Market Brief 07/10/2024

VIETNAM STOCK MARKET

1,269.93

1D -0.05%

YTD 12.21%

232.47

1D -0.09%

YTD 1.08%

1,335.48

1D -0.05%

YTD 18.01%

92.47

1D 0.11%

YTD 5.58%

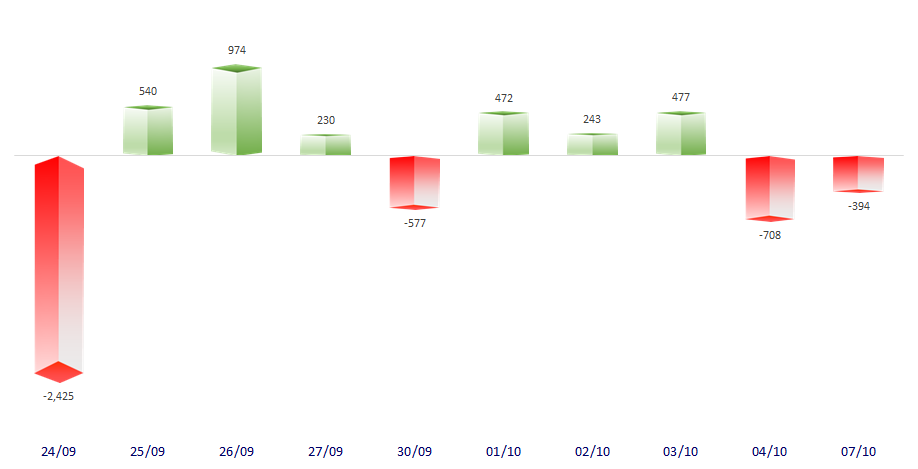

-394.10

1D 0.00%

YTD 0.00%

13,531.37

1D -12.21%

YTD -28.39%

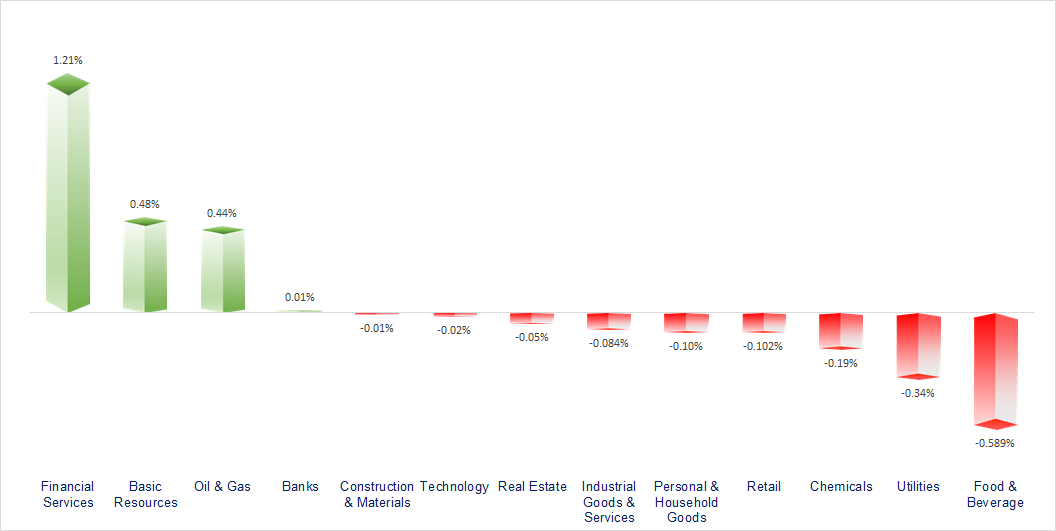

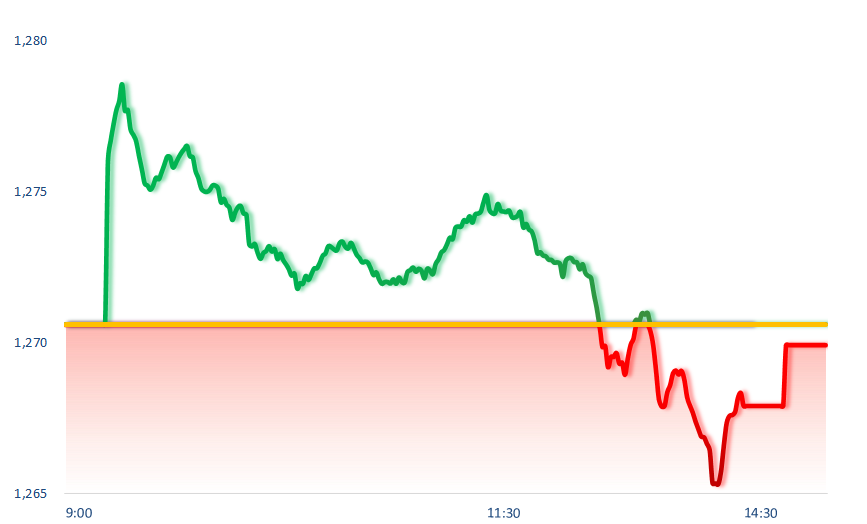

VNIndex fell for four consecutive sessions despite positive macro data. Banking stocks were mixed, with STB being the most positive, closing up 2.1%, mainly driven by foreign net buying. Securities stocks unexpectedly rose at the end of the session, with VCI +3.7%, ORS +3.8%, FTS +2.3%, and HCM +2.1%.

ETF & DERIVATIVES

23,410

1D 0.13%

YTD 19.87%

16,030

1D -0.31%

YTD 19.18%

16,630

1D -0.60%

YTD 19.99%

20,070

1D -0.35%

YTD 18.20%

21,940

1D 0.41%

YTD 19.24%

33,400

1D -0.15%

YTD 28.31%

17,890

1D -0.50%

YTD 17.16%

1,340

1D -0.22%

YTD 0.00%

1,341

1D -0.33%

YTD 0.00%

1,339

1D -0.29%

YTD 0.00%

1,340

1D -0.23%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

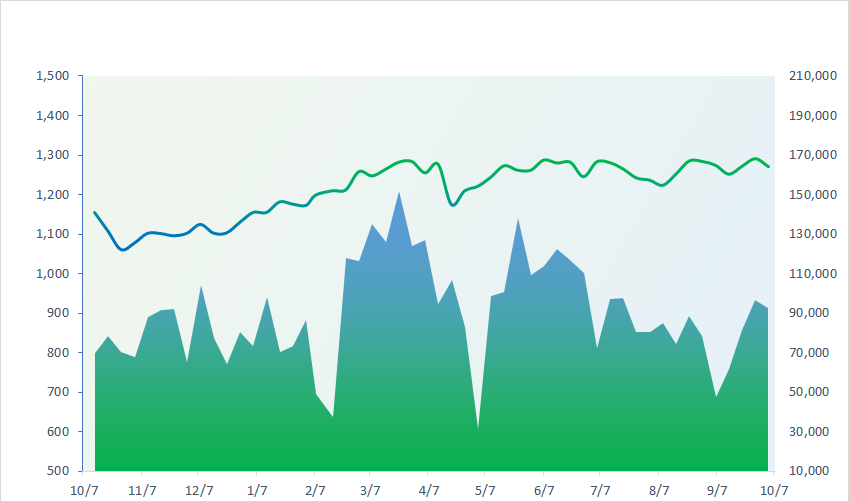

VNINDEX (12M)

GLOBAL MARKET

39,332.74

1D 1.80%

YTD 17.54%

3,336.49

1D 0.00%

YTD 12.63%

23,099.78

1D 1.60%

YTD 37.59%

2,610.38

1D 1.58%

YTD -2.23%

81,050.00

1D -0.78%

YTD 12.74%

3,599.19

1D 0.42%

YTD 11.43%

1,452.20

1D 0.55%

YTD 1.31%

79.66

1D 2.71%

YTD 3.42%

2,656.96

1D 0.31%

YTD 27.94%

Asia-Pacific markets mostly climbed on Monday, led by Japan’s Nikkei 225 rising almost 2%, powered by financials and consumer cyclical stocks. Three central banks are set to release their interest rate decisions this week, namely the Bank of Korea, the Reserve Bank of New Zealand and the Reserve Bank of India. Economists polled by Reuters expect the BOK and RBNZ to cut rates, while the RBI will hold.

VIETNAM ECONOMY

3.56%

1D (bps) -16

YTD (bps) -4

4.60%

YTD (bps) -20

2.29%

1D (bps) -24

YTD (bps) 41

3.23%

1D (bps) 15

YTD (bps) 105

2503000.00%

1D (%) 0.36%

YTD (%) 2.12%

2802923.00%

1D (%) 0.25%

YTD (%) 2.39%

359792.00%

1D (%) -0.03%

YTD (%) 3.51%

The U.S. dollar edged down on Monday after a rally sparked by Friday's strong U.S. jobs data and an escalation in the Middle East conflict. The dollar index measure against major peers was down 0.05% at 102.48. It rose 0.5% on Friday to a seven-week high. Oil prices extended gains on Monday, with Brent nearing USD80 to build on last week's steepest weekly jump since early 2023.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister sets GDP growth target of 7.5-8% in Q4, over 7% for the whole year;

- The government will submit a report on the high-speed railway project to the National Assembly before October 21;

- Hung Thinh and Novaland submit proposals on projects in Ba Ria - Vung Tau;

- Japan's yen drops to its lowest level in nearly two months;

- Two reports this week could help investors determine the pace of Fed interest rate cuts;

- Hurricane Milton could lead to large evacuation from Florida's west coast.

VN30

BANK

92,000

1D -0.33%

5D 0.00%

Buy Vol. 1,200,098

Sell Vol. 1,442,695

49,050

1D -0.30%

5D -1.31%

Buy Vol. 2,821,598

Sell Vol. 3,615,937

35,800

1D 0.56%

5D -3.11%

Buy Vol. 10,694,398

Sell Vol. 9,813,320

24,150

1D 0.42%

5D -0.21%

Buy Vol. 25,371,115

Sell Vol. 25,377,020

20,000

1D 0.00%

5D -0.50%

Buy Vol. 49,730,520

Sell Vol. 78,658,277

25,200

1D 0.40%

5D -1.95%

Buy Vol. 25,542,294

Sell Vol. 21,617,338

26,850

1D -1.65%

5D -4.79%

Buy Vol. 12,200,403

Sell Vol. 13,531,803

17,500

1D 1.45%

5D 1.74%

Buy Vol. 41,877,419

Sell Vol. 34,123,090

33,800

1D 2.11%

5D 1.35%

Buy Vol. 38,581,906

Sell Vol. 29,837,893

19,200

1D -0.26%

5D -0.52%

Buy Vol. 18,978,441

Sell Vol. 17,464,080

25,450

1D 0.20%

5D -1.17%

Buy Vol. 12,714,343

Sell Vol. 13,428,309

10,850

1D 0.00%

5D -1.36%

Buy Vol. 39,844,271

Sell Vol. 46,489,919

17,100

1D -2.29%

5D 0.29%

Buy Vol. 2,465,725

Sell Vol. 2,899,421

According to the SBV's survey, the proportion of banks expecting positive pre-tax profit growth in 2024 decreased compared to the most recent survey. In addition, 15.9% of banks are concerned about negative profit growth, higher than the rate of 11% in the previous survey.

OIL & GAS

72,900

1D -0.55%

5D -0.41%

Buy Vol. 1,200,391

Sell Vol. 1,795,948

12,750

1D -1.54%

5D -2.67%

Buy Vol. 8,631,431

Sell Vol. 9,916,146

44,950

1D -0.33%

5D 1.01%

Buy Vol. 1,355,568

Sell Vol. 2,027,552

POW: As of the end of August, the overall progress of the EPC package was estimated at 87%.

VINGROUP

40,850

1D -0.37%

5D -2.74%

Buy Vol. 3,125,876

Sell Vol. 3,874,209

41,200

1D -0.72%

5D -3.74%

Buy Vol. 11,742,537

Sell Vol. 18,103,435

18,250

1D -0.27%

5D -4.45%

Buy Vol. 9,842,620

Sell Vol. 9,951,115

In the first 9 months of the year, foreign investors disbursed in Vietnam's real estate business activities reached USD1.43 billion, 1.8 times higher than the same period last year.

FOOD & BEVERAGE

67,100

1D -2.04%

5D -4.28%

Buy Vol. 9,275,149

Sell Vol. 9,790,730

74,800

1D -1.06%

5D -1.19%

Buy Vol. 7,327,163

Sell Vol. 7,996,050

56,700

1D 0.18%

5D -1.90%

Buy Vol. 831,111

Sell Vol. 910,816

MSN: Masan Group has donated VND100 billion to eliminate temporary housing and dilapidated houses nationwide.

OTHERS

68,400

1D 0.74%

5D -2.56%

Buy Vol. 572,855

Sell Vol. 568,401

42,950

1D 0.23%

5D 0.23%

Buy Vol. 499,998

Sell Vol. 828,592

105,000

1D -0.28%

5D 0.00%

Buy Vol. 740,735

Sell Vol. 944,049

134,100

1D 0.00%

5D -0.30%

Buy Vol. 2,318,461

Sell Vol. 2,523,843

66,300

1D -0.15%

5D -2.64%

Buy Vol. 8,908,166

Sell Vol. 11,291,823

34,800

1D -0.29%

5D -2.66%

Buy Vol. 2,770,212

Sell Vol. 3,600,383

27,600

1D 1.10%

5D -1.08%

Buy Vol. 23,781,137

Sell Vol. 20,791,308

26,400

1D 0.76%

5D 0.19%

Buy Vol. 26,347,806

Sell Vol. 32,555,231

VJC: Vietjet Air and Castlelake (a global investment management company) have reached an agreement to arrange financing for 4 aircraft worth USD560 million.

Market by numbers

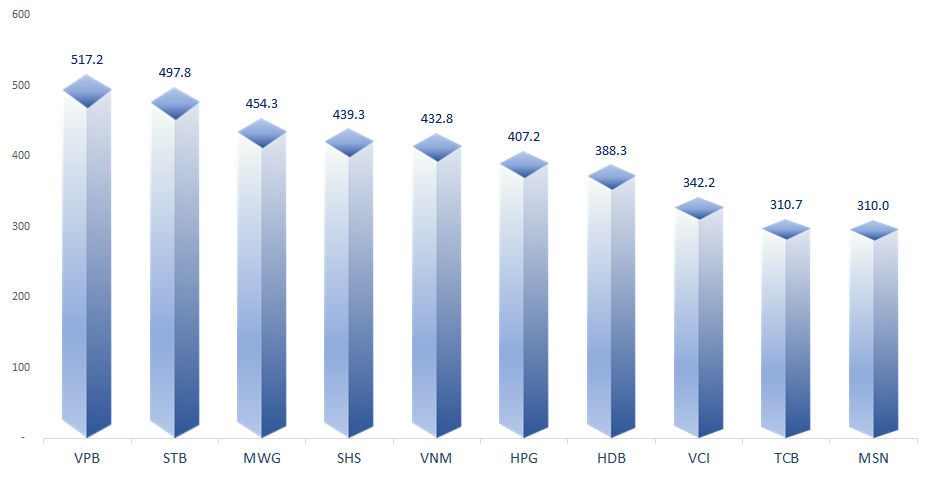

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

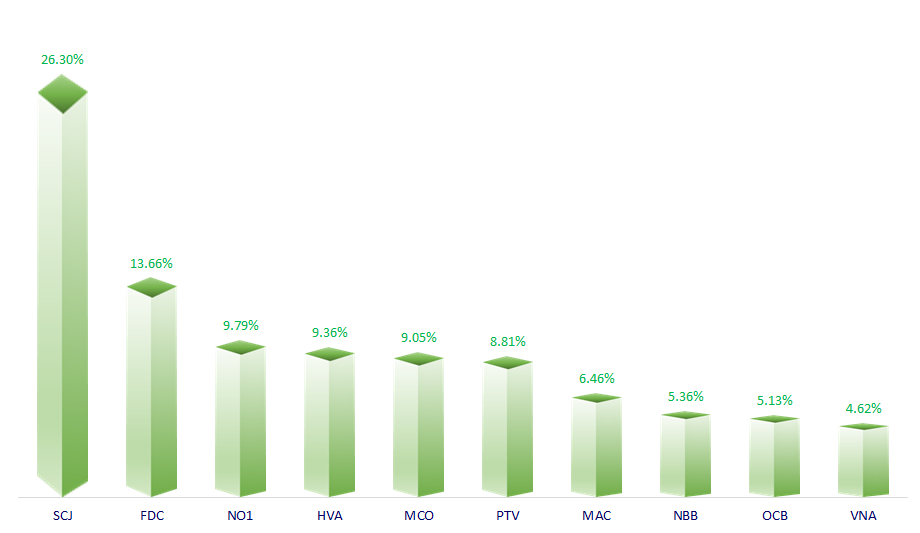

TOP INCREASES 3 CONSECUTIVE SESSIONS

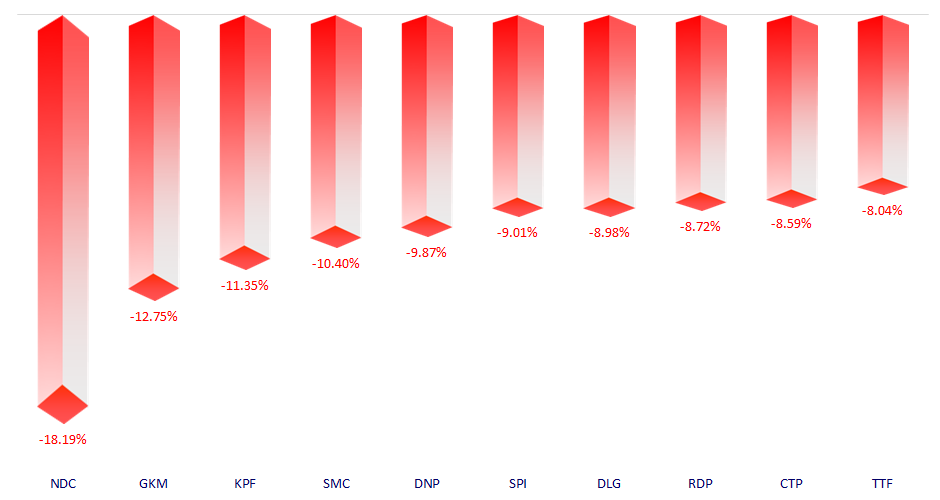

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.