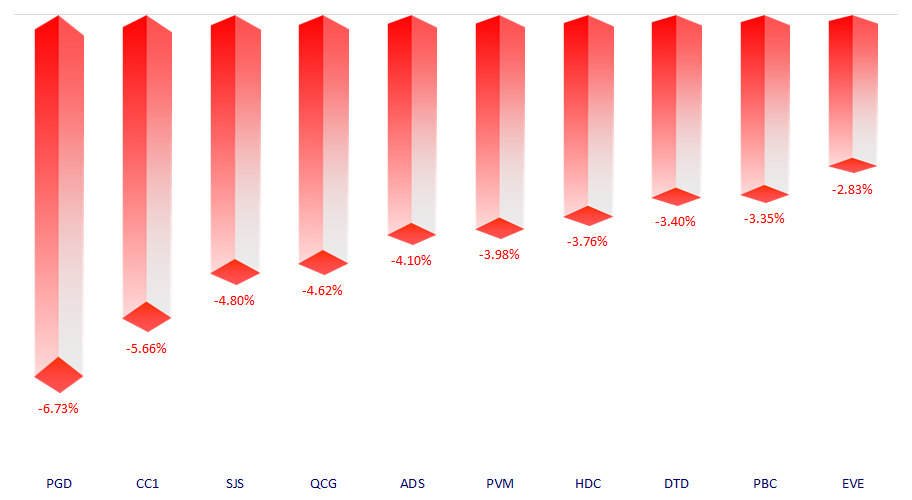

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.