Market Brief 02/07/2024

VIETNAM STOCK MARKET

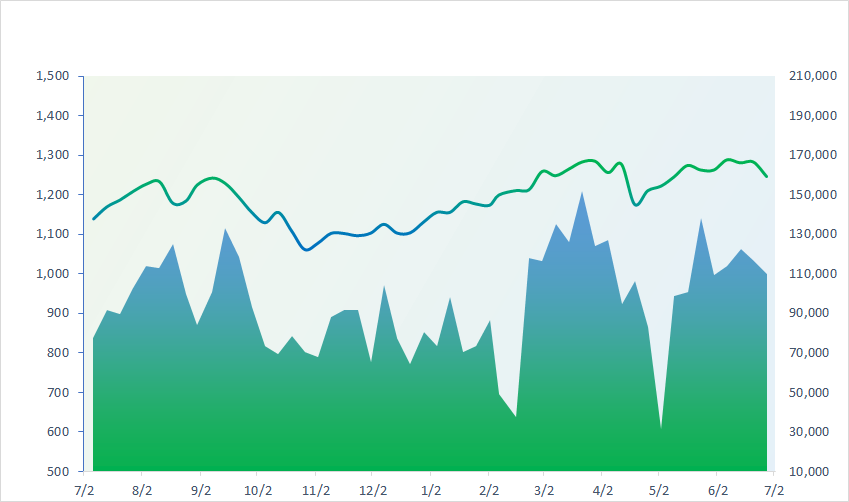

1,269.79

1D 1.21%

YTD 12.20%

240.80

1D 0.94%

YTD 4.70%

1,296.06

1D 0.82%

YTD 14.53%

97.58

1D 0.29%

YTD 11.42%

-18.69

1D 0.00%

YTD 0.00%

15,691.81

1D 5.41%

YTD -16.96%

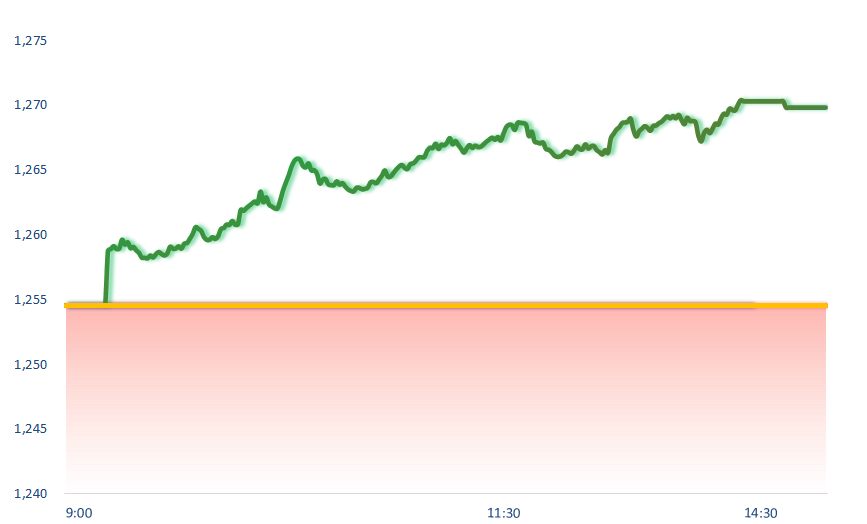

The market increased positively thanks to the leadership of the banking group. The trio of state-owned banks including VCB, BID, and CTG increased sharply from the beginning of the morning session. At the end of the session, VCB +2.4% and BID +4.2% contributed more than 5.6 points to VNIndex.

ETF & DERIVATIVES

22,600

1D -0.22%

YTD 15.72%

15,580

1D 1.17%

YTD 15.84%

16,100

1D 1.13%

YTD 16.16%

19,490

1D 0.78%

YTD 14.78%

20,590

1D 0.68%

YTD 11.90%

32,610

1D 1.15%

YTD 25.28%

17,530

1D 0.17%

YTD 14.80%

1,295

1D 0.79%

YTD 0.00%

1,297

1D 0.84%

YTD 0.00%

1,300

1D 0.93%

YTD 0.00%

1,301

1D 0.74%

YTD 0.00%

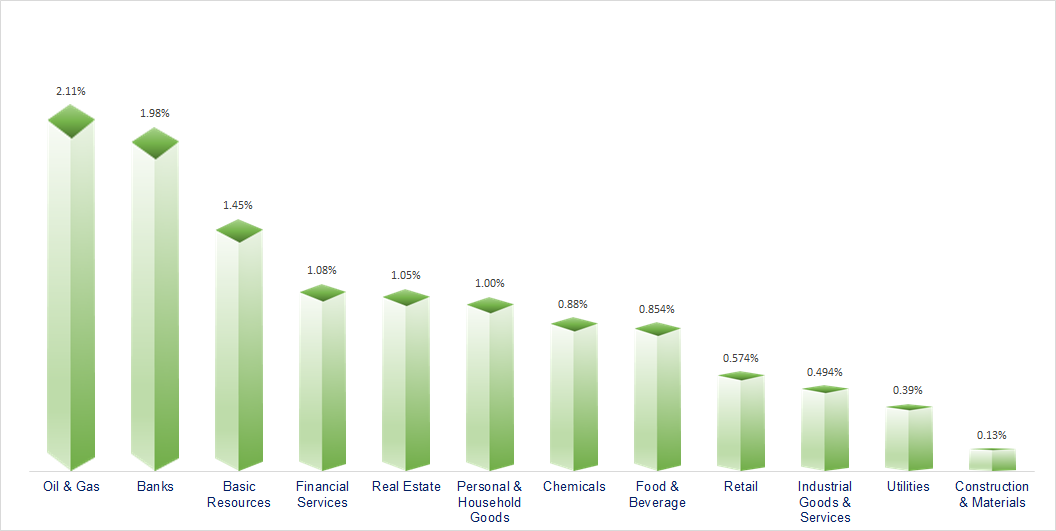

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,074.69

1D 1.12%

YTD 19.75%

2,997.01

1D 0.08%

YTD 1.17%

17,769.14

1D 0.29%

YTD 5.84%

2,780.86

1D -0.84%

YTD 4.16%

79,441.45

1D -0.04%

YTD 10.50%

3,367.90

1D 0.88%

YTD 4.27%

1,288.58

1D -0.83%

YTD -10.10%

87.17

1D 0.44%

YTD 13.17%

2,333.50

1D 0.03%

YTD 12.36%

Asia-Pacific markets were mixed on Tuesday. Japan’s Nikkei 225 rose 1.12% to close at a 3-month high. The Japanese yen weakened to as much as 161.67 against the dollar, staying at 38-year lows. The Bank of Japan is likely to cut bond purchases by about USD100 billion in the first year under a quantitative tightening plan to be released this month, according to a Reuters survey.

VIETNAM ECONOMY

4.51%

1D (bps) -35

YTD (bps) 91

4.60%

YTD (bps) -20

2.38%

YTD (bps) 50

2.73%

1D (bps) -4

YTD (bps) 55

25,465

1D (%) 0.00%

YTD (%) 3.90%

28,058

1D (%) -0.09%

YTD (%) 2.49%

357507.00%

1D (%) 0.09%

YTD (%) 2.85%

Today, the State Bank increased the central exchange rate by 1VND compared to yesterday, to 24,253 VND/USD. At some commercial banks, the selling exchange rate also has the same trend. The exchange rate on the "black market" has been stable for 3 consecutive sessions, around 25,900 - 25,980 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Real estate business revenue in Ho Chi Minh City increased again;

- Promoting exports through cross-border e-commerce;

- Total import-export turnover of the country reached 336.48 billion USD;

- CNN: Mr. Trump won in the first presidential debate;

- IMF slightly adjusted the US economic growth forecast to 2.6%;

- Chinese automakers are expected to account for 33% of the global market share by 2030.

- SBV net withdrew for the second consecutive month;

- SBV net withdrew for the second consecutive month;

- Vanguard sees Yen drop to 170 if BOJ bond policy disappoints;

- The U.S. Federal Reserve and European Central Bank could move to cut rates in September;

- China to buy another African mine for just USD2.

VN30

BANK

88,200

1D 2.44%

5D 3.16%

Buy Vol. 5,416,706

Sell Vol. 4,902,644

45,750

1D 4.21%

5D 3.51%

Buy Vol. 6,306,715

Sell Vol. 5,755,939

32,300

1D 0.94%

5D 2.22%

Buy Vol. 8,661,238

Sell Vol. 12,996,868

22,900

1D 1.10%

5D -4.58%

Buy Vol. 16,029,397

Sell Vol. 14,944,832

18,950

1D -0.26%

5D -0.26%

Buy Vol. 29,330,903

Sell Vol. 39,220,233

22,700

1D 1.11%

5D 0.44%

Buy Vol. 24,118,936

Sell Vol. 22,284,420

24,100

1D 4.33%

5D 6.64%

Buy Vol. 29,232,759

Sell Vol. 23,306,253

17,450

1D 0.58%

5D -0.57%

Buy Vol. 6,260,469

Sell Vol. 6,813,419

29,600

1D 1.02%

5D 0.00%

Buy Vol. 12,151,432

Sell Vol. 14,349,809

21,400

1D 0.94%

5D 0.47%

Buy Vol. 4,692,135

Sell Vol. 4,538,088

24,050

1D 1.05%

5D 0.00%

Buy Vol. 15,823,397

Sell Vol. 11,682,993

11,750

1D 1.29%

5D 3.07%

Buy Vol. 54,634,003

Sell Vol. 84,251,815

20,900

1D 0.24%

5D -1.18%

Buy Vol. 5,277,760

Sell Vol. 5,075,586

HDB: HDBank has just announced the Board of Directors' Resolution on dividend payment in 2023 at a rate of 30%, including 10% in cash and 20% in shares. Accordingly, the closing date is July 15, 2024.

OIL & GAS

78,200

1D 0.64%

5D -3.33%

Buy Vol. 1,634,999

Sell Vol. 17,744,016

14,500

1D -0.34%

5D 0.85%

Buy Vol. 22,000,082

Sell Vol. 1,600,906

41,350

1D 1.35%

5D 0.97%

Buy Vol. 1,514,859

Sell Vol. 3,188,031

POW: Total electricity output in 6 months is estimated at 8,574 million kWh, reaching 98% of the plan assigned by PVN and equal to 103% compared to the same period in 2023.

VINGROUP

41,600

1D 0.60%

5D 0.93%

Buy Vol. 2,527,783

Sell Vol. 10,761,021

38,150

1D 1.19%

5D 1.88%

Buy Vol. 9,098,197

Sell Vol. 22,793,016

21,700

1D -0.69%

5D 1.07%

Buy Vol. 18,169,689

Sell Vol. 5,212,903

VRE: In just one month, Vincom Retail has had 3 shopping centers in operation.

FOOD & BEVERAGE

66,200

1D 0.30%

5D 3.25%

Buy Vol. 3,728,674

Sell Vol. 7,936,722

76,300

1D 0.39%

5D 0.99%

Buy Vol. 4,180,316

Sell Vol. 1,032,149

61,200

1D 0.49%

5D 1.27%

Buy Vol. 1,051,602

Sell Vol. 1,392,301

The Vietnam Beer - Alcohol - Beverage Association has sent an official dispatch to the Ministry of Finance commenting on the shocking increase in special consumption tax.

OTHERS

63,800

1D 1.11%

5D 6.25%

Buy Vol. 1,349,968

Sell Vol. 3,508,710

47,600

1D 2.59%

5D 6.25%

Buy Vol. 2,612,215

Sell Vol. 3,508,710

101,000

1D 0.30%

5D -0.59%

Buy Vol. 1,692,502

Sell Vol. 1,348,449

128,000

1D -0.47%

5D -1.54%

Buy Vol. 14,096,881

Sell Vol. 10,460,805

66,000

1D 0.30%

5D 7.30%

Buy Vol. 15,979,092

Sell Vol. 15,713,568

34,600

1D 0.87%

5D 2.98%

Buy Vol. 3,652,599

Sell Vol. 4,073,007

34,350

1D 1.33%

5D -0.58%

Buy Vol. 12,553,631

Sell Vol. 13,672,385

28,700

1D 1.23%

5D 0.00%

Buy Vol. 36,088,821

Sell Vol. 41,534,962

MWG: In May, Bach Hoa Xanh chain recorded an average revenue of 2 billion VND/store, up from VND1.8 billion in the first quarter and VND1.9 billion in April. Accumulated revenue is estimated at VND15,800 billion, increased by 42% and contributed more than 29% of total revenue for MWG.

Market by numbers

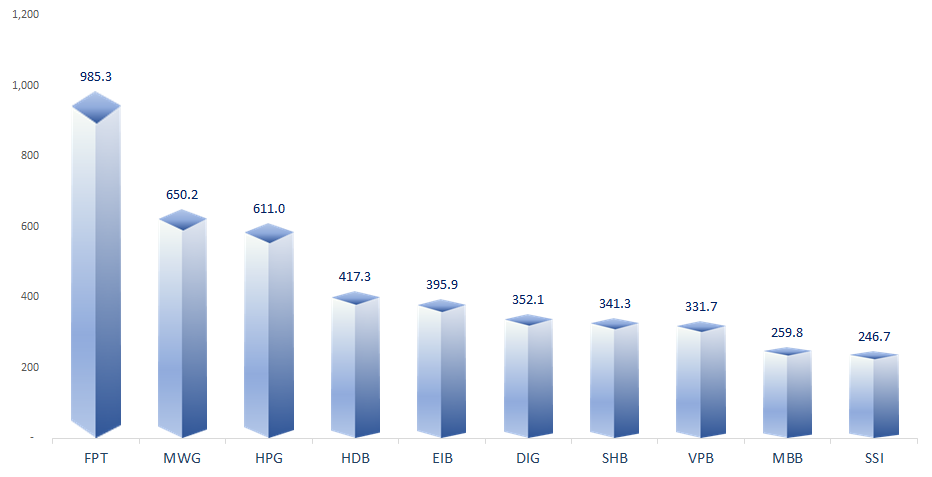

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

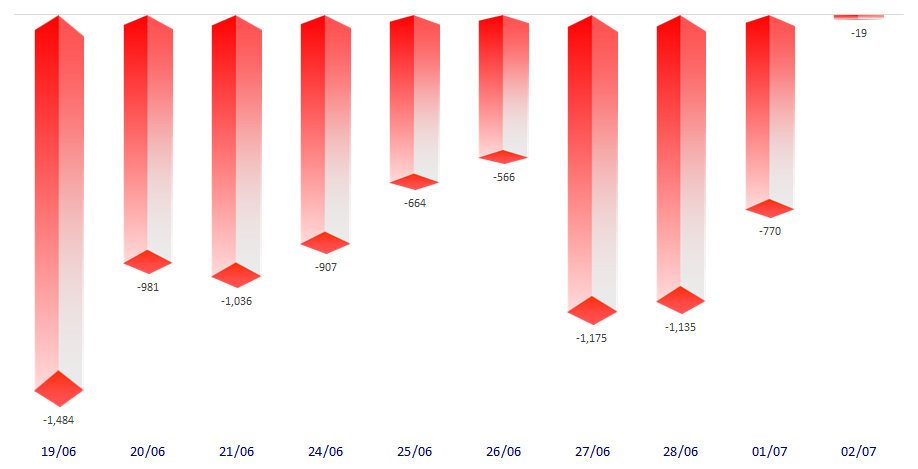

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

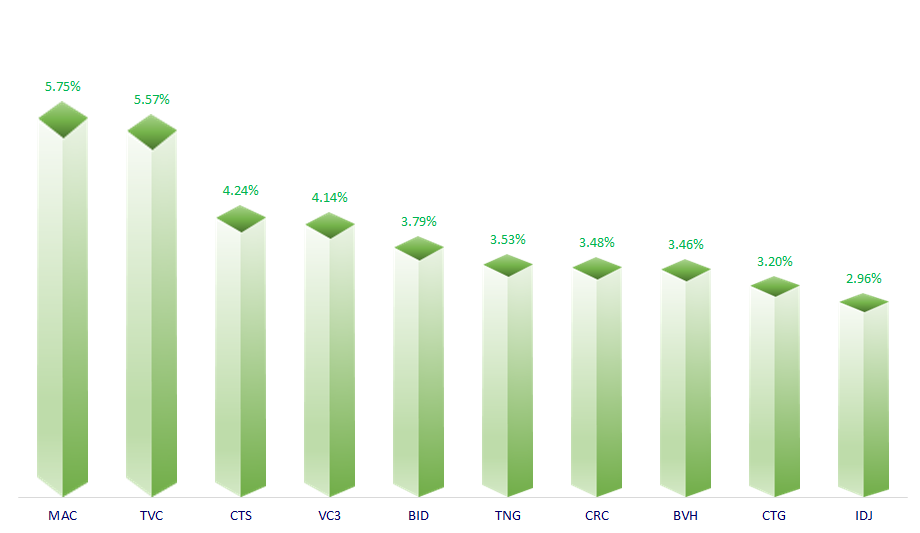

TOP INCREASES 3 CONSECUTIVE SESSIONS

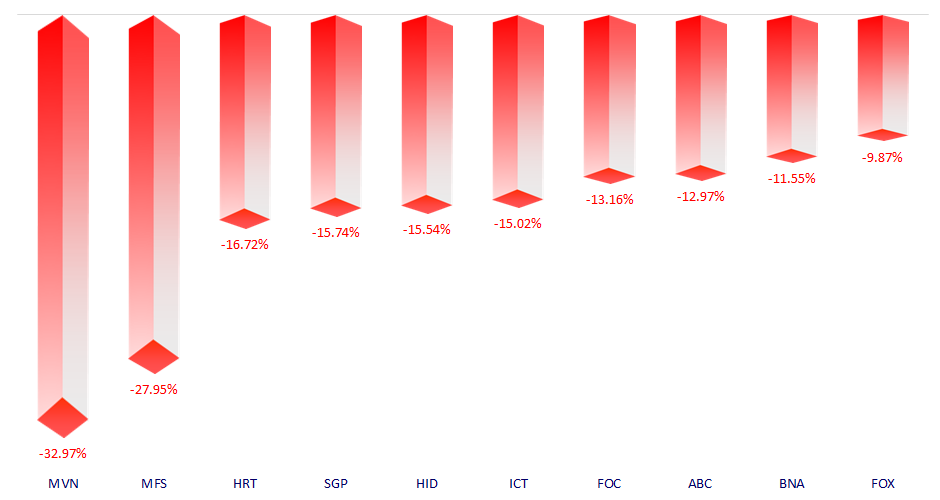

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.