Market brief 29/12/2023

VIETNAM STOCK MARKET

1,129.93

1D 0.09%

YTD 12.20%

231.04

1D -0.13%

YTD 12.54%

1,131.46

1D 0.26%

YTD 12.56%

87.04

1D 0.08%

YTD 21.48%

361.94

1D 0.00%

YTD 0.00%

18,110.72

1D 4.67%

YTD 110.20%

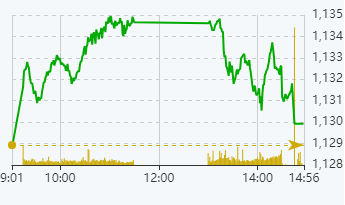

The market ended the final session of 2023 quite positively. VNIndex has increased sharply since opening this morning. Although the index weakened in the ATC session, it still closed the last session of the year in green. Some outstanding stocks were GVR (+4.4%), HDB (+4.9%), VPB (+2.1%).

ETF & DERIVATIVES

19,430

1D 0.00%

YTD 12.12%

13,490

1D 0.75%

YTD 13.17%

13,970

1D 1.16%

YTD 11.94%

16,700

1D 0.60%

YTD 18.86%

18,450

1D 1.15%

YTD 28.57%

26,440

1D 2.16%

YTD 18.04%

15,330

1D 0.26%

YTD 18.38%

1,135

1D 0.15%

YTD 0.00%

1,136

1D 0.44%

YTD 0.00%

1,135

1D 0.15%

YTD 0.00%

1,130

1D 0.20%

YTD 0.00%

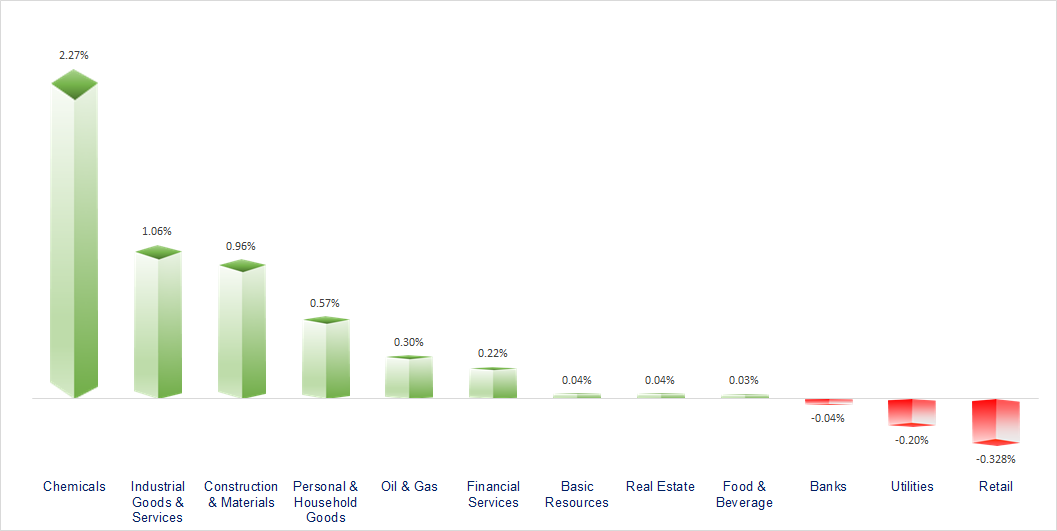

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

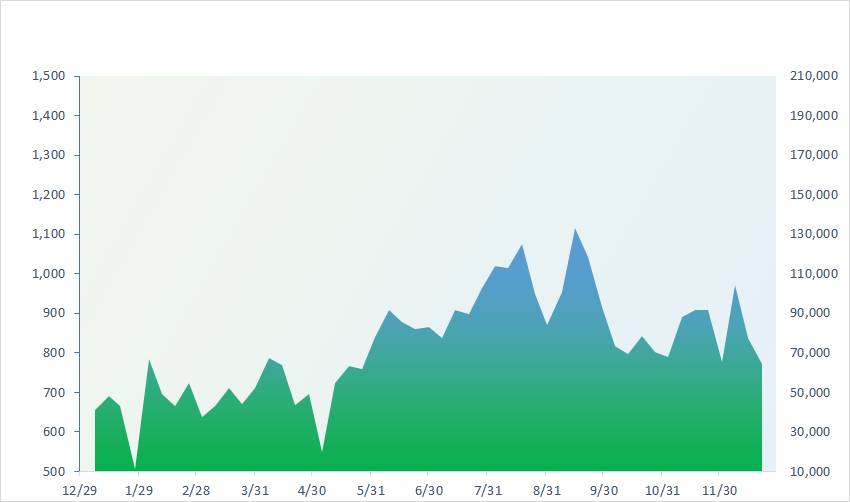

VNINDEX (12M)

GLOBAL MARKET

33,464.17

1D -0.22%

YTD 28.24%

2,974.93

1D 0.68%

YTD -3.70%

17,047.39

1D 0.02%

YTD -13.82%

2,655.28

1D 0.00%

YTD 18.73%

72,191.28

1D -0.30%

YTD 18.66%

3,237.46

1D 0.72%

YTD -0.43%

1,415.85

1D 0.00%

YTD -15.24%

77.94

1D -0.76%

YTD -9.28%

2,068.55

1D -0.40%

YTD 13.27%

Some Asian markets closed for the New Year holiday from today such as Korea and Thailand. Elsewhere, Asian stock indexes mostly rose on the last trading day of the year on expectations of a positive new year. The Nikkei 225 index had almost the best performance in Asia, up more than 28% this year.

VIETNAM ECONOMY

3.60%

1D (bps) 281

YTD (bps) -137

4.80%

YTD (bps) -260

1.88%

1D (bps) -1

YTD (bps) -291

2.18%

1D (bps) -4

YTD (bps) -272

24,430

1D (%) -0.02%

YTD (%) 2.82%

27,537

1D (%) -0.29%

YTD (%) 7.32%

3,480

1D (%) -0.32%

YTD (%) -0.14%

Overnight interbank interest rates increased sharply in the context of credit growth showing a breakthrough in the final weeks of 2023. Since 2014 until now (excluding 2020), interbank interest rates tend to increase in the last month of the year, and often continue into the first quarter of the following year, at the same time credit growth also reaches the highest speed.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- GDP expands 5.05% in 2023;

- Draft amendment to Circular 16: Many important changes related to banks buying and selling corporate bonds;

- Total insurance premium revenue in 2023 is estimated to reach VND211,187 billion;

- Talk of a soft landing for the U.S. economy has investors dreaming of a 1990s-style boom soon afterward;

- Fitch Ratings: Default rates to rise in U.S. and Europe in 2024;

- The New York Times sued OpenAI and Microsoft for copyright infringement.

VN30

BANK

80,300

1D -3.02%

5D -0.74%

Buy Vol. 2,294,791

Sell Vol. 3,755,033

43,400

1D 1.64%

5D 2.24%

Buy Vol. 2,933,588

Sell Vol. 1,567,992

27,100

1D 0.00%

5D 2.46%

Buy Vol. 13,766,245

Sell Vol. 8,678,080

31,800

1D 0.95%

5D 3.92%

Buy Vol. 13,175,672

Sell Vol. 8,611,286

19,200

1D 2.13%

5D 5.79%

Buy Vol. 26,849,968

Sell Vol. 30,284,515

18,650

1D 0.54%

5D 1.91%

Buy Vol. 27,599,761

Sell Vol. 25,887,709

20,300

1D 4.91%

5D 7.12%

Buy Vol. 20,170,548

Sell Vol. 17,330,010

17,400

1D 0.58%

5D 2.96%

Buy Vol. 6,617,175

Sell Vol. 9,931,722

27,950

1D 1.27%

5D 2.76%

Buy Vol. 33,916,688

Sell Vol. 34,535,149

19,600

1D -0.25%

5D 4.53%

Buy Vol. 16,416,242

Sell Vol. 16,388,555

23,900

1D 0.63%

5D 3.02%

Buy Vol. 18,631,237

Sell Vol. 18,915,210

10,800

1D 0.00%

5D 0.93%

Buy Vol. 28,339,390

Sell Vol. 34,144,452

23,900

1D 1.06%

5D 5.75%

Buy Vol. 1,377,399

Sell Vol. 2,799,045

According to a report from the General Statistics Office, the economy's credit growth reached 11.09% (at the same time in 2022, the growth rate is 12.87%). Previously, SBV said that the outstanding credit balance of the entire system as of mid-December was still growing slowly, far from the yearly target. Specifically, as of December 13, credit increased by 9.87% compared to the end of 2022, much lower than the same period last year.

OIL & GAS

75,500

1D -0.66%

5D 0.00%

Buy Vol. 1,731,954

Sell Vol. 12,469,812

11,250

1D 0.00%

5D 2.07%

Buy Vol. 14,019,231

Sell Vol. 1,499,369

34,500

1D 0.00%

5D 3.36%

Buy Vol. 1,170,679

Sell Vol. 5,910,686

POW: The management board said that electricity output in 2023 has reached about 14.97 billion kWh, reaching 96% of the plan and accounting for 64% of PVN Group's total electricity output.

VINGROUP

44,600

1D 0.34%

5D 7.20%

Buy Vol. 3,088,034

Sell Vol. 13,249,389

43,200

1D -1.14%

5D 1.53%

Buy Vol. 8,758,848

Sell Vol. 8,547,919

23,300

1D -0.85%

5D 0.75%

Buy Vol. 6,183,681

Sell Vol. 4,889,540

VIC: VinFast VF 8 ranked top 1 in the test of operating range efficiency, far surpassing many famous electric cars from Mercedes and BMW.

FOOD & BEVERAGE

67,600

1D -1.31%

5D 6.35%

Buy Vol. 3,531,770

Sell Vol. 4,986,367

67,000

1D 0.00%

5D 2.44%

Buy Vol. 3,836,544

Sell Vol. 2,559,952

63,000

1D 1.29%

5D 1.78%

Buy Vol. 2,669,508

Sell Vol. 1,116,645

Foreign investors continued to net sell VNM shares with a value of VND60 billion, in contrast to the net buying of the entire market in the past 2 sessions.

OTHERS

62,900

1D 0.32%

5D 1.54%

Buy Vol. 1,056,302

Sell Vol. 868,627

39,500

1D -0.25%

5D 1.54%

Buy Vol. 742,836

Sell Vol. 868,627

108,000

1D 0.00%

5D 1.69%

Buy Vol. 2,754,946

Sell Vol. 2,287,492

96,100

1D -0.52%

5D 1.59%

Buy Vol. 3,471,630

Sell Vol. 3,913,462

42,800

1D -0.58%

5D 1.06%

Buy Vol. 7,559,300

Sell Vol. 11,491,482

21,200

1D 4.43%

5D 4.69%

Buy Vol. 12,748,019

Sell Vol. 11,546,526

32,800

1D -0.61%

5D 1.39%

Buy Vol. 25,282,525

Sell Vol. 30,513,052

27,950

1D 0.00%

5D 3.33%

Buy Vol. 41,539,280

Sell Vol. 47,572,733

BVH: On December 28, BVH announced to start paying dividends in cash at a rate of 9.54%, equivalent to each share receiving VND954. With more than 742 million outstanding shares, Bao Viet will spend more than VND708 billion to pay dividends to existing shareholders.

Market by numbers

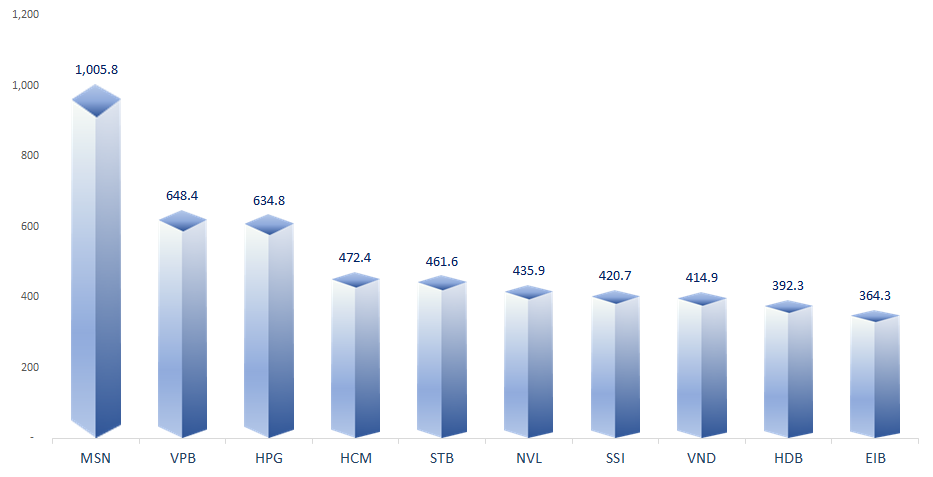

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

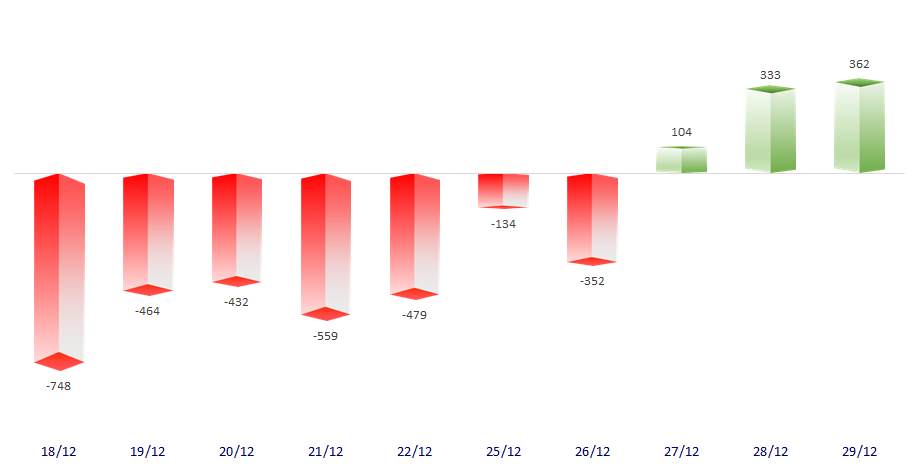

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

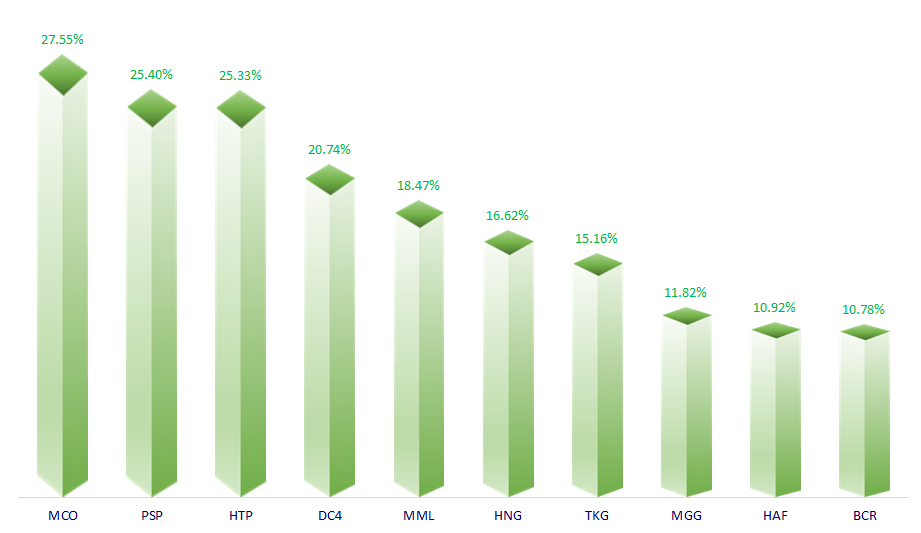

TOP INCREASES 3 CONSECUTIVE SESSIONS

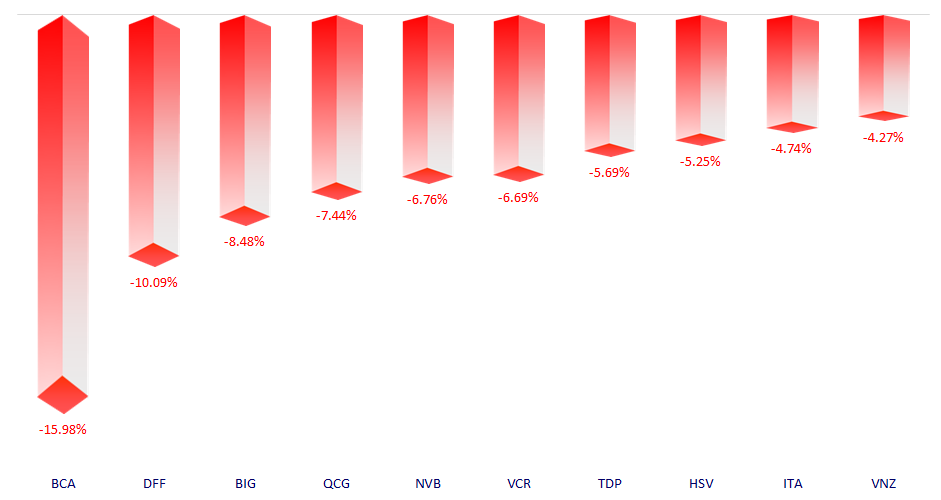

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.