Market brief 14/10/2024

VIETNAM STOCK MARKET

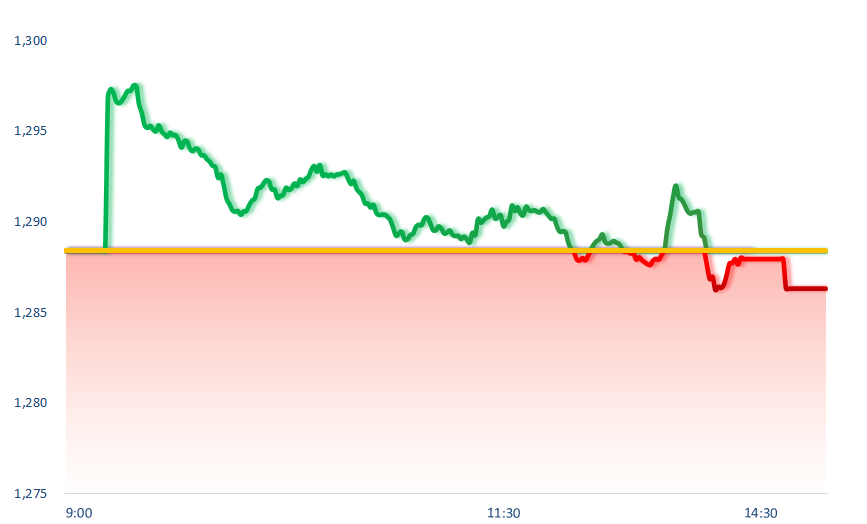

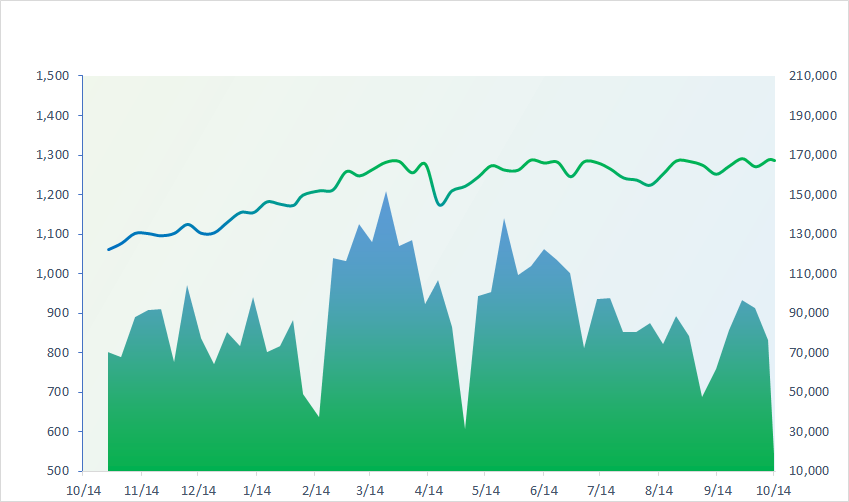

1,286.34

1D -0.16%

YTD 13.66%

230.72

1D -0.28%

YTD 0.32%

1,358.76

1D -0.27%

YTD 20.07%

92.38

1D -0.24%

YTD 5.48%

-636.53

1D 0.00%

YTD 0.00%

19,451.18

1D 33.20%

YTD 2.94%

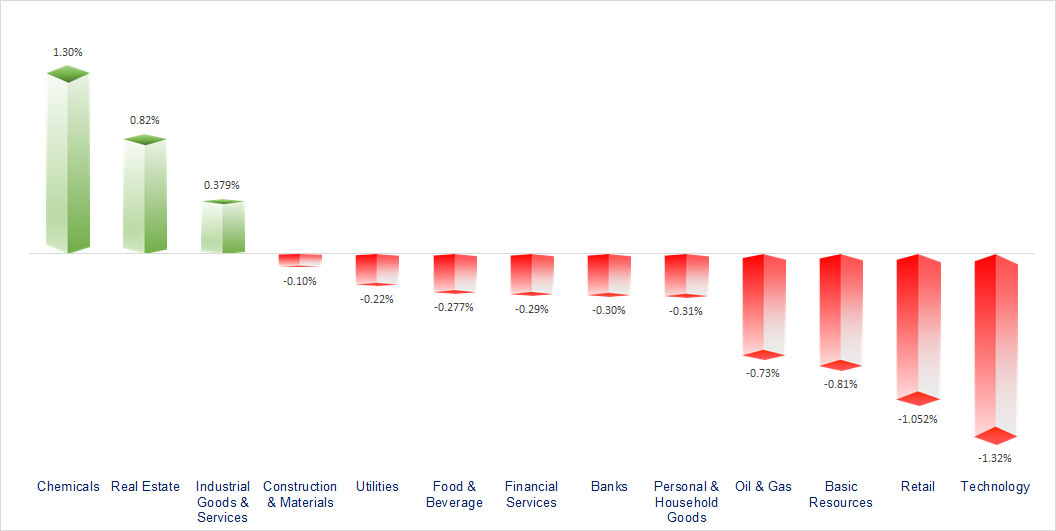

VNIndex continued to be sold off in the afternoon session, gradually creating a short-term peak. Telecommunications, chemicals and real estate were the most active groups today. On the contrary, oil & gas, technology and retail were quite gloomy.

ETF & DERIVATIVES

23,770

1D -0.25%

YTD 21.71%

16,370

1D 0.00%

YTD 21.71%

17,000

1D 0.41%

YTD 22.66%

20,350

1D 0.15%

YTD 19.85%

22,110

1D -0.58%

YTD 20.16%

33,640

1D -0.59%

YTD 29.24%

18,180

1D -0.11%

YTD 19.06%

1,359

1D -0.56%

YTD 0.00%

1,364

1D -0.33%

YTD 0.00%

1,364

1D -0.17%

YTD 0.00%

1,363

1D -0.15%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,605.80

1D 0.00%

YTD 18.35%

3,284.32

1D 2.07%

YTD 10.87%

21,092.87

1D -0.75%

YTD 25.64%

2,623.29

1D 1.02%

YTD -1.74%

81,973.05

1D 0.73%

YTD 14.02%

3,594.74

1D 0.59%

YTD 11.29%

1,470.10

1D 0.00%

YTD 2.56%

77.12

1D -1.17%

YTD 0.12%

2,659.80

1D 0.46%

YTD 28.07%

Asian stocks rose across the board in early trading on Monday, with Chinese shares rising more than 1% after the country's finance minister said late last week that more stimulus was needed to boost the economy.

VIETNAM ECONOMY

3.12%

1D (bps) -10

YTD (bps) -48

4.60%

YTD (bps) -20

2.47%

1D (bps) 8

YTD (bps) 59

3.81%

1D (bps) 24

YTD (bps) 163

2503200.00%

1D (%) 0.05%

YTD (%) 2.13%

2791400.00%

1D (%) -0.01%

YTD (%) 1.97%

358000.00%

1D (%) 0.28%

YTD (%) 2.99%

The domestic USD exchange rate today recorded a second consecutive decrease since the end of last week with a decrease ranging from 6 to 30 VND. The USD buying price is currently in the range of 24,610 - 24,650 VND/USD while the selling price is currently fluctuating in the range of 25,000 - 25,030 VND/USD. Of which, VietinBank has the highest USD buying price.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- China is ready to cooperate with Vietnam in the high-speed rail industry;

- International visitors to Vietnam are about to reach the peak;

- Dong Thap earns billions of USD from exporting pangasius;

- China faces increasing deflationary pressure;

- Kamala Harris leads Donald Trump by 4 points among potential voters;

- European and American car companies are running out of steam.

VN30

BANK

91,400

1D -0.11%

5D -0.65%

Buy Vol. 1,609,204

Sell Vol. 2,225,831

49,400

1D 0.00%

5D 0.71%

Buy Vol. 2,606,517

Sell Vol. 3,239,055

36,050

1D -0.55%

5D 0.70%

Buy Vol. 8,874,104

Sell Vol. 11,184,812

24,350

1D -0.41%

5D 0.83%

Buy Vol. 19,028,382

Sell Vol. 21,716,939

20,650

1D -0.24%

5D 3.25%

Buy Vol. 39,271,213

Sell Vol. 51,411,837

25,850

1D 1.17%

5D 2.58%

Buy Vol. 33,107,948

Sell Vol. 28,879,023

27,000

1D -1.28%

5D 0.56%

Buy Vol. 9,550,430

Sell Vol. 12,821,950

17,450

1D -0.29%

5D -0.29%

Buy Vol. 30,832,070

Sell Vol. 31,701,741

33,900

1D 0.30%

5D 0.30%

Buy Vol. 23,355,557

Sell Vol. 23,810,975

19,050

1D -0.26%

5D -0.78%

Buy Vol. 14,435,542

Sell Vol. 16,645,529

25,950

1D -0.57%

5D 1.96%

Buy Vol. 16,192,346

Sell Vol. 15,652,220

10,800

1D 0.00%

5D -0.46%

Buy Vol. 34,514,785

Sell Vol. 41,246,797

17,400

1D -1.14%

5D 1.75%

Buy Vol. 2,308,620

Sell Vol. 5,028,246

TPB: According to Brand Finance, TPBank is one of the outstanding units with a brand strategy that leaves an impression on customers in Vietnam. In 2024, TPBank's brand value will reach USD461 million, ranking 23rd in the 100 most valuable brands in Vietnam.

OIL & GAS

72,900

1D -0.41%

5D 0.00%

Buy Vol. 1,040,282

Sell Vol. 1,518,992

12,800

1D 1.59%

5D 0.39%

Buy Vol. 20,541,641

Sell Vol. 17,364,280

44,450

1D -0.56%

5D -1.11%

Buy Vol. 1,401,062

Sell Vol. 1,858,638

PLX: Petrolimex promotes cooperation with Aramco Group.

VINGROUP

42,150

1D 0.84%

5D 3.18%

Buy Vol. 7,111,065

Sell Vol. 8,687,649

45,350

1D 4.01%

5D 10.07%

Buy Vol. 42,271,029

Sell Vol. 40,855,892

19,150

1D 0.79%

5D 4.93%

Buy Vol. 22,718,526

Sell Vol. 26,990,678

VHM: VHM shares increased by 34%, exceeding book value before the company bought treasury shares.

FOOD & BEVERAGE

67,200

1D -0.74%

5D 0.15%

Buy Vol. 5,881,750

Sell Vol. 5,079,690

80,300

1D -0.99%

5D 7.35%

Buy Vol. 10,779,591

Sell Vol. 11,776,417

57,200

1D -0.52%

5D 0.88%

Buy Vol. 685,424

Sell Vol. 1,072,029

VNM: Vinamilk has joined hands with Hau Giang Pharmaceutical to research and develop (R&D), market, and distribute product lines and functional foods.

OTHERS

68,300

1D 0.00%

5D -0.15%

Buy Vol. 476,024

Sell Vol. 534,713

44,000

1D -0.23%

5D 2.44%

Buy Vol. 850,203

Sell Vol. 865,048

107,300

1D -1.47%

5D 2.19%

Buy Vol. 1,367,699

Sell Vol. 1,673,957

137,600

1D -1.43%

5D 2.61%

Buy Vol. 8,236,128

Sell Vol. 9,864,939

63,600

1D -1.40%

5D -4.07%

Buy Vol. 13,900,615

Sell Vol. 15,710,568

36,300

1D 2.25%

5D 4.31%

Buy Vol. 8,074,011

Sell Vol. 8,188,231

27,650

1D 0.73%

5D 0.18%

Buy Vol. 28,791,617

Sell Vol. 31,028,556

27,050

1D -0.92%

5D 2.46%

Buy Vol. 29,409,541

Sell Vol. 34,528,122

GVR: GVR leaders have proposed that the State Capital Management Committee at Enterprises consider the investment policy for industrial parks in the Southeast region.

Market by numbers

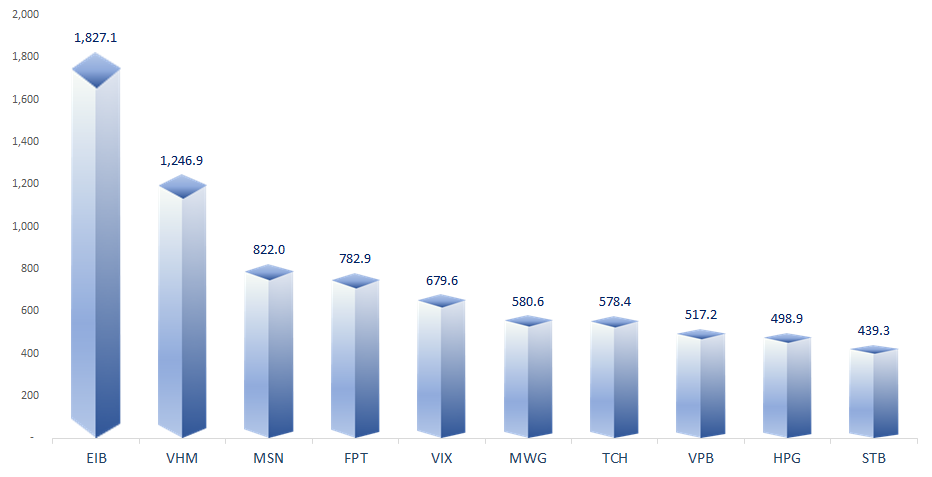

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

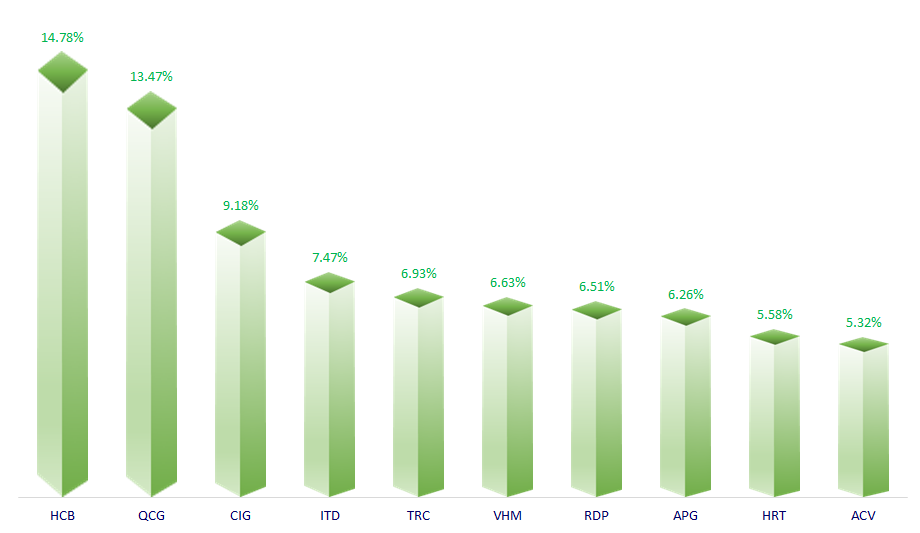

TOP INCREASES 3 CONSECUTIVE SESSIONS

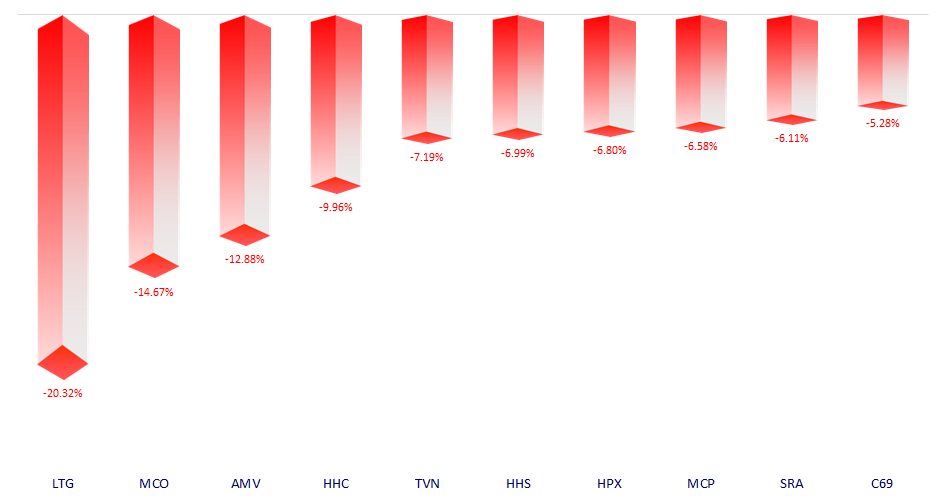

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.