Market Brief 01/11/2023

VIETNAM STOCK MARKET

1,039.66

1D 1.12%

YTD 3.23%

1,051.65

1D 1.18%

YTD 4.62%

209.65

1D 1.69%

YTD 2.11%

81.70

1D 0.95%

YTD 14.03%

116.49

1D 0.00%

YTD 0.00%

15,107.12

1D -12.81%

YTD 75.34%

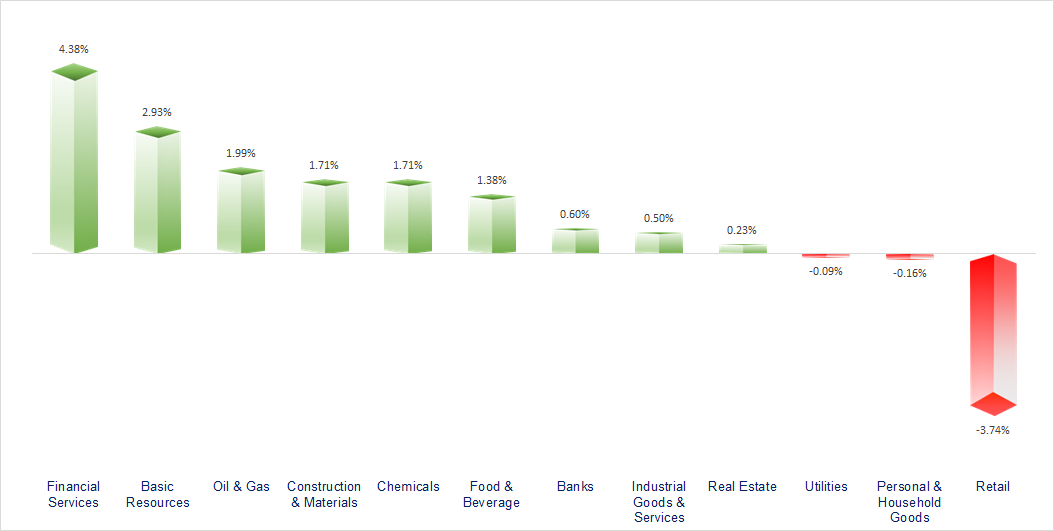

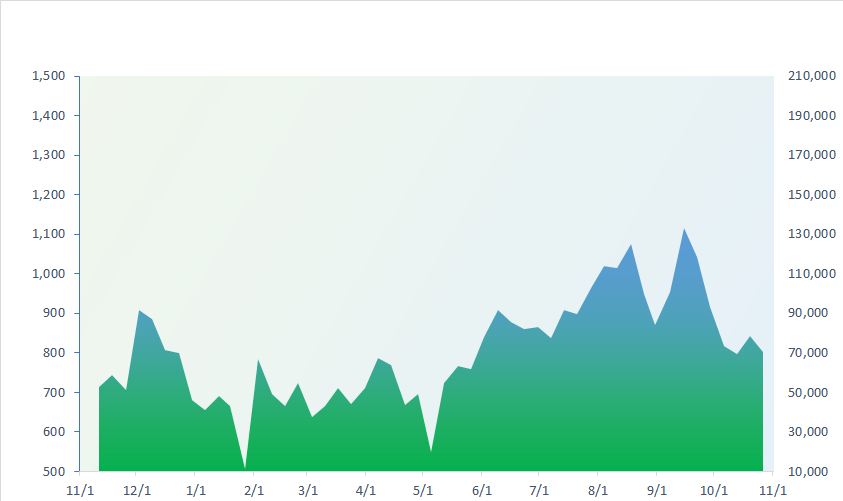

The market opened quite gloomily after information that PMI decreased for the second consecutive month at below 50 points, showing that manufacturing activities are still quite weak. After 2:00 p.m., VNIndex increased strongly when large cash flows entered the market. Financial services and basic resources are the two sectors with the strongest gains today.

ETF & DERIVATIVES

18,300

1D 0.00%

YTD 5.60%

12,450

1D 1.22%

YTD 4.45%

12,960

1D -4.50%

YTD 3.85%

15,800

1D 0.64%

YTD 12.46%

16,920

1D -1.91%

YTD 17.91%

23,170

1D -1.82%

YTD 3.44%

14,010

1D 0.21%

YTD 8.19%

1,048

1D 0.75%

YTD 0.00%

1,041

1D 0.39%

YTD 0.00%

1,046

1D 0.61%

YTD 0.00%

1,043

1D 1.14%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,601.65

1D 2.41%

YTD 21.10%

3,023.08

1D -0.13%

YTD -2.14%

9,826.73

1D -0.38%

YTD -10.80%

17,101.78

1D -0.06%

YTD -13.55%

2,301.56

1D 1.03%

YTD 2.91%

63,663.06

1D -0.52%

YTD 4.64%

3,076.77

1D 0.29%

YTD -5.37%

1,379.01

1D -0.20%

YTD -17.44%

85.89

1D 0.43%

YTD -0.02%

1,980.78

1D 0.03%

YTD 8.46%

Asian stocks were mixed on Wednesday ahead of a keenly awaited policy decision from the Federal Reserve later in the day, while the yen was stuck near one-year lows against the dollar as Tokyo ramped up intervention warnings. Japan's Nikkei 225 was 2% higher as the wake of the Bank of Japan's decision to tweak its bond yield control policy again on Tuesday, further loosening its grip on long-term interest rates.

VIETNAM ECONOMY

1.17%

1D (bps) 32

YTD (bps) -380

5.10%

YTD (bps) -230

2.25%

1D (bps) -6

YTD (bps) -254

2.69%

1D (bps) -10

YTD (bps) -221

24,761

1D (%) 0.11%

YTD (%) 4.21%

26,693

1D (%) -0.36%

YTD (%) 4.03%

3,430

1D (%) 0.03%

YTD (%) -1.58%

The US dollar index rebounded by over 0.5% ahead of the crucial Federal Reserve's interest rate decision today. In the domestic market this morning, the USD exchange rate also recorded an increase within the range of VND30.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI continued to be below the average threshold, new orders increased weakly;

- Gasoline prices increased by more than 400 VND/liter;

- Days in inventory of cement enterprises increased because of weak consumption;

- China’s warmwater shrimp import prices fall for fifth straight month to new record low;

- Because of the US AI chip export ban, semiconductor giant Nividia could lose USD5 billion;

- The global economy is precarious as conflicts increase.

VN30

BANK

87,800

1D 1.15%

5D 2.33%

Buy Vol. 2,220,226

Sell Vol. 2,079,989

40,000

1D -0.50%

5D -1.84%

Buy Vol. 919,987

Sell Vol. 1,022,765

27,400

1D -1.08%

5D -5.52%

Buy Vol. 5,031,345

Sell Vol. 4,982,007

28,200

1D 1.81%

5D -9.62%

Buy Vol. 7,554,001

Sell Vol. 7,599,201

19,800

1D -1.00%

5D -5.71%

Buy Vol. 7,861,880

Sell Vol. 9,730,708

17,200

1D 0.58%

5D -3.37%

Buy Vol. 9,583,111

Sell Vol. 10,068,294

17,250

1D 0.29%

5D -1.43%

Buy Vol. 9,181,015

Sell Vol. 12,495,972

15,800

1D 0.00%

5D -5.67%

Buy Vol. 6,725,443

Sell Vol. 5,794,382

27,650

1D 2.41%

5D -6.43%

Buy Vol. 19,636,336

Sell Vol. 16,375,538

18,000

1D 0.56%

5D -1.64%

Buy Vol. 4,497,914

Sell Vol. 5,332,678

21,600

1D 0.93%

5D -1.37%

Buy Vol. 8,389,416

Sell Vol. 8,521,446

10,350

1D 2.48%

5D -1.90%

Buy Vol. 27,091,984

Sell Vol. 25,701,265

25,900

1D 0.39%

5D 0.00%

Buy Vol. 1,395,555

Sell Vol. 1,629,491

CTG: Vietinbank's consolidated pre-tax profit reached VND4,871 billion, up 17.2% over the same period in 2022. With this result, VietinBank entered the group with the best profit growth in the third quarter.

OIL & GAS

10,700

1D 0.39%

5D -4.46%

Buy Vol. 8,027,149

Sell Vol. 8,178,366

32,300

1D 0.94%

5D -8.63%

Buy Vol. 1,249,956

Sell Vol. 1,095,624

40,400

1D 1.25%

5D -9.62%

Buy Vol. 7,272,370

Sell Vol. 8,324,360

PLX: Accumulated for 9 months, PLX's net revenue decreased by 9% to VND205,596 billion. Profit after tax increased 4.6 times over the same period in 2022, reaching VND2,288 billion.

VINGROUP

38,450

1D -0.25%

5D -14.37%

Buy Vol. 13,285,581

Sell Vol. 17,316,849

22,700

1D -1.41%

5D -14.18%

Buy Vol. 11,113,118

Sell Vol. 9,255,195

70,400

1D 2.25%

5D 2.03%

Buy Vol. 3,894,090

Sell Vol. 3,770,038

VHM: On November 1, foreign investors continued to sell VHM the most with a net selling value of VND683 billion.

FOOD & BEVERAGE

59,500

1D 3.53%

5D -9.85%

Buy Vol. 2,766,044

Sell Vol. 2,577,196

57,400

1D 2.23%

5D -17.05%

Buy Vol. 1,240,961

Sell Vol. 1,094,651

58,000

1D 1.23%

5D -7.35%

Buy Vol. 363,973

Sell Vol. 348,370

MSN: The consumer business segment including WinCommerce, Masan Consumer, MEATLife, Phuc Long recorded EBIT in the first 9M +45.5% yoy and +47.3% yoy in Q3.

OTHERS

39,000

1D -1.02%

5D -4.53%

Buy Vol. 564,897

Sell Vol. 560,960

39,000

1D 0.26%

5D -4.53%

Buy Vol. 564,897

Sell Vol. 560,960

104,400

1D 5.45%

5D 1.56%

Buy Vol. 1,113,224

Sell Vol. 1,103,280

85,400

1D 2.89%

5D -6.05%

Buy Vol. 3,997,767

Sell Vol. 3,055,424

35,100

1D -6.90%

5D -19.31%

Buy Vol. 25,974,669

Sell Vol. 31,827,519

17,300

1D 2.37%

5D -15.61%

Buy Vol. 3,679,794

Sell Vol. 2,513,382

27,150

1D 5.44%

5D -11.85%

Buy Vol. 66,062,126

Sell Vol. 50,214,268

23,950

1D 4.13%

5D -0.42%

Buy Vol. 35,763,351

Sell Vol. 31,995,308

MWG: In Q3, MWG recorded revenue of VND30,287 billion, down nearly 6% over the same period last year but up nearly 3% over the previous quarter. Gross profit margin continued to narrow to only 15.3% compared to 23% in the same period last year and 18.5% in the previous quarter.

Market by numbers

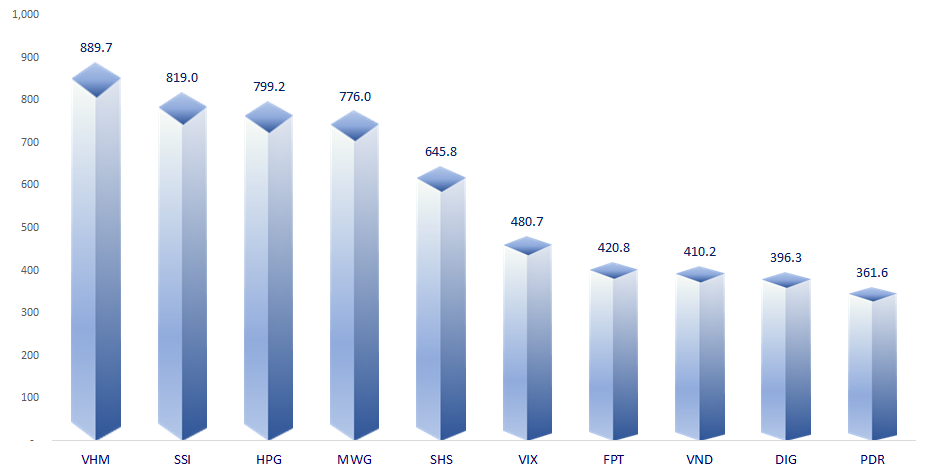

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

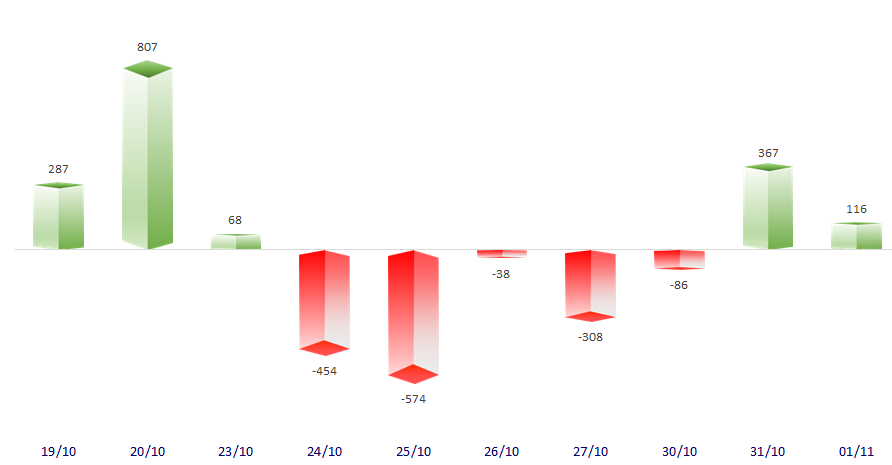

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

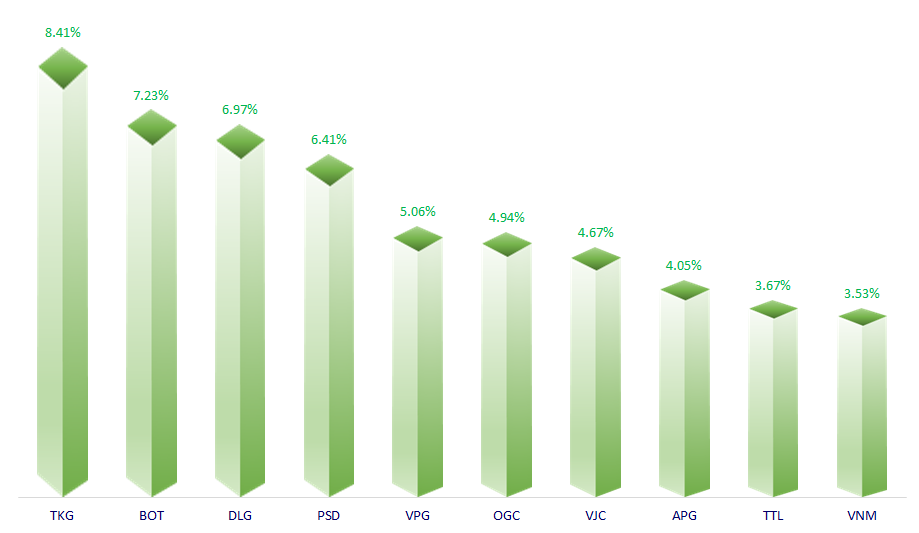

TOP INCREASES 3 CONSECUTIVE SESSIONS

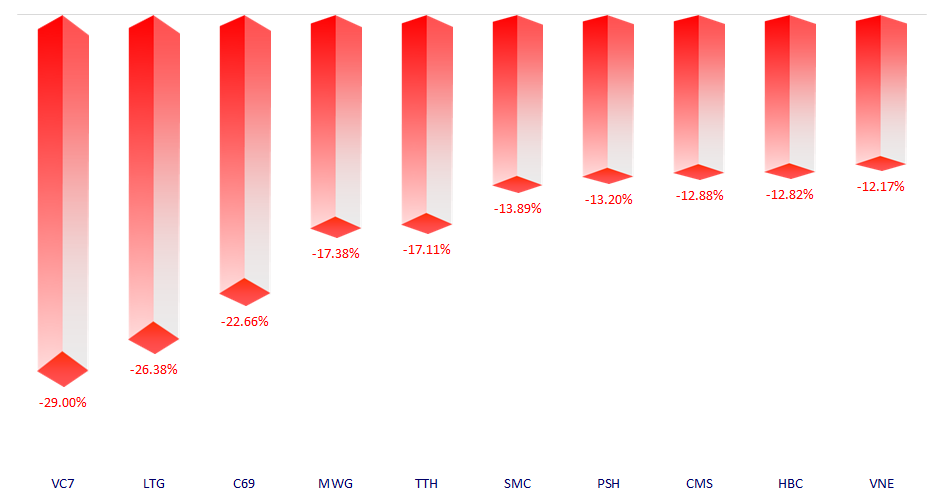

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.