Market Brief 14/11/2023

VIETNAM STOCK MARKET

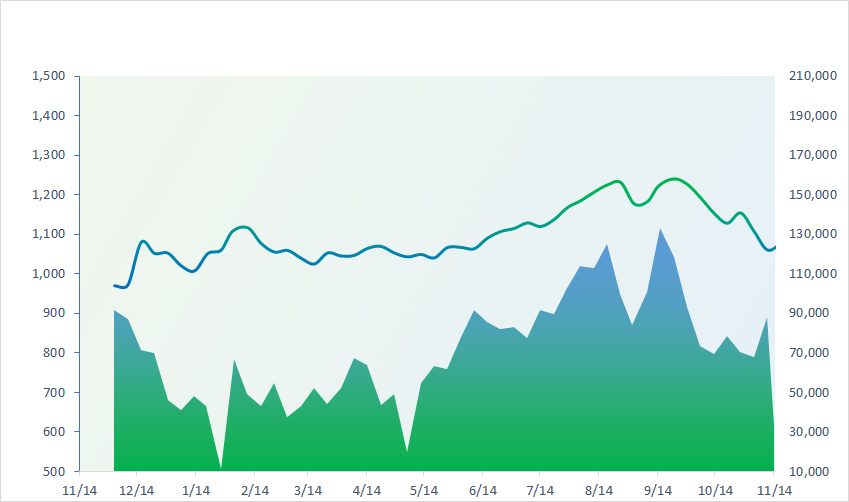

1,109.73

1D 0.88%

YTD 10.19%

1,119.28

1D 1.13%

YTD 11.35%

227.43

1D 0.58%

YTD 10.77%

86.65

1D 0.78%

YTD 20.94%

-376.95

1D 0.00%

YTD 0.00%

19,401.58

1D 6.13%

YTD 125.18%

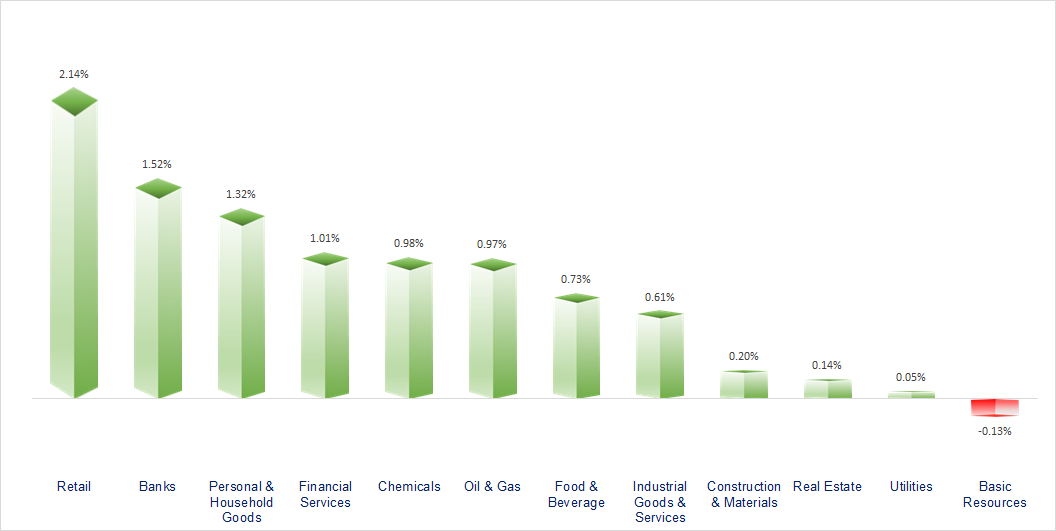

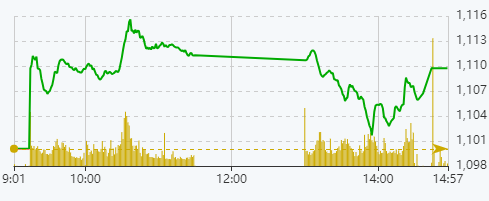

Since the opening, VNIndex has jumped a gap and at one point VNIndex increased by nearly 15 points in the morning session. However, profit-taking pressure and the approaching derivatives expiration session prevented the VNIndex from maintaining its highest level until the end of the session. Most industries increased, with retail and banking being two most positive groups.

ETF & DERIVATIVES

19,300

1D 1.31%

YTD 11.37%

13,270

1D 1.30%

YTD 11.33%

13,790

1D 1.40%

YTD 10.50%

16,990

1D 1.13%

YTD 20.93%

18,370

1D 2.34%

YTD 28.01%

25,250

1D 1.53%

YTD 12.72%

14,980

1D 0.27%

YTD 15.68%

1,120

1D 1.17%

YTD 0.00%

1,116

1D 1.00%

YTD 0.00%

1,112

1D 0.91%

YTD 0.00%

1,111

1D 1.38%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,695.93

1D 0.34%

YTD 25.30%

3,056.07

1D 0.31%

YTD -1.07%

10,005.56

1D 0.17%

YTD -9.17%

17,396.86

1D -0.17%

YTD -12.05%

2,433.25

1D 1.23%

YTD 8.80%

64,933.87

1D -0.06%

YTD 6.73%

3,102.87

1D -0.12%

YTD -4.57%

1,384.22

1D -0.21%

YTD -17.13%

82.57

1D -0.42%

YTD -3.89%

1,945.72

1D -0.04%

YTD 6.54%

Asian stocks pared gains on concern China’s economy is slowing. China is scheduled to publish a range of economic data Wednesday including retail sales, industrial production and fixed-asset investment. Elsewhere, Chinese President Xi Jinping and his US counterpart Joe Biden are due to meet Wednesday on the sidelines of the Asia-Pacific Economic Cooperation summit. There are several optimistic that the discussion will help ease tensions between the two economic giants.

VIETNAM ECONOMY

0.56%

YTD (bps) -441

5.00%

YTD (bps) -240

2.16%

1D (bps) 1

YTD (bps) -263

2.49%

1D (bps) 22

YTD (bps) -241

24,535

1D (%) -0.06%

YTD (%) 3.26%

26,822

1D (%) 0.05%

YTD (%) 4.53%

3,412

1D (%) -0.09%

YTD (%) -2.09%

In the context that the State Bank stopped absorbing money through T-bills and pumped a large amount of liquidity into the system, interbank interest rates continued their downward trend last week. On November 13, the average interbank offered interest rate in Dong decreased by 0.08 - 0.18 percentage points for all terms from 1 month or less compared to last week's session, specifically: ON 0.56%; 1W 0.74%; 2W 1.06% and 1M 1.70%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Mortgage demand from homebuyers and real estate investors continues to decline;

- Fruit and vegetable exports could reach a record of USD6 billion in 2023;

- Top 10 banks with the highest ROA in the first 9 months of 2023;

- Bitcoin investment funds attract record amounts of money;

- The LockBit ransomware group published data allegedly stolen from the aerospace giant Boeing in a recent attack;

- Goldman Sachs: US stocks could increase 8% in 2024.

VN30

BANK

86,000

1D 0.58%

5D -2.60%

Buy Vol. 1,985,014

Sell Vol. 1,753,857

43,000

1D 2.14%

5D 2.87%

Buy Vol. 3,007,951

Sell Vol. 2,836,907

29,800

1D 1.36%

5D 4.38%

Buy Vol. 6,408,071

Sell Vol. 7,882,737

31,500

1D 1.94%

5D 2.94%

Buy Vol. 7,033,661

Sell Vol. 8,198,648

19,600

1D 2.08%

5D -0.67%

Buy Vol. 26,709,910

Sell Vol. 24,409,909

18,450

1D 1.93%

5D 3.65%

Buy Vol. 25,571,821

Sell Vol. 29,007,237

18,750

1D -0.27%

5D 4.17%

Buy Vol. 12,431,208

Sell Vol. 14,390,752

17,400

1D 0.87%

5D 5.14%

Buy Vol. 21,291,639

Sell Vol. 25,054,136

30,000

1D 2.56%

5D 3.45%

Buy Vol. 40,445,070

Sell Vol. 45,174,782

19,600

1D 2.08%

5D 4.81%

Buy Vol. 12,053,971

Sell Vol. 10,247,510

22,700

1D 1.11%

5D 2.71%

Buy Vol. 14,728,713

Sell Vol. 20,889,828

11,450

1D 3.62%

5D 5.53%

Buy Vol. 64,725,755

Sell Vol. 77,549,362

23,150

1D 0.65%

5D -5.12%

Buy Vol. 5,306,925

Sell Vol. 3,095,009

BID: As of the end of October, BIDV's credit growth only reached 8.1%. In particular, credit growth of the real estate mortgage sector was very slow, reaching only 4% while the annual rate is usually about 20%.

OIL & GAS

11,850

1D 0.13%

5D 6.28%

Buy Vol. 18,230,943

Sell Vol. 18,579,210

33,500

1D -0.42%

5D 1.06%

Buy Vol. 1,633,675

Sell Vol. 2,069,618

44,950

1D 0.45%

5D 6.90%

Buy Vol. 6,419,271

Sell Vol. 10,332,965

POW: In October, POW's revenue was estimated at nearly VND2,234 billion, up 20% over the same period.

VINGROUP

41,000

1D 0.33%

5D 2.50%

Buy Vol. 13,128,910

Sell Vol. 14,027,822

24,000

1D -0.85%

5D 3.67%

Buy Vol. 6,677,025

Sell Vol. 7,398,428

68,900

1D 2.13%

5D -2.68%

Buy Vol. 5,730,564

Sell Vol. 4,458,218

VRE: In Q3, VRE's floor occupancy rate was 85.4%, an increase of 1.5 percentage points over the same period.

FOOD & BEVERAGE

62,600

1D 0.29%

5D 0.97%

Buy Vol. 2,638,414

Sell Vol. 2,712,311

62,000

1D 0.97%

5D -4.76%

Buy Vol. 1,559,473

Sell Vol. 1,206,183

60,000

1D 1.14%

5D 3.09%

Buy Vol. 461,423

Sell Vol. 520,187

MSN: Masan aims to open 11 new Phuc Long stores in the last months of the year and improves sales per store to the same level as the fourth quarter of last year.

OTHERS

40,800

1D 0.33%

5D 0.99%

Buy Vol. 545,508

Sell Vol. 641,311

40,800

1D 0.62%

5D 0.99%

Buy Vol. 545,508

Sell Vol. 641,311

107,800

1D -0.19%

5D 1.70%

Buy Vol. 1,130,571

Sell Vol. 1,148,836

92,600

1D 1.31%

5D 4.87%

Buy Vol. 3,526,077

Sell Vol. 5,798,890

41,500

1D 3.75%

5D 8.64%

Buy Vol. 27,154,511

Sell Vol. 24,973,591

19,700

1D 1.29%

5D 6.78%

Buy Vol. 3,144,873

Sell Vol. 3,700,882

31,750

1D 0.95%

5D 11.99%

Buy Vol. 41,672,944

Sell Vol. 47,398,787

27,000

1D -0.74%

5D 4.65%

Buy Vol. 43,406,704

Sell Vol. 52,807,541

FPT: In the first 10 months of 2023, FPT's revenue reached VND42,465 billion, pre-tax profit reached VND7,689 billion, up 21% and 19.1% over the same period, respectively. At the end of 10 months, FPT has achieved 81.2% of revenue plan and 84.9% of profit plan for the whole year 2023.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

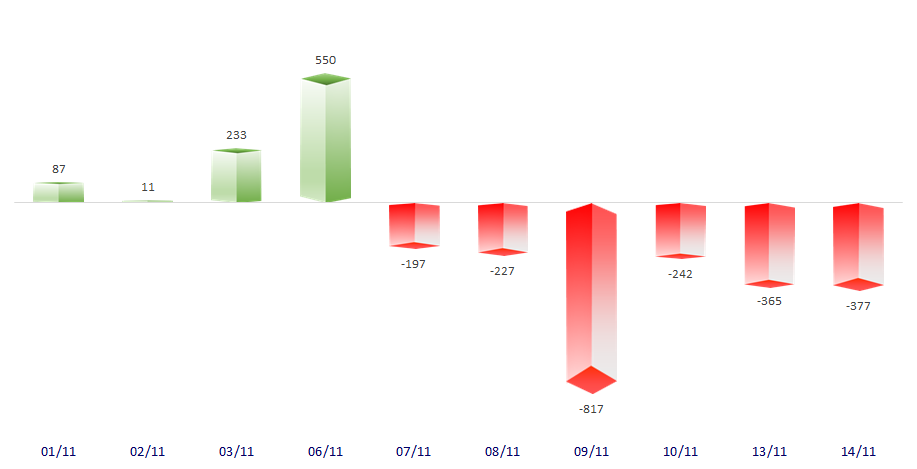

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

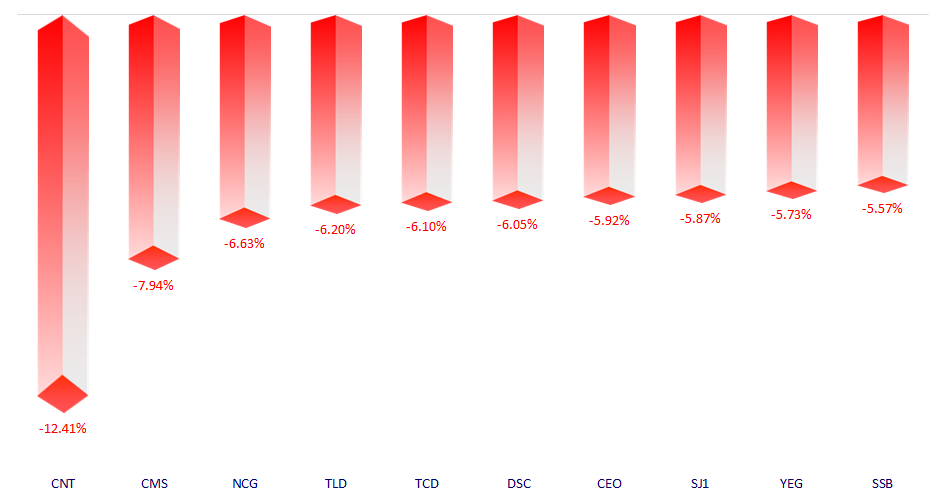

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.