Market brief 18/04/2025

VIETNAM STOCK MARKET

1,219.12

1D 0.15%

YTD -3.76%

213.10

1D 1.68%

YTD -6.30%

1,306.24

1D 0.25%

YTD -2.86%

91.30

1D 0.85%

YTD -3.96%

-0.93

1D 0.00%

YTD 0.00%

23,781.22

1D 3.70%

YTD 31.16%

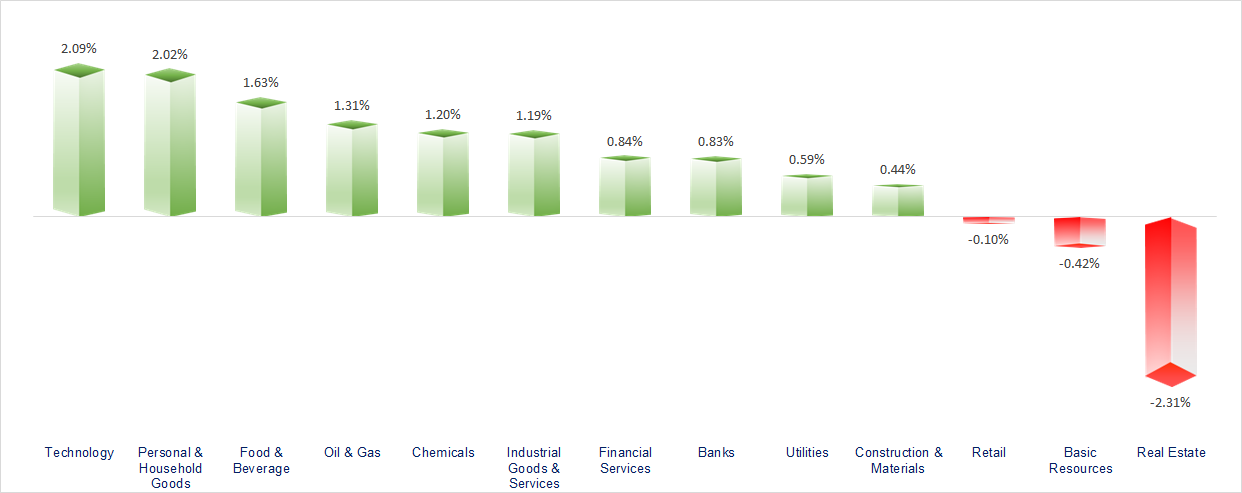

The market unexpectedly dropped sharply at the end of the session, pressured by a floor-hitting sell-off in Vingroup-related stocks. The Technology and Personal & Household Goods sectors posted the most impressive gains today. In contrast, Real Estate and Basic Resources were the two most negatively affected sectors in the market.

ETF & DERIVATIVES

22,760

1D 0.75%

YTD -3.07%

15,820

1D 0.57%

YTD -2.83%

16,200

1D 1.82%

YTD -2.99%

19,700

1D 0.00%

YTD -1.99%

21,800

1D 1.11%

YTD -1.36%

29,190

1D 2.06%

YTD -12.92%

17,230

1D 0.70%

YTD -3.85%

1,290

1D -1.03%

YTD 0.00%

1,291

1D -0.90%

YTD 0.00%

1,310

1D 0.66%

YTD 0.00%

1,304

1D -

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

34,730.28

1D 1.03%

YTD -12.94%

3,276.73

1D -0.11%

YTD -2.24%

21,395.14

1D 0.00%

YTD 6.66%

2,483.42

1D 0.00%

YTD 3.50%

78,553.20

1D 0.00%

YTD -0.03%

3,720.34

1D 0.00%

YTD -1.78%

1,150.95

1D 0.85%

YTD -17.80%

66.83

1D 2.47%

YTD -10.96%

3,327.38

1D 0.01%

YTD 26.27%

Asian stock markets mostly gained on Friday's trading session. Notably, Japan’s Nikkei 225 rose 1% following data showing that the country's March inflation increased by 3.6% year-over-year. This marks the third consecutive year that Japan’s inflation has remained above the Bank of Japan’s 2% target.

VIETNAM ECONOMY

4.18%

1D (bps) 8

YTD (bps) 21

4.60%

2.53%

1D (bps) 7

YTD (bps) 6

2.92%

1D (bps) -4

YTD (bps) 7

2610000.00%

1D (%) 0.15%

YTD (%) 2.15%

3029011.00%

1D (%) 0.26%

YTD (%) 11.09%

361264.00%

1D (%) 0.47%

YTD (%) 1.45%

On April 18, domestic gold prices continued to experience strong volatility, with SJC gold bars repeatedly setting new record highs, reaching an unprecedented VND120 million/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Minister of Finance supports the proposal to reduce taxes for all small and medium-sized enterprises (SMEs);

- A proposal has been made to allocate at least 20% of the total value of government procurement packages to SMEs;

- A plan to invest VND56,301 billion in the construction of the Binh Duong New City – Suoi Tien metro line has been proposed;

- The European Central Bank (ECB) continues to cut interest rates amid growing concerns over trade tariffs;

- China escalates its actions against Boeing: Following the suspension of new purchases, the country has now announced it will return aircraft to the U.S;

- FED remains hawkish, despite former President Trump’s threats to fire Chair Jerome Powell, stating: “There is no need to adjust interest rates at this time.”

VN30

BANK

58,100

1D 0.00%

5D -2.84%

Buy Vol. 3,879,515

Sell Vol. 4,199,523

35,950

1D 0.28%

5D -2.18%

Buy Vol. 5,786,958

Sell Vol. 7,326,098

37,450

1D 0.54%

5D -2.47%

Buy Vol. 14,398,937

Sell Vol. 16,444,709

26,000

1D 0.00%

5D -2.26%

Buy Vol. 26,267,134

Sell Vol. 40,302,186

16,950

1D 2.42%

5D -2.87%

Buy Vol. 34,919,138

Sell Vol. 31,461,145

23,250

1D 1.09%

5D -0.85%

Buy Vol. 70,358,234

Sell Vol. 56,849,360

20,800

1D 0.48%

5D 0.48%

Buy Vol. 14,676,413

Sell Vol. 12,674,421

13,200

1D 0.76%

5D 0.00%

Buy Vol. 24,653,840

Sell Vol. 28,666,961

38,550

1D 0.65%

5D 1.85%

Buy Vol. 21,586,834

Sell Vol. 27,791,056

18,300

1D 1.67%

5D -1.88%

Buy Vol. 10,079,297

Sell Vol. 11,357,032

24,500

1D 0.82%

5D -1.41%

Buy Vol. 16,929,030

Sell Vol. 20,795,077

12,850

1D 6.64%

5D 5.76%

Buy Vol. 275,113,973

Sell Vol. 181,499,680

19,350

1D 0.00%

5D -3.25%

Buy Vol. 2,836,344

Sell Vol. 3,299,636

33,900

1D 0.89%

5D -0.88%

Buy Vol. 7,629,814

Sell Vol. 8,067,368

CTG: As of April 15, 2025, VietinBank’s total assets reached approximately VND2.5 quadrillion, up 3.9% from the beginning of the year. Total outstanding credit stood at around VND1.8 quadrillion, increasing 4.7%, while standalone customer deposits reached VND2.3 quadrillion, up 6%. Non-performing loans (NPL) under Circular 31 are currently at 1.36%–1.46%, and under conventional calculation, at 1.66%. Standalone pre-tax profit is estimated at VND9,417 billion, up 19.6% year-over-year.

OIL & GAS

58,400

1D 0.52%

5D 0.52%

Buy Vol. 1,410,721

Sell Vol. 1,570,343

34,000

1D 0.44%

5D -3.82%

Buy Vol. 1,257,130

Sell Vol. 1,511,110

Oil prices surged over 3% overnight after the U.S. imposed new sanctions to restrict Iran’s oil exports, raising concerns about supply.

VINGROUP

66,100

1D -6.90%

5D 1.54%

Buy Vol. 13,838,379

Sell Vol. 22,392,225

55,000

1D -3.17%

5D 2.80%

Buy Vol. 18,344,730

Sell Vol. 20,883,675

20,400

1D 0.00%

5D 5.15%

Buy Vol. 29,010,740

Sell Vol. 37,839,803

VIC: Vingroup has partnered with Cleveland Clinic to develop Vinmec Can Gio International Hospital, set to begin construction in August 2025.

FOOD & BEVERAGE

56,600

1D 1.07%

5D -1.57%

Buy Vol. 5,912,061

Sell Vol. 7,483,460

58,000

1D 1.22%

5D 1.58%

Buy Vol. 6,410,933

Sell Vol. 7,439,474

47,350

1D 0.74%

5D -3.37%

Buy Vol. 1,761,578

Sell Vol. 1,768,702

MSN: Masan saw net foreign buying for the second consecutive session, with a value of over VND27 billion today.

OTHERS

54,000

1D 0.93%

5D -9.55%

Buy Vol. 1,201,131

Sell Vol. 1,062,725

45,000

1D -0.77%

5D 2.27%

Buy Vol. 882,008

Sell Vol. 1,332,252

86,500

1D -1.70%

5D 1.29%

Buy Vol. 1,028,881

Sell Vol. 1,324,064

111,600

1D 2.01%

5D -5.82%

Buy Vol. 11,867,214

Sell Vol. 15,125,082

56,200

1D -1.06%

5D 6.24%

Buy Vol. 10,671,068

Sell Vol. 11,865,231

24,500

1D 1.24%

5D -5.77%

Buy Vol. 5,732,721

Sell Vol. 6,748,986

23,350

1D 1.08%

5D -0.43%

Buy Vol. 44,477,973

Sell Vol. 52,278,482

25,450

1D -0.20%

5D 4.73%

Buy Vol. 33,558,984

Sell Vol. 42,603,696

SSI: In 2025, SSI targets consolidated revenue of VND9,695 billion and pre-tax profit of VND4,252 billion, representing increases of 11% and 20% respectively from 2024. In Q1/2025, SSI estimates consolidated revenue at VND2,186 billion and pre-tax profit at VND1,035 billion, completing 22.5% and 24.3% of the full-year plan, respectively.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

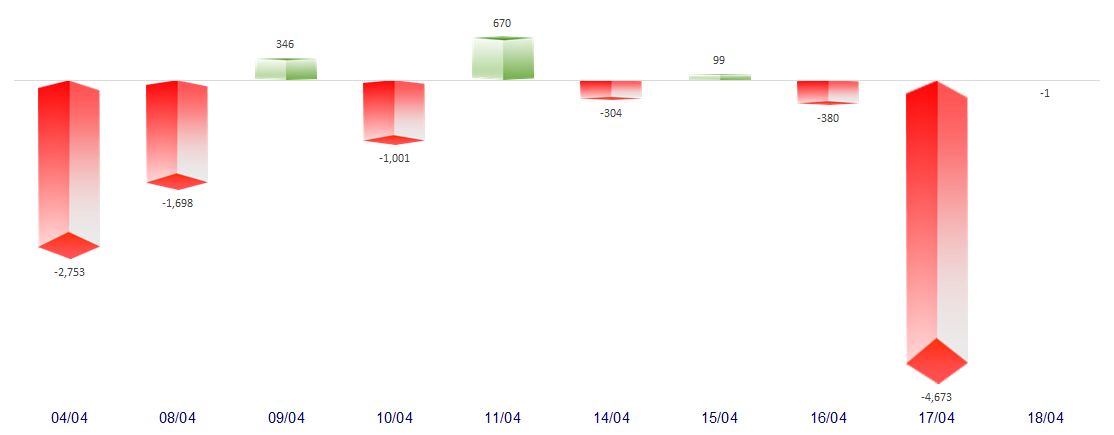

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

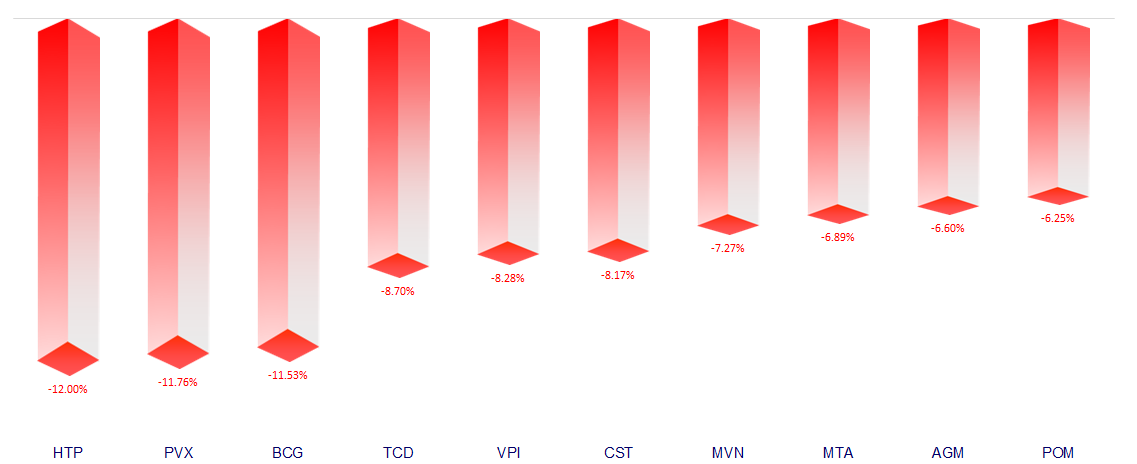

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.