Market Brief 21/08/2024

VIETNAM STOCK MARKET

1,284.05

1D 0.90%

YTD 13.46%

238.42

1D 0.47%

YTD 3.67%

1,317.69

1D 0.95%

YTD 16.44%

94.48

1D 0.40%

YTD 7.88%

-321.83

1D 0.00%

YTD 0.00%

22,973.95

1D 8.67%

YTD 21.58%

The market continued to have 4 consecutive sessions of increase. Banking stocks led the market today, with VCB +2.2%, CTG and BID both up 3%, NAB +4%, BVB +2.6%, MBB +2.1%.

ETF & DERIVATIVES

22,990

1D 0.88%

YTD 17.72%

15,800

1D 0.89%

YTD 17.47%

16,380

1D 0.31%

YTD 18.18%

19,740

1D 0.92%

YTD 16.25%

20,740

1D 1.07%

YTD 12.72%

33,680

1D 0.84%

YTD 29.39%

17,770

1D 1.02%

YTD 16.37%

1,312

1D 0.80%

YTD 0.00%

1,314

1D 0.87%

YTD 0.00%

1,313

1D 0.68%

YTD 0.00%

1,314

1D 0.72%

YTD 0.00%

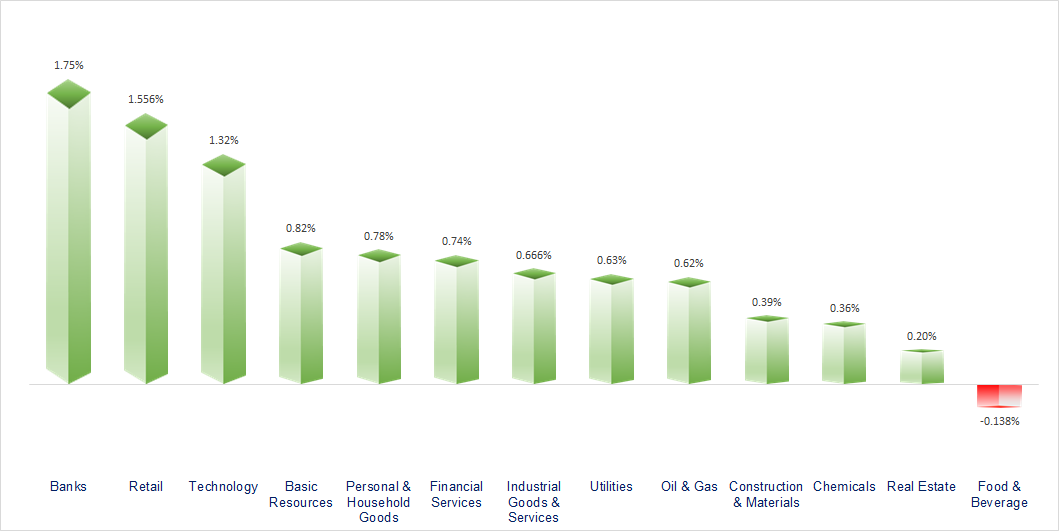

CHANGE IN PRICE BY SECTOR

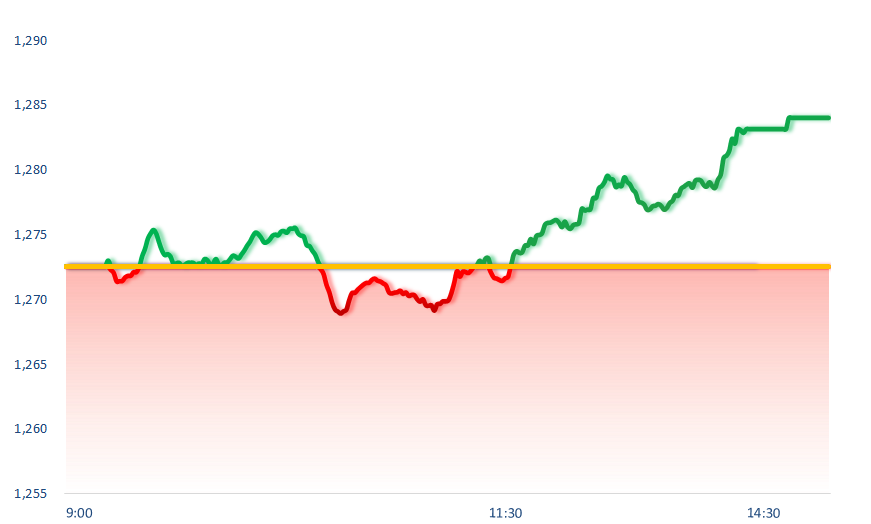

INTRADAY VNINDEX

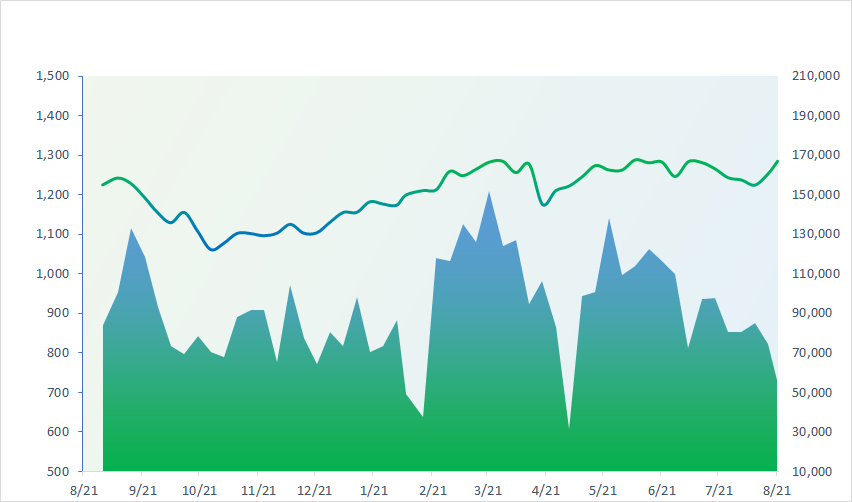

VNINDEX (12M)

GLOBAL MARKET

37,951.80

1D -0.29%

YTD 13.41%

2,856.58

1D -0.35%

YTD -3.57%

17,391.01

1D -0.69%

YTD 3.59%

2,701.13

1D 0.17%

YTD 1.17%

80,905.30

1D 0.13%

YTD 12.54%

3,373.76

1D 0.10%

YTD 4.45%

1,337.83

1D 0.73%

YTD -6.67%

77.64

1D 0.60%

YTD 0.80%

2,505.89

1D -0.44%

YTD 20.66%

Asia-Pacific markets were mixed on Wednesday. Japan’s Nikkei 225 slipped 0.29% after the trade data release. Japan’s trade data for July showed exports rose 10.3% year on year and imports grew 16.6%. With exports coming in lower than expected and imports rising more than expected, Japan swung to a trade deficit of USD4.28 billion.

VIETNAM ECONOMY

4.50%

YTD (bps) 90

4.60%

YTD (bps) -20

2.35%

1D (bps) -1

YTD (bps) 47

2.74%

1D (bps) 6

YTD (bps) 56

2509000.00%

1D (%) 0.08%

YTD (%) 2.37%

2850257.00%

1D (%) 0.15%

YTD (%) 4.12%

356828.00%

1D (%) 0.20%

YTD (%) 2.65%

On August 21, the State Bank of Vietnam listed the central exchange rate at 24,246 VND/USD, down VND5 compared to yesterday's session. Also in yesterday's session, SBV reduced the interest rate on T-bills from 4.25%/year to 4.2%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ministry of Transport proposes 5 levels of tolls for expressways invested by the State;

- More than 30,000 F&B stores have closed in the first half of the year;

- Ministry of Finance requests provinces to calculate land rental prices early;

- Sugar prices hit bottom in nearly 2 years;

- Gloomy outlook for China's steel market;

- Europe slashes tariffs for Tesla vehicles made in China.

VN30

BANK

92,800

1D 2.20%

5D 5.45%

Buy Vol. 4,958,315

Sell Vol. 4,945,527

50,600

1D 2.95%

5D 7.55%

Buy Vol. 9,987,402

Sell Vol. 11,131,482

34,200

1D 3.01%

5D 7.55%

Buy Vol. 48,069,245

Sell Vol. 38,457,790

22,000

1D 0.69%

5D 3.77%

Buy Vol. 36,380,332

Sell Vol. 30,636,351

18,750

1D 0.81%

5D 4.17%

Buy Vol. 58,861,251

Sell Vol. 63,038,092

24,750

1D 2.06%

5D 5.77%

Buy Vol. 43,658,641

Sell Vol. 38,589,175

27,100

1D 1.12%

5D 4.63%

Buy Vol. 9,217,787

Sell Vol. 10,464,854

17,900

1D 1.99%

5D 4.07%

Buy Vol. 32,873,480

Sell Vol. 28,426,523

29,950

1D 1.01%

5D 2.57%

Buy Vol. 14,289,263

Sell Vol. 15,363,092

21,350

1D -0.23%

5D 3.64%

Buy Vol. 10,767,738

Sell Vol. 13,254,133

24,400

1D 1.24%

5D 3.61%

Buy Vol. 14,804,615

Sell Vol. 13,440,877

10,700

1D 0.47%

5D 2.39%

Buy Vol. 39,904,158

Sell Vol. 35,447,223

21,650

1D 0.23%

5D 0.23%

Buy Vol. 4,582,181

Sell Vol. 3,781,166

According to the State Bank, as of the end of June, the credit growth of the whole system reached 6% compared to the end of last year. In terms of scale, BIDV, VCB, CTG and Agribank continued to maintain the top positions in lending.

OIL & GAS

85,000

1D 0.59%

5D 3.66%

Buy Vol. 3,876,281

Sell Vol. 4,117,992

13,750

1D 1.85%

5D 3.00%

Buy Vol. 27,535,841

Sell Vol. 32,864,852

48,800

1D -1.31%

5D -0.81%

Buy Vol. 6,758,352

Sell Vol. 5,745,156

VPI forecasts that gasoline prices will decrease slightly in the operating period on August 22.

VINGROUP

41,850

1D 0.36%

5D 2.57%

Buy Vol. 3,806,126

Sell Vol. 3,862,348

39,750

1D 0.89%

5D 6.85%

Buy Vol. 22,094,353

Sell Vol. 23,577,591

18,900

1D 0.80%

5D 5.00%

Buy Vol. 13,615,524

Sell Vol. 23,288,375

From August 20 to November 30, VinFast offers a 50% discount on registration fees for VF 6/7/8/9 models, directly reducing the selling price.

FOOD & BEVERAGE

75,300

1D -0.40%

5D 1.76%

Buy Vol. 8,390,080

Sell Vol. 8,953,988

77,500

1D -0.13%

5D 1.31%

Buy Vol. 8,650,186

Sell Vol. 10,224,701

57,400

1D -1.03%

5D 3.05%

Buy Vol. 1,352,206

Sell Vol. 1,712,218

MSN: In the second quarter, WinCommerce's revenue reached VND7,844 billion, up 9.2% over the same period.

OTHERS

72,000

1D -0.69%

5D 0.00%

Buy Vol. 1,469,883

Sell Vol. 2,361,759

44,700

1D 0.45%

5D 3.23%

Buy Vol. 1,055,810

Sell Vol. 1,184,754

104,900

1D -0.47%

5D 2.34%

Buy Vol. 821,759

Sell Vol. 1,186,987

133,500

1D 1.52%

5D 3.09%

Buy Vol. 10,268,758

Sell Vol. 10,571,717

69,800

1D 0.43%

5D 4.80%

Buy Vol. 15,293,635

Sell Vol. 15,639,314

35,250

1D 0.43%

5D 5.54%

Buy Vol. 4,614,636

Sell Vol. 4,586,544

33,050

1D 1.23%

5D 5.25%

Buy Vol. 26,033,454

Sell Vol. 25,403,607

26,150

1D 1.36%

5D 2.75%

Buy Vol. 42,104,787

Sell Vol. 45,234,154

FPT was the stock that foreign investors bought the most today with a value of VND273 billion.

Market by numbers

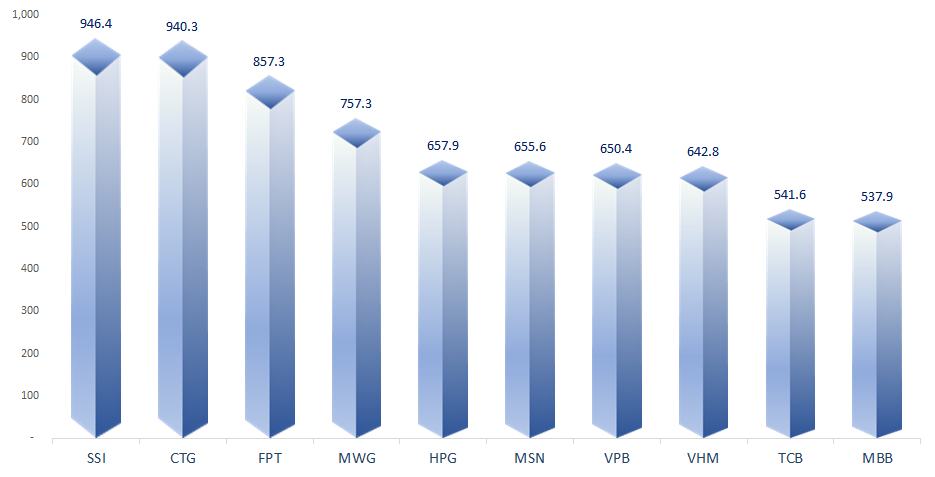

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

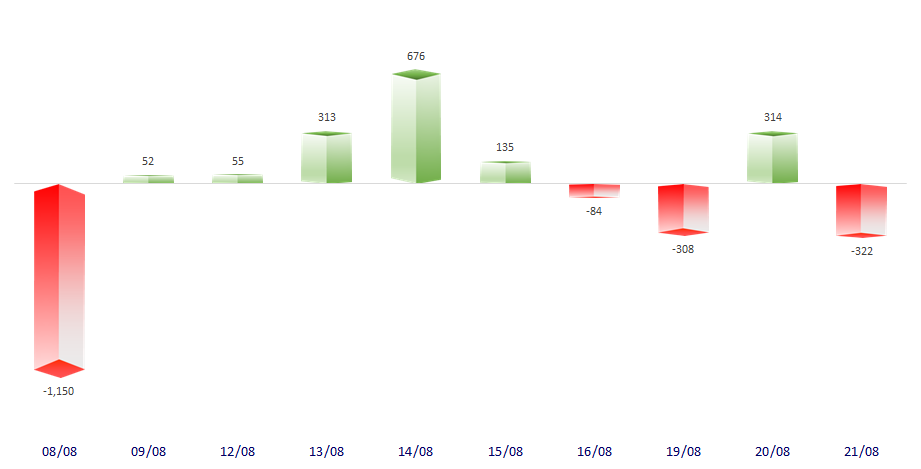

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

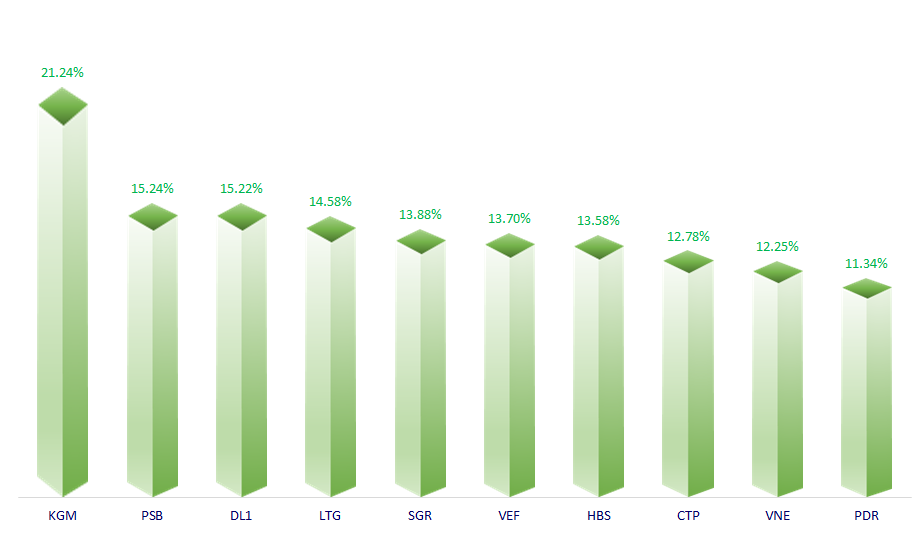

TOP INCREASES 3 CONSECUTIVE SESSIONS

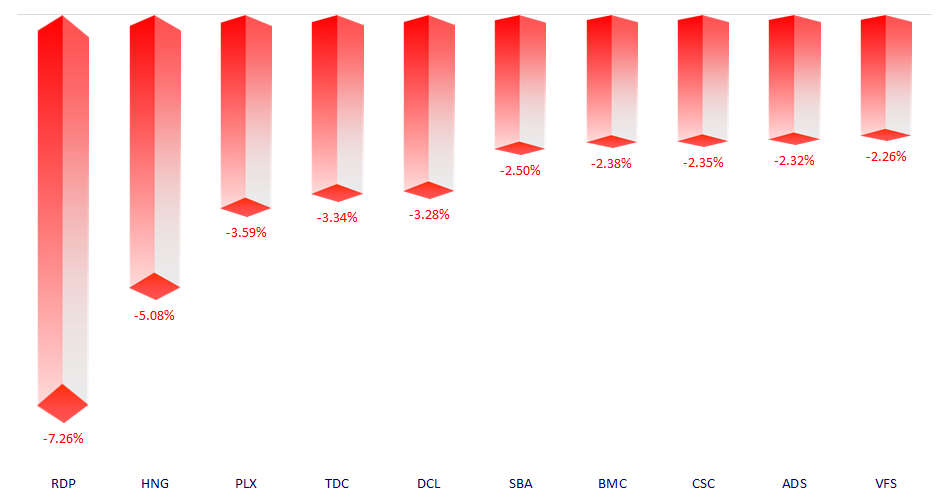

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.