Market brief 28/07/2025

VIETNAM STOCK MARKET

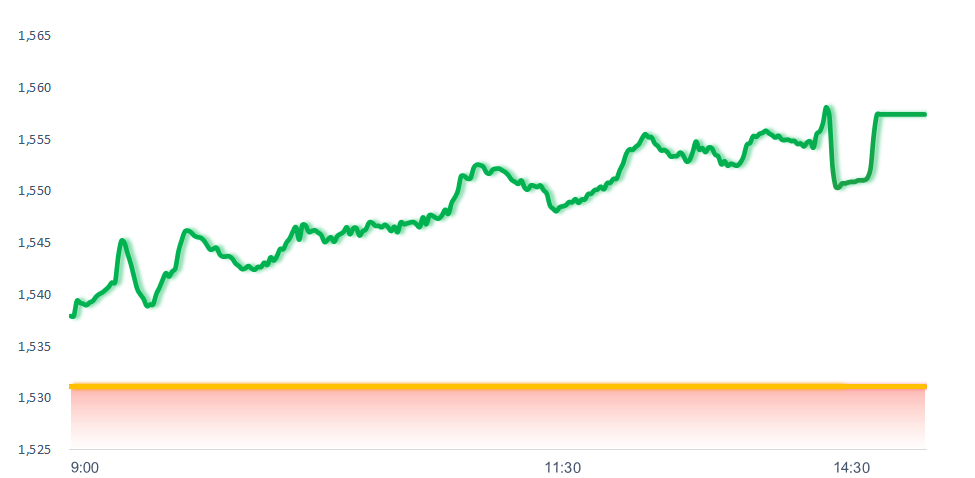

1,557.42

1D 1.72%

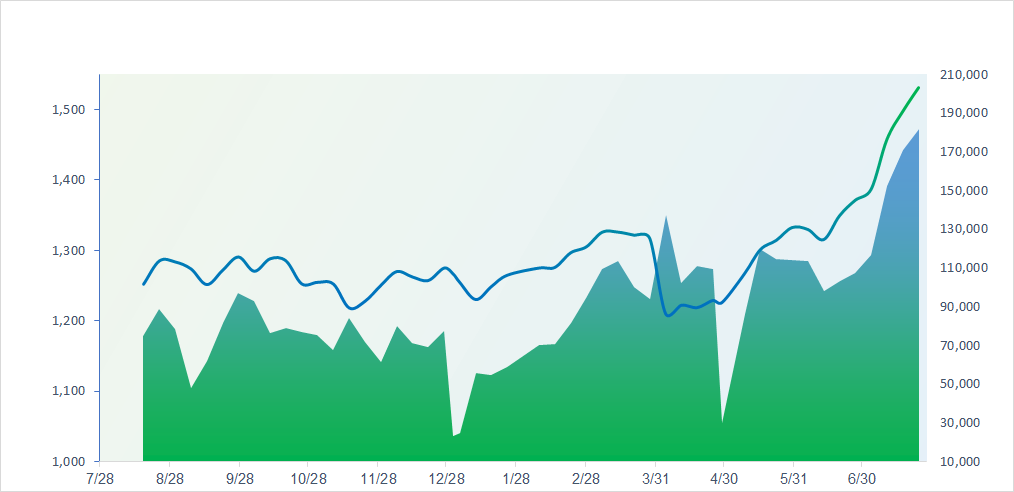

YTD 22.94%

263.79

1D 3.63%

YTD 15.99%

1,695.63

1D 1.58%

YTD 26.09%

106.94

1D 1.11%

YTD 12.50%

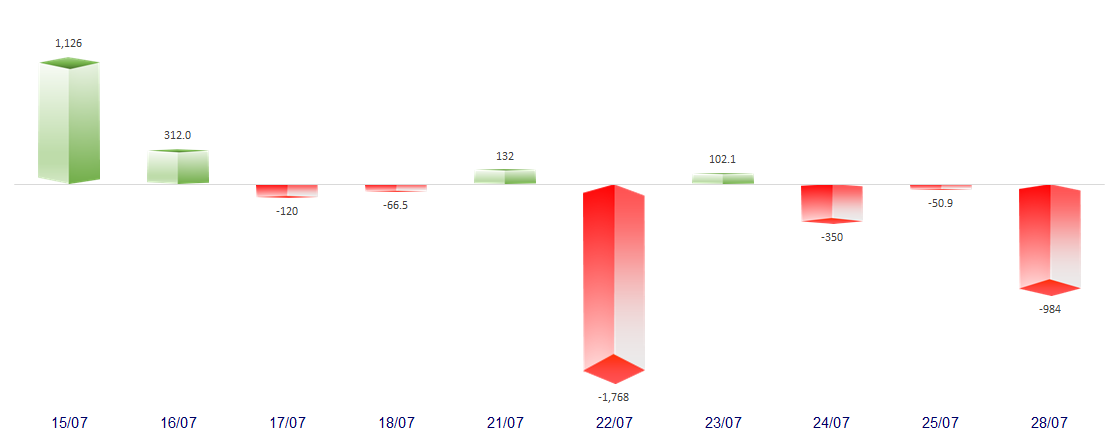

-984.33

1D 0.00%

YTD 0.00%

52,173.00

1D 24.82%

YTD 187.76%

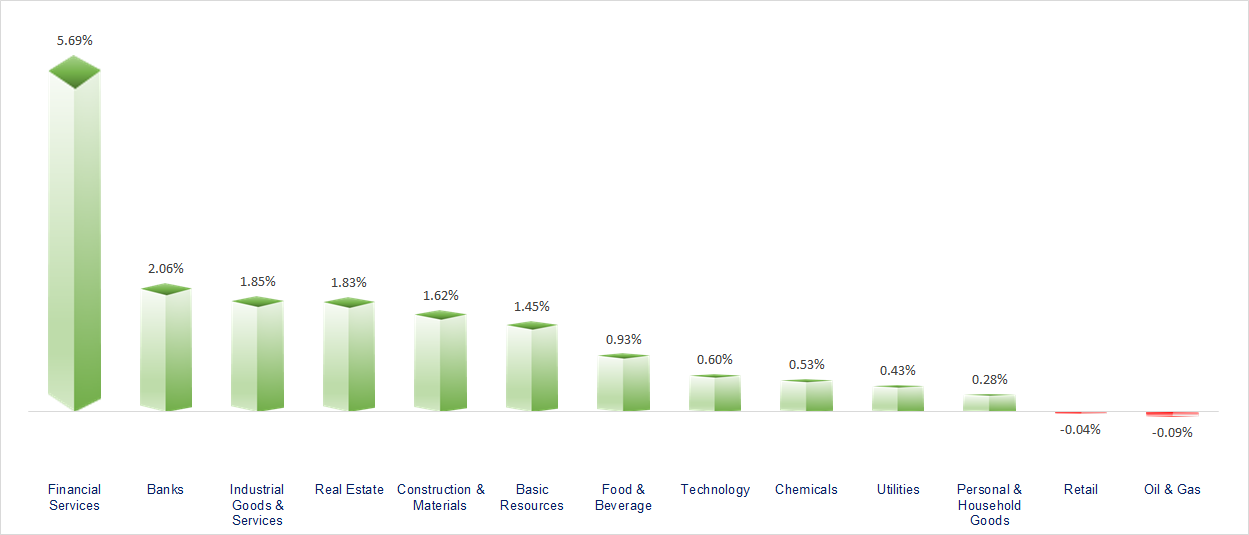

VN-Index officially set a new all-time high today, with an explosive trading value exceeding VND50,000 billion. Securities, Banking, and Real Estate were the most positive sectors during the session. In contrast, Oil & Gas and Retail stocks underperformed.

ETF & DERIVATIVES

29,700

1D 1.96%

YTD 26.49%

20,430

1D 0.89%

YTD 25.49%

21,100

1D 1.44%

YTD 26.35%

25,200

1D 2.11%

YTD 25.37%

29,270

1D 3.94%

YTD 32.44%

36,600

1D 1.27%

YTD 9.19%

22,250

1D 2.77%

YTD 24.16%

1,693

1D 1.20%

YTD 0.00%

1,670

1D 1.32%

YTD 0.00%

1,686

1D 1.04%

YTD 0.00%

1,675

1D 1.27%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,998.27

1D -1.10%

YTD 2.77%

3,597.94

1D 0.12%

YTD 7.34%

25,562.13

1D 0.68%

YTD 27.43%

3,209.52

1D 0.42%

YTD 33.76%

80,871.06

1D -0.73%

YTD 2.92%

4,241.14

1D -0.47%

YTD 11.97%

1,217.15

1D 0.00%

YTD -13.07%

68.26

1D 0.38%

YTD -9.05%

3,337.00

1D -0.35%

YTD 26.64%

Asian stock markets traded mixed amid the newly reached trade agreement between the U.S. and the EU. Specifically, the EU will be subject to a 15% reciprocal tariff imposed by the U.S. Meanwhile, investors are shifting their focus to the upcoming U.S.–China negotiations, expected to begin in Stockholm later today.

VIETNAM ECONOMY

5.88%

1D (bps) -69

YTD (bps) 191

4.60%

2.88%

1D (bps) 5

YTD (bps) 41

3.21%

1D (bps) -4

YTD (bps) 37

26,370

1D (%) 0.19%

YTD (%) 3.21%

31,344

1D (%) -0.40%

YTD (%) 14.96%

3,710

1D (%) 0.13%

YTD (%) 4.18%

U.S. Dollar Index (DXY) has shown a solid rebound of over 0.7% since early July, reaching 98.05 points.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Tomorrow, the Government will meet with leaders of Vinhomes, Novaland, Sunshine Group, and other major corporations to discuss an important matter;

- Money is pouring into the stock market as the VN-Index breaks its historical high, with record-breaking matched order liquidity;

- Vietnamese consumers are spending over VND1.23 trillion (approx. USD48 million) on online shopping every day;

- Ahead of the third round of trade negotiations, the Trump administration unexpectedly took a "softer" approach toward China;

- The Houthi group declared it would target ships linked to Israel;

- Thailand and Cambodia have begun negotiations in Malaysia.

VN30

BANK

62,800

1D 1.29%

5D 2.45%

Buy Vol. 17,926,643

Sell Vol. 15,058,625

39,400

1D 1.42%

5D 3.41%

Buy Vol. 17,632,039

Sell Vol. 16,552,706

45,600

1D 0.00%

5D 0.88%

Buy Vol. 13,654,586

Sell Vol. 14,727,882

35,600

1D 1.14%

5D 0.42%

Buy Vol. 47,500,938

Sell Vol. 47,517,492

25,100

1D 4.37%

5D 12.56%

Buy Vol. 82,124,598

Sell Vol. 74,342,857

28,750

1D 1.05%

5D 6.68%

Buy Vol. 51,672,467

Sell Vol. 34,294,412

28,450

1D 0.71%

5D 16.12%

Buy Vol. 32,373,615

Sell Vol. 38,836,120

16,450

1D 5.45%

5D 8.94%

Buy Vol. 73,384,554

Sell Vol. 59,211,698

49,100

1D 0.61%

5D -0.81%

Buy Vol. 21,708,729

Sell Vol. 21,307,037

18,850

1D 2.45%

5D 8.65%

Buy Vol. 39,031,741

Sell Vol. 40,440,422

23,850

1D 1.06%

5D 4.38%

Buy Vol. 25,848,410

Sell Vol. 24,489,621

16,100

1D 6.98%

5D 10.27%

Buy Vol. 230,227,006

Sell Vol. 178,404,044

21,100

1D 1.93%

5D 6.03%

Buy Vol. 4,700,297

Sell Vol. 4,160,028

36,550

1D 3.69%

5D 2.96%

Buy Vol. 12,619,759

Sell Vol. 9,773,863

During last week (July 21–25), VND interbank interest rates for key tenors continued to rise sharply in most sessions. In addition, the State Bank of Vietnam (SBV) actively supported liquidity for the banking system. Through the Open Market Operation (OMO) channel, the SBV offered a total of VND229 trillion in lending via secured papers with 7-day, 14-day, 28-day, and 91-day maturities, all at an interest rate of 4.0%. This is a sharp increase from VND161 trillion in the previous week. As a result, VND173.701 trillion was successfully bid across all four tenors.

OIL & GAS

68,900

1D 0.29%

5D 2.07%

Buy Vol. 1,841,165

Sell Vol. 2,291,135

37,850

1D -0.66%

5D 2.02%

Buy Vol. 5,348,439

Sell Vol. 5,659,162

GAS: PV Gas plans to spend nearly VND4.92 trillion on 2024 dividend payments to shareholders, with an implementation rate of 21%.

VINGROUP

115,600

1D 1.31%

5D 3.21%

Buy Vol. 5,130,473

Sell Vol. 6,301,404

95,600

1D 2.03%

5D 3.91%

Buy Vol. 11,798,489

Sell Vol. 9,989,881

29,350

1D -0.51%

5D 1.21%

Buy Vol. 6,866,803

Sell Vol. 8,677,762

VIC: Da Nang City has issued Notice No. 1193/SXD-QLN, confirming that Vinpearl JSC – a member of Vingroup – is eligible to mobilize capital for developing residential housing at the Lang Van Tourism.

FOOD & BEVERAGE

63,300

1D 0.16%

5D 5.50%

Buy Vol. 12,726,475

Sell Vol. 13,836,989

77,600

1D 2.37%

5D 0.13%

Buy Vol. 18,420,985

Sell Vol. 17,463,757

49,300

1D 0.41%

5D 3.35%

Buy Vol. 4,099,191

Sell Vol. 4,350,812

MSN: Masan reported net profit of VND1.619 trillion for Q2 and VND2.602 trillion for the first half of 2025, up more than 80% year-on-year, surpassing 50% of its full-year target.

OTHERS

69,700

1D -0.14%

5D 4.34%

Buy Vol. 2,041,256

Sell Vol. 1,943,722

52,200

1D 0.38%

5D 0.58%

Buy Vol. 1,580,307

Sell Vol. 1,211,629

127,000

1D 4.18%

5D 33.54%

Buy Vol. 4,194,450

Sell Vol. 5,142,085

111,300

1D 0.54%

5D 0.91%

Buy Vol. 12,330,009

Sell Vol. 11,241,583

70,200

1D 0.14%

5D 1.73%

Buy Vol. 13,947,194

Sell Vol. 14,821,776

31,400

1D 0.64%

5D 2.61%

Buy Vol. 14,833,859

Sell Vol. 13,635,119

35,800

1D 5.29%

5D 14.19%

Buy Vol. 64,129,483

Sell Vol. 68,667,200

26,350

1D 1.15%

5D 0.57%

Buy Vol. 159,976,329

Sell Vol. 143,258,735

HPG: European Union has officially imposed two separate tariffs on coated steel products from China, including anti-dumping and countervailing duties. The rates vary by company: Union Steel China received the most favorable treatment, with a countervailing duty of 13.7% and full exemption from anti-dumping duties. In contrast, Zhangjiagang Panhua Steel Strip Co. faces the heaviest penalties, with a 29.7% countervailing duty and a 26.1% anti-dumping duty. Most other Chinese firms will be subject to a 26.8% countervailing duty and a 16.2% anti-dumping duty.

Market by numbers

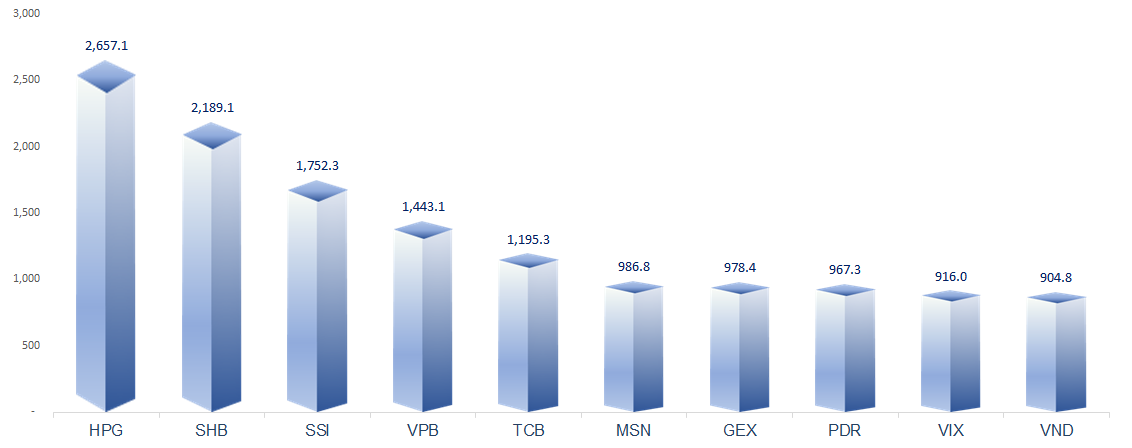

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

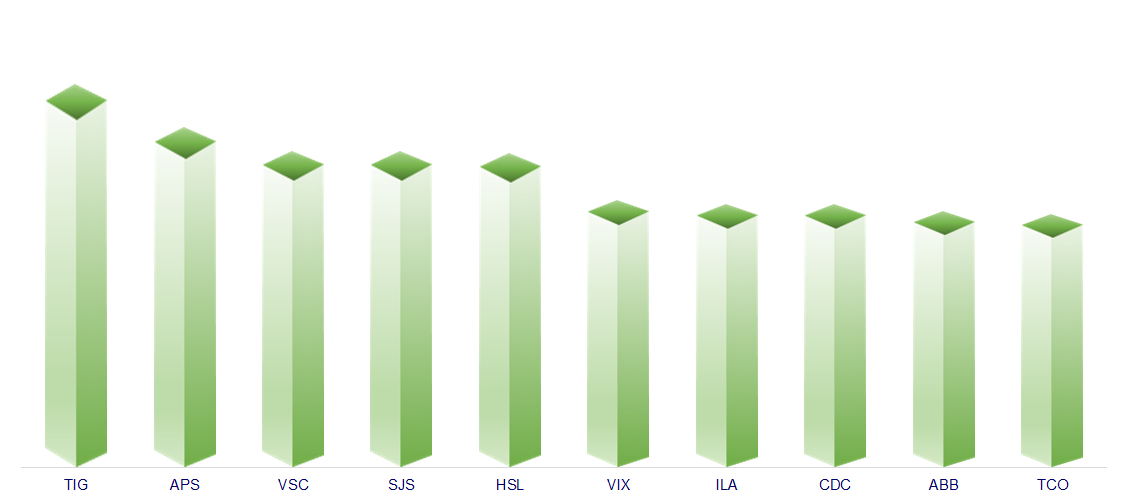

TOP INCREASES 3 CONSECUTIVE SESSIONS

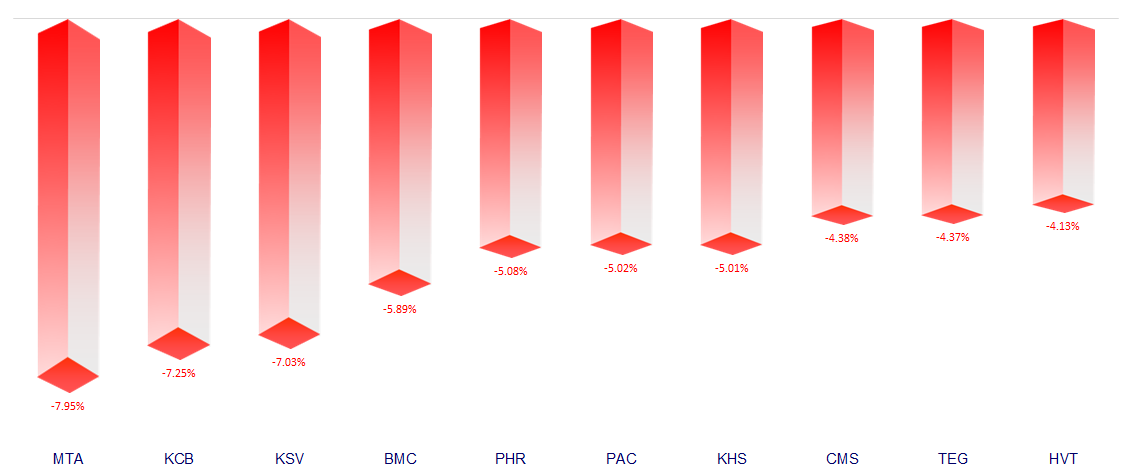

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.