Market Brief 30/01/2024

VIETNAM STOCK MARKET

1,179.65

1D 0.34%

YTD 4.24%

230.66

1D 0.70%

YTD 0.29%

1,181.71

1D 0.22%

YTD 4.42%

87.85

1D 0.29%

YTD 0.31%

255.32

1D 0.00%

YTD 0.00%

15,726.16

1D -1.16%

YTD -16.78%

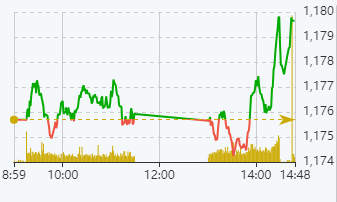

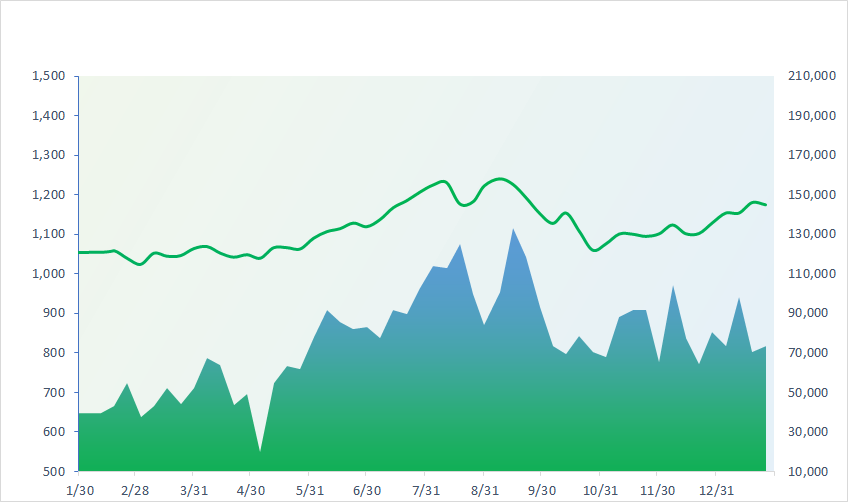

Today's session, the market increased slightly as the final business results reports were gradually announced. VNIndex mostly traded sideways around the reference level before rebounding strongly at the end of the session. Retail and industrial park were the two most positive sectors in today's session.

ETF & DERIVATIVES

20,390

1D 0.15%

YTD 4.40%

14,050

1D 0.29%

YTD 4.46%

14,570

1D 0.28%

YTD 5.12%

17,220

1D 0.82%

YTD 1.41%

19,800

1D 0.05%

YTD 7.61%

27,360

1D 0.33%

YTD 5.11%

15,880

1D -0.06%

YTD 3.99%

1,186

1D 0.20%

YTD 0.00%

1,186

1D 0.14%

YTD 0.00%

1,184

1D 0.19%

YTD 0.00%

1,182

1D 0.16%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,065.86

1D 0.11%

YTD 7.77%

2,830.52

1D -1.83%

YTD -4.45%

15,703.45

1D -2.32%

YTD -6.46%

2,498.81

1D -0.07%

YTD -6.40%

71,141.12

1D -1.10%

YTD -1.05%

3,150.04

1D 0.31%

YTD -2.47%

1,373.14

1D -0.23%

YTD -4.20%

82.71

1D -0.02%

YTD 4.91%

2,036.67

1D 0.25%

YTD -1.93%

Asian stocks stumbled on Tuesday as the court-ordered liquidation of property giant China Evergrande weighed on sentiment while geopolitical tensions lifted oil prices and dented risk appetite ahead of the Federal Reserve's meeting. Uncertainty around how the court order to liquidate Evergrande Group, opens new tab will play out and its impact on the nation's fragile property market is keeping investors on edge.

VIETNAM ECONOMY

0.12%

YTD (bps) -348

4.70%

YTD (bps) -10

1.73%

1D (bps) 2

YTD (bps) -15

2.37%

1D (bps) 4

YTD (bps) 19

24,578

1D (%) -0.57%

YTD (%) 0.28%

27,151

1D (%) -0.66%

YTD (%) -0.82%

3,470

1D (%) -0.52%

YTD (%) -0.17%

Today, the domestic exchange rate at banks and on the "black market" dropped sharply. This morning, VCB decreased by VND30 in both buying and selling directions - the lowest decrease in the banking system. Other banks have reduced exchange rates from 55 to 100 VND. On the "black market", recorded at 9am this morning, the buying price and selling price both decreased by VND30 compared to yesterday morning.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is ready to supply rice in a strategic, long-term, stable manner at an affordable price to the Philippines;

- Many banks record positive profits from investment securities in 2023;

- The new policies take effect from February 2024;

- China discovers oilfield with 100 million tonnes of reserves;

- Vladimir Putin officially registered for March Presidential election in which he's all but certain to win;

- EU threatens to silence Hungary if it blocks Ukrainian funds.

VN30

BANK

91,000

1D -0.22%

5D -0.55%

Buy Vol. 1,279,566

Sell Vol. 1,721,503

48,450

1D -0.51%

5D -1.92%

Buy Vol. 2,584,126

Sell Vol. 2,106,926

32,200

1D -0.31%

5D 0.00%

Buy Vol. 7,834,461

Sell Vol. 7,139,285

35,200

1D -0.14%

5D -0.71%

Buy Vol. 9,132,030

Sell Vol. 7,771,837

19,700

1D -0.25%

5D 0.00%

Buy Vol. 31,968,947

Sell Vol. 16,189,297

22,100

1D -0.23%

5D 0.68%

Buy Vol. 26,236,689

Sell Vol. 26,436,972

21,850

1D 2.10%

5D 4.05%

Buy Vol. 13,324,904

Sell Vol. 9,672,222

18,300

1D 0.83%

5D -1.61%

Buy Vol. 15,129,121

Sell Vol. 16,780,044

30,700

1D 1.15%

5D 0.66%

Buy Vol. 24,110,315

Sell Vol. 24,248,817

20,900

1D 0.48%

5D -0.24%

Buy Vol. 6,861,490

Sell Vol. 5,978,140

25,950

1D 0.00%

5D -0.38%

Buy Vol. 12,394,280

Sell Vol. 12,723,254

12,300

1D 0.00%

5D 1.65%

Buy Vol. 40,740,824

Sell Vol. 46,544,611

23,000

1D 0.00%

5D -0.43%

Buy Vol. 1,667,820

Sell Vol. 2,367,025

MBB: The Board of Directors of MBBank has just approved the implementation of a private offering of 73 million shares to Viettel Group and SCIC. Of which, MBB offered to sell 43 million shares to Viettel and 30 million shares to SCIC. According to the Resolution, the offering price for Viettel and SCIC is 15,959 VND/share, expected to be offered in the first quarter of 2024.

OIL & GAS

76,400

1D -0.26%

5D 0.44%

Buy Vol. 983,279

Sell Vol. 17,853,841

11,500

1D 0.88%

5D -0.29%

Buy Vol. 22,096,856

Sell Vol. 968,241

34,750

1D 0.14%

5D -0.93%

Buy Vol. 576,268

Sell Vol. 2,687,358

GAS: PV GAS's Board of Directors announced approval of the main contents of the Nam Du - U Minh field gas transaction agreement between PV GAS and Mitra Energy (Nam Du), Mitra Energy (Tho Chu).

VINGROUP

42,700

1D 0.12%

5D -0.83%

Buy Vol. 2,401,151

Sell Vol. 6,198,326

42,000

1D 0.48%

5D -1.47%

Buy Vol. 6,471,072

Sell Vol. 12,339,208

23,400

1D 0.43%

5D -1.18%

Buy Vol. 18,339,828

Sell Vol. 4,157,937

VRE: In Q4/2023, VRE's net revenue reached VND9,791 billion, profit after tax reached VND4,409 billion, up 33% and 58.8% respectively over the same period.

FOOD & BEVERAGE

66,900

1D -0.15%

5D -2.07%

Buy Vol. 3,153,286

Sell Vol. 2,624,229

66,100

1D 0.76%

5D -5.14%

Buy Vol. 2,622,534

Sell Vol. 1,359,466

57,200

1D -1.21%

5D 5.32%

Buy Vol. 1,234,803

Sell Vol. 2,879,318

MSN: In 2023, MSN's consolidated net revenue has reached more than VND78,000 billion, an increase of nearly 3% compared to 2022,

OTHERS

65,300

1D 5.15%

5D 0.49%

Buy Vol. 3,470,036

Sell Vol. 523,609

41,000

1D -0.49%

5D 0.49%

Buy Vol. 393,011

Sell Vol. 523,609

105,600

1D -0.19%

5D 0.57%

Buy Vol. 723,373

Sell Vol. 905,958

95,600

1D -0.31%

5D 0.00%

Buy Vol. 1,815,770

Sell Vol. 2,050,189

45,400

1D 1.79%

5D 0.00%

Buy Vol. 12,395,495

Sell Vol. 12,646,760

22,950

1D 2.00%

5D 9.81%

Buy Vol. 7,764,307

Sell Vol. 7,558,617

34,150

1D 0.59%

5D 1.04%

Buy Vol. 24,102,812

Sell Vol. 25,514,398

28,000

1D 0.00%

5D -1.23%

Buy Vol. 32,097,457

Sell Vol. 29,991,229

MWG: In 2023, MWG's revenue has reached VND118,280 billion, down 11% compared to 2022. Of which, online revenue has contributed nearly VND16,900 billion, also down 11% compared to 2022, accounting for 14% of the total revenue. In terms of chains, Dien May Xanh still makes the largest contribution with a proportion of 46.7% of revenue; Bach Hoa Xanh chain's revenue accounts for 26.7%.

Market by numbers

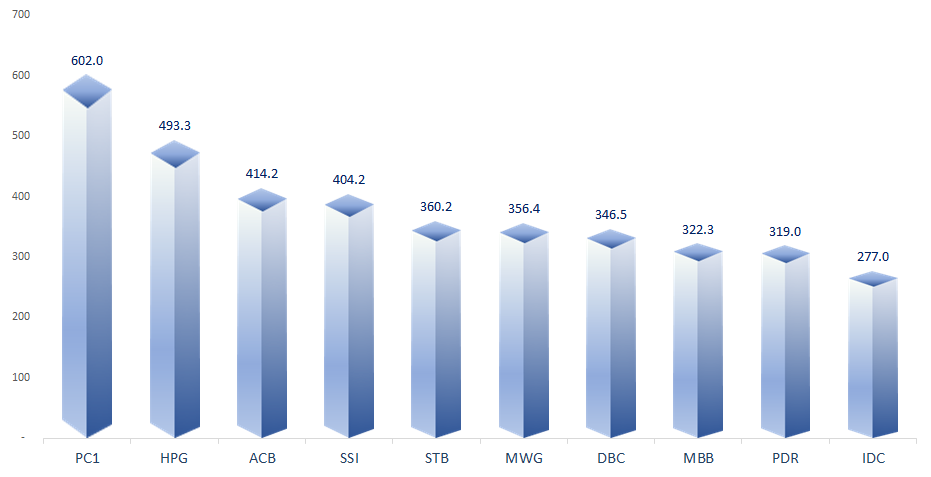

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

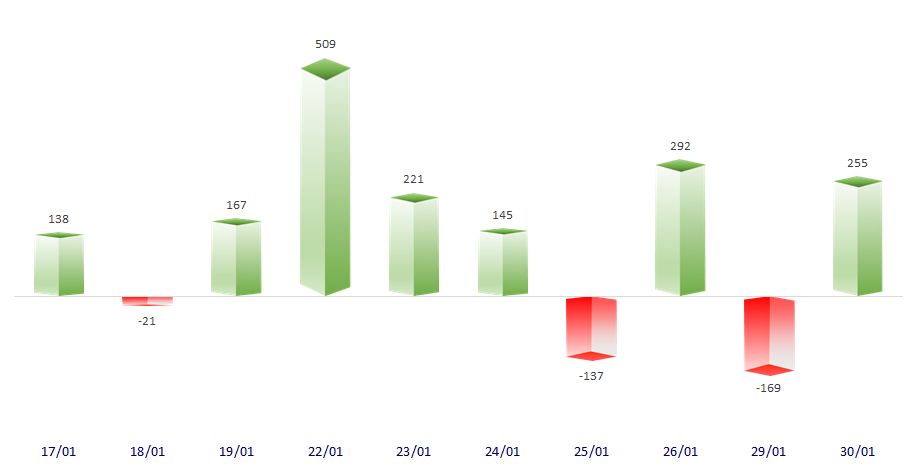

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

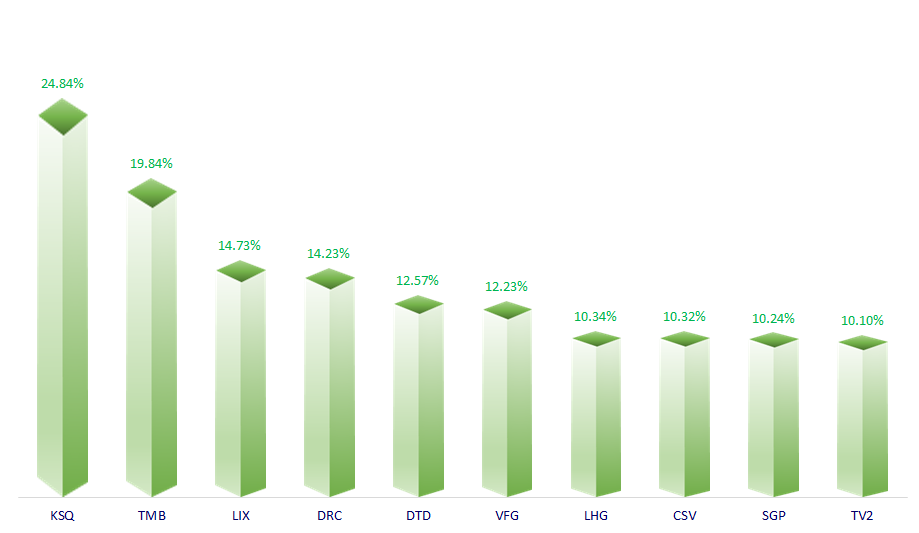

TOP INCREASES 3 CONSECUTIVE SESSIONS

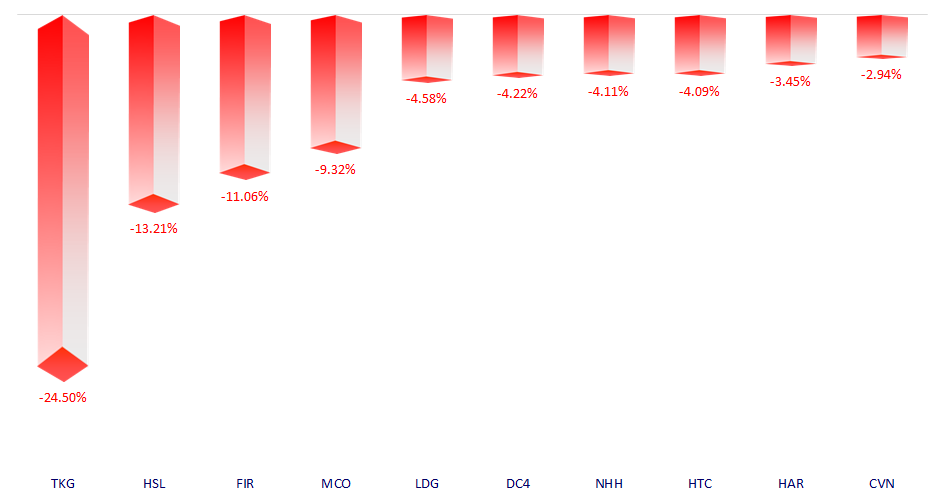

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.