Market brief 18/09/2024

VIETNAM STOCK MARKET

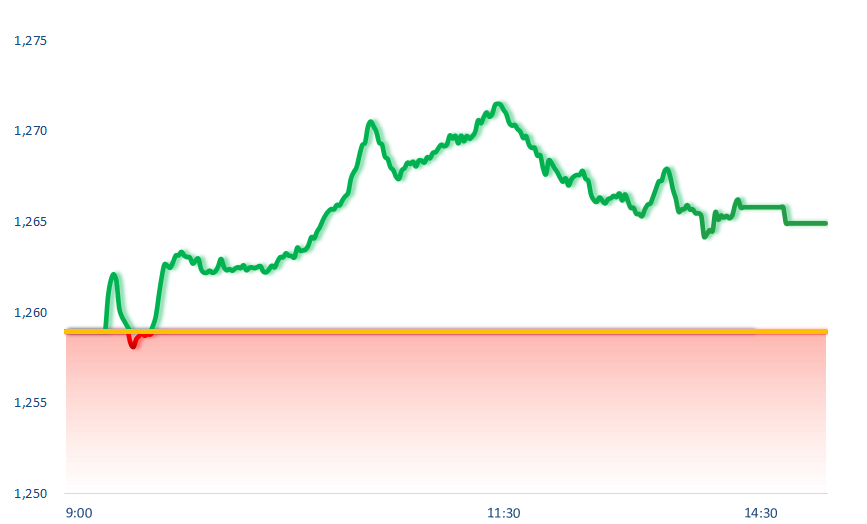

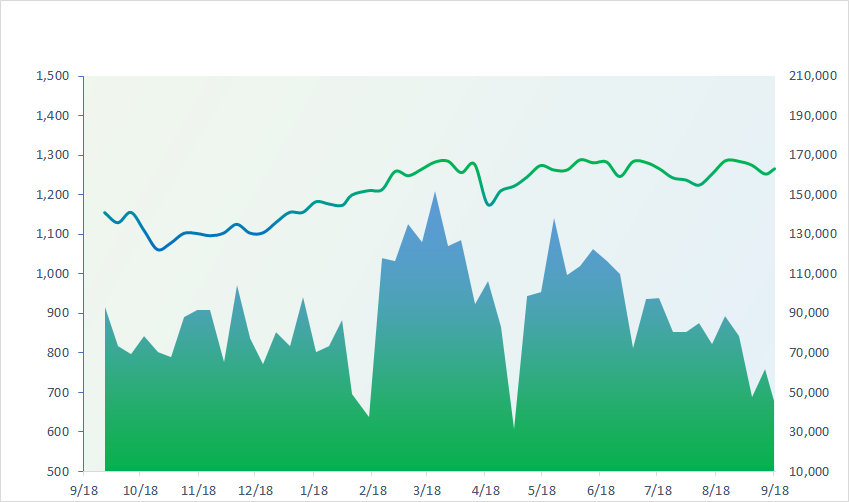

1,264.90

1D 0.47%

YTD 11.77%

232.95

1D 0.28%

YTD 1.29%

1,310.94

1D 0.56%

YTD 15.84%

93.47

1D 0.38%

YTD 6.73%

301.18

1D 0.00%

YTD 0.00%

20,122.40

1D 33.33%

YTD 6.49%

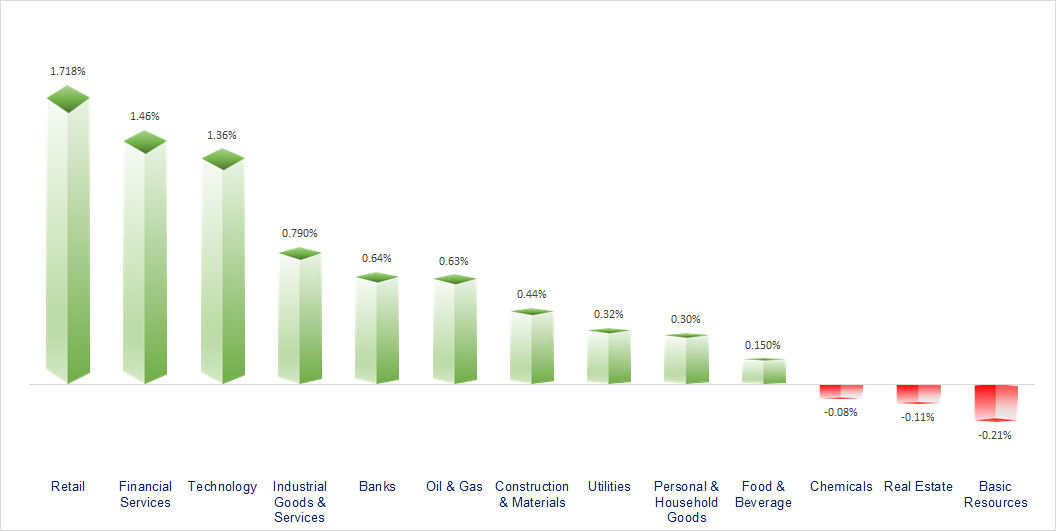

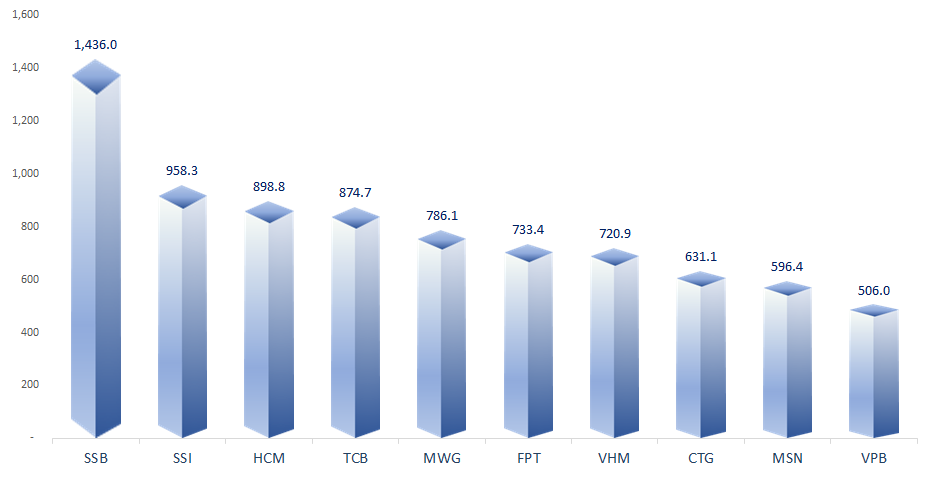

VNIndex had a second session of gains ahead of the Fed meeting tonight. Telecommunications, airlines and financial services were the most active sectors. In contrast, basic resources and real estate were quite gloomy.

ETF & DERIVATIVES

22,940

1D 0.53%

YTD 17.46%

15,800

1D 0.77%

YTD 17.47%

16,350

1D 0.93%

YTD 17.97%

19,630

1D 0.67%

YTD 15.61%

20,750

1D 1.22%

YTD 12.77%

33,180

1D 0.58%

YTD 27.47%

17,600

1D 1.09%

YTD 15.26%

1,312

1D 0.47%

YTD 0.00%

1,315

1D 0.60%

YTD 0.00%

1,311

1D 0.65%

YTD 0.00%

1,314

1D 0.91%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,380.17

1D 0.49%

YTD 8.71%

2,717.28

1D 0.49%

YTD -8.27%

17,660.02

1D 0.00%

YTD 5.19%

2,575.41

1D 0.00%

YTD -3.54%

82,948.23

1D -0.16%

YTD 15.38%

3,589.30

1D -0.09%

YTD 11.13%

1,435.77

1D -0.06%

YTD 0.17%

72.68

1D -1.13%

YTD -5.64%

2,576.36

1D 0.08%

YTD 24.06%

Asian stocks were mixed on Tuesday. While South Korea and Hong Kong markets were closed for the Mid-Autumn Festival, China resumed trading. Japan's Nikkei 225 index was upbeat after the country's finance ministry reported a 2.3% rise in imports and a 5.6% rise in exports in August.

VIETNAM ECONOMY

3.22%

1D (bps) -1

YTD (bps) -38

4.60%

YTD (bps) -20

2.14%

1D (bps) -15

YTD (bps) 25

2.67%

1D (bps) 4

YTD (bps) 49

2477000.00%

1D (%) -0.11%

YTD (%) 1.06%

2814800.00%

1D (%) -0.13%

YTD (%) 2.82%

354200.00%

1D (%) 0.00%

YTD (%) 1.90%

On the interbank market, the closing exchange rate on September 17 was VND24,630/USD, a sharp increase of VND80 compared to the session on September 16. The USD exchange rate listed at domestic banks also increased sharply. Recorded this morning (September 18), the USD price at banks was adjusted to increase by VND80-120/USD compared to the same time yesterday.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interbank interest rates fall sharply;

- Central government discusses North-South high-speed railway project;

- Finding ways to remove bottlenecks in disbursing public investment capital in Bac Ninh;

- Fed meeting tonight: 3 signals to watch out for besides interest rate decision;

- India is considering easing restrictions on non-basmati rice exports;

- Reuters: US may buy back up to 6 million barrels of strategic oil reserves.

VN30

BANK

91,000

1D 0.55%

5D 2.94%

Buy Vol. 2,562,766

Sell Vol. 3,497,524

49,050

1D 0.72%

5D 1.55%

Buy Vol. 4,286,006

Sell Vol. 4,657,442

35,700

1D 2.15%

5D 2.15%

Buy Vol. 29,225,452

Sell Vol. 35,085,770

23,000

1D 1.10%

5D 4.07%

Buy Vol. 29,244,638

Sell Vol. 31,170,075

18,650

1D 0.00%

5D 2.19%

Buy Vol. 45,319,645

Sell Vol. 43,790,707

24,400

1D 0.62%

5D 2.09%

Buy Vol. 31,477,325

Sell Vol. 30,228,625

26,700

1D 0.38%

5D 1.33%

Buy Vol. 8,257,791

Sell Vol. 7,813,982

18,250

1D 0.55%

5D 2.24%

Buy Vol. 25,792,701

Sell Vol. 36,584,829

30,250

1D 1.34%

5D 2.20%

Buy Vol. 28,333,227

Sell Vol. 29,810,366

18,250

1D 0.55%

5D 2.24%

Buy Vol. 5,953,686

Sell Vol. 6,439,845

24,650

1D 0.61%

5D 2.07%

Buy Vol. 14,202,012

Sell Vol. 16,209,229

10,350

1D -0.48%

5D 0.49%

Buy Vol. 24,417,931

Sell Vol. 29,403,024

15,600

1D 0.97%

5D -2.50%

Buy Vol. 4,247,660

Sell Vol. 3,017,274

VCB: Vietcombank's Chairman said the bank is still working closely with an international consulting organization to implement the private share issuance plan. With the current progress, Vietcombank expects to complete the private issuance plan in the first half of 2025 if the market develops favorably.

OIL & GAS

73,100

1D 0.55%

5D -3.91%

Buy Vol. 1,382,776

Sell Vol. 1,726,496

12,750

1D 1.59%

5D -0.78%

Buy Vol. 13,162,241

Sell Vol. 14,052,368

45,000

1D 0.00%

5D -1.75%

Buy Vol. 2,220,900

Sell Vol. 2,088,219

POW: PV Power charging station is testing the final steps.

VINGROUP

42,650

1D -0.58%

5D -0.81%

Buy Vol. 4,537,125

Sell Vol. 5,447,334

43,900

1D -0.23%

5D 2.09%

Buy Vol. 22,627,237

Sell Vol. 29,850,051

19,150

1D -1.29%

5D 0.26%

Buy Vol. 13,541,369

Sell Vol. 24,711,778

VHM: Royal Island Hai Phong product absorption rate reaches 95%.

FOOD & BEVERAGE

73,300

1D -0.14%

5D -1.74%

Buy Vol. 4,504,614

Sell Vol. 6,139,621

74,400

1D -0.13%

5D -0.93%

Buy Vol. 4,573,167

Sell Vol. 6,915,462

56,100

1D -0.71%

5D 1.26%

Buy Vol. 1,116,441

Sell Vol. 1,139,443

MSN: Masan Consumer raises dividend rate by 168%.

OTHERS

71,400

1D 0.00%

5D 0.00%

Buy Vol. 756,476

Sell Vol. 1,152,103

42,850

1D 0.00%

5D -0.58%

Buy Vol. 435,604

Sell Vol. 568,387

105,100

1D 0.10%

5D 0.10%

Buy Vol. 1,084,359

Sell Vol. 1,207,395

134,600

1D 1.28%

5D 3.06%

Buy Vol. 7,716,111

Sell Vol. 10,020,572

68,200

1D 2.10%

5D 0.59%

Buy Vol. 16,528,067

Sell Vol. 15,672,908

35,550

1D -0.14%

5D 4.25%

Buy Vol. 6,381,823

Sell Vol. 8,358,425

33,400

1D 2.14%

5D 2.77%

Buy Vol. 48,450,291

Sell Vol. 54,811,990

25,100

1D -0.59%

5D -0.99%

Buy Vol. 22,758,753

Sell Vol. 33,158,376

FPT: According to information from FPT, the number of employees has exceeded 80,000, the highest in history. FPT currently has more than 80,013 employees working in 30 countries around the world.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

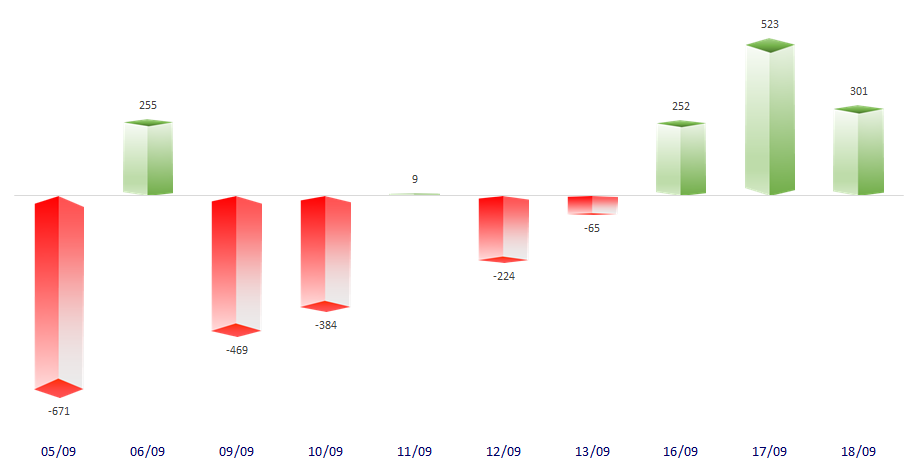

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

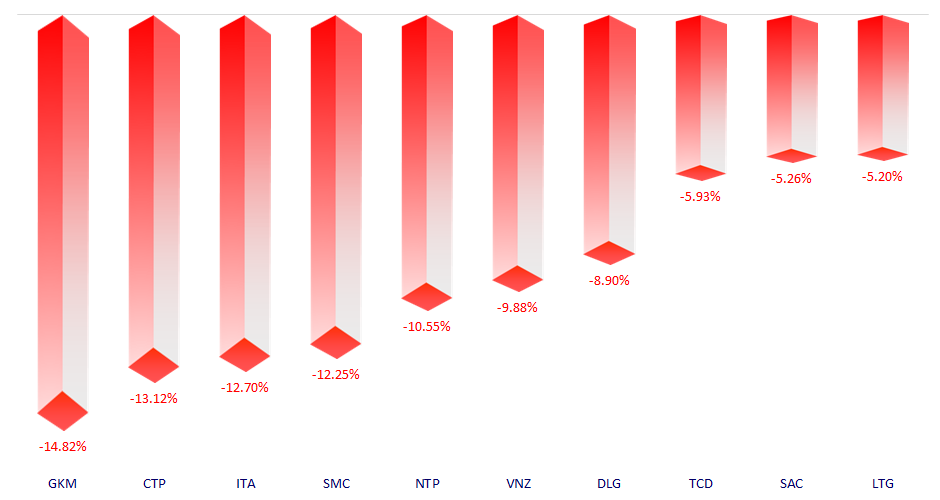

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.