Market brief 09/06/2025

VIETNAM STOCK MARKET

1,310.57

1D -1.45%

YTD 3.46%

226.49

1D -0.93%

YTD -0.41%

1,396.56

1D -1.58%

YTD 3.85%

98.19

1D -0.71%

YTD 3.29%

-338.95

1D 0.00%

YTD 0.00%

19,817.73

1D -26.96%

YTD 9.30%

VN-Index experienced a sharp correction after officially falling below the 20-day moving average (MA20). Retail and Technology were among the few sectors that showed positive performance today. In contrast, the Real Estate and Industrial Goods & Services sectors saw notably negative declines.

ETF & DERIVATIVES

24,750

1D -0.60%

YTD 5.41%

17,080

1D -0.93%

YTD 4.91%

16,810

1D -3.11%

YTD 0.66%

20,300

1D -2.17%

YTD 1.00%

23,190

1D -0.22%

YTD 4.93%

31,450

1D -0.22%

YTD -6.18%

18,180

1D -0.55%

YTD 1.45%

1,397

1D -1.88%

YTD 0.00%

1,397

1D -1.32%

YTD 0.00%

1,396

1D -1.65%

YTD 0.00%

1,400

1D -1.55%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

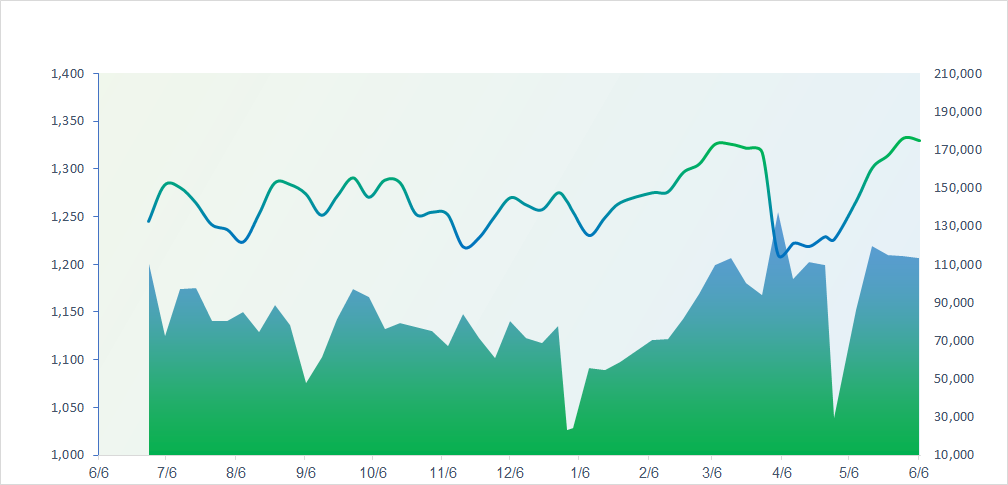

VNINDEX (12M)

GLOBAL MARKET

38,088.57

1D 0.92%

YTD -4.53%

3,399.77

1D 0.43%

YTD 1.43%

24,181.43

1D 1.63%

YTD 20.55%

2,855.77

1D 1.55%

YTD 19.02%

82,446.44

1D 0.30%

YTD 4.93%

3,936.33

1D 0.05%

YTD 3.93%

1,135.24

1D -0.10%

YTD -18.92%

66.72

1D 0.11%

YTD -11.10%

3,319.00

1D 0.27%

YTD 25.96%

Asian stock markets mostly gained today as investors await the outcome of trade negotiations between the U.S. and China. Notably, trade tensions between the world’s two largest economies appear to be easing, with China reportedly granting temporary rare earth export licenses, while aircraft manufacturer Boeing has resumed deliveries of commercial planes to China. Additionally, China’s May Consumer Price Index (CPI) fell by 0.1% year-over-year. Meanwhile, the Indian government has introduced a series of new anti-dumping tax measures targeting certain imported goods originating from China, Japan, Switzerland, and the EU.

VIETNAM ECONOMY

2.88%

1D (bps) 8

YTD (bps) -109

4.60%

2.62%

1D (bps) -1

YTD (bps) 14

3.01%

1D (bps) 2

YTD (bps) 16

26,220

1D (%) 0.00%

YTD (%) 2.62%

30,511

1D (%) -0.13%

YTD (%) 11.90%

3,680

1D (%) -0.07%

YTD (%) 3.35%

According to a survey conducted on the morning of June 9, the euro exchange rate fell by around VND100 at local banks. As a result, the euro dropped on both buying and selling sides, now quoted at 29,300 – 30,500 VND/EUR.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi Chairman: Determined to reduce motorbike usage in 4 central districts;

- Decree No. 67/2025/NĐ-CP regarding policies for officials, public servants, workers, and armed forces personnel during organizational restructuring;

- Over VND 66 trillion to be invested in Hai Phong seaport system;

- U.S.: Surge in goods volume raises risk of port congestion;

- Key focus of U.S.–China negotiations on June 9;

- Russia announces its first advance into a central Ukrainian province, Kyiv faces a new reality.

VN30

BANK

55,900

1D -0.36%

5D -0.53%

Buy Vol. 4,299,691

Sell Vol. 5,370,754

35,250

1D 0.00%

5D -1.26%

Buy Vol. 2,665,811

Sell Vol. 3,003,017

38,000

1D -0.52%

5D -1.04%

Buy Vol. 6,820,494

Sell Vol. 6,970,644

29,750

1D -1.82%

5D -3.57%

Buy Vol. 28,915,590

Sell Vol. 27,791,325

17,850

1D 0.28%

5D -0.83%

Buy Vol. 30,871,545

Sell Vol. 28,483,773

24,250

1D 0.41%

5D -1.42%

Buy Vol. 31,468,375

Sell Vol. 20,927,002

21,450

1D -1.61%

5D -0.69%

Buy Vol. 11,150,611

Sell Vol. 12,719,543

13,050

1D -0.38%

5D -0.38%

Buy Vol. 13,586,749

Sell Vol. 16,125,020

41,950

1D 0.48%

5D 0.36%

Buy Vol. 17,000,203

Sell Vol. 16,702,215

17,850

1D 0.00%

5D -1.11%

Buy Vol. 3,982,932

Sell Vol. 4,376,503

20,950

1D -0.24%

5D -0.71%

Buy Vol. 13,683,162

Sell Vol. 9,992,766

13,050

1D -1.14%

5D -1.14%

Buy Vol. 99,426,456

Sell Vol. 124,102,894

18,150

1D -0.27%

5D -1.89%

Buy Vol. 3,118,296

Sell Vol. 3,366,399

31,250

1D 0.16%

5D -2.34%

Buy Vol. 4,205,824

Sell Vol. 3,049,266

ACB: In May, Asia Commercial Bank (ACB) received approval from the State Bank of Vietnam to increase its charter capital by nearly VND6,700 billion through a stock dividend issuance plan. The bank expects to complete the capital increase in Q3/2025.

OIL & GAS

63,300

1D 0.48%

5D -3.36%

Buy Vol. 1,242,986

Sell Vol. 1,233,426

37,000

1D -1.07%

5D 3.93%

Buy Vol. 3,196,541

Sell Vol. 3,890,109

GAS: In the first five months, consolidated revenue and pre-tax profit reached over VND46.5 and 7.4 trillion, completing 63% and 112% of the annual targets.

VINGROUP

90,300

1D -6.91%

5D -7.86%

Buy Vol. 5,011,866

Sell Vol. 7,539,628

70,700

1D -6.97%

5D -8.18%

Buy Vol. 7,481,841

Sell Vol. 11,169,636

25,550

1D -3.58%

5D -4.31%

Buy Vol. 10,529,854

Sell Vol. 10,396,701

Only three stocks — VIC, VHM, and VRE — collectively dragged the VN-Index down by 11 points in today's trading session. Notably, VIC and VHM unexpectedly hit their floor prices.

FOOD & BEVERAGE

55,300

1D 0.00%

5D 1.28%

Buy Vol. 5,007,130

Sell Vol. 5,951,182

64,100

1D -1.38%

5D 3.22%

Buy Vol. 6,879,463

Sell Vol. 7,915,600

48,850

1D -0.41%

5D -0.61%

Buy Vol. 1,284,036

Sell Vol. 1,690,006

SAB: Foreign investors recorded net selling for three consecutive sessions, totaling VND41.17 billion in SAB shares.

OTHERS

59,700

1D -1.97%

5D -0.50%

Buy Vol. 688,561

Sell Vol. 961,275

48,600

1D -1.82%

5D -3.76%

Buy Vol. 777,968

Sell Vol. 1,023,103

88,800

1D -1.33%

5D -0.78%

Buy Vol. 1,679,832

Sell Vol. 2,039,810

116,200

1D 1.04%

5D 0.09%

Buy Vol. 6,376,337

Sell Vol. 6,381,286

60,500

1D 0.00%

5D -0.82%

Buy Vol. 11,961,570

Sell Vol. 10,201,054

27,700

1D -2.29%

5D -5.46%

Buy Vol. 3,978,040

Sell Vol. 4,344,089

23,350

1D -1.06%

5D -1.48%

Buy Vol. 28,292,896

Sell Vol. 27,627,463

26,300

1D 0.96%

5D 2.94%

Buy Vol. 38,240,817

Sell Vol. 48,012,419

FPT: June 12 is the ex-dividend date for FPT’s cash dividend payment at a 10% rate.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.