Market brief 18/03/2025

VIETNAM STOCK MARKET

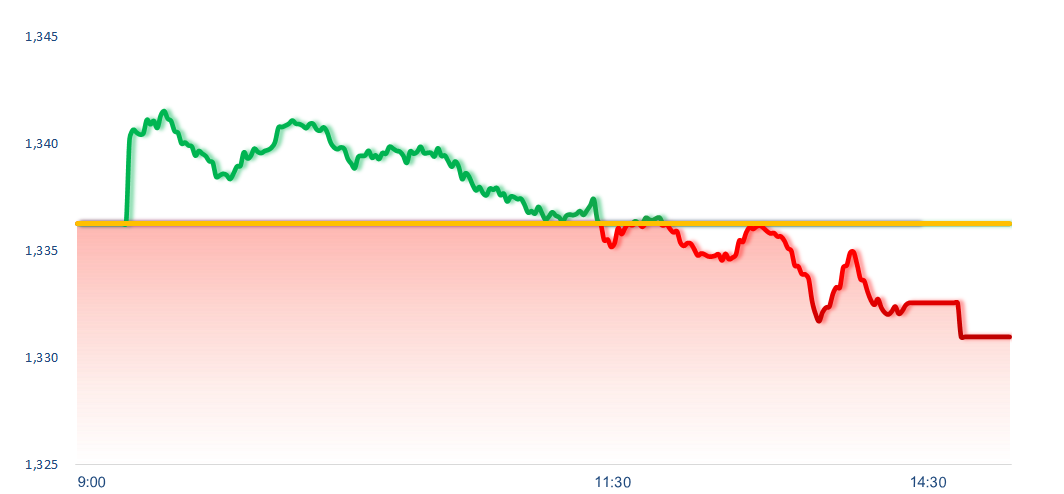

1,330.97

1D -0.40%

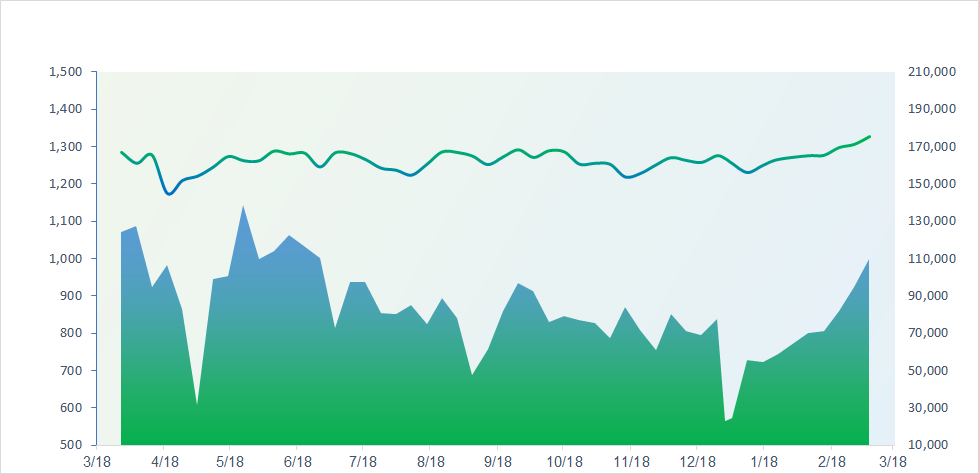

YTD 5.07%

247.03

1D 0.11%

YTD 8.62%

1,388.64

1D -0.45%

YTD 3.26%

100.29

1D -0.14%

YTD 5.50%

-490.68

1D 0.00%

YTD 0.00%

21,473.04

1D 18.43%

YTD 18.43%

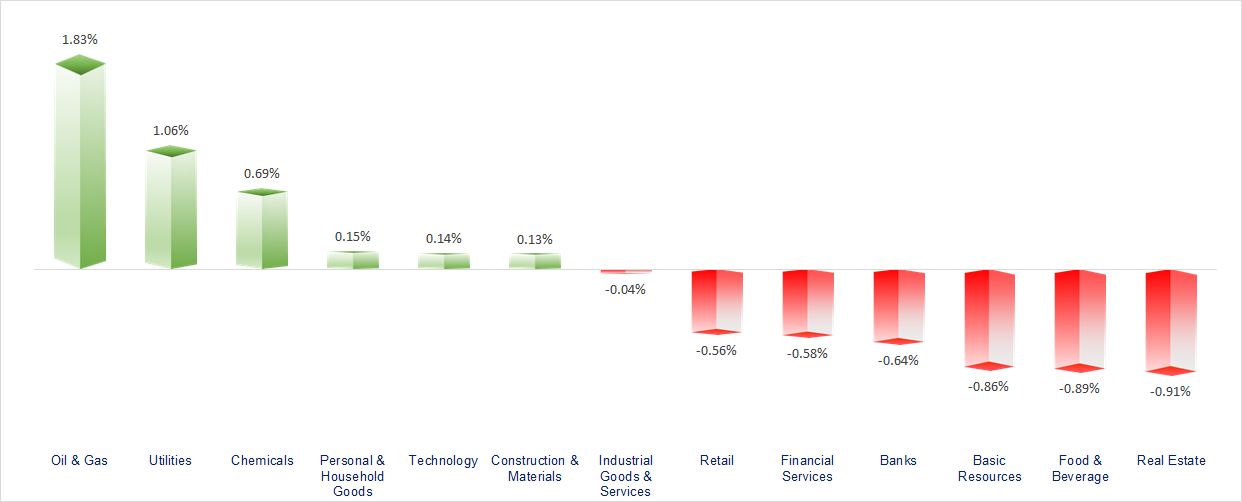

Market slightly adjusts ahead of derivatives expiry and FED interest rate decision. Telecommunications, oil & gas, and utilities were the top-performing sectors today, while tourism & entertainment, real estate, and resources had the most negative impact on the market.

ETF & DERIVATIVES

24,290

1D -0.29%

YTD 3.45%

16,740

1D 0.00%

YTD 2.83%

17,250

1D 0.00%

YTD 3.29%

20,730

1D -1.00%

YTD 3.13%

23,470

1D -2.21%

YTD 6.20%

32,630

1D -0.82%

YTD -2.66%

18,550

1D -1.75%

YTD 3.52%

1,386

1D -0.04%

YTD 0.00%

1,388

1D -0.20%

YTD 0.00%

1,382

1D -0.26%

YTD 0.00%

1,385

1D -0.42%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

37,888.50

1D 1.32%

YTD -5.03%

3,429.76

1D 0.11%

YTD 2.33%

24,740.58

1D 2.46%

YTD 23.34%

2,612.34

1D 0.06%

YTD 8.87%

75,301.26

1D 1.59%

YTD -4.17%

3,894.98

1D 0.92%

YTD 2.84%

1,176.17

1D 0.53%

YTD -16.00%

71.69

1D 0.74%

YTD -4.48%

3,024.00

1D 0.65%

YTD 14.76%

Asian Stock Markets Mostly Up on Tuesday. Hong Kong gains with optimism over China’s economic stimulus measures and strong capital inflows into major tech stocks driven by AI enthusiasm. Top five securities firms in Japan saw stock price increases after receiving additional investments from billionaire Warren Buffett’s Berkshire Hathaway. Especially, in Indonesia, the market dropped over 7% amid concerns over the president’s plan to nationalize some major corporations.

VIETNAM ECONOMY

4.16%

1D (bps) -8

YTD (bps) 19

4.60%

2.51%

YTD (bps) 4

2.92%

1D (bps) -1

YTD (bps) 7

2571000.00%

1D (%) -0.04%

YTD (%) 0.62%

2873000.00%

1D (%) 0.59%

YTD (%) 5.37%

359138.00%

1D (%) 0.15%

YTD (%) 0.85%

Domestic gold prices surged again, pushing SJC gold bars above 98.2 million VND/tael, while plain round gold rings neared the 99 million VND/tael mark.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Provincial Mergers: Must be well-prepared to meet housing demands for officials and civil servants;

- Proposal for a 'Conductor': Choosing Russia and Japan to build a nuclear power plant;

- Bac Ninh Leads in FDI Attraction: Aims to develop Vietnam’s own 'Silicon Valley';

- U.S. SOS: China's shipbuilding industry overwhelmingly surpasses the U.S.; a single Chinese shipyard outproduces all of America’s;

- Americans Struggle with Fallout from Trump’s New Tariffs;

- China Develops Nuclear Battery with a 100-Year Lifespan.

VN30

BANK

66,800

1D -0.74%

5D 3.17%

Buy Vol. 5,356,111

Sell Vol. 6,773,176

40,000

1D -0.87%

5D -3.38%

Buy Vol. 5,644,430

Sell Vol. 6,823,910

42,000

1D -1.41%

5D -1.41%

Buy Vol. 10,348,024

Sell Vol. 9,537,455

27,400

1D -0.18%

5D -2.14%

Buy Vol. 15,249,430

Sell Vol. 15,091,878

19,800

1D -1.98%

5D 0.51%

Buy Vol. 39,600,635

Sell Vol. 56,728,739

23,900

1D -1.65%

5D -3.63%

Buy Vol. 51,773,982

Sell Vol. 45,954,247

23,250

1D -0.64%

5D -2.31%

Buy Vol. 9,555,562

Sell Vol. 12,163,500

16,250

1D -0.61%

5D 0.00%

Buy Vol. 13,947,279

Sell Vol. 24,226,099

38,400

1D -1.16%

5D -3.76%

Buy Vol. 12,189,029

Sell Vol. 13,917,000

20,400

1D -0.49%

5D -1.92%

Buy Vol. 14,094,182

Sell Vol. 15,842,576

26,300

1D 0.38%

5D -0.57%

Buy Vol. 12,429,495

Sell Vol. 12,406,206

11,600

1D 3.11%

5D 16.12%

Buy Vol. 174,079,900

Sell Vol. 134,768,731

19,700

1D -0.51%

5D -0.51%

Buy Vol. 1,845,251

Sell Vol. 3,099,662

35,400

1D 2.02%

5D 2.16%

Buy Vol. 9,950,126

Sell Vol. 9,875,127

ACB: ACB has issued a resolution on the first private bond issuance plan for the 2025 financial year. The bank will issue up to VND20,000 billion in non-convertible, non-warranted, unsecured, and non-subordinated bonds.

OIL & GAS

69,100

1D 1.32%

5D 2.52%

Buy Vol. 5,159,201

Sell Vol. 5,015,130

41,700

1D 0.60%

5D -3.70%

Buy Vol. 2,896,826

Sell Vol. 2,559,770

PLX: PLX has announced the record date for attending the 2025 AGM as March 31, 2025, with the ex-rights date on March 28, 2025.

VINGROUP

51,300

1D -1.54%

5D 8.46%

Buy Vol. 9,749,937

Sell Vol. 11,238,576

47,300

1D -1.05%

5D 3.96%

Buy Vol. 17,708,892

Sell Vol. 23,394,713

18,450

1D -1.34%

5D 1.37%

Buy Vol. 17,503,021

Sell Vol. 22,621,652

VIC: POW has signed a cooperation agreement with Vingroup to develop charging stations, assigning V-Green to implement and complete the plan to reach 1,000 charging points nationwide by 2035.

FOOD & BEVERAGE

62,500

1D -0.79%

5D 0.16%

Buy Vol. 5,478,606

Sell Vol. 8,292,061

69,600

1D -1.28%

5D 1.02%

Buy Vol. 9,356,667

Sell Vol. 12,687,079

51,100

1D -0.97%

5D -0.20%

Buy Vol. 3,071,184

Sell Vol. 3,402,807

SAB: WSB (a subsidiary of SAB) has proposed a 50% cash dividend for 2024, higher than the initial plan of 40%, equivalent to a payout of approximately VND73 billion.

OTHERS

81,800

1D 0.00%

5D 2.00%

Buy Vol. 1,122,304

Sell Vol. 1,464,288

53,300

1D 0.57%

5D -2.91%

Buy Vol. 707,958

Sell Vol. 606,326

98,400

1D -0.71%

5D 0.72%

Buy Vol. 818,476

Sell Vol. 1,275,219

130,000

1D 0.00%

5D -5.45%

Buy Vol. 10,830,952

Sell Vol. 8,349,455

61,800

1D -0.32%

5D -1.90%

Buy Vol. 8,625,348

Sell Vol. 10,012,922

33,400

1D 1.06%

5D 0.00%

Buy Vol. 6,597,009

Sell Vol. 9,132,825

26,800

1D -0.74%

5D 0.37%

Buy Vol. 45,414,407

Sell Vol. 66,729,440

27,600

1D -0.90%

5D -1.95%

Buy Vol. 29,958,853

Sell Vol. 51,732,265

FPT: Foreign investors continued to sell off FPT shares aggressively, with a net sell value of nearly VND333 billion in today’s session.

Market by numbers

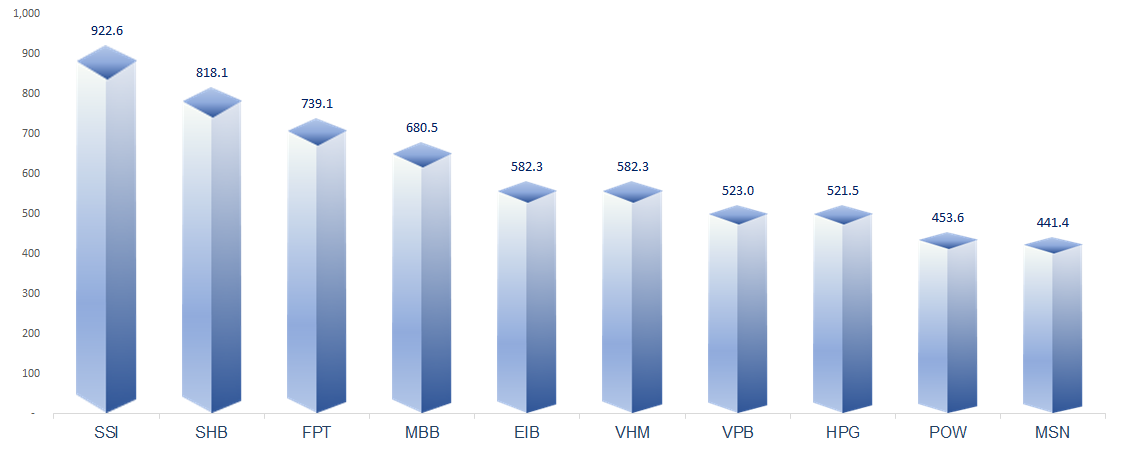

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

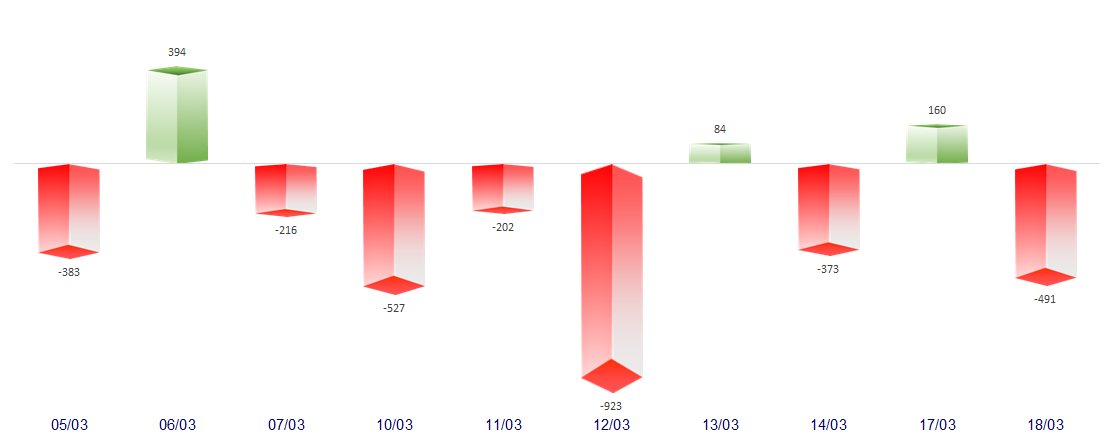

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

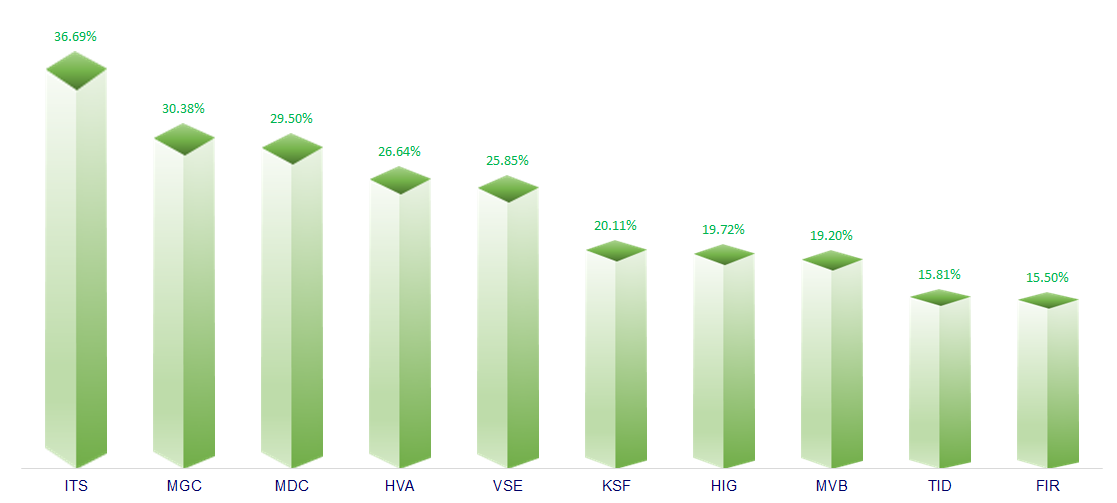

TOP INCREASES 3 CONSECUTIVE SESSIONS

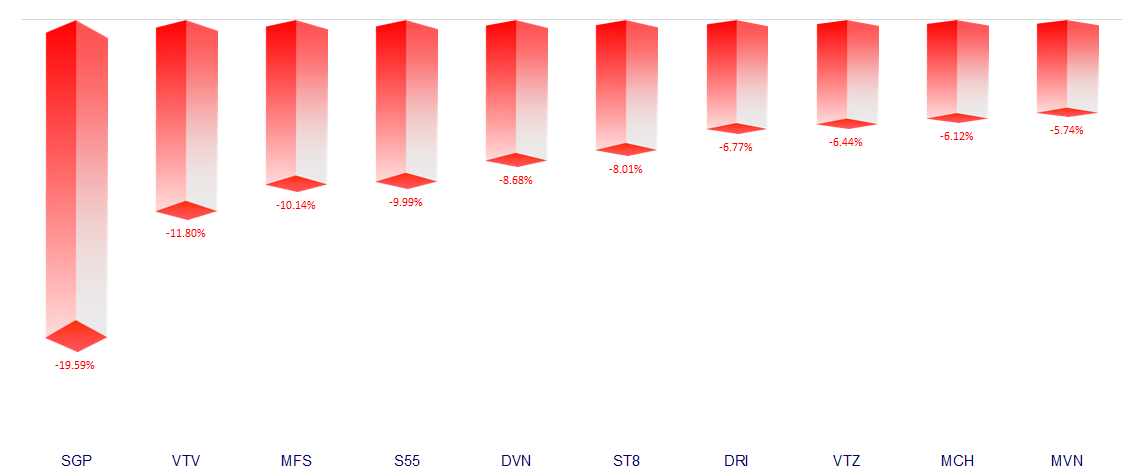

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.