Market Brief 30/11/2023

VIETNAM STOCK MARKET

1,094.13

1D -0.79%

YTD 8.64%

226.15

1D -0.39%

YTD 10.16%

1,081.70

1D -1.05%

YTD 7.61%

84.99

1D -0.06%

YTD 18.62%

-497.71

1D 0.00%

YTD 0.00%

17,060.28

1D 16.24%

YTD 98.01%

VNIndex had a falling session in the last session of November. While VNIndex increased sharply in the morning, after 2:00 p.m, the market turned red and began to decline sharply. Industrial zone was the most positive group in today's session, while oil and gas, food and basic resources were the three most negative industry groups.

ETF & DERIVATIVES

18,850

1D -0.21%

YTD 8.77%

12,890

1D -0.69%

YTD 8.14%

13,460

1D 0.07%

YTD 7.85%

16,900

1D 2.05%

YTD 20.28%

17,820

1D -0.45%

YTD 24.18%

24,830

1D -0.16%

YTD 10.85%

14,800

1D -0.27%

YTD 14.29%

1,076

1D -1.47%

YTD 0.00%

1,078

1D -1.19%

YTD 0.00%

1,071

1D -1.33%

YTD 0.00%

1,074

1D -1.06%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

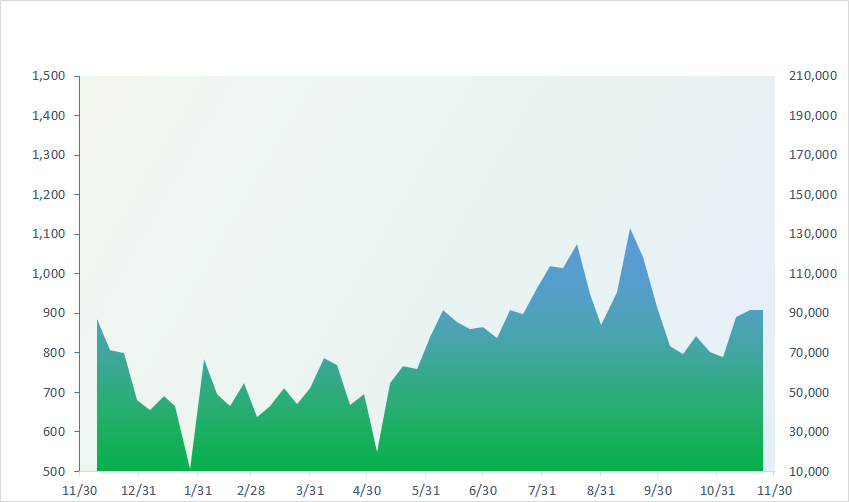

VNINDEX (12M)

GLOBAL MARKET

33,486.89

1D 0.50%

YTD 28.33%

3,029.67

1D 0.26%

YTD -1.93%

9,726.92

1D -0.18%

YTD -11.70%

17,042.88

1D 0.29%

YTD -13.84%

2,535.29

1D 0.61%

YTD 13.36%

66,988.44

1D 0.13%

YTD 10.10%

3,072.99

1D -0.38%

YTD -5.48%

1,380.18

1D -0.54%

YTD -17.37%

83.85

1D 1.64%

YTD -2.40%

2,037.97

1D -0.40%

YTD 11.60%

Asian stocks mostly increased today's session. The Japanese market is still showing a positive trend due to the less hawkish outlook from the US Federal Reserve, as well as the BoJ taking a more dovish stance since its meeting earlier this month. Meanwhile, the Chinese and Hong Kong markets have also recovered after many sessions of decline due to the country's weak economic situation.

VIETNAM ECONOMY

0.14%

YTD (bps) -483

4.80%

YTD (bps) -260

1.91%

1D (bps) -14

YTD (bps) -288

2.28%

1D (bps) -8

YTD (bps) -262

24,485

1D (%) 0.20%

YTD (%) 3.05%

26,937

1D (%) -1.59%

YTD (%) 4.98%

3,472

1D (%) -0.03%

YTD (%) -0.37%

The USD has rebounded slightly from a three-month low as the market received data showing that the US economy grew faster in the third quarter. Exchange rates at banks and the free market both increased slightly in the context of the central exchange rate continuing to adjust downward.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- ST25 rice won the world's best rice award 2023;

- Construction steel prices increased twice in a row in just 10 days;

- The agricultural sector has a trade surplus of USD10.5 billion after 11 months;

- Google agrees to pay for Canadian journalism;

- Norway earned USD31 billion thanks to the Russia-Ukraine conflict;

- China's Shein files for US IPO, valued at up to USD60 billion - 3 times more than H&M.

VN30

BANK

84,700

1D -0.47%

5D -0.94%

Buy Vol. 1,794,054

Sell Vol. 1,675,660

38,850

1D -1.15%

5D 1.81%

Buy Vol. 1,180,718

Sell Vol. 1,820,114

26,300

1D -0.04%

5D 0.65%

Buy Vol. 5,143,178

Sell Vol. 5,123,744

29,500

1D -1.34%

5D -2.96%

Buy Vol. 5,417,518

Sell Vol. 5,618,265

19,100

1D -0.78%

5D -0.26%

Buy Vol. 14,109,054

Sell Vol. 14,780,937

17,800

1D -0.28%

5D -0.56%

Buy Vol. 12,208,655

Sell Vol. 12,741,341

18,000

1D -0.28%

5D -0.28%

Buy Vol. 7,350,193

Sell Vol. 8,564,547

17,000

1D 0.89%

5D 0.00%

Buy Vol. 18,021,242

Sell Vol. 15,412,934

27,500

1D -1.08%

5D -2.48%

Buy Vol. 25,081,612

Sell Vol. 27,348,537

18,700

1D -0.53%

5D -0.53%

Buy Vol. 3,086,917

Sell Vol. 3,322,203

21,950

1D -0.45%

5D -1.13%

Buy Vol. 7,728,705

Sell Vol. 9,985,460

10,800

1D -0.46%

5D -1.37%

Buy Vol. 21,297,290

Sell Vol. 28,549,576

22,600

1D -1.95%

5D -1.74%

Buy Vol. 2,095,705

Sell Vol. 3,274,297

On November 29, 2023, the State Bank of Vietnam announced to expand credit room for banks. Currently, banks with outstanding loans reaching 80% of the assigned credit target from the beginning of the year will have their credit room expanded, based on the 2022 ranking. In addition, SBV prioritizes banks that focus on priority areas of the Government and has lowered lending interest rates to low levels recently.

OIL & GAS

76,500

1D -1.67%

5D -1.75%

Buy Vol. 9,145,061

Sell Vol. 10,453,788

11,250

1D -0.44%

5D 4.15%

Buy Vol. 1,554,125

Sell Vol. 2,304,564

35,100

1D -1.96%

5D 1.09%

Buy Vol. 5,223,753

Sell Vol. 6,989,324

From 3:00 p.m, RON 95 gasoline price decreased slightly by 34 VND/liter, while RON 92 increased by 109 VND/liter.

VINGROUP

41,750

1D -1.88%

5D 5.90%

Buy Vol. 10,751,021

Sell Vol. 14,042,830

41,300

1D 0.24%

5D -2.21%

Buy Vol. 6,404,450

Sell Vol. 7,863,623

22,100

1D -4.74%

5D -1.89%

Buy Vol. 3,601,284

Sell Vol. 4,114,256

XanhSM officially participates in the delivery field. If the delivery is not successful, the driver will be refunded the trip fee and 100% of the COD fee, up to VND2 million (if any).

FOOD & BEVERAGE

67,400

1D -1.46%

5D -4.42%

Buy Vol. 4,031,848

Sell Vol. 3,275,738

60,500

1D -3.82%

5D 7.62%

Buy Vol. 918,423

Sell Vol. 1,166,019

65,000

1D -1.81%

5D 0.16%

Buy Vol. 579,419

Sell Vol. 639,835

VNM: Vinamilk said it will continue to develop new markets such as South America, the Caribbean, West and South Africa.

OTHERS

58,200

1D 0.00%

5D -1.37%

Buy Vol. 912,929

Sell Vol. 1,065,729

39,000

1D -1.76%

5D -1.37%

Buy Vol. 912,929

Sell Vol. 1,065,729

102,000

1D -4.49%

5D -2.86%

Buy Vol. 1,583,637

Sell Vol. 1,198,745

91,900

1D 0.22%

5D 1.21%

Buy Vol. 4,051,856

Sell Vol. 4,651,470

38,500

1D -0.77%

5D 3.22%

Buy Vol. 6,912,128

Sell Vol. 9,530,186

20,000

1D 0.76%

5D 3.63%

Buy Vol. 6,865,815

Sell Vol. 7,301,565

31,300

1D -0.95%

5D 1.29%

Buy Vol. 31,126,310

Sell Vol. 39,771,196

26,550

1D -1.67%

5D 2.71%

Buy Vol. 42,409,041

Sell Vol. 51,002,460

FRT (FPT's associate company) said that the Long Chau pharmacy chain is maintaining average revenue/pharmacy/month at nearly VND1.1 billion. Long Chau has also just increased capital to invest in pharmacy chains, focusing on the province while improving customer experience.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

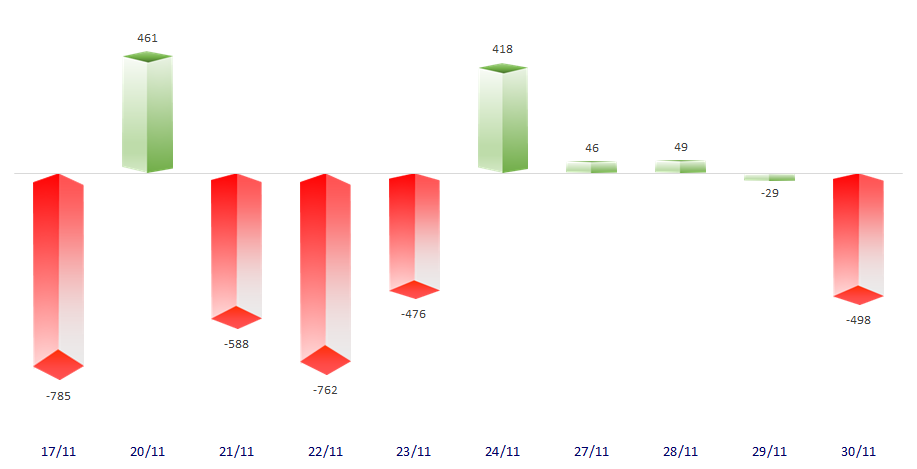

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

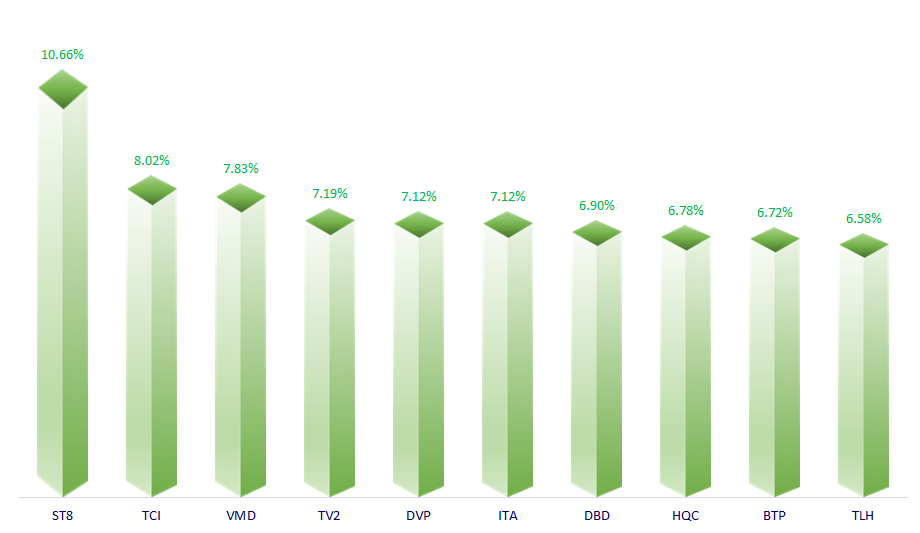

TOP INCREASES 3 CONSECUTIVE SESSIONS

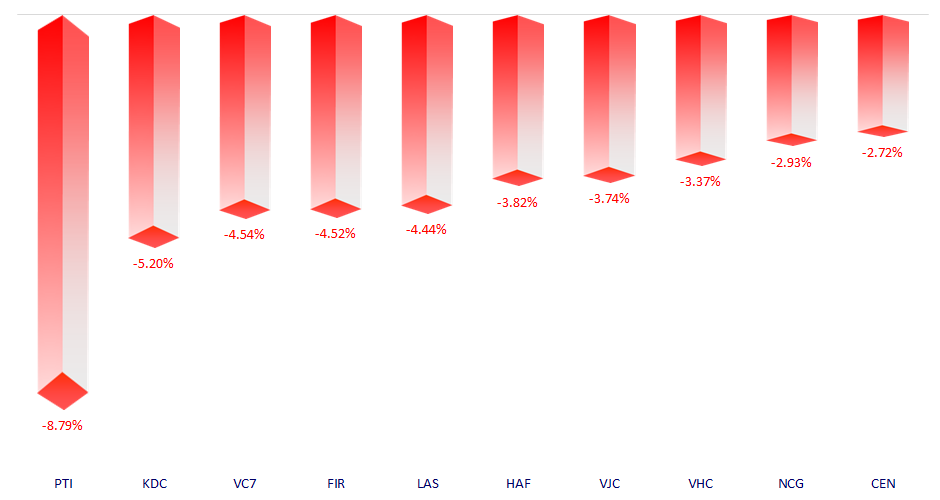

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.