Market brief 11/08/2023

VIETNAM STOCK MARKET

1,232.21

1D 0.95%

YTD 22.35%

1,240.77

1D 1.19%

YTD 23.44%

245.25

1D 0.55%

YTD 19.45%

93.28

1D 0.19%

YTD 30.19%

-67.79

1D 0.00%

YTD 0.00%

24,458.53

1D 3.04%

YTD 183.88%

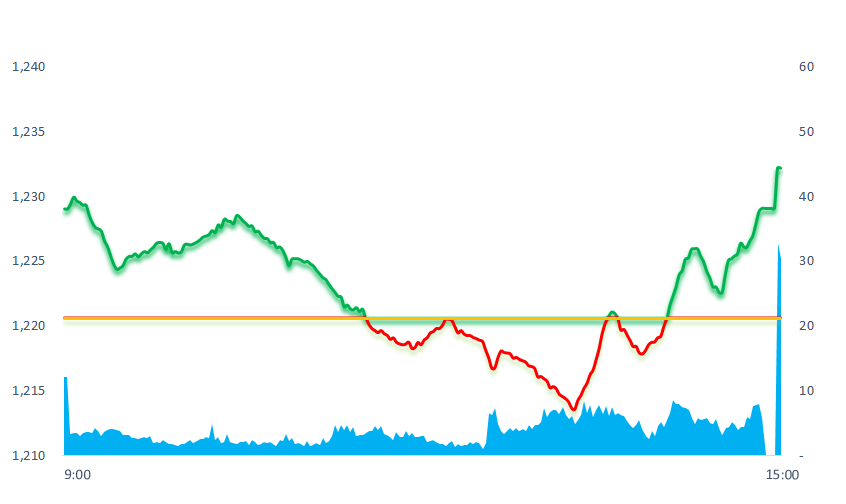

Today, the stock market opened similar to yesterday's scenario when it increased slightly at the beginning of the session, then turned down and traded around the reference level. However, after 14:00, the rebound of large-cap stocks helped VNINdex regain its score.

ETF & DERIVATIVES

21,210

1D 0.52%

YTD 22.39%

14,670

1D 1.31%

YTD 23.07%

15,190

1D 0.60%

YTD 21.71%

19,000

1D 0.58%

YTD 35.23%

18,970

1D -0.68%

YTD 32.20%

26,000

1D 0.31%

YTD 16.07%

16,050

1D 0.31%

YTD 23.94%

1,240

1D 1.10%

YTD 0.00%

1,240

1D 0.98%

YTD 0.00%

1,237

1D 0.78%

YTD 0.00%

1,236

1D 1.09%

YTD 0.00%

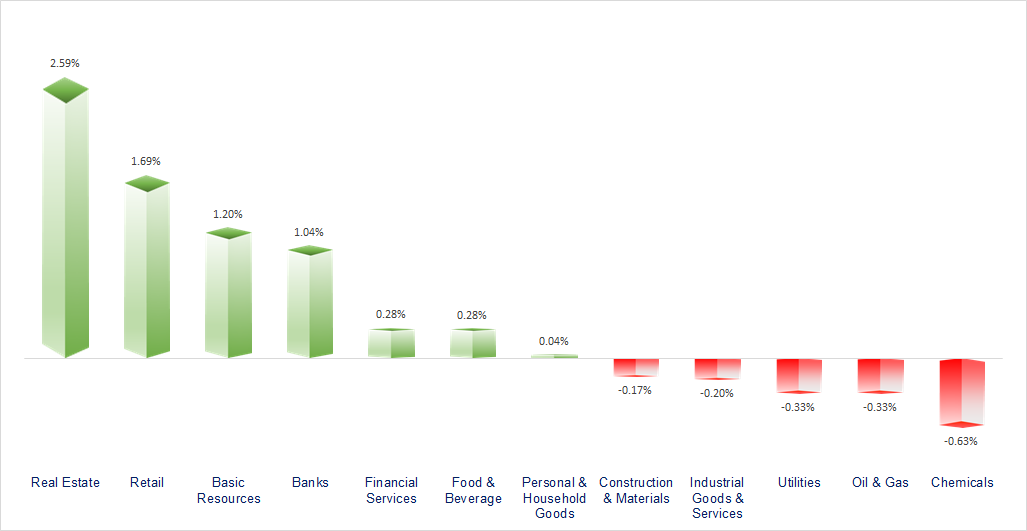

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

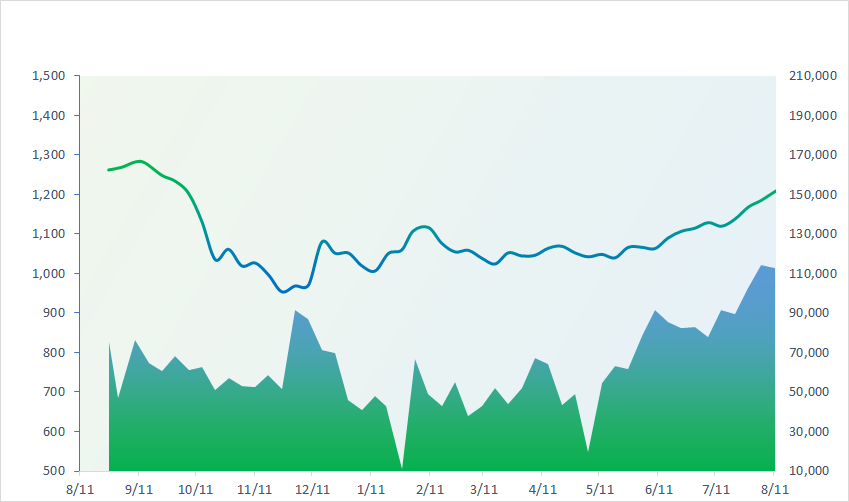

VNINDEX (12M)

GLOBAL MARKET

0

1D 32473.65

YTD 0.008362851

0

1D 3189.25

YTD -0.020067229

0

1D 10808.87

YTD -0.021841194

0

1D 19075.19

YTD -0.008991462

0

1D 2591.26

YTD -0.003959163

0

1D 65322.65

YTD -0.004084734

0

1D 3294.28

YTD -0.008621909

0

1D 1535.16

YTD 0.006589689

0

1D 85.92

YTD -0.007966747

0

1D 1918.2

YTD 0.001644866

Most Asian stocks fell on Friday, with Chinese shares leading the way (down more than 2%) on lingering concerns about the real estate market.

VIETNAM ECONOMY

0.21%

1D (bps) -4

YTD (bps) -476

6.30%

YTD (bps) -110

1.78%

YTD (bps) -301

2.44%

YTD (bps) -246

23,931

1D (%) 0.06%

YTD (%) 0.72%

26,812

1D (%) -0.06%

YTD (%) 4.49%

3,353

1D (%) -0.21%

YTD (%) -3.79%

Data from the Hanoi Stock Exchange (HNX) shows that in July, there were 23 separate bond issuances by 13 companies. Total mobilized value reached VND21,380 billion, increased sharply compared to VND8,170 billion in June, equivalent to 2.6 times.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- WB forecasts Vietnam's economic growth in 2023 at 4.7%;

- The Prime Minister requested to study the formation of the Social Housing Development Fund;

- EVFTA: Taking advantage of bringing Vietnamese goods into high-end markets;

- US inflation at 3.2% in July, lower than forecast;

- India may soon lift the ban on rice exports;

- Japan: Crime of fraud via e-banking has increased to a record.

VN30

BANK

90,400

1D 2.15%

5D 0.33%

Buy Vol. 1,624,411

Sell Vol. 1,913,486

46,700

1D 0.43%

5D -3.51%

Buy Vol. 3,741,690

Sell Vol. 3,994,857

32,100

1D 1.42%

5D 3.55%

Buy Vol. 13,880,238

Sell Vol. 11,334,095

33,650

1D 0.45%

5D 0.15%

Buy Vol. 10,191,188

Sell Vol. 9,850,936

22,000

1D 0.23%

5D -0.90%

Buy Vol. 22,293,102

Sell Vol. 20,629,281

18,900

1D 0.00%

5D -0.53%

Buy Vol. 19,140,452

Sell Vol. 17,699,694

17,050

1D -0.87%

5D -0.58%

Buy Vol. 4,795,760

Sell Vol. 6,450,798

18,650

1D 0.81%

5D -1.58%

Buy Vol. 10,839,579

Sell Vol. 10,398,933

31,850

1D 4.26%

5D 10.02%

Buy Vol. 63,609,768

Sell Vol. 56,745,767

20,550

1D -0.48%

5D -2.14%

Buy Vol. 7,529,700

Sell Vol. 9,196,078

22,900

1D 0.00%

5D -6.15%

Buy Vol. 17,610,265

Sell Vol. 16,564,764

12,950

1D 0.00%

5D -2.63%

Buy Vol. 35,000,826

Sell Vol. 42,767,860

30,400

1D 1.33%

5D 4.83%

Buy Vol. 3,802,859

Sell Vol. 3,422,490

SHB: By the end of the second quarter of 2023, the scale indicators of SHB achieved good growth. Cumulative pre-tax profit in the first 6 months of the year reached VND6,073 billion, up 5.13% over the same period in 2022. Total assets of SHB reached VND585 trillion, up 6.21% compared to the beginning of the year, equity reached VND66 trillion. Deposits from market I of SHB achieved good growth with an increase of 13.7% compared to the beginning of the year, reaching VND462 trillion, credit balance reached VND418 trillion.

OIL & GAS

101,500

1D -0.49%

5D 1.20%

Buy Vol. 657,983

Sell Vol. 717,047

13,650

1D -1.09%

5D 0.37%

Buy Vol. 23,829,378

Sell Vol. 22,045,471

40,650

1D -0.37%

5D 0.87%

Buy Vol. 2,354,538

Sell Vol. 2,882,539

POW: Revenue is estimated at VND2,312 billion in July, up MoM and slightly exceeding 1% of the monthly plan. 7 months, total revenue is estimated at over VND18.6 trillion dong.

VINGROUP

72,600

1D 6.92%

5D 16.72%

Buy Vol. 33,399,080

Sell Vol. 24,955,458

60,900

1D 0.50%

5D -3.33%

Buy Vol. 6,697,971

Sell Vol. 8,074,660

30,750

1D 2.33%

5D 7.14%

Buy Vol. 18,534,229

Sell Vol. 16,279,914

VHM: Khanh Hoa is preparing to welcome the Vinhomes Happy Home project with a scale of more than 20,000 people. The project has an investment of more than 3,700 billion VND.

FOOD & BEVERAGE

73,500

1D 0.55%

5D 0.68%

Buy Vol. 3,803,867

Sell Vol. 4,502,305

84,500

1D 1.81%

5D -2.09%

Buy Vol. 4,154,533

Sell Vol. 3,329,239

159,500

1D -0.68%

5D -0.62%

Buy Vol. 312,229

Sell Vol. 379,441

VIC: The merger plan of VinFast and Black Spade has been approved, expected to be listed on the US stock exchange on August 15.

OTHERS

46,700

1D -0.64%

5D -0.85%

Buy Vol. 2,036,057

Sell Vol. 2,234,255

46,700

1D -0.64%

5D -0.85%

Buy Vol. 2,036,057

Sell Vol. 2,234,255

101,100

1D 0.40%

5D 0.10%

Buy Vol. 1,136,717

Sell Vol. 1,245,996

82,000

1D -0.24%

5D -1.56%

Buy Vol. 1,985,520

Sell Vol. 2,038,587

53,300

1D 2.50%

5D 0.57%

Buy Vol. 11,058,240

Sell Vol. 11,897,306

21,100

1D -1.63%

5D -3.65%

Buy Vol. 7,109,828

Sell Vol. 7,254,036

28,150

1D 0.18%

5D -3.60%

Buy Vol. 43,707,866

Sell Vol. 53,832,667

27,700

1D 1.28%

5D 1.28%

Buy Vol. 40,669,214

Sell Vol. 48,688,906

BVH: Accumulated in the first 6 months of 2023, BVH has a gross loss of VND870 billion in insurance business; while financial investment profit increased by 33% to VND5,193 billion. Therefore, BVH's net profit still increased 16% to nearly VND934 billion.

Market by numbers

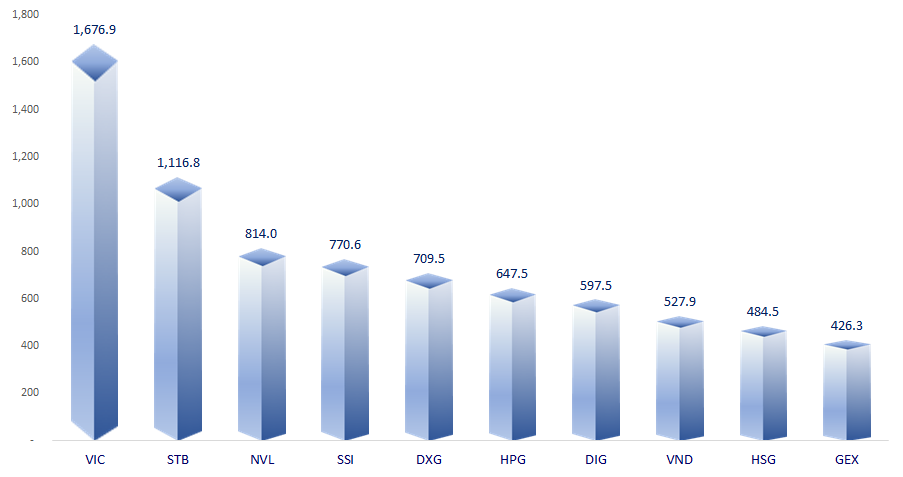

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

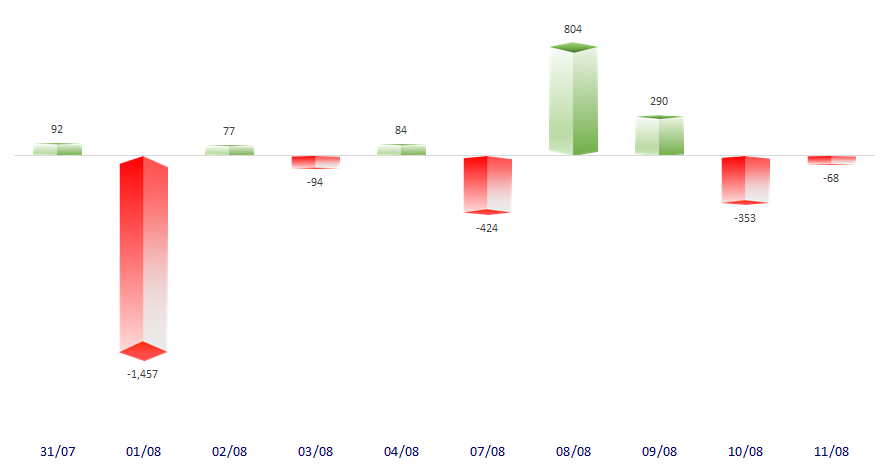

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

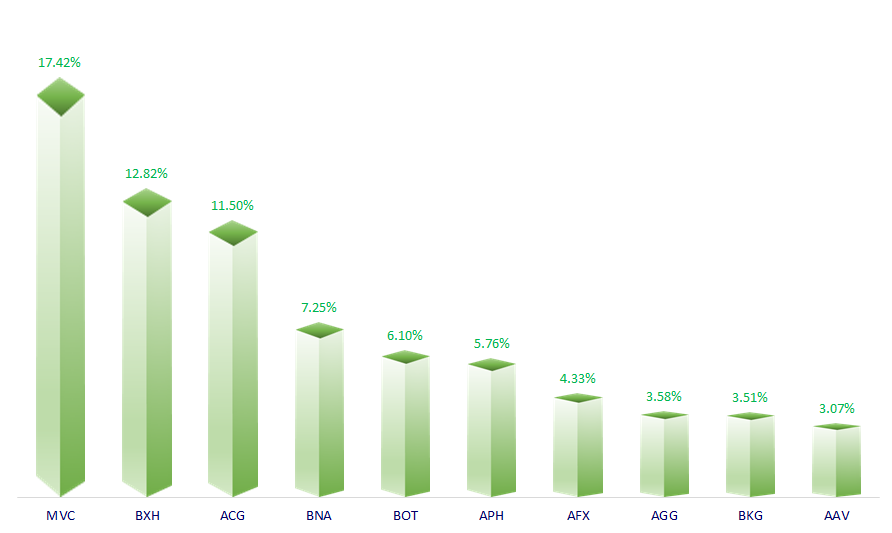

TOP INCREASES 3 CONSECUTIVE SESSIONS

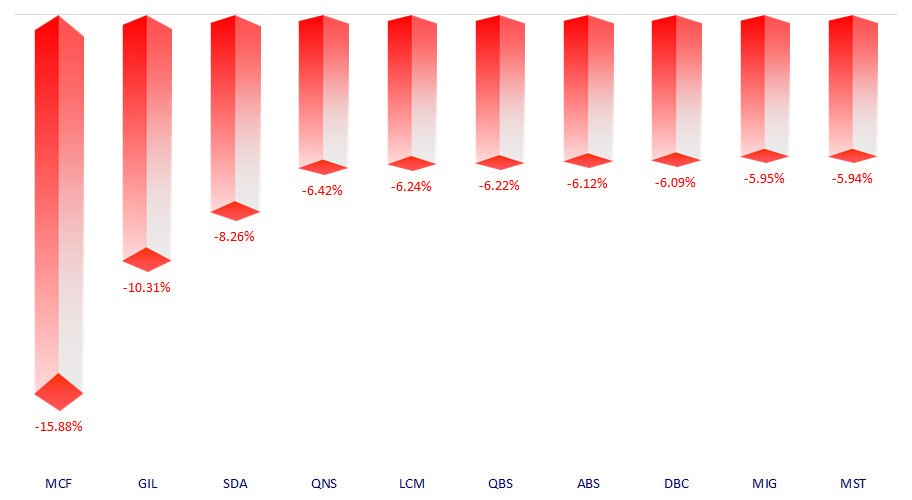

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.