Market Brief 27/09/2024

VIETNAM STOCK MARKET

1,290.92

1D -0.04%

YTD 14.07%

235.71

1D -0.09%

YTD 2.49%

1,352.57

1D 0.13%

YTD 19.52%

90.90

1D -2.78%

YTD 3.79%

230.04

1D 0.00%

YTD 0.00%

24,038.63

1D 0.26%

YTD 27.21%

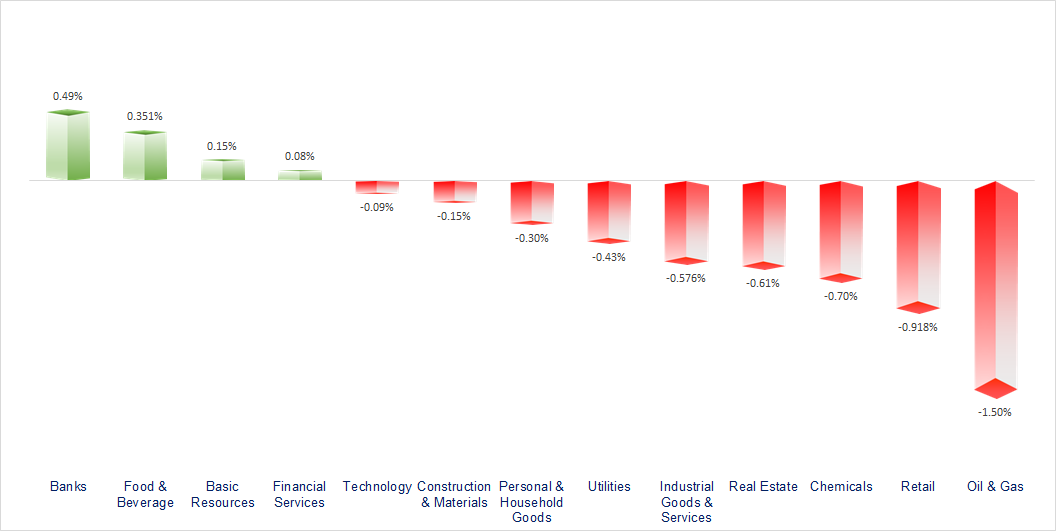

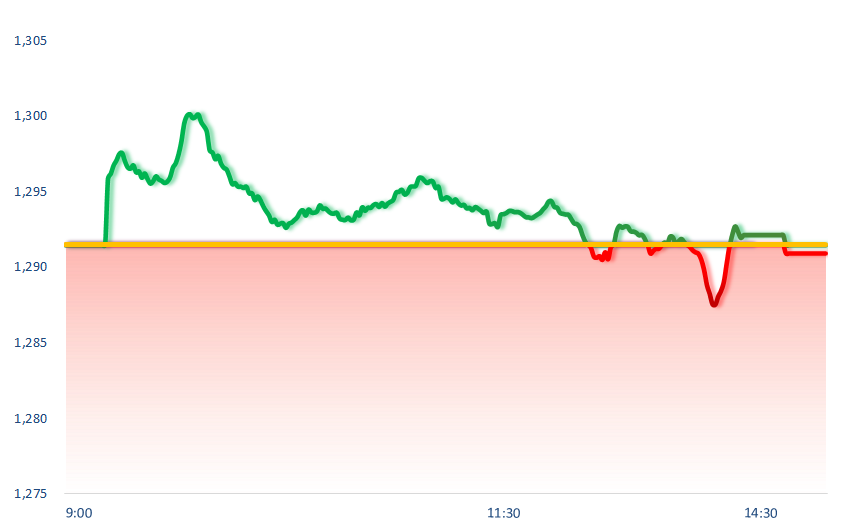

The market had a volatile session after reaching the 1,300 point mark. Banks, food and beverage and basic resources were the most positive sectors. The trio of banking stocks, including CTG, STB and SHB, contributed nearly 1.5 points to the VNIndex.

ETF & DERIVATIVES

23,680

1D -0.08%

YTD 21.25%

16,280

1D 0.43%

YTD 21.04%

16,890

1D 0.06%

YTD 21.86%

20,200

1D 0.00%

YTD 18.96%

22,000

1D 0.69%

YTD 19.57%

33,870

1D -0.38%

YTD 30.12%

18,000

1D -0.88%

YTD 17.88%

1,356

1D -0.07%

YTD 0.00%

1,357

1D -0.09%

YTD 0.00%

1,355

1D -0.18%

YTD 0.00%

1,355

1D -0.01%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

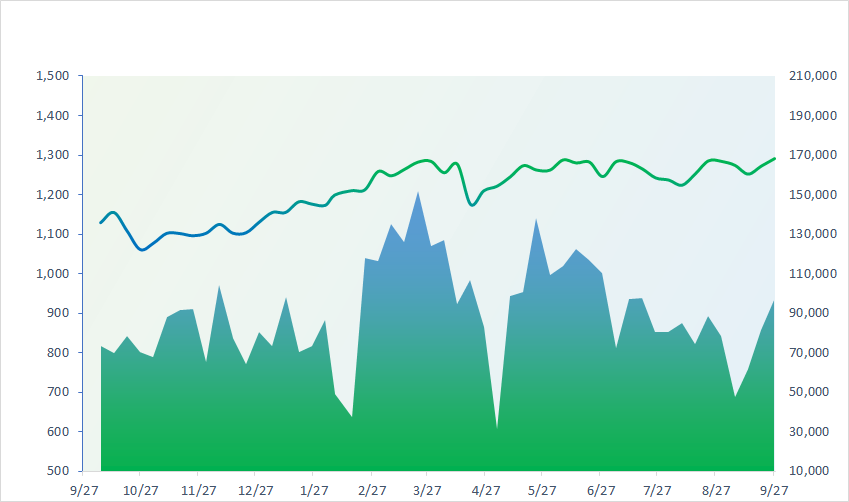

VNINDEX (12M)

GLOBAL MARKET

39,829.56

1D 2.32%

YTD 19.02%

3,087.52

1D 2.88%

YTD 4.23%

20,632.30

1D 3.55%

YTD 22.90%

2,649.78

1D -0.82%

YTD -0.75%

85,571.85

1D -0.31%

YTD 19.03%

3,573.36

1D -0.25%

YTD 10.63%

1,450.15

1D -0.34%

YTD 1.17%

71.77

1D -0.22%

YTD -6.82%

2,664.72

1D -0.23%

YTD 28.31%

Chinese markets clocked their best week in almost 16 years. The last time the mainland’s CSI 300 saw a bigger weekly gain was the week ending Nov 14, 2008. Other Asia-Pacific markets also mostly rose Friday, with investors also assessing September inflation numbers from Japan’s capital. Tokyo’s headline inflation rate eased to 2.2%, down from August’s 2.6%.

VIETNAM ECONOMY

4.24%

1D (bps) 1

YTD (bps) 64

4.60%

YTD (bps) -20

2.39%

1D (bps) -1

YTD (bps) 51

2.86%

1D (bps) 1

YTD (bps) 68

2480000.00%

1D (%) 0.04%

YTD (%) 1.18%

2827494.00%

1D (%) 0.30%

YTD (%) 3.28%

358786.00%

1D (%) 0.29%

YTD (%) 3.22%

In the afternoon of September 27, the price of gold rings at some stores continued to increase by about 100,000-200,000 VND/tael. At DOJI Group, the buying price of gold rings remained the same, the selling price increased to 82.75-83.45 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposal to reduce land rent by up to VND4,000 billion;

- “Made in Vietnam” Macbook and iPad to be manufactured locally;

- Asian Development Bank provides USD2 million in aid to the Vietnamese Government to support people affected by Typhoon Yagi;

- China steel mills are facing a wave of bankruptcies;

- Japan's Shigeru Ishiba is set to become prime minister;

- Drought reduces Amazon River in Colombia by as much as 90%.

VN30

BANK

92,500

1D 0.00%

5D 2.10%

Buy Vol. 1,908,061

Sell Vol. 2,727,941

50,100

1D 0.20%

5D 2.14%

Buy Vol. 6,322,373

Sell Vol. 7,148,116

37,000

1D 1.65%

5D 2.78%

Buy Vol. 29,397,968

Sell Vol. 26,855,650

24,200

1D 0.41%

5D 2.76%

Buy Vol. 28,268,657

Sell Vol. 43,033,759

19,750

1D 0.77%

5D 4.22%

Buy Vol. 120,993,991

Sell Vol. 104,663,861

25,700

1D 0.00%

5D 3.84%

Buy Vol. 35,052,585

Sell Vol. 40,794,479

28,300

1D 0.00%

5D 4.62%

Buy Vol. 12,877,027

Sell Vol. 17,314,887

16,900

1D 1.50%

5D 12.05%

Buy Vol. 98,450,432

Sell Vol. 82,096,082

33,600

1D 2.60%

5D 8.91%

Buy Vol. 38,807,316

Sell Vol. 36,131,066

19,350

1D -0.26%

5D 4.88%

Buy Vol. 25,596,921

Sell Vol. 27,787,146

25,900

1D -0.38%

5D 0.97%

Buy Vol. 20,780,858

Sell Vol. 21,867,188

11,000

1D 2.33%

5D 5.26%

Buy Vol. 95,229,225

Sell Vol. 116,033,515

17,000

1D 0.00%

5D 2.72%

Buy Vol. 3,410,613

Sell Vol. 3,712,354

The Governor requested banks to quickly support customers affected by Typhoon Yagi by restructuring debt repayment terms and reducing loan interest rates for customers according to current regulations.

OIL & GAS

73,500

1D -0.68%

5D 0.55%

Buy Vol. 883,181

Sell Vol. 1,768,895

13,050

1D 0.00%

5D 3.98%

Buy Vol. 16,812,138

Sell Vol. 17,682,429

44,950

1D -1.43%

5D -2.28%

Buy Vol. 2,782,908

Sell Vol. 3,244,171

POW: Hua Na Hydropower JSC - a subsidiary of PV Power plans to acquire Nam Non Hydropower Plant for nearly VND698 billion.

VINGROUP

42,500

1D -0.23%

5D 0.47%

Buy Vol. 4,677,118

Sell Vol. 5,056,532

43,400

1D -2.25%

5D -0.80%

Buy Vol. 31,277,071

Sell Vol. 33,409,263

19,400

1D 1.04%

5D -0.51%

Buy Vol. 31,522,046

Sell Vol. 23,917,917

Vietnam Exhibition Fair Center Joint Stock Company (VEFAC) - a subsidiary of Vingroup appoints a new CEO.

FOOD & BEVERAGE

71,000

1D 0.42%

5D 1.06%

Buy Vol. 4,478,216

Sell Vol. 7,256,576

75,900

1D -0.26%

5D 1.61%

Buy Vol. 6,507,079

Sell Vol. 8,041,708

58,500

1D 0.69%

5D 1.92%

Buy Vol. 1,641,555

Sell Vol. 1,876,171

VNM: Foreign investors net bought VNM shares for two consecutive sessions with a total value of VND193 billion.

OTHERS

71,300

1D -0.97%

5D 0.00%

Buy Vol. 797,266

Sell Vol. 1,246,824

43,300

1D 0.00%

5D 0.46%

Buy Vol. 560,999

Sell Vol. 827,169

105,100

1D 0.00%

5D -0.10%

Buy Vol. 903,911

Sell Vol. 1,122,977

134,200

1D -0.07%

5D -0.81%

Buy Vol. 4,833,895

Sell Vol. 5,470,163

67,500

1D -1.17%

5D -0.74%

Buy Vol. 20,342,039

Sell Vol. 21,526,412

36,000

1D -1.10%

5D 1.12%

Buy Vol. 4,400,761

Sell Vol. 6,504,479

27,600

1D 0.36%

5D 5.22%

Buy Vol. 21,886,731

Sell Vol. 27,002,322

26,050

1D 0.00%

5D 1.56%

Buy Vol. 55,850,539

Sell Vol. 58,840,170

VJC: Vietjet Air wants to issue VND2,000 billion in bonds. There will be two issuances this year, each issuance of VND1,000 billion.

Market by numbers

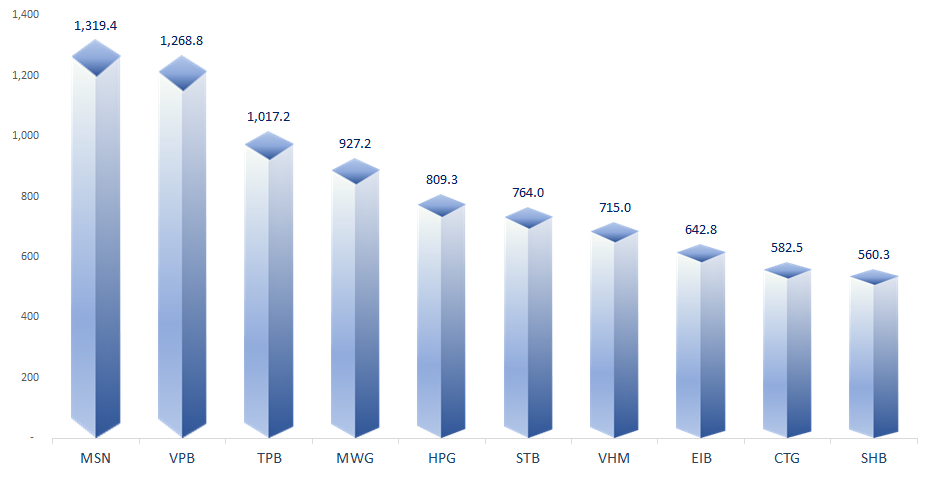

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

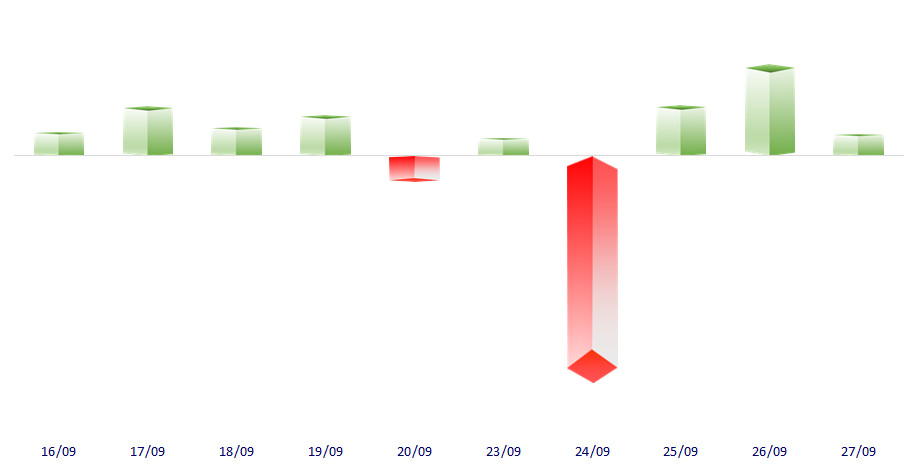

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

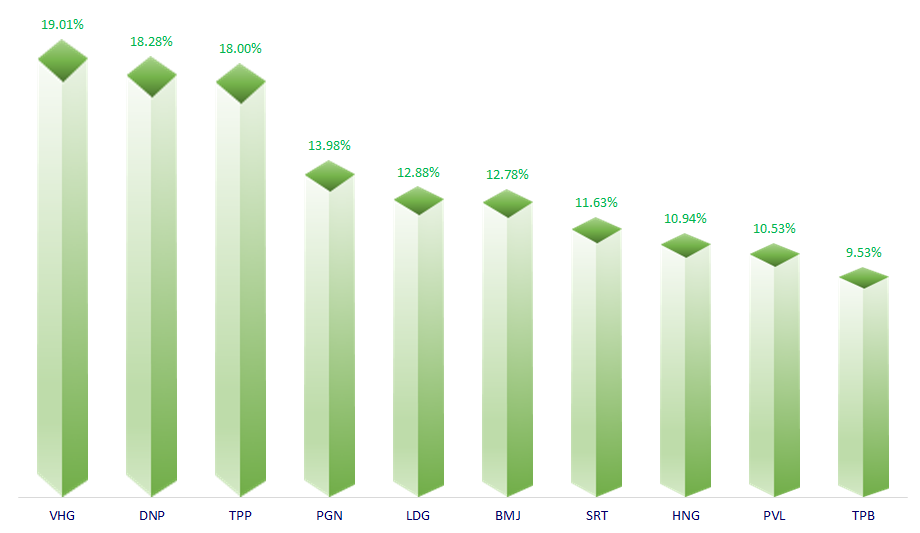

TOP INCREASES 3 CONSECUTIVE SESSIONS

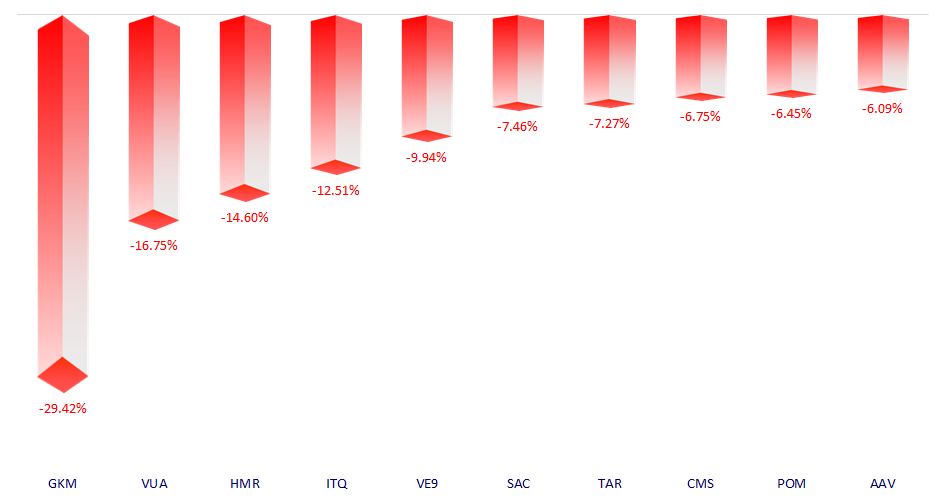

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.