Market Brief 24/07/2024

VIETNAM STOCK MARKET

1,238.47

1D 0.54%

YTD 9.43%

236.17

1D 0.67%

YTD 2.69%

1,280.51

1D 0.14%

YTD 13.16%

94.53

1D 0.14%

YTD 7.94%

288.98

1D 0.00%

YTD 0.00%

19,983.79

1D -1.19%

YTD 5.75%

The market has recovered after 3 consecutive sessions of decline, but liquidity is still low. Chemicals, fertilizers and rubber groups all prospered with the two most prominent stocks, GVR and CSV, both hitting the ceiling. Retail stocks were the most negative group, specifically DGW -5.5%, MWG -1.8%.

ETF & DERIVATIVES

22,310

1D -0.53%

YTD 14.23%

15,350

1D 0.00%

YTD 14.13%

15,960

1D -0.62%

YTD 15.15%

19,310

1D -0.46%

YTD 13.72%

20,650

1D -0.96%

YTD 12.23%

32,450

1D 0.00%

YTD 24.66%

17,300

1D -1.70%

YTD 13.29%

1,284

1D -0.05%

YTD 0.00%

1,286

1D -0.08%

YTD 0.00%

1,287

1D -0.08%

YTD 0.00%

1,288

1D 0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

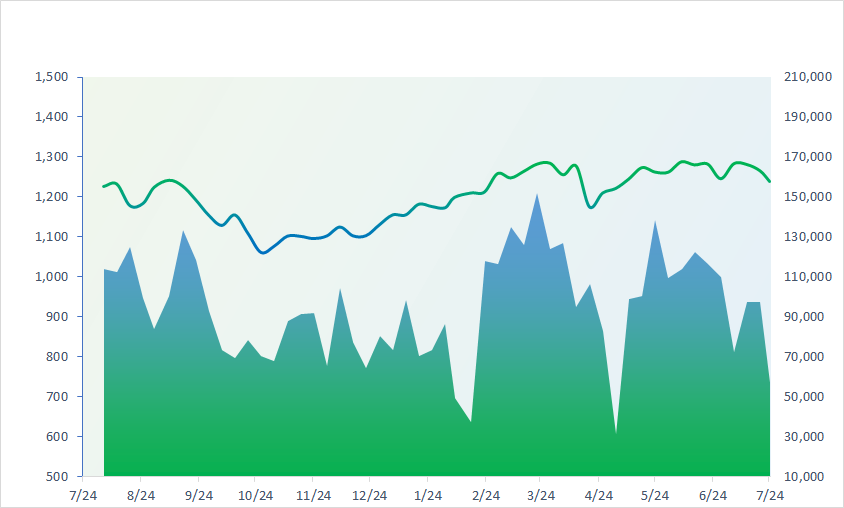

VNINDEX (12M)

GLOBAL MARKET

39,154.85

1D -1.11%

YTD 17.01%

2,901.95

1D -0.46%

YTD -2.04%

17,311.05

1D -0.91%

YTD 3.11%

2,758.71

1D -0.56%

YTD 3.33%

80,148.88

1D -0.35%

YTD 11.48%

3,460.82

1D -0.01%

YTD 7.15%

1,298.08

1D -0.27%

YTD -9.44%

81.66

1D 0.48%

YTD 6.02%

2,413.07

1D 0.22%

YTD 16.19%

Asia-Pacific markets fell Wednesday as traders assessed July business activity data from Japan and Australia, and tech earnings from the U.S. Japan’s Nikkei 225 dropped to close at 39,154.85, marking a one-month low. Japan’s composite purchasing managers’ index for July was at 52.6, up from 49.7 in June.

VIETNAM ECONOMY

4.66%

YTD (bps) 106

4.60%

YTD (bps) -20

2.45%

1D (bps) 6

YTD (bps) 57

2.77%

1D (bps) 5

YTD (bps) 59

2547700.00%

1D (%) 0.00%

YTD (%) 3.95%

2828152.00%

1D (%) 0.03%

YTD (%) 3.31%

356136.00%

1D (%) 0.12%

YTD (%) 2.46%

This mornig, the price of gold rings decreased slightly by 50,000 - 100,000 VND/tael compared to yesterday. Currently, the selling price is still above 77 million VND/tael. SJC gold price did not fluctuate when buying at 77.5 million VND/tael and selling at 79.5 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government discusses the North-South high-speed railway project;

- The Ministry of Industry and Trade recommends 6 solutions to promote import and export;

- Japanese flour miller Nippn will build a factory in Vietnam;

- Ms. Harris, whose campaign says she has secured the Democratic nomination, led Trump 44% to 42% in the national poll;

- Tesla's profit fell 45% in the second quarter;

- Warren Buffett's Berkshire Hathaway trims BYD stake to below 5%.

VN30

BANK

87,500

1D 0.00%

5D -0.57%

Buy Vol. 2,536,029

Sell Vol. 2,970,294

46,100

1D 0.22%

5D -3.96%

Buy Vol. 5,995,660

Sell Vol. 4,284,667

32,200

1D -0.62%

5D -2.42%

Buy Vol. 20,408,415

Sell Vol. 22,562,996

23,000

1D -0.22%

5D -2.95%

Buy Vol. 18,323,953

Sell Vol. 18,405,850

18,500

1D 0.54%

5D -2.63%

Buy Vol. 28,557,145

Sell Vol. 26,108,232

23,950

1D 0.21%

5D -2.24%

Buy Vol. 53,770,666

Sell Vol. 45,011,732

25,050

1D 0.00%

5D -0.60%

Buy Vol. 14,187,287

Sell Vol. 12,796,039

17,950

1D 1.13%

5D 0.56%

Buy Vol. 33,248,303

Sell Vol. 27,192,177

29,200

1D 0.69%

5D -3.95%

Buy Vol. 27,113,597

Sell Vol. 21,201,134

21,000

1D -0.47%

5D -2.78%

Buy Vol. 6,238,266

Sell Vol. 7,065,001

24,200

1D 0.83%

5D -1.22%

Buy Vol. 22,736,415

Sell Vol. 19,870,880

11,100

1D 0.91%

5D -2.20%

Buy Vol. 36,774,509

Sell Vol. 39,350,220

21,950

1D 2.33%

5D 5.53%

Buy Vol. 3,645,984

Sell Vol. 5,254,549

VPB: Chairman of the Board of Directors Ngo Chi Dung and a group of related shareholders increased their ownership ratio at VPBank from more than 14% at the end of 2023 to nearly 34% as of July 19.

OIL & GAS

77,000

1D 0.26%

5D -5.04%

Buy Vol. 2,147,795

Sell Vol. 1,606,699

13,200

1D 2.72%

5D 3.33%

Buy Vol. 32,654,124

Sell Vol. 22,667,425

46,500

1D 2.20%

5D 0.74%

Buy Vol. 6,123,841

Sell Vol. 5,220,071

Vietnam plans to import 4.5 million tons of petroleum in the second half of 2024.

VINGROUP

40,900

1D 0.12%

5D 1.47%

Buy Vol. 2,827,480

Sell Vol. 3,492,940

37,850

1D 0.00%

5D 2.03%

Buy Vol. 7,757,476

Sell Vol. 9,289,134

20,150

1D 0.50%

5D -0.15%

Buy Vol. 13,115,151

Sell Vol. 14,365,745

VRE: In the first 6 months of 2024, VRE's net revenue reached VND4,733 billion, profit after tax reached VND2,104 billion, up 15% and 4% over the same period, respectively.

FOOD & BEVERAGE

65,600

1D -0.46%

5D -0.42%

Buy Vol. 5,966,637

Sell Vol. 6,370,062

71,500

1D 0.70%

5D 1.11%

Buy Vol. 6,334,155

Sell Vol. 5,987,119

54,600

1D -0.18%

5D -0.74%

Buy Vol. 795,244

Sell Vol. 880,463

VNM: Foreign investors returned to net buying VNM shares for the third consecutive session with a total net buying value of more than VND196 billion in three sessions.

OTHERS

66,900

1D 0.30%

5D -8.51%

Buy Vol. 1,826,265

Sell Vol. 1,705,426

42,450

1D -2.41%

5D 2.27%

Buy Vol. 2,437,762

Sell Vol. 2,510,136

107,900

1D 1.79%

5D -4.47%

Buy Vol. 1,173,924

Sell Vol. 1,456,826

126,000

1D 0.40%

5D -3.31%

Buy Vol. 7,463,664

Sell Vol. 6,890,003

61,400

1D -1.76%

5D -8.02%

Buy Vol. 24,697,918

Sell Vol. 25,948,684

32,700

1D 6.86%

5D -3.66%

Buy Vol. 12,681,328

Sell Vol. 6,624,483

32,900

1D -2.81%

5D -1.77%

Buy Vol. 38,525,414

Sell Vol. 38,387,297

27,700

1D -0.36%

5D 0.00%

Buy Vol. 37,186,567

Sell Vol. 37,361,019

GVR: Thanks to the surge at the end of the session, GVR has become the gaining stock with the most influence on VNIndex today.

Market by numbers

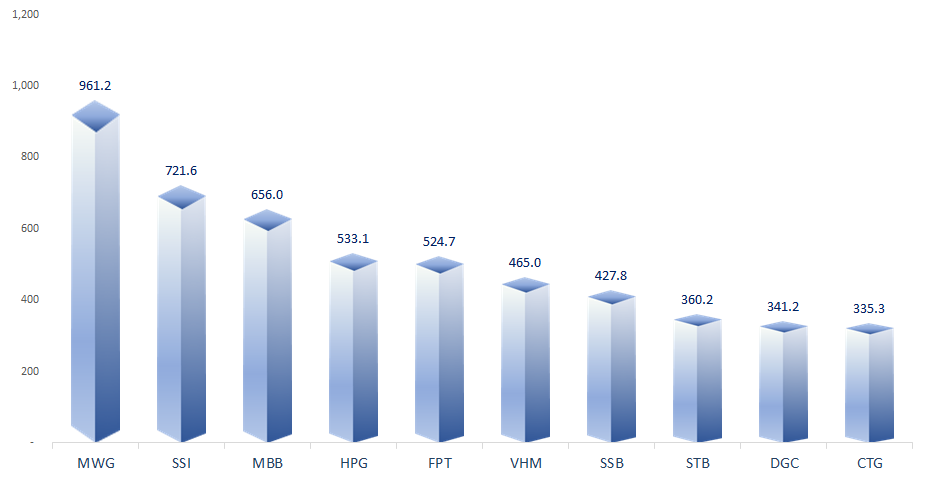

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.