Market Brief 02/11/2023

VIETNAM STOCK MARKET

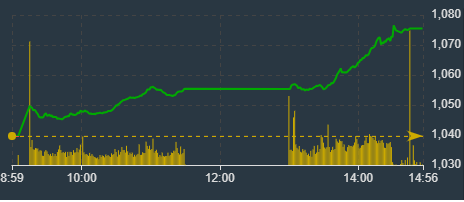

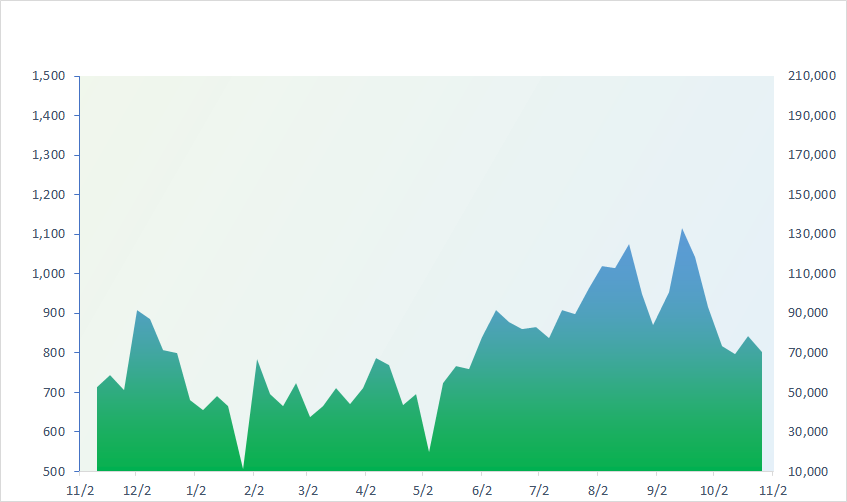

1,075.47

1D 3.44%

YTD 6.79%

1,087.50

1D 3.41%

YTD 8.19%

217.97

1D 3.97%

YTD 6.17%

83.97

1D 2.78%

YTD 17.19%

10.62

1D 0.00%

YTD 0.00%

17,437.97

1D 15.43%

YTD 102.39%

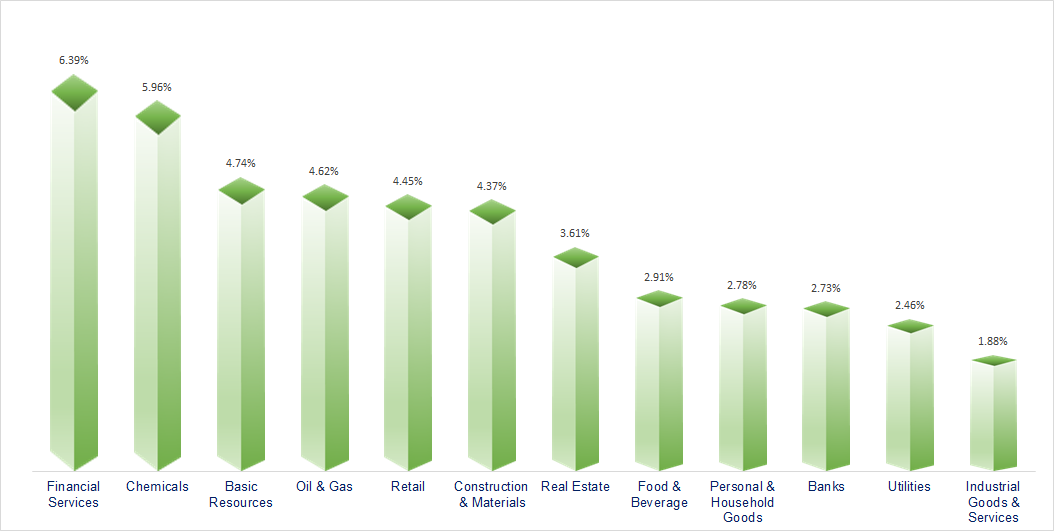

The market recovered strongly and VN-Index had the strongest gaining session this year with more than 3%. Almost all industry groups increased in today's session, with financial services, construction and basic resources being the most positive.

ETF & DERIVATIVES

18,660

1D 1.97%

YTD 7.67%

12,860

1D 3.29%

YTD 7.89%

13,350

1D 3.01%

YTD 6.97%

16,490

1D 4.37%

YTD 17.37%

17,580

1D 3.90%

YTD 22.51%

24,080

1D 3.93%

YTD 7.50%

14,500

1D 3.50%

YTD 11.97%

1,087

1D 3.77%

YTD 0.00%

1,084

1D 4.09%

YTD 0.00%

1,080

1D 3.25%

YTD 0.00%

1,079

1D 3.45%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

31,949.89

1D 1.10%

YTD 22.44%

3,009.41

1D -0.45%

YTD -2.58%

9,734.77

1D -0.94%

YTD -11.63%

17,236.02

1D 0.78%

YTD -12.87%

2,343.12

1D 1.81%

YTD 4.77%

63,996.09

1D 0.52%

YTD 5.19%

3,080.66

1D 0.13%

YTD -5.25%

1,403.99

1D 1.81%

YTD -15.95%

85.84

1D 0.57%

YTD -0.08%

1,986.28

1D 0.02%

YTD 8.77%

Most Asian stocks increased after the Fed's decision not to raise interest rates as well as its less hawkish stance at yesterday's meeting. Only the Chinese market decreased in today's session after weak economic data from this country. In Hong Kong, the Monetary Authority (HKMA) on Thursday left its base rate charged through the overnight discount window unchanged at 5.75%, tracking a move by the U.S. Federal Reserve to keep rates steady.

VIETNAM ECONOMY

1.04%

1D (bps) -13

YTD (bps) -393

5.10%

YTD (bps) -230

2.24%

1D (bps) -1

YTD (bps) -255

2.65%

1D (bps) -4

YTD (bps) -225

24,744

1D (%) -0.08%

YTD (%) 4.14%

26,837

1D (%) 0.12%

YTD (%) 4.59%

3,428

1D (%) -0.09%

YTD (%) -1.64%

Oil prices rebounded on Thursday to snap its three-day decline, as risk appetite returned to financial markets after the U.S. Federal Reserve kept benchmark interest rates on hold.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Seafood exports decreased by 20% after 10 months;

- List of top 10 banks disbursing the most in the first 9 months of 2023;

- Proposal to upgrade two railway lines connecting to China;

- Copper prices dropped sharply because of concerns about oversupply;

- China faces the risk of coal surplus;

- The Japanese yen is approaching a record low in 33 years.

VN30

BANK

89,000

1D 1.37%

5D 5.33%

41,650

1D 4.13%

5D 2.71%

28,250

1D 3.10%

5D -0.35%

29,350

1D 4.08%

5D -1.51%

20,300

1D 2.53%

5D 0.50%

17,700

1D 2.91%

5D 2.91%

17,600

1D 2.03%

5D 3.53%

16,400

1D 3.80%

5D 2.50%

29,000

1D 4.88%

5D 3.20%

18,550

1D 3.06%

5D 6.92%

22,300

1D 3.24%

5D 5.69%

10,900

1D 5.31%

5D 8.46%

25,950

1D 0.19%

5D 1.76%

The total pre-tax profit of 28 banks that announced their financial statements reached nearly VND187,500 billion in the first 9 months of the year, equivalent to 68% of the year's plan. Among them, there are 5 banks that have achieved 80% or more of their profit plans. Kienlongbank is temporarily leading, having achieved 91.3% of the target. In addition, HDBank, MSB, Saigonbank and SHB are also banks with a high possibility of reaching the finish line in 2023.

OIL & GAS

11,100

1D 2.99%

5D 2.78%

33,400

1D 3.74%

5D 1.52%

41,450

1D 3.41%

5D -0.36%

PLX: As of September 30, PLX's total assets reached VND81,876 billion (+10% YTD). Cash, cash equivalents and bank deposits are about VND24,791 billion.

VINGROUP

39,950

1D 2.60%

5D -4.43%

23,250

1D 3.90%

5D -5.49%

70,900

1D 2.42%

5D 5.82%

VHM: The Hau Nghia - Duc Hoa new urban area project in Long An is expected to include 517 villas, 4,510 commercial sites and shophouses, 16 hectares of land for social housing.

FOOD & BEVERAGE

62,700

1D 0.71%

5D 2.12%

61,400

1D 5.38%

5D -7.25%

58,800

1D 6.97%

5D -1.34%

According to AC Nielsen, the fast-moving consumer goods industry will end the third quarter of 2023 with a 2% decrease in value compared to the same period in 2022

OTHERS

40,600

1D 1.38%

5D 3.97%

40,600

1D 4.10%

5D 3.97%

104,900

1D 0.48%

5D 5.11%

89,000

1D 4.22%

5D 2.53%

37,000

1D 5.41%

5D -11.90%

18,500

1D 6.94%

5D -3.14%

28,900

1D 6.45%

5D 0.70%

25,250

1D 5.43%

5D 10.75%

MWG: Accumulated in the first 9 months of the year, the Bach Hoa Xanh chain recorded revenue of VND22,323 billion. In the third quarter, revenue reached more than VND8,600 billion, up 21% over the same period and up 18% over the second quarter. Average revenue per Bach Hoa Xanh store in June reached 1.65 billion VND/store and is expected to Continue to improve over the next month.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

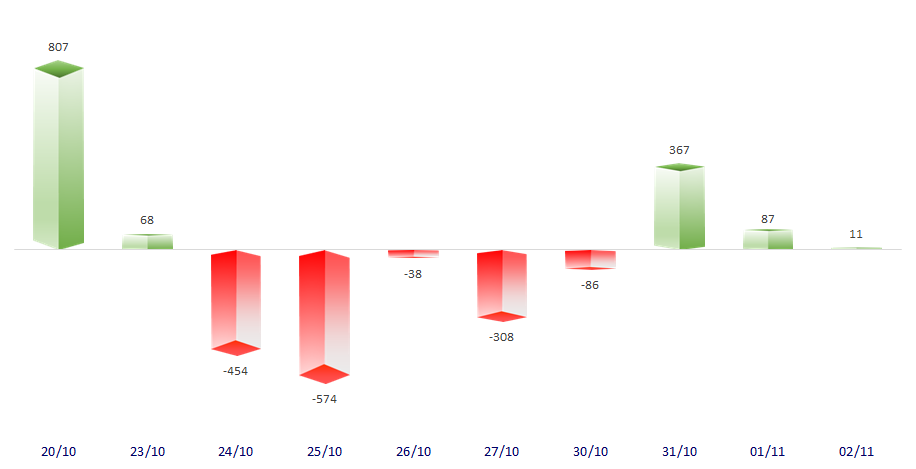

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

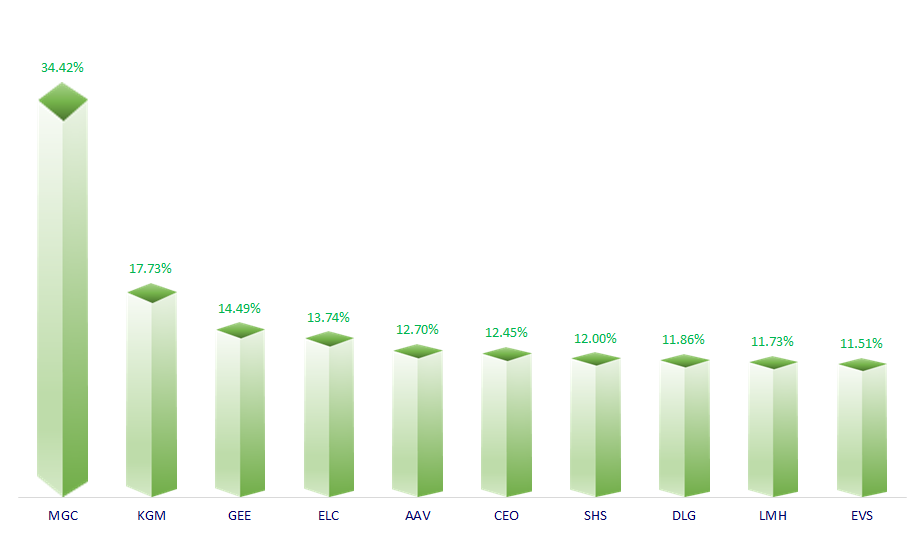

TOP INCREASES 3 CONSECUTIVE SESSIONS

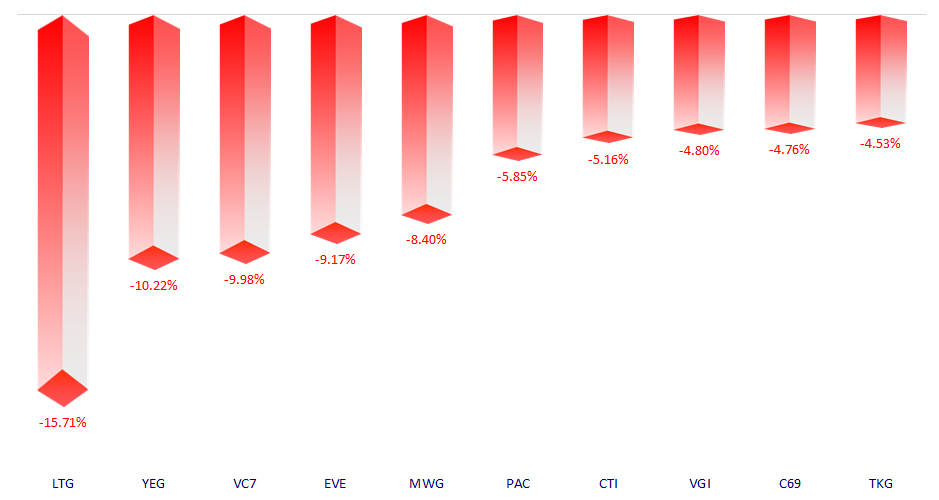

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.