Market brief 24/08/2023

VIETNAM STOCK MARKET

1,189.39

1D 1.44%

YTD 18.10%

1,201.88

1D 1.60%

YTD 19.57%

243.23

1D 2.17%

YTD 18.47%

90.85

1D 1.63%

YTD 26.80%

196.86

1D 0.00%

YTD 0.00%

21,353.92

1D 11.50%

YTD 147.84%

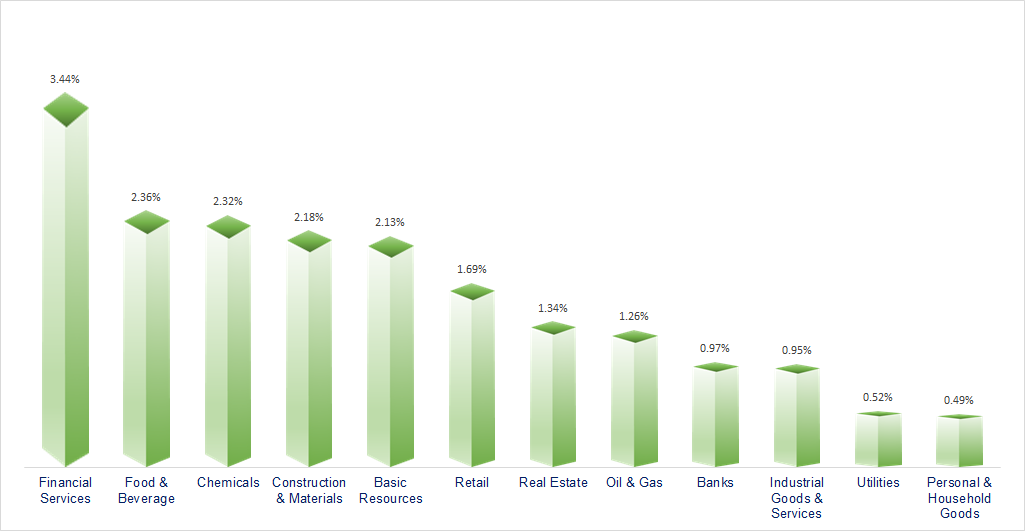

The stock market rallied at the beginning of the session, but only in the afternoon session, when buying power gradually overwhelmed, VNIndex really break through. All industry groups gained in today's session. In which, Financial Services was the group that broke out the most with the industry index increasing by over 3.4%.

ETF & DERIVATIVES

20,640

1D 0.98%

YTD 19.10%

14,220

1D 1.64%

YTD 19.30%

14,860

1D 2.48%

YTD 19.07%

18,500

1D -2.12%

YTD 31.67%

18,790

1D 0.75%

YTD 30.94%

25,700

1D 1.58%

YTD 14.73%

15,700

1D 0.83%

YTD 21.24%

1,198

1D 1.47%

YTD 0.00%

1,199

1D 1.58%

YTD 0.00%

1,197

1D 1.60%

YTD 0.00%

1,191

1D 1.59%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

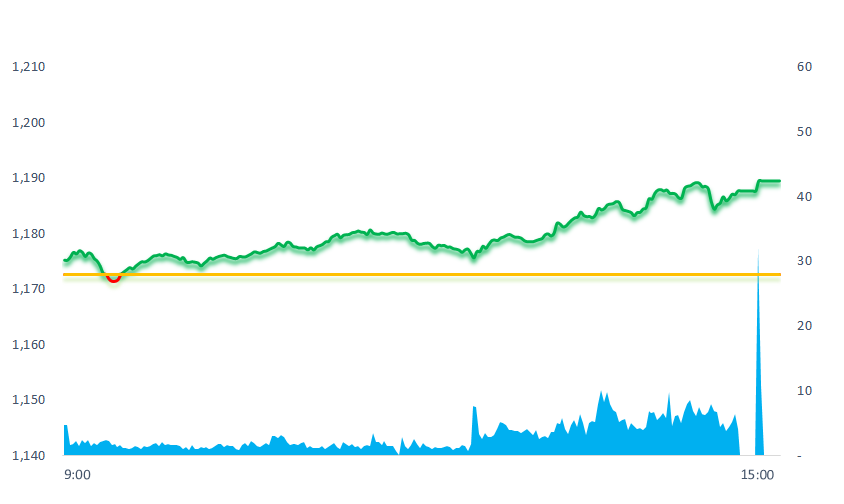

INTRADAY VNINDEX

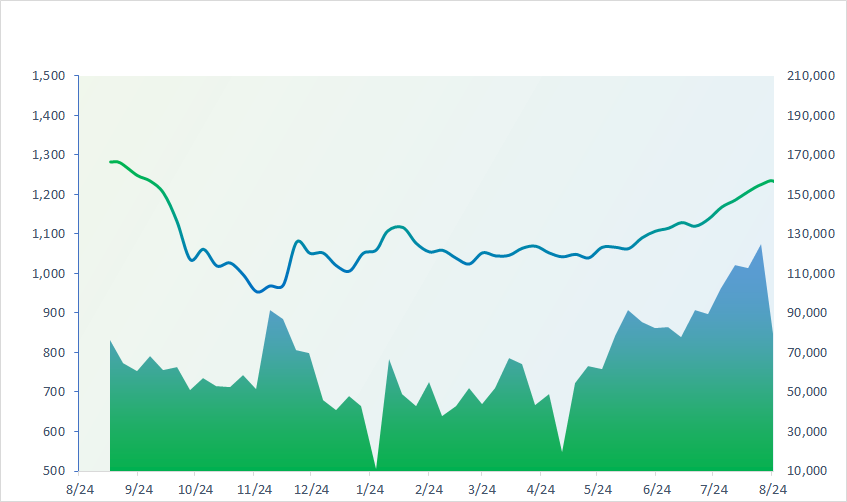

VNINDEX (12M)

GLOBAL MARKET

0

1D 32287.21

YTD 0.008651913

0

1D 3082.24

YTD 0.001247401

0

1D 10256.19

YTD 0.010203298

0

1D 18212.17

YTD 0.020522898

0

1D 2537.68

YTD 0.012843744

0

1D 65378.92

YTD -0.000831075

0

1D 3184.55

YTD 0.003266985

0

1D 1560.47

YTD 0.007398274

0

1D 83.36

YTD 0.006034275

0

1D 1920.63

YTD 0.001480871

Tech-focused Asian exchanges were the best performers among Asian stock markets on Thursday, with the Hang Seng index up more than 2.05%. Korea's KOSPI also increased by 1.28%. Big Asian tech stocks, mainly suppliers to Nvidia, have rallied like South Korea's TSMC and SK Hynix Inc.

VIETNAM ECONOMY

0.20%

YTD (bps) -477

5.80%

YTD (bps) -160

1.78%

YTD (bps) -301

2.57%

1D (bps) 1

YTD (bps) -233

24,160

1D (%) -0.19%

YTD (%) 1.68%

26,788

1D (%) 1.57%

YTD (%) 4.40%

3,366

1D (%) 0.18%

YTD (%) -3.41%

The Prime Minister requested the State Bank to urgently review and amend Circular No. 06/2023/TT-NHNN in the direction of suspending the implementation of regulations that cause difficulties and create favorable conditions for businesses and people to continue to access to credit.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank of Vietnam has suspended the implementation of a number of regulations on lending under Circular 06;

- The Ministry of Transport proposed nearly VND1,400 billion to invest in National Highway 15D;

- Proposing to reduce the social insurance premium;

- Bloomberg: China's USD9 trillion debt is getting more and more ominous;

- China stopped importing seafood from Japan;

- Sugar volume declines, India is expected to ban sugar exports from October.

VN30

BANK

87,000

1D 0.81%

5D -2.68%

Buy Vol. 1,752,252

Sell Vol. 1,616,006

45,800

1D 0.22%

5D -2.76%

Buy Vol. 2,304,040

Sell Vol. 2,471,596

31,750

1D 1.44%

5D -2.61%

Buy Vol. 8,746,752

Sell Vol. 8,008,706

33,800

1D 1.81%

5D -2.59%

Buy Vol. 10,145,510

Sell Vol. 10,465,821

20,500

1D 1.23%

5D -7.45%

Buy Vol. 23,742,043

Sell Vol. 20,787,492

18,250

1D 1.39%

5D -3.18%

Buy Vol. 22,556,650

Sell Vol. 12,850,593

16,200

1D 0.62%

5D -5.54%

Buy Vol. 5,009,171

Sell Vol. 3,761,538

18,800

1D 1.62%

5D -0.27%

Buy Vol. 16,701,777

Sell Vol. 16,073,677

31,550

1D 2.10%

5D -2.47%

Buy Vol. 24,772,945

Sell Vol. 29,322,036

19,750

1D 0.00%

5D -4.59%

Buy Vol. 6,465,714

Sell Vol. 5,986,040

22,050

1D 0.92%

5D -2.86%

Buy Vol. 9,896,540

Sell Vol. 10,236,434

12,100

1D 0.83%

5D -5.84%

Buy Vol. 33,181,376

Sell Vol. 30,524,117

28,450

1D 0.89%

5D -3.23%

Buy Vol. 2,374,595

Sell Vol. 1,961,797

TCB: By the end of the second quarter, Techcombank was the bank with a ROA ratio of 2.65%, although a sharp decrease compared to 3.22% achieved in 2022. Techcombank continuously maintained the highest ROA ratio in the system thanks to the strategy of focusing on increasing the source of cheap demand deposits, leading to the highest CASA rate in the system for many years.

OIL & GAS

102,400

1D 0.49%

5D 2.40%

Buy Vol. 979,791

Sell Vol. 1,045,212

12,600

1D 2.02%

5D -10.00%

Buy Vol. 20,790,025

Sell Vol. 14,027,147

37,800

1D 1.07%

5D -4.91%

Buy Vol. 1,413,061

Sell Vol. 1,271,245

PLX: At the end of Q2/2023, PLX held VND16.2 trillion in cash and VND11 trillion of investment held to maturity, up 45% compared to the beginning of the year.

VINGROUP

64,200

1D -1.23%

5D -10.71%

Buy Vol. 27,454,335

Sell Vol. 27,281,353

55,400

1D 1.65%

5D -9.18%

Buy Vol. 7,083,065

Sell Vol. 6,645,609

29,050

1D 1.04%

5D -5.07%

Buy Vol. 5,694,459

Sell Vol. 6,557,778

Q2/2023, inventory of VIC and VHM decreased by 4% compared to the beginning of the year, to nearly VND361 trillion, ~ 82% of the total inventory of the 92 listed real estate companies.

FOOD & BEVERAGE

74,700

1D 1.63%

5D 1.49%

Buy Vol. 6,931,733

Sell Vol. 7,254,131

80,000

1D 3.23%

5D -2.56%

Buy Vol. 3,278,334

Sell Vol. 3,059,375

153,500

1D 2.27%

5D -1.41%

Buy Vol. 1,000,945

Sell Vol. 895,906

SAB: SAB announced to close the right to issue bonus shares with the ratio 1:1. After completing the issuance, the charter capital of SAB will double to approximately VND12,826 billion.

OTHERS

45,400

1D -0.22%

5D -2.37%

Buy Vol. 994,072

Sell Vol. 1,064,268

45,400

1D -0.22%

5D -2.37%

Buy Vol. 994,072

Sell Vol. 1,064,268

97,500

1D 1.04%

5D -2.50%

Buy Vol. 1,144,938

Sell Vol. 1,132,013

90,000

1D 5.27%

5D 5.88%

Buy Vol. 8,810,516

Sell Vol. 7,980,610

50,300

1D 1.21%

5D -6.68%

Buy Vol. 10,827,744

Sell Vol. 10,077,872

19,800

1D 3.13%

5D -7.04%

Buy Vol. 4,071,329

Sell Vol. 3,254,718

32,000

1D 5.26%

5D 6.84%

Buy Vol. 87,113,935

Sell Vol. 70,271,119

26,300

1D 2.53%

5D -6.41%

Buy Vol. 41,549,058

Sell Vol. 30,159,734

FPT: Today, FPT increased by 5.3% to VND90,000 (leading the VN30 group). This is also the historical peak of this stock since listing. Today is the ex-dividend date of this stock's cash dividend at the rate of 10%.

Market by numbers

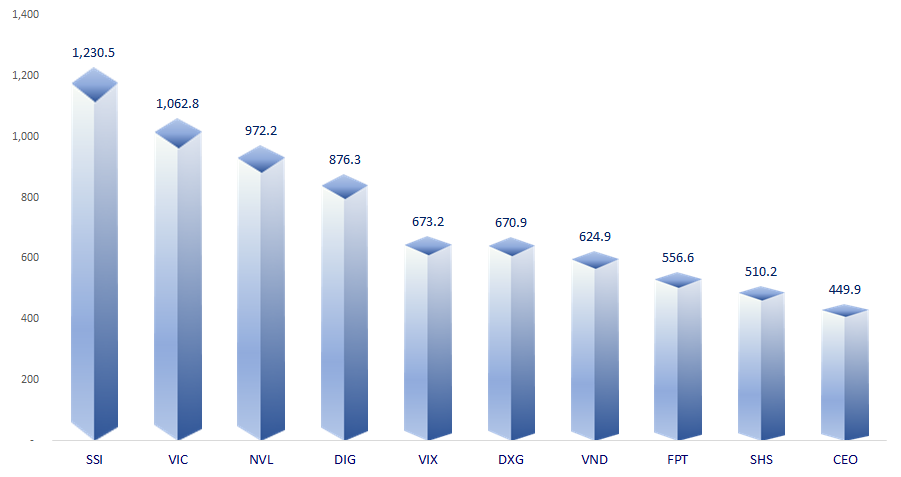

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

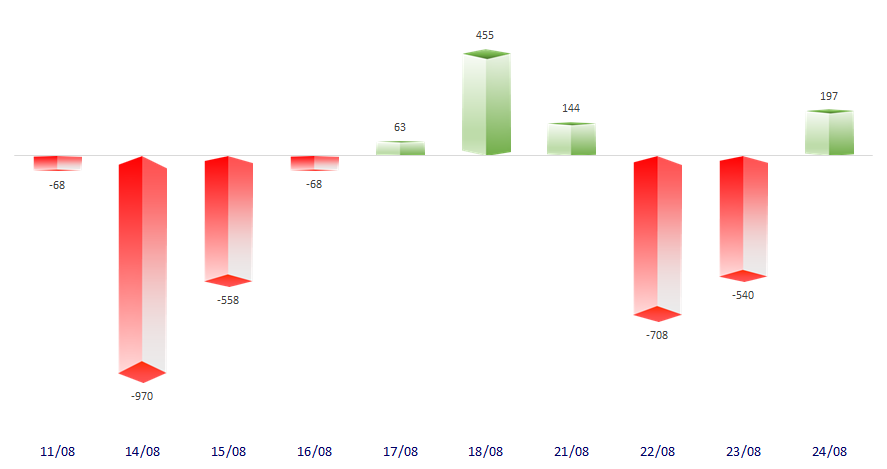

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

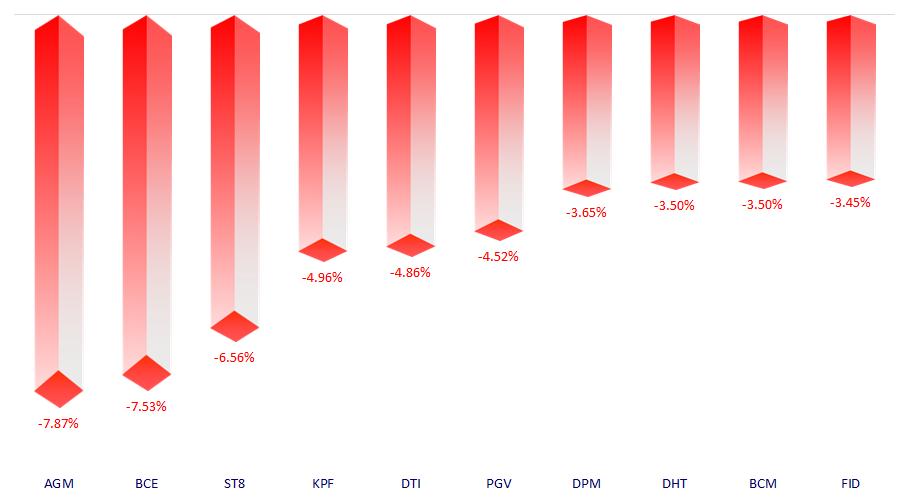

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.