Market brief 02/06/2025

VIETNAM STOCK MARKET

1,336.30

1D 0.28%

YTD 5.49%

226.17

1D -2.61%

YTD -0.55%

1,423.04

1D -0.04%

YTD 5.82%

98.36

1D -0.13%

YTD 3.47%

-166.96

1D 0.00%

YTD 0.00%

23,156.58

1D -5.89%

YTD 27.72%

VN-Index staged a strong intraday rebound, driven by a surge in Real Estate and Oil & Gas stocks. Securities, Oil & Gas, and Chemicals were the top-performing sectors on the market today. In contrast, Retail and Basic Resources experienced a pullback during the session.

ETF & DERIVATIVES

24,770

1D -0.12%

YTD 5.49%

17,300

1D -0.29%

YTD 6.27%

17,100

1D -1.67%

YTD 2.40%

20,290

1D -0.25%

YTD 0.95%

23,500

1D -1.26%

YTD 6.33%

32,000

1D 0.00%

YTD -4.53%

18,270

1D 1.05%

YTD 1.95%

1,415

1D -0.60%

YTD 0.00%

1,413

1D -0.23%

YTD 0.00%

1,409

1D -0.72%

YTD 0.00%

1,411

1D -0.77%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

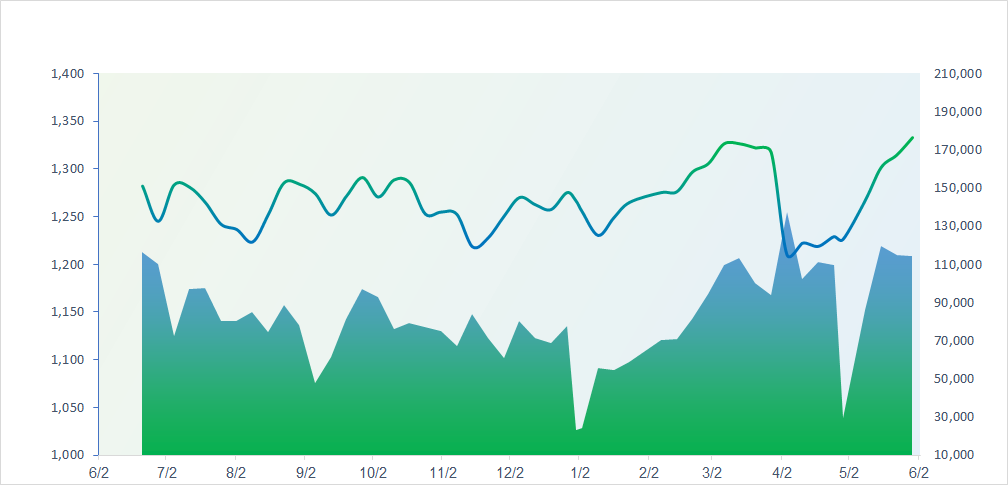

VNINDEX (12M)

GLOBAL MARKET

37,470.67

1D -1.30%

YTD -6.08%

3,347.49

1D 0.00%

YTD -0.13%

23,157.97

1D -0.57%

YTD 15.45%

2,698.97

1D 0.05%

YTD 12.48%

81,217.00

1D -0.27%

YTD 3.36%

3,890.60

1D -0.10%

YTD 2.72%

1,152.84

1D 0.00%

YTD -17.67%

64.69

1D 2.98%

YTD -13.80%

3,348.00

1D 1.76%

YTD 27.06%

Asian stock markets mostly declined as President Trump announced a doubling of tariffs on imported steel and aluminum. South Korea’s Kospi edged higher despite its May PMI coming in at 47.7, marking the fourth consecutive month below the 50-point threshold. Chinese markets were closed today for a public holiday.

VIETNAM ECONOMY

3.83%

1D (bps) 75

YTD (bps) -14

4.60%

2.63%

1D (bps) 13

YTD (bps) 15

3.09%

1D (bps) 7

YTD (bps) 24

26,180

1D (%) 0.08%

YTD (%) 2.46%

30,552

1D (%) 0.69%

YTD (%) 12.05%

3,669

1D (%) -0.03%

YTD (%) 3.04%

Brent crude oil prices rebounded strongly by more than 2%, as OPEC+ projected an increase in production starting July 2025, while political tensions between Ukraine and Russia escalated ahead of the second round of peace talks.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Minister leads delegation of 50 businesses to the U.S. to boost trade relations;

- Proposal to establish two interregional renewable energy hubs;

- Prime Minister: Multiple headquarters may be maintained temporarily during administrative unit consolidation;

- Fed Chair forecasts interest rate cuts by year-end;

- Trump and Xi may hold trade negotiations this week;

- Asian manufacturing struggles amid tariff pressures.

VN30

BANK

56,200

1D -0.35%

5D -1.40%

Buy Vol. 8,342,825

Sell Vol. 5,890,056

35,700

1D -0.83%

5D -0.42%

Buy Vol. 5,185,777

Sell Vol. 4,542,833

38,400

1D 0.26%

5D -2.17%

Buy Vol. 8,474,046

Sell Vol. 8,333,015

30,850

1D 1.31%

5D 1.65%

Buy Vol. 23,156,261

Sell Vol. 23,596,929

18,000

1D 0.28%

5D -0.83%

Buy Vol. 41,899,694

Sell Vol. 41,305,708

24,600

1D 1.03%

5D -0.81%

Buy Vol. 36,771,639

Sell Vol. 32,119,321

21,600

1D -0.46%

5D -4.42%

Buy Vol. 14,671,455

Sell Vol. 15,432,391

13,100

1D -1.13%

5D -1.87%

Buy Vol. 47,361,372

Sell Vol. 36,816,275

41,800

1D 2.70%

5D 0.60%

Buy Vol. 20,193,506

Sell Vol. 18,754,663

18,050

1D 0.84%

5D -1.10%

Buy Vol. 6,431,543

Sell Vol. 5,462,968

21,100

1D 0.00%

5D -1.86%

Buy Vol. 14,644,605

Sell Vol. 12,719,427

13,700

1D 1.11%

5D 0.74%

Buy Vol. 101,407,522

Sell Vol. 109,259,895

18,500

1D 0.54%

5D -0.80%

Buy Vol. 23,841,821

Sell Vol. 24,009,081

32,000

1D 0.63%

5D -1.54%

Buy Vol. 4,737,083

Sell Vol. 3,533,621

According to Resolution 154/NQ-CP dated May 31, 2025, the Vietnamese Government has instructed the State Bank of Vietnam (SBV) to manage credit growth in line with economic growth and inflation control goals, while ensuring the safety of the banking system. The resolution also calls for the SBV to consider allocating additional credit growth quotas to commercial banks within its jurisdiction.

OIL & GAS

65,500

1D 0.77%

5D 3.97%

Buy Vol. 1,209,873

Sell Vol. 1,535,629

35,600

1D 3.19%

5D 2.59%

Buy Vol. 3,893,973

Sell Vol. 2,944,374

PLX: Petrolimex will pay a cash dividend at a rate of 12%. The payment date is set for June 24, with the record date on June 11.

VINGROUP

98,000

1D -0.41%

5D 3.70%

Buy Vol. 7,938,041

Sell Vol. 11,151,931

77,000

1D -0.77%

5D 4.76%

Buy Vol. 7,782,674

Sell Vol. 8,755,040

26,700

1D -2.91%

5D 4.71%

Buy Vol. 14,522,002

Sell Vol. 15,329,937

All four Vingroup-related stocks posted corrections today, with VIC, VHM, VRE, and VPL collectively dragging the VN-Index down by 2 points.

FOOD & BEVERAGE

54,600

1D -0.55%

5D -1.97%

Buy Vol. 4,342,000

Sell Vol. 4,908,761

62,100

1D 0.16%

5D -2.66%

Buy Vol. 4,637,148

Sell Vol. 4,652,102

49,150

1D 0.82%

5D -0.61%

Buy Vol. 1,188,650

Sell Vol. 1,136,774

VNM: Foreign investors have recorded six consecutive sessions of net selling Vinamilk, with a total value reaching VND239 billion.

OTHERS

60,000

1D -0.99%

5D -2.76%

Buy Vol. 965,663

Sell Vol. 856,076

50,500

1D -0.20%

5D -1.75%

Buy Vol. 758,448

Sell Vol. 835,700

89,500

1D 2.87%

5D 1.94%

Buy Vol. 1,901,156

Sell Vol. 1,824,239

116,100

1D -0.34%

5D -1.02%

Buy Vol. 6,107,907

Sell Vol. 6,516,768

61,000

1D -1.77%

5D -5.43%

Buy Vol. 24,847,389

Sell Vol. 21,607,201

29,300

1D 2.09%

5D 1.56%

Buy Vol. 5,007,001

Sell Vol. 5,258,575

23,700

1D 1.07%

5D 0.42%

Buy Vol. 27,976,774

Sell Vol. 25,732,208

25,550

1D -0.78%

5D 0.00%

Buy Vol. 39,586,480

Sell Vol. 36,325,561

HPG: U.S. President Donald Trump is expected to raise import tariffs on aluminum and steel to 50%, effective from June 4.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.