Market brief 10/08/2023

VIETNAM STOCK MARKET

1,220.61

1D -1.08%

YTD 21.20%

1,226.20

1D -1.10%

YTD 21.99%

243.91

1D -0.80%

YTD 18.80%

93.10

1D -0.75%

YTD 29.94%

-61.00

1D 0.00%

YTD 0.00%

23,737.87

1D -4.16%

YTD 175.51%

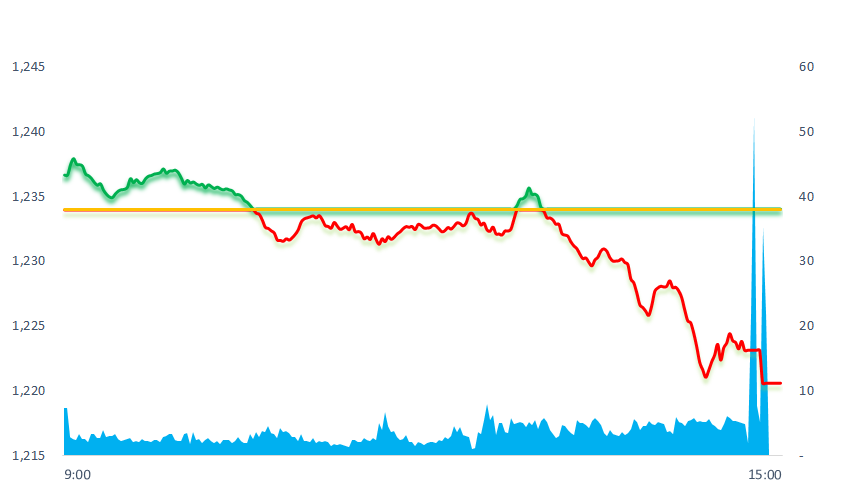

Today, the stock market opened with a slight increase at the beginning of the session, then turned down and traded around the reference level. Around 14:00, the selling force continuously poured into the market, causing VNIndex to drop deeply and close at the lowest level of the session.

ETF & DERIVATIVES

21,100

1D -0.80%

YTD 21.75%

14,480

1D -1.23%

YTD 21.48%

15,100

1D -0.66%

YTD 20.99%

18,890

1D -2.18%

YTD 34.45%

19,100

1D -0.05%

YTD 33.10%

25,920

1D -1.18%

YTD 15.71%

16,000

1D -0.81%

YTD 23.55%

1,226

1D -1.13%

YTD 0.00%

1,228

1D -0.94%

YTD 0.00%

1,227

1D -0.98%

YTD 0.00%

1,223

1D -1.08%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

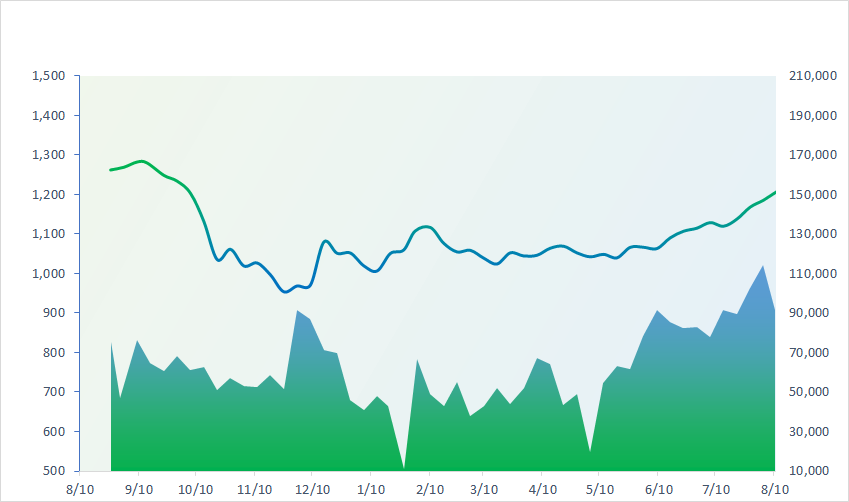

VNINDEX (12M)

GLOBAL MARKET

0

1D 32473.65

YTD 0.008362851

0

1D 3254.56

YTD 0.003103724

0

1D 11050.22

YTD 0.000975592

0

1D 19248.26

YTD 0.000115868

0

1D 2601.56

YTD -0.00136654

0

1D 65590.57

YTD -0.00614039

0

1D 3322.93

YTD 0.002758171

0

1D 1525.11

YTD -0.002087287

0

1D 87.55

YTD 0.016250725

0

1D 1920.12

YTD 0.001523054

Most Asian stock markets rallied on Thursday. US President Joe Biden on Wednesday signed an executive order that will block some new investments in China's technology industries such as semiconductors, but the Chinese market still recorded a slight increase.

VIETNAM ECONOMY

0.25%

1D (bps) 2

YTD (bps) -472

6.30%

YTD (bps) -110

1.78%

1D (bps) 3

YTD (bps) -301

2.44%

1D (bps) 1

YTD (bps) -246

23,917

1D (%) 0.04%

YTD (%) 0.66%

26,901

1D (%) 0.50%

YTD (%) 4.84%

3,364

1D (%) 0.06%

YTD (%) -3.47%

Total state budget revenue in 7 months of 2023 is estimated at VND1,016.1 trillion, equal to 62.7% of the year estimate, in the context of this year's economy facing many difficulties.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government requested the State Bank to direct and operate drastically to continue reducing the interest rate;

- The Ministry of Industry and Trade announces the national planning for the energy and mineral sectors;

- Government bond mobilizing interest rate continued to decrease in July;

- 7 months budget revenue of more than VND1 million billion;

- Asian rice prices to the highest level in 15 years;

- The yuan has depreciated more than 4% year-to-date;

- Russia increases agricultural trade with China.

VN30

BANK

88,500

1D -1.88%

5D -2.32%

Buy Vol. 2,228,448

Sell Vol. 2,063,561

46,500

1D -3.53%

5D -4.22%

Buy Vol. 3,957,044

Sell Vol. 4,724,998

31,650

1D -2.62%

5D 2.43%

Buy Vol. 11,932,237

Sell Vol. 15,767,261

33,500

1D -1.47%

5D 0.00%

Buy Vol. 9,226,046

Sell Vol. 11,150,164

21,950

1D -0.45%

5D 1.15%

Buy Vol. 28,656,069

Sell Vol. 29,402,868

18,900

1D -1.31%

5D 0.27%

Buy Vol. 16,958,921

Sell Vol. 18,414,521

17,200

1D -0.58%

5D 0.00%

Buy Vol. 3,843,253

Sell Vol. 5,664,877

18,500

1D -1.86%

5D 0.27%

Buy Vol. 9,020,606

Sell Vol. 12,029,651

30,550

1D -2.08%

5D 6.82%

Buy Vol. 20,254,531

Sell Vol. 29,663,186

20,650

1D -1.43%

5D 0.00%

Buy Vol. 7,179,623

Sell Vol. 8,959,659

22,900

1D -1.29%

5D -2.35%

Buy Vol. 19,576,696

Sell Vol. 22,235,527

12,950

1D -1.52%

5D 2.37%

Buy Vol. 31,324,043

Sell Vol. 45,274,421

30,000

1D 0.00%

5D -0.83%

Buy Vol. 1,370,328

Sell Vol. 2,476,662

Currently, in the group of large private banks, the highest interest rates mainly fluctuate in the range of 6.4 - 6.9%/year such as, SHB (6.9%), Sacombank (6.8%), MB (6.8%), VPBank (6.8%), ACB (6.6%), Techcombank (6.4%). State-owned commercial banks including Agribank, BIDV, Vietcombank and Vietinbank have the highest interest rate at 6.3%/year. This interest rate is applicable for terms of 12 months or more.

OIL & GAS

102,000

1D 0.99%

5D 2.41%

Buy Vol. 1,628,564

Sell Vol. 1,959,010

13,800

1D -0.72%

5D 2.22%

Buy Vol. 23,636,010

Sell Vol. 31,486,443

40,800

1D 0.25%

5D 1.75%

Buy Vol. 3,687,735

Sell Vol. 5,037,327

Oil prices soared to a 10-month high as US fuel inventories plummeted and production cuts by Saudi Arabia and Russia offset concerns about slowing demand from China.

VINGROUP

67,900

1D 3.19%

5D 16.67%

Buy Vol. 14,489,323

Sell Vol. 14,174,226

60,600

1D 0.00%

5D 0.83%

Buy Vol. 6,591,821

Sell Vol. 7,889,300

30,050

1D -2.75%

5D 5.81%

Buy Vol. 12,706,623

Sell Vol. 12,814,763

VHM: Khanh Hoa is preparing to welcome the Vinhomes Happy Home project with a scale of more than 20,000 people. The project has an investment of more than 3,700 billion VND.

FOOD & BEVERAGE

73,100

1D 0.00%

5D 0.69%

Buy Vol. 4,695,470

Sell Vol. 5,849,729

83,000

1D -5.68%

5D -3.60%

Buy Vol. 6,631,426

Sell Vol. 6,651,827

160,600

1D -0.25%

5D -0.56%

Buy Vol. 328,209

Sell Vol. 458,617

MSN: Phuc Long gross profit margin increased from 35% to over 60%, the best in all segments in MSN. In 2023, Phuc Long's goal is to bring in a net revenue VND2,500b and VND3,000b.

OTHERS

47,000

1D -0.84%

5D -0.63%

Buy Vol. 1,277,934

Sell Vol. 1,504,109

47,000

1D -0.84%

5D -0.63%

Buy Vol. 1,277,934

Sell Vol. 1,504,109

100,700

1D -0.89%

5D -0.30%

Buy Vol. 1,114,738

Sell Vol. 1,297,151

82,200

1D -1.08%

5D -1.79%

Buy Vol. 1,980,141

Sell Vol. 2,166,854

52,000

1D -1.14%

5D -1.33%

Buy Vol. 7,084,837

Sell Vol. 9,313,280

21,450

1D -3.16%

5D -1.61%

Buy Vol. 4,789,953

Sell Vol. 5,755,848

28,100

1D -1.75%

5D -1.40%

Buy Vol. 39,144,222

Sell Vol. 59,872,457

27,350

1D -1.62%

5D 1.86%

Buy Vol. 28,674,251

Sell Vol. 40,802,318

HPG: HPG's production output may decrease in the period from September to November 2023, because HPG plans to suspend blast furnace No. 3 at Hai Duong complex for maintenance from September. Capacity of blast furnace This is at 1.2 million tons/year, accounting for 14% of the total capacity of this steel company.

Market by numbers

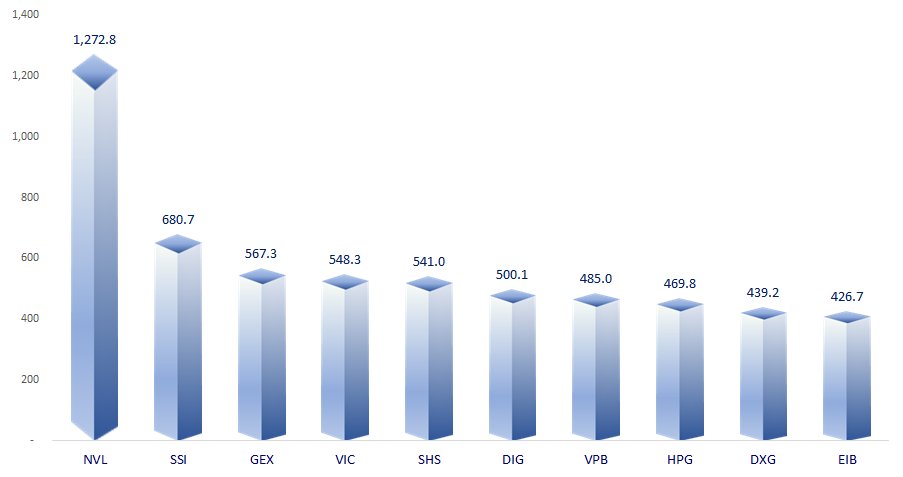

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

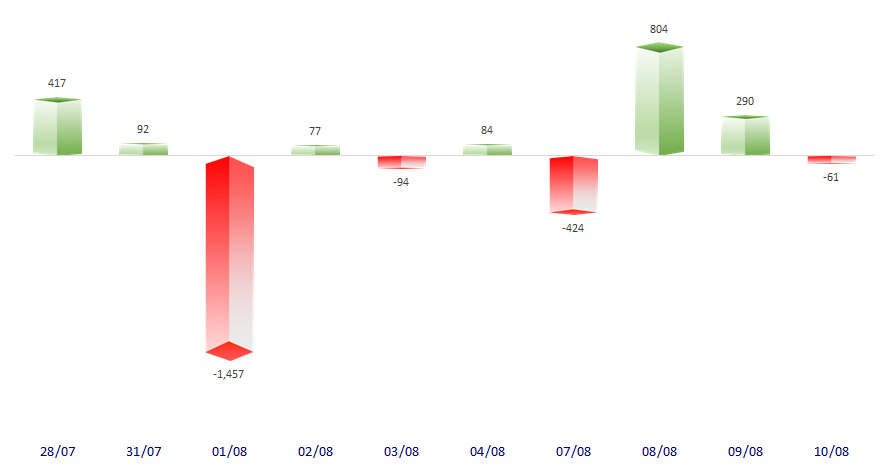

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

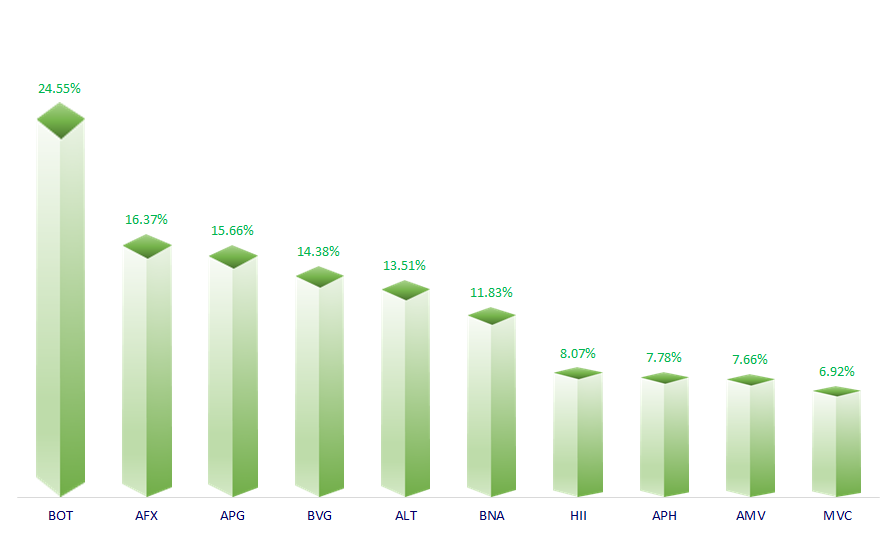

TOP INCREASES 3 CONSECUTIVE SESSIONS

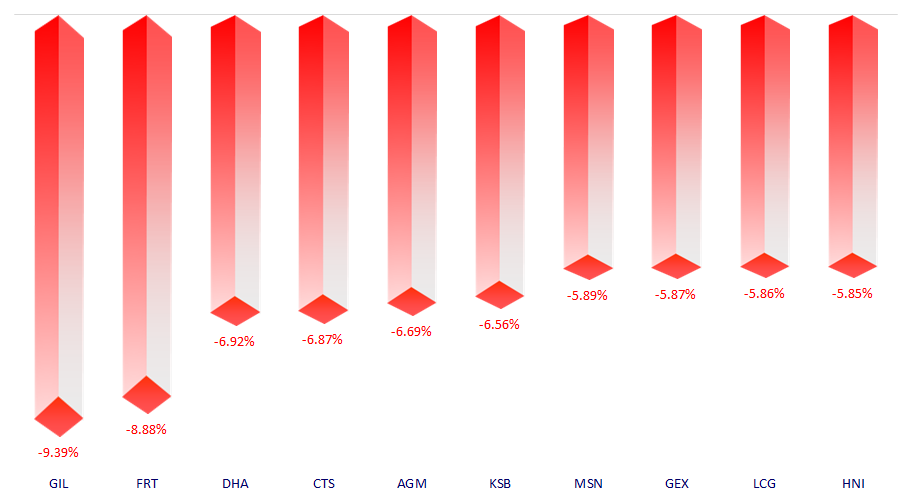

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.