Market Brief 11/10/2024

VIETNAM STOCK MARKET

1,288.39

1D 0.16%

YTD 13.84%

231.37

1D 0.03%

YTD 0.60%

1,362.50

1D 0.14%

YTD 20.40%

92.60

1D 0.03%

YTD 5.73%

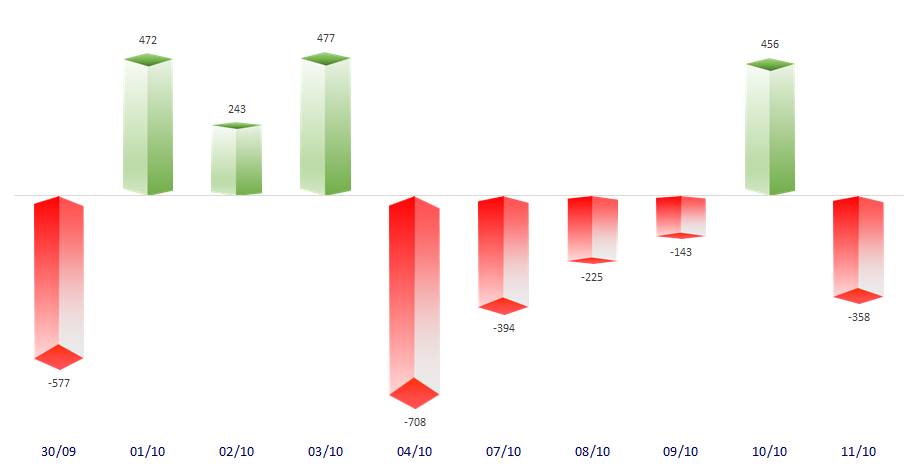

-358.25

1D 0.00%

YTD 0.00%

14,602.62

1D -28.62%

YTD -22.72%

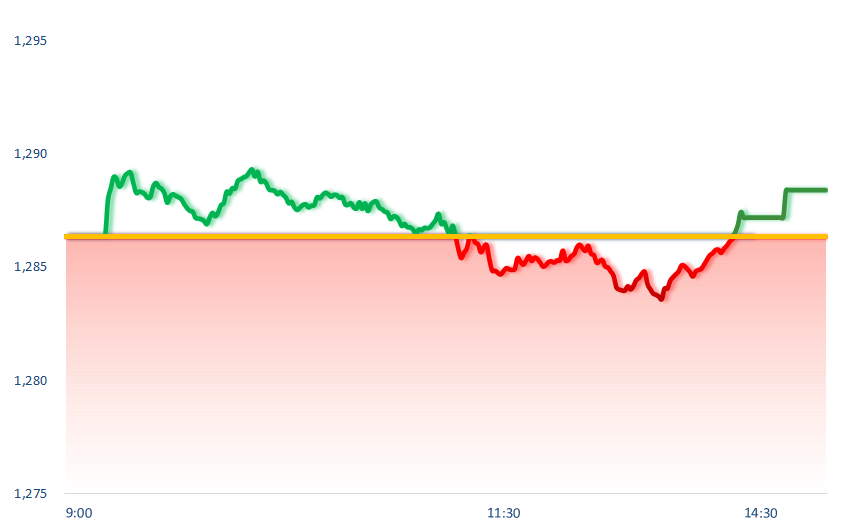

VNIndex recovered strongly at the end of the session, after almost filling the gap of yesterday's session. VHM was the bright star of today's session, contributing 1.6 points to VNIndex. VHM alone supported the market almost the entire session.

ETF & DERIVATIVES

23,830

1D 0.13%

YTD 22.02%

16,370

1D -0.12%

YTD 21.71%

16,930

1D -0.24%

YTD 22.15%

20,320

1D -0.39%

YTD 19.67%

22,240

1D 0.41%

YTD 20.87%

33,840

1D -0.12%

YTD 30.00%

18,200

1D -0.16%

YTD 19.19%

1,367

1D 0.03%

YTD 0.00%

1,368

1D 0.13%

YTD 0.00%

1,366

1D 0.03%

YTD 0.00%

1,365

1D -0.07%

YTD 0.00%

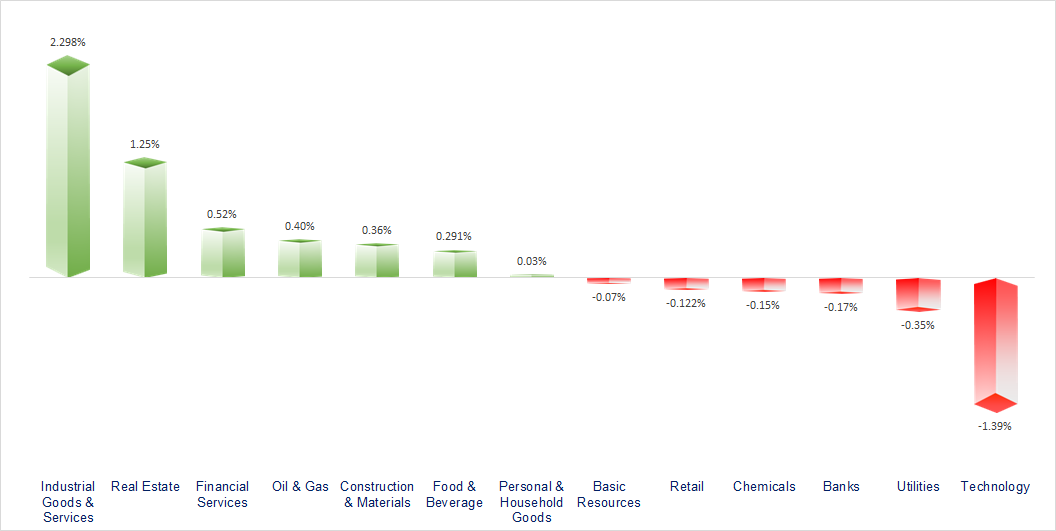

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

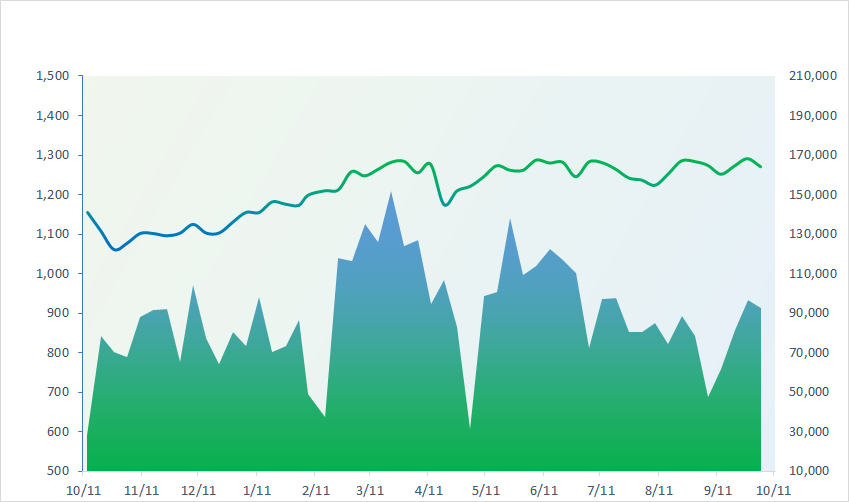

VNINDEX (12M)

GLOBAL MARKET

39,605.80

1D 0.57%

YTD 18.35%

3,217.73

1D -2.55%

YTD 8.62%

21,251.98

1D 0.00%

YTD 26.59%

2,596.91

1D -0.09%

YTD -2.73%

81,381.36

1D -0.28%

YTD 13.20%

3,573.76

1D -0.32%

YTD 10.64%

1,470.10

1D 0.11%

YTD 2.56%

78.69

1D -0.49%

YTD 2.16%

2,641.57

1D 0.30%

YTD 27.20%

Asia-Pacific markets mostly rose Friday as investors digested a sticky U.S. inflation report. Investors in Asia assessed a rate decision from the Bank of Korea, with the BOK cutting its benchmark interest rate by 25 basis points to 3.25%, its first rate cut since 2020. The decision comes as inflation in South Korea eased to 1.6% in September, the lowest level since early 2021 and below the central bank’s medium-target of 2%. Hong Kong Exchnage was closed for a holiday today.

VIETNAM ECONOMY

3.22%

1D (bps) -9

YTD (bps) -38

4.60%

YTD (bps) -20

2.39%

1D (bps) -1

YTD (bps) 51

3.57%

1D (bps) 3

YTD (bps) 139

2502000.00%

1D (%) -0.04%

YTD (%) 2.08%

2791584.00%

1D (%) -0.11%

YTD (%) 1.97%

356996.00%

1D (%) 0.01%

YTD (%) 2.70%

According to a survey by the State Bank, home loan interest rates at some banks in October remained unchanged compared to the previous month. According to the survey, home loan interest rates in October are fluctuating between 3.99 - 8.49%/year, with loan terms of up to 35 years.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV: Reviewing banks with low 2nd year insurance renewal rates;

- Proposal to adjust the implementation time of phase 1 of Long Thanh airport project to 2026;

- State Bank said it will continue to inspect the gold market;

- US shrimp imports in August highest in 2024;

- Turkey imposes duties on China, Russia, India, Japan steel imports;

- China investors expect USD283 billion of new stimulus this weekend.

VN30

BANK

91,500

1D -0.44%

5D -0.87%

Buy Vol. 2,502,666

Sell Vol. 1,852,430

49,400

1D -0.70%

5D 0.41%

Buy Vol. 3,000,607

Sell Vol. 4,312,813

36,250

1D 0.28%

5D 1.83%

Buy Vol. 8,512,708

Sell Vol. 10,826,781

24,450

1D -0.41%

5D 1.66%

Buy Vol. 23,868,345

Sell Vol. 23,807,008

20,700

1D 0.73%

5D 3.50%

Buy Vol. 41,868,287

Sell Vol. 46,364,162

25,550

1D 0.20%

5D 1.79%

Buy Vol. 20,866,419

Sell Vol. 18,546,245

27,350

1D -0.36%

5D 0.18%

Buy Vol. 9,884,810

Sell Vol. 11,003,935

17,500

1D 0.29%

5D 1.45%

Buy Vol. 38,795,707

Sell Vol. 27,640,812

33,800

1D 0.60%

5D 2.11%

Buy Vol. 22,306,655

Sell Vol. 14,127,327

19,100

1D 0.00%

5D -0.78%

Buy Vol. 16,524,060

Sell Vol. 16,031,106

26,100

1D -0.38%

5D 2.76%

Buy Vol. 13,988,027

Sell Vol. 13,288,247

10,800

1D 0.47%

5D -0.46%

Buy Vol. 25,243,034

Sell Vol. 35,922,858

17,600

1D 0.57%

5D 0.57%

Buy Vol. 2,281,789

Sell Vol. 3,186,202

VPB: VPBank and the Japan Bank for International Cooperation (JBIC) have just signed a credit contract worth up to USD150 million to finance renewable energy and power transmission projects in Vietnam.

OIL & GAS

73,200

1D -0.14%

5D -0.14%

Buy Vol. 965,121

Sell Vol. 1,796,219

12,600

1D -2.33%

5D -2.70%

Buy Vol. 14,339,489

Sell Vol. 17,586,323

44,700

1D 0.45%

5D -0.89%

Buy Vol. 1,598,716

Sell Vol. 2,534,626

Despite a slight decrease in today's session, crude oil pricesstill recorded a positive week as investors assessed the possibility of Israel attacking Iranian oil exploitation sites.

VINGROUP

41,800

1D 0.97%

5D 1.95%

Buy Vol. 3,557,813

Sell Vol. 3,527,251

43,600

1D 3.44%

5D 5.06%

Buy Vol. 35,680,712

Sell Vol. 32,279,900

19,000

1D 2.98%

5D 3.83%

Buy Vol. 30,431,493

Sell Vol. 26,216,413

VHM: The State Securities Commission announced that it has received Vinhomes' application to buy treasury shares.

FOOD & BEVERAGE

67,700

1D 0.00%

5D -1.17%

Buy Vol. 5,548,427

Sell Vol. 4,937,650

81,100

1D 1.38%

5D 7.28%

Buy Vol. 12,540,233

Sell Vol. 11,628,190

57,500

1D -0.35%

5D 1.59%

Buy Vol. 720,275

Sell Vol. 1,292,838

MSN: Foreign investors strongly net bought MSN shares with a value of VND177 billion.

OTHERS

68,300

1D 0.00%

5D 0.59%

Buy Vol. 571,044

Sell Vol. 567,892

44,100

1D 0.46%

5D 2.92%

Buy Vol. 1,049,102

Sell Vol. 1,535,923

108,900

1D 2.74%

5D 3.42%

Buy Vol. 2,302,353

Sell Vol. 1,990,662

139,600

1D -1.48%

5D 4.10%

Buy Vol. 6,280,813

Sell Vol. 7,002,796

64,500

1D -0.77%

5D -2.86%

Buy Vol. 18,323,582

Sell Vol. 17,176,817

35,500

1D -0.42%

5D 1.72%

Buy Vol. 3,558,343

Sell Vol. 4,456,432

27,450

1D -0.36%

5D 0.55%

Buy Vol. 21,595,302

Sell Vol. 19,591,109

27,300

1D 0.18%

5D 4.20%

Buy Vol. 35,857,510

Sell Vol. 35,964,920

HPG: Accumulated in 9 months, Hoa Phat recorded more than VND105,000 billion in revenue equivalent to more than USD4 billion, up 23% over the same period last year (VND85,431 billion), completing 75% of the 2024 plan.

Market by numbers

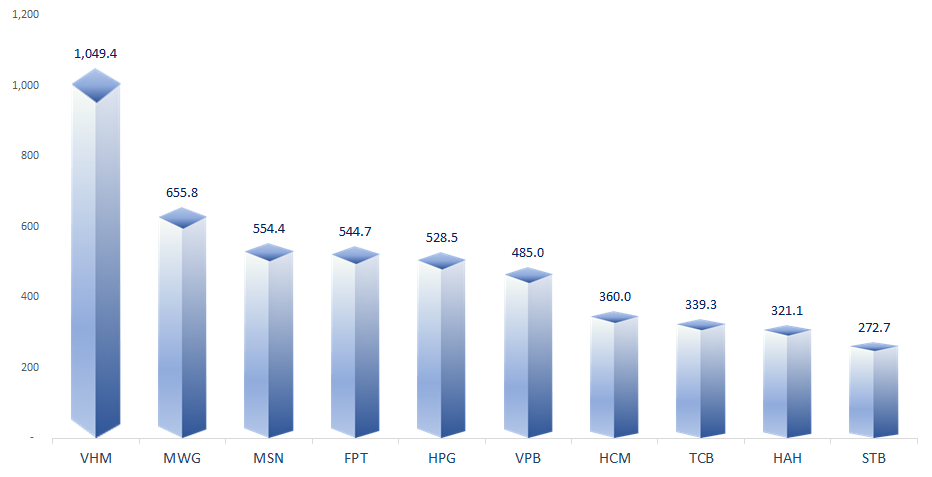

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

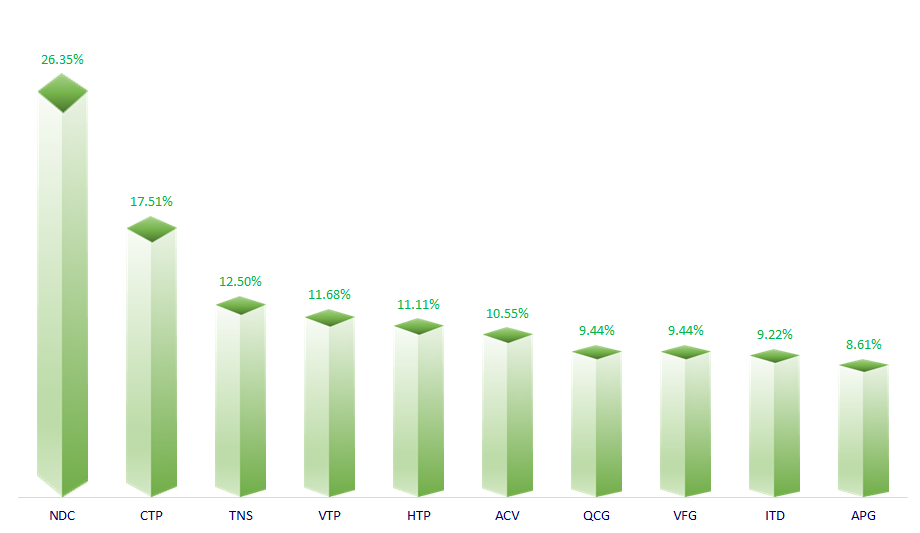

TOP INCREASES 3 CONSECUTIVE SESSIONS

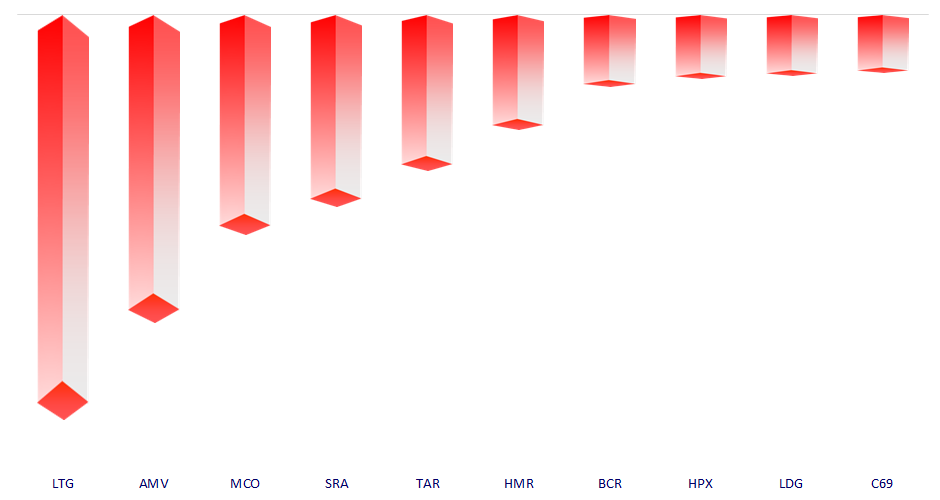

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.