Market brief 23/04/2025

VIETNAM STOCK MARKET

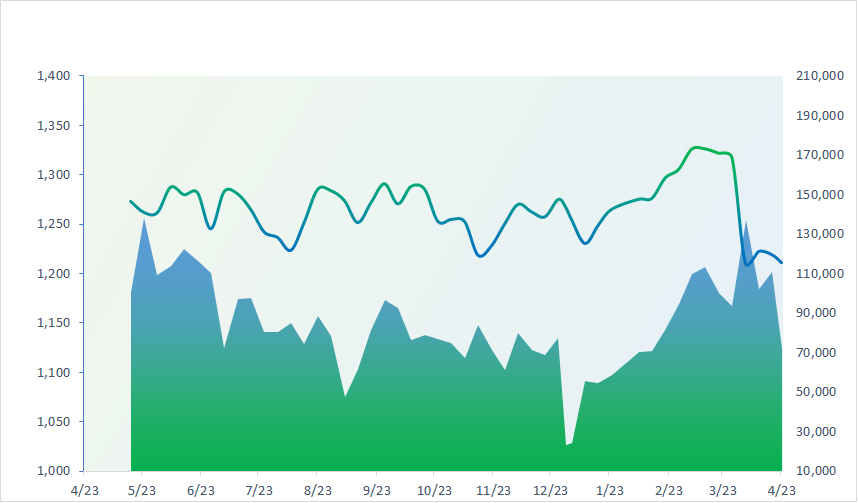

1,211.00

1D 1.16%

YTD -4.40%

211.45

1D 1.80%

YTD -7.03%

1,303.04

1D 0.98%

YTD -3.10%

91.46

1D 2.00%

YTD -3.79%

-114.67

1D 0.00%

YTD 0.00%

20,613.36

1D -43.88%

YTD 13.69%

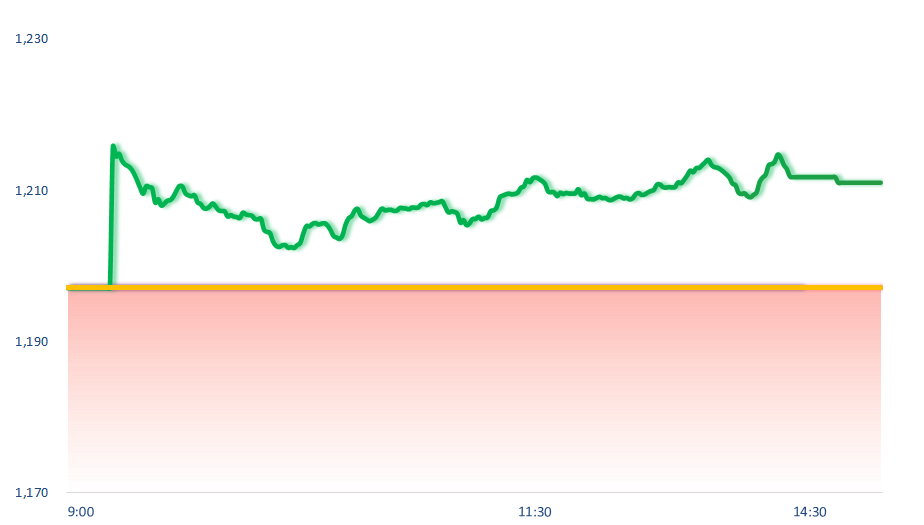

VNINDEX had a bumpy trading session after the market continuously received positive news about the potential easing of the trade war. Nearly all sectors gained points today, with telecommunications, chemicals, and retail being the most positive performers.

ETF & DERIVATIVES

22,600

1D 0.67%

YTD -3.75%

15,690

1D 2.68%

YTD -3.62%

16,020

1D 0.13%

YTD -4.07%

19,210

1D -0.21%

YTD -4.43%

21,520

1D 1.03%

YTD -2.62%

28,320

1D 0.78%

YTD -15.51%

17,040

1D 0.41%

YTD -4.91%

1,301

1D 0.70%

YTD 0.00%

1,297

1D 0.85%

YTD 0.00%

1,307

1D 0.69%

YTD 0.00%

1,309

1D 0.72%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

34,868.63

1D 1.89%

YTD -12.60%

3,296.36

1D -0.10%

YTD -1.65%

22,072.62

1D 2.37%

YTD 10.04%

2,525.56

1D 1.57%

YTD 5.25%

80,029.94

1D 0.55%

YTD 1.85%

3,833.30

1D 1.00%

YTD 1.21%

1,151.87

1D 0.68%

YTD -17.74%

68.36

1D 1.87%

YTD -8.91%

3,346.91

1D -0.69%

YTD 27.02%

Asian stock markets rallied today following news that the U.S. President announced tariffs on Chinese goods would be “significantly reduced, but not to 0%.” The biggest gainer was Hong Kong’s Hang Seng Index, up 2.4%, followed by Japan’s market with a 1.85% increase.

VIETNAM ECONOMY

3.97%

1D (bps) -50

4.60%

2.56%

1D (bps) 4

YTD (bps) 9

3.02%

1D (bps) 7

YTD (bps) 17

2614100.00%

1D (%) 0.08%

YTD (%) 2.31%

3053050.00%

1D (%) -0.24%

YTD (%) 11.97%

362383.00%

1D (%) 0.72%

YTD (%) 1.76%

The USD exchange rate at banks rose sharply this morning, with common increases ranging from 50 to 85 VND. Buying prices moved up to the range of 25,750–25,796 VND/USD, while selling prices approached the upper trading limit, fluctuating around 26,140–26,141 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- VAT reduction is expected to continue in the last 6 months of 2025 and throughout 2026;

- Vietnam’s economy is projected to reach USD1.1 trillion by 2035;

- The Ministry of Industry and Trade will transfer state ownership representation of 3 joint-stock companies to SCIC;

- The USD surged after hitting a nearly 3-year low: Two remarks by Mr. Trump provided relief to investors;

- The U.S. Treasury Secretary stated that a trade war with China is unsustainable;

- If Mr. Trump delists Chinese companies, the U.S. may also suffer consequences.

VN30

BANK

58,000

1D -0.85%

5D -2.19%

Buy Vol. 3,040,265

Sell Vol. 5,105,904

35,350

1D 0.71%

5D -1.81%

Buy Vol. 3,784,479

Sell Vol. 4,564,925

37,300

1D 0.54%

5D 0.27%

Buy Vol. 12,547,792

Sell Vol. 15,753,139

26,100

1D 3.78%

5D 1.16%

Buy Vol. 32,262,445

Sell Vol. 30,128,607

16,700

1D 0.60%

5D -0.60%

Buy Vol. 20,354,703

Sell Vol. 31,659,933

23,400

1D 1.30%

5D 2.18%

Buy Vol. 62,787,012

Sell Vol. 70,056,294

20,350

1D 0.25%

5D -1.45%

Buy Vol. 18,138,431

Sell Vol. 16,622,562

13,500

1D 0.75%

5D 4.25%

Buy Vol. 16,036,251

Sell Vol. 21,260,075

40,200

1D -1.11%

5D 5.37%

Buy Vol. 19,294,568

Sell Vol. 33,468,506

17,650

1D 0.86%

5D 0.82%

Buy Vol. 5,267,407

Sell Vol. 7,200,409

24,600

1D 2.07%

5D 1.23%

Buy Vol. 15,289,188

Sell Vol. 15,284,462

13,000

1D -1.52%

5D 8.33%

Buy Vol. 158,675,927

Sell Vol. 171,631,346

18,500

1D -3.65%

5D -1.07%

Buy Vol. 3,603,436

Sell Vol. 3,971,754

33,300

1D 0.15%

5D 1.99%

Buy Vol. 4,751,932

Sell Vol. 5,493,967

VPB: Vietnam Prosperity Joint Stock Commercial Bank – VPBank (VPB) released its consolidated and separate Q1 financial statements. Consolidated pre-tax profit increased nearly 20% year-over-year, reaching VND5,015 billion. At the parent bank level, the separate report showed a Q1 pre-tax profit of VND4,942 billion, accounting for over 98% of the total pre-tax profit.

OIL & GAS

57,500

1D 0.00%

5D -1.03%

Buy Vol. 1,642,277

Sell Vol. 1,593,679

33,450

1D 1.06%

5D 1.36%

Buy Vol. 2,358,253

Sell Vol. 1,468,731

As of 4:00 PM today, Brent crude oil price continued to rise by more than 1.5%, reaching 68.5 USD/barrel.

VINGROUP

58,600

1D -0.68%

5D -13.70%

Buy Vol. 26,722,508

Sell Vol. 27,052,596

58,500

1D 1.74%

5D 3.54%

Buy Vol. 13,407,113

Sell Vol. 17,635,242

21,950

1D 6.55%

5D 7.60%

Buy Vol. 50,813,848

Sell Vol. 37,578,319

VHM: Vinhomes has set a record profit target of VND42,000 billion for 2025, up 20% compared to 2024. The company plans to launch sales for the Vinhomes Can Gio project this year.

FOOD & BEVERAGE

56,400

1D 0.71%

5D 0.71%

Buy Vol. 6,147,063

Sell Vol. 7,496,307

59,600

1D 1.53%

5D 5.67%

Buy Vol. 7,759,624

Sell Vol. 10,669,578

48,600

1D 4.29%

5D 2.10%

Buy Vol. 2,676,788

Sell Vol. 2,268,387

MSN: Today, foreign investors made a net purchase of over VND45 billion in MSN shares.

OTHERS

55,000

1D 5.77%

5D 2.80%

Buy Vol. 1,785,739

Sell Vol. 1,691,738

44,000

1D 1.38%

5D -0.11%

Buy Vol. 1,044,961

Sell Vol. 1,015,936

85,700

1D 2.63%

5D 0.35%

Buy Vol. 1,162,277

Sell Vol. 1,105,187

110,400

1D 0.00%

5D 2.32%

Buy Vol. 9,599,247

Sell Vol. 12,354,875

58,800

1D 2.62%

5D 3.52%

Buy Vol. 12,688,315

Sell Vol. 15,691,678

23,150

1D 3.81%

5D -1.49%

Buy Vol. 11,706,423

Sell Vol. 10,456,691

22,750

1D 2.25%

5D -1.09%

Buy Vol. 23,505,303

Sell Vol. 31,087,931

25,550

1D 2.00%

5D 0.20%

Buy Vol. 37,802,154

Sell Vol. 48,993,853

HPG: Hoa Phat Pipe Company Limited (a subsidiary of Hoa Phat Group – HPG) has delivered on schedule 2,400 tons of various round steel pipes, helping the T3 passenger terminal project complete ahead of schedule.

Market by numbers

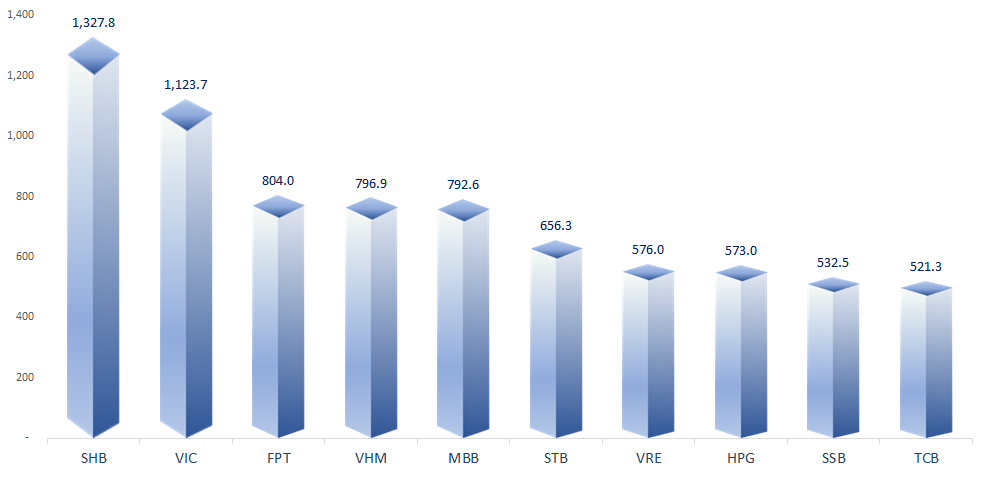

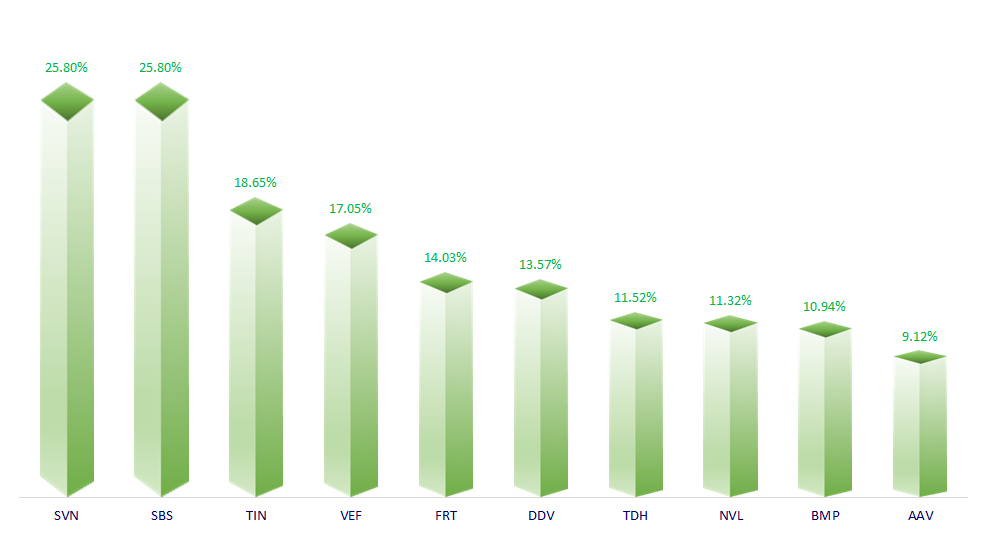

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

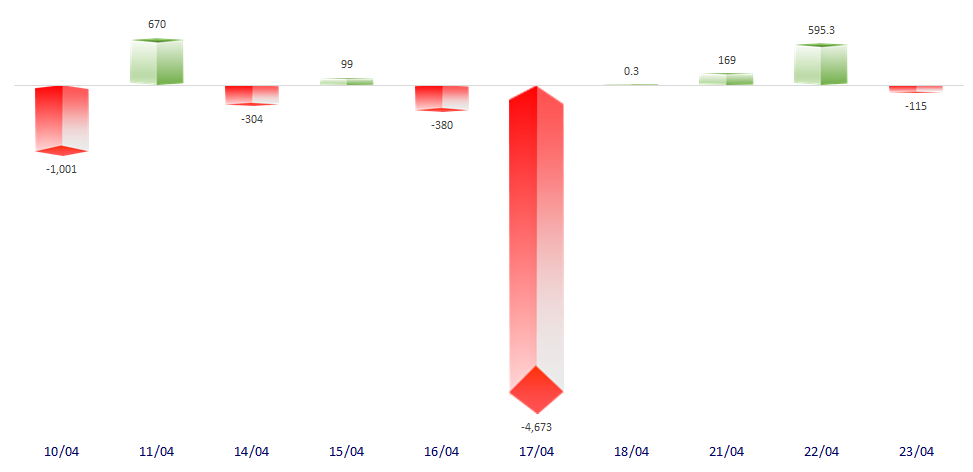

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.