Market brief 29/11/2024

VIETNAM STOCK MARKET

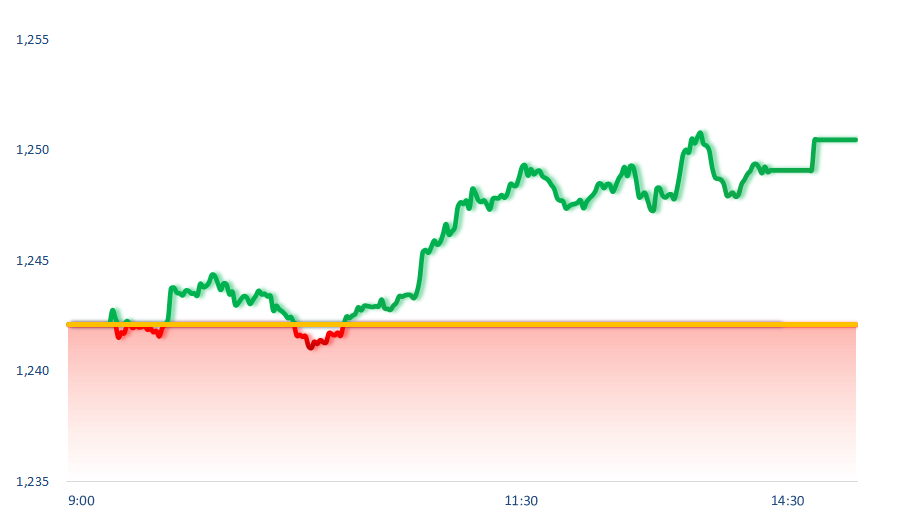

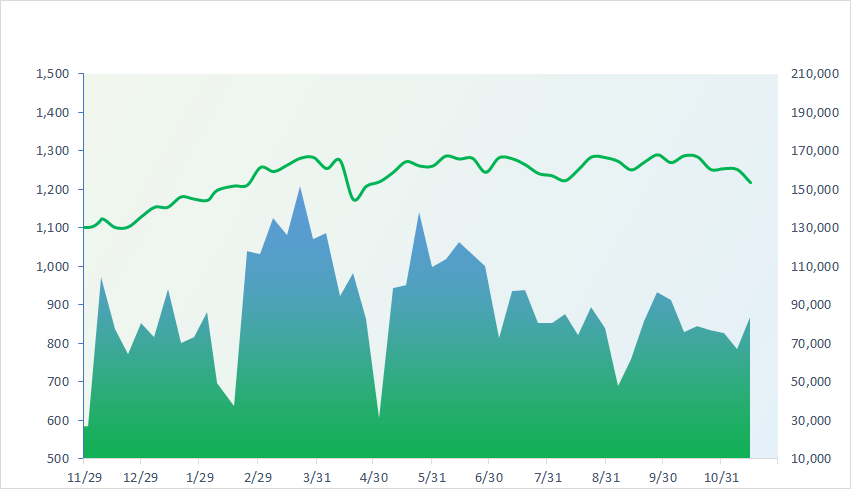

1,250.46

1D 0.67%

YTD 10.49%

224.64

1D 0.48%

YTD -2.33%

1,311.26

1D 0.75%

YTD 15.87%

92.74

1D 0.42%

YTD 5.89%

359.68

1D 0.00%

YTD 0.00%

14,657.58

1D -15.11%

YTD -22.43%

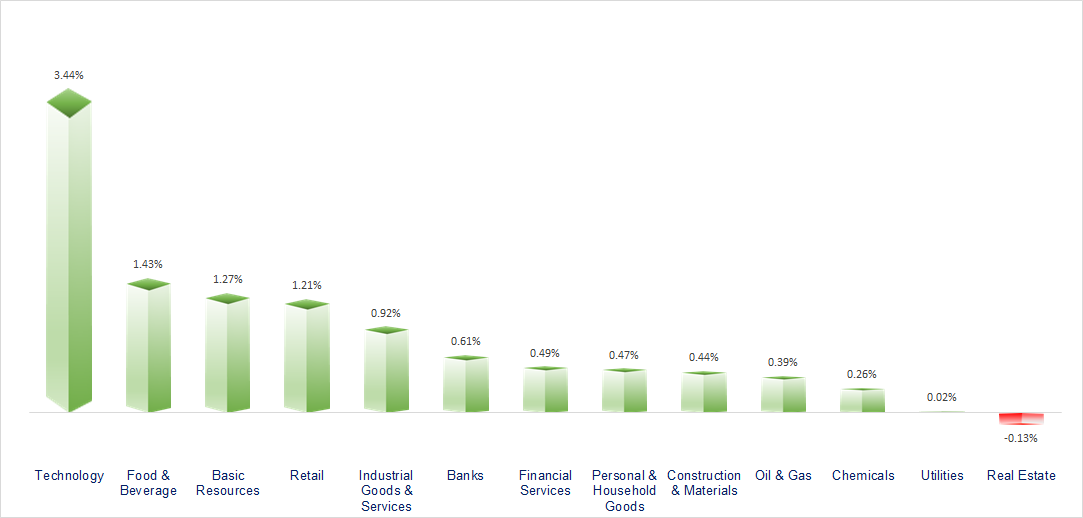

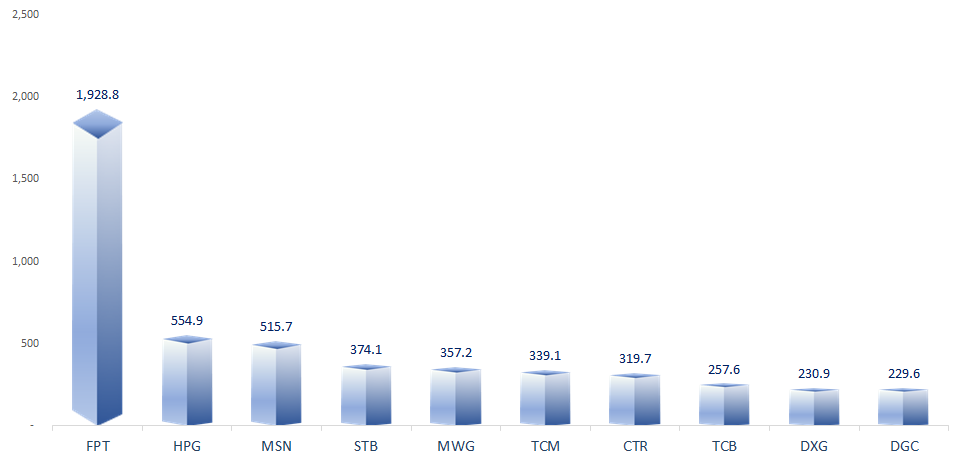

VNINDEX broke through the strong resistance level of 1,250, while FPT reached a record high. Some notable stocks today, such as BVH and MIG hit the ceiling price, with FPT rising by 3.52%. In contrast, the real estate sector showed weak performance during today’s session, with NVL down by 1.35% and DIG down by 0.25%.

ETF & DERIVATIVES

22,920

1D 0.97%

YTD 17.36%

15,850

1D 0.51%

YTD 17.84%

16,280

1D 0.80%

YTD 17.46%

19,540

1D 0.83%

YTD 15.08%

21,150

1D 0.86%

YTD 14.95%

32,490

1D 0.90%

YTD 24.82%

17,500

1D -0.85%

YTD 14.60%

1,318

1D 0.96%

YTD 0.00%

1,321

1D 0.79%

YTD 0.00%

1,321

1D 0.84%

YTD 0.00%

1,325

1D 1.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,208.03

1D -0.37%

YTD 14.18%

3,326.46

1D 0.93%

YTD 12.29%

19,423.61

1D 0.29%

YTD 15.70%

2,455.91

1D -1.95%

YTD -8.01%

79,752.69

1D 0.90%

YTD 10.93%

3,733.03

1D -0.11%

YTD 15.58%

1,428.10

1D 0.02%

YTD -0.37%

73.06

1D 0.26%

YTD -5.15%

2,660.98

1D 0.54%

YTD 28.13%

Asian stock markets showed mixed performance in Friday's trading session as the yen recorded its strongest weekly gain in four months. Notably, high inflation data from Tokyo has led investors to expect the Bank of Japan to raise interest rates soon.

VIETNAM ECONOMY

3.13%

1D (bps) -127

YTD (bps) -47

4.60%

YTD (bps) -20

2.11%

1D (bps) -7

YTD (bps) 23

2.66%

1D (bps) -5

YTD (bps) 48

2546300.00%

1D (%) -0.08%

YTD (%) 3.89%

2752752.00%

1D (%) 0.25%

YTD (%) 0.55%

355694.00%

1D (%) 0.06%

YTD (%) 2.33%

World gold prices edged higher on Friday, supported by a weaker USD and rising geopolitical tensions. In the domestic market, the SJC gold bar price increased by 500,000 VND per tael in both buying and selling prices, reaching VND83.3 million for bid price and VND85.8 million for ask price.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The list of Government members for the 2021-2026 term after being finalized;

- Continued reduction of VAT until June 2025;

- Russia is ready to support Vietnam in implementing nuclear power projects;

- Chinese companies rush to issue convertible bonds;

- The U.S. considers adding 200 Chinese chip companies to the "blacklist" for trade;

- South Korea continues to cut interest rates for the second consecutive time.

VN30

BANK

93,300

1D 0.76%

5D 2.98%

Buy Vol. 1,717,659

Sell Vol. 2,096,403

46,750

1D 1.41%

5D 2.30%

Buy Vol. 2,619,008

Sell Vol. 3,645,781

35,750

1D 0.99%

5D 2.14%

Buy Vol. 9,034,287

Sell Vol. 12,807,013

23,600

1D 0.00%

5D 0.43%

Buy Vol. 15,931,281

Sell Vol. 15,521,827

19,150

1D 0.52%

5D 0.52%

Buy Vol. 12,853,925

Sell Vol. 17,778,600

24,150

1D 0.63%

5D 0.63%

Buy Vol. 8,913,824

Sell Vol. 9,516,913

25,350

1D 0.20%

5D 2.63%

Buy Vol. 9,705,045

Sell Vol. 13,501,858

16,200

1D -0.31%

5D 0.62%

Buy Vol. 12,510,036

Sell Vol. 14,048,584

33,300

1D 0.45%

5D 1.99%

Buy Vol. 13,896,032

Sell Vol. 13,155,051

19,000

1D 0.53%

5D 4.40%

Buy Vol. 15,478,047

Sell Vol. 20,550,835

25,200

1D 0.20%

5D 1.00%

Buy Vol. 7,552,681

Sell Vol. 9,436,812

10,300

1D 0.49%

5D 0.49%

Buy Vol. 19,942,864

Sell Vol. 13,574,595

17,000

1D 0.00%

5D 0.59%

Buy Vol. 3,227,486

Sell Vol. 3,580,657

BID: At the investor conference, the leadership of BIDV stated that the bank plans to pay a 21% dividend in 2025 and is working with potential investors to issue a private placement of 2.9% in Q1/2025. The remaining 6.1% will be issued later, depending on market conditions.

OIL & GAS

69,600

1D 0.43%

5D 0.58%

Buy Vol. 739,087

Sell Vol. 986,756

12,400

1D -0.40%

5D 8.77%

Buy Vol. 14,978,022

Sell Vol. 17,248,829

40,000

1D 0.00%

5D 2.17%

Buy Vol. 1,067,940

Sell Vol. 1,911,287

The Dakdrinh Hydropower Reservoir, owned by Dakdrinh Hydropower JSC (a subsidiary of POW), is 'water-starved' even during the rainy season.

VINGROUP

40,500

1D -0.49%

5D 0.12%

Buy Vol. 3,311,422

Sell Vol. 4,159,872

40,800

1D -0.73%

5D -1.92%

Buy Vol. 10,882,698

Sell Vol. 9,805,032

17,900

1D -0.56%

5D -1.10%

Buy Vol. 14,939,649

Sell Vol. 15,997,827

VIC: VinFast will produce a new model smaller than the VF 3.

FOOD & BEVERAGE

64,600

1D 0.16%

5D 0.47%

Buy Vol. 2,149,301

Sell Vol. 3,100,133

73,200

1D 1.10%

5D 3.10%

Buy Vol. 7,345,066

Sell Vol. 8,653,361

56,100

1D 1.08%

5D 1.26%

Buy Vol. 1,056,445

Sell Vol. 994,822

MSN: Foreign investors have net bought MSN shares for 5 consecutive sessions, with a total value of over VND430 billion.

OTHERS

66,500

1D 0.45%

5D 1.06%

Buy Vol. 380,131

Sell Vol. 414,323

47,500

1D 6.98%

5D 7.47%

Buy Vol. 3,960,130

Sell Vol. 2,258,919

102,400

1D 0.20%

5D 0.69%

Buy Vol. 1,088,545

Sell Vol. 1,125,597

144,300

1D 3.52%

5D 7.77%

Buy Vol. 17,745,196

Sell Vol. 18,486,038

60,500

1D 0.83%

5D 2.54%

Buy Vol. 10,279,435

Sell Vol. 10,471,443

31,300

1D -0.16%

5D 1.29%

Buy Vol. 3,400,080

Sell Vol. 4,363,629

24,550

1D 1.03%

5D 0.82%

Buy Vol. 17,524,445

Sell Vol. 19,518,734

26,750

1D 1.33%

5D 2.49%

Buy Vol. 34,198,484

Sell Vol. 30,432,407

HPG: Hoa Phat Group reported October 2024 sales volume of nearly 804 thousand tons, a 14% increase from the previous month and a 15.9% rise compared to the same period last year. Although export sales dropped by 33% year-on-year, domestic consumption grew impressively by 44.3%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

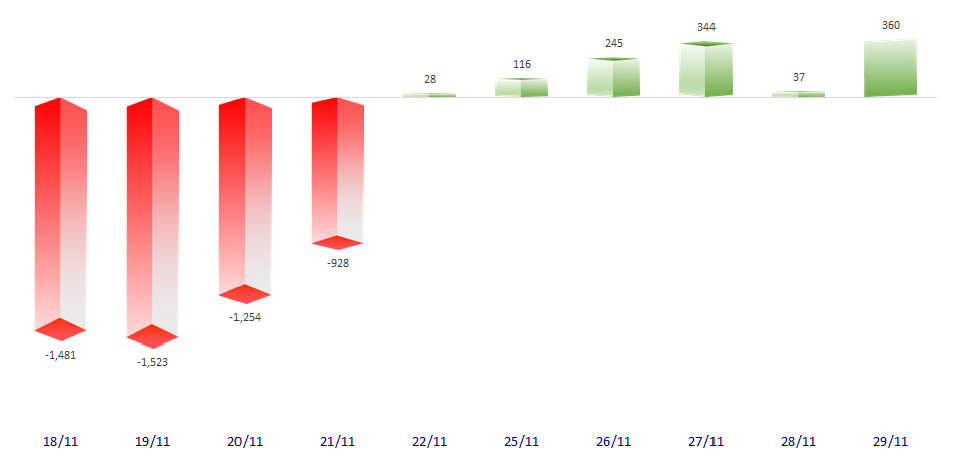

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

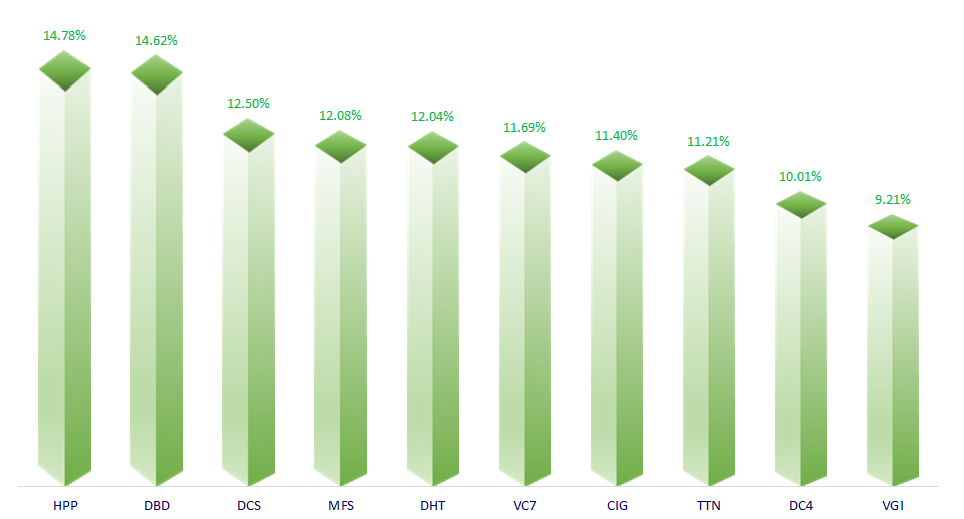

TOP INCREASES 3 CONSECUTIVE SESSIONS

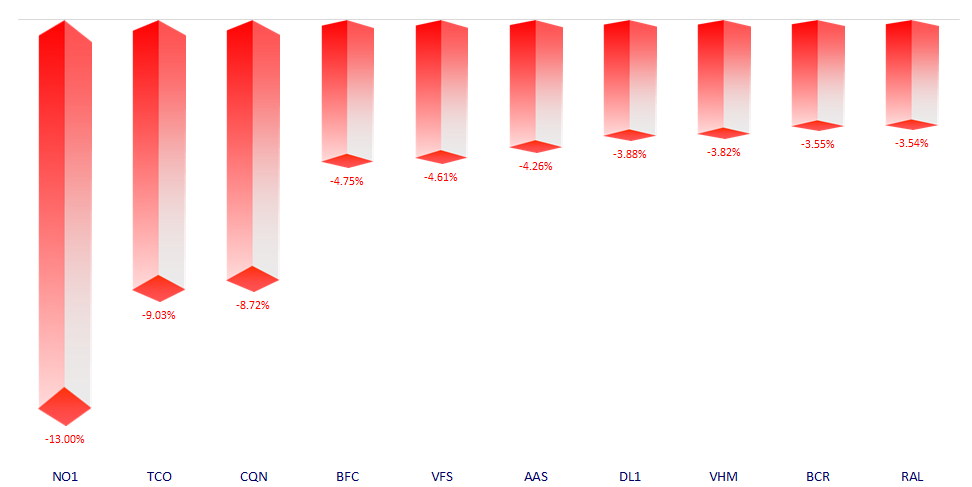

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.