Market brief 30/07/2025

VIETNAM STOCK MARKET

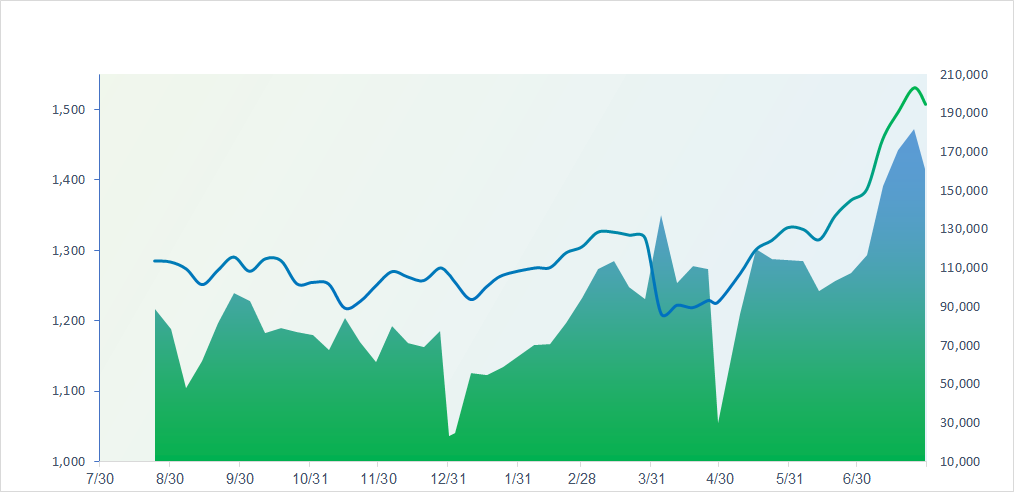

1,507.63

1D 0.95%

YTD 19.01%

261.51

1D 2.41%

YTD 14.98%

1,630.78

1D 0.59%

YTD 21.27%

105.11

1D -0.91%

YTD 10.57%

1,600.83

1D 0.00%

YTD 0.00%

46,828.00

1D -41.63%

YTD 158.28%

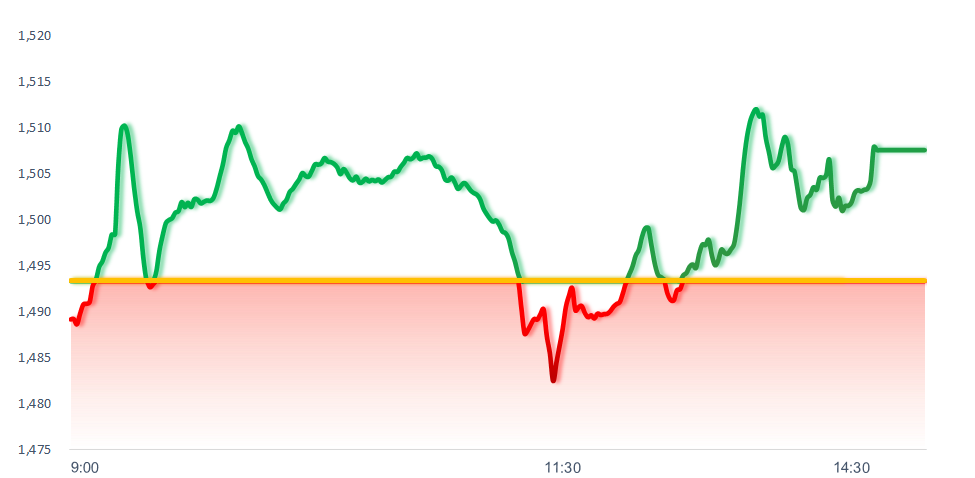

VN-Index rebounded today with liquidity reaching nearly USD1.8 billion. Securities, Banking, and Chemicals were the standout sectors driving the recovery. In contrast, Real Estate and F&B underperformed during the session.

ETF & DERIVATIVES

28,790

1D -0.03%

YTD 22.61%

19,840

1D 1.22%

YTD 21.87%

20,890

1D 1.16%

YTD 25.09%

24,290

1D -0.37%

YTD 20.85%

28,000

1D -0.88%

YTD 26.70%

34,850

1D -2.22%

YTD 3.97%

21,570

1D 0.79%

YTD 20.37%

1,623

1D 0.14%

YTD 0.00%

1,616

1D 0.38%

YTD 0.00%

1,612

1D -0.56%

YTD 0.00%

1,620

1D 0.32%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,654.70

1D -0.05%

YTD 1.91%

3,615.72

1D 0.17%

YTD 7.88%

25,176.93

1D -1.36%

YTD 25.51%

3,254.47

1D 0.74%

YTD 35.63%

81,535.52

1D 0.24%

YTD 3.77%

4,217.93

1D -0.27%

YTD 11.36%

1,243.21

1D 0.77%

YTD -11.21%

71.75

1D 3.18%

YTD -4.40%

3,332.60

1D 0.59%

YTD 26.47%

Asian stock markets showed mixed movements today as investors await the upcoming FED policy meeting. The Nikkei 225 declined amid expectations that the Bank of Japan will keep interest rates unchanged this Thursday.

VIETNAM ECONOMY

3.68%

1D (bps) -74

YTD (bps) -29

4.60%

2.91%

1D (bps) 4

YTD (bps) 43

3.24%

1D (bps) 2

YTD (bps) 39

26,400

1D (%) 0.00%

YTD (%) 3.32%

31,094

1D (%) -0.29%

YTD (%) 14.04%

3,712

1D (%) -0.02%

YTD (%) 4.24%

The central exchange rate announced by the State Bank of Vietnam on the morning of July 30 rose by VND22 to 25,228 VND/USD, marking the highest level on record.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Air travel surges, pushing airlines to operate beyond capacity;

- Ho Chi Minh City People’s Committee orders inspections of delayed construction projects;

- A major Vietnamese project worth over VND9,000 billion is approaching a key milestone, with construction time halved and manpower doubled;

- While the Fed may not cut interest rates, this week’s meeting remains highly anticipated due to a series of critical developments;

- New signals emerge regarding Trump’s tariff stance as the deadline approaches;

- IMF raises its growth forecast for emerging and developing economies.

VN30

BANK

60,900

1D -0.16%

5D -1.93%

Buy Vol. 13,321,862

Sell Vol. 10,615,807

38,100

1D 1.87%

5D -1.55%

Buy Vol. 16,199,731

Sell Vol. 14,916,029

46,200

1D 5.48%

5D 1.20%

Buy Vol. 32,430,076

Sell Vol. 31,046,429

34,500

1D 1.77%

5D -1.43%

Buy Vol. 51,548,615

Sell Vol. 41,041,149

25,250

1D 6.99%

5D 8.14%

Buy Vol. 150,451,330

Sell Vol. 102,652,321

27,400

1D 2.05%

5D 0.00%

Buy Vol. 71,631,425

Sell Vol. 44,761,574

26,650

1D 0.57%

5D 0.57%

Buy Vol. 32,699,524

Sell Vol. 27,765,839

15,900

1D 3.92%

5D 3.25%

Buy Vol. 55,318,661

Sell Vol. 44,847,119

49,300

1D 2.71%

5D 1.23%

Buy Vol. 30,238,171

Sell Vol. 28,420,272

19,350

1D 4.31%

5D 8.71%

Buy Vol. 57,093,172

Sell Vol. 46,730,309

23,000

1D 1.10%

5D 0.00%

Buy Vol. 31,086,821

Sell Vol. 21,892,455

16,100

1D 6.98%

5D 9.90%

Buy Vol. 259,373,780

Sell Vol. 173,410,986

19,250

1D -3.27%

5D -3.02%

Buy Vol. 3,774,846

Sell Vol. 4,781,659

34,200

1D -0.29%

5D -2.98%

Buy Vol. 5,885,356

Sell Vol. 5,770,218

SHB: Saigon - Hanoi Commercial Joint Stock Bank (SHB) has just announced its business results for the first half of the year, with many financial indicators showing strong growth. In particular, pre-tax profit in Q2 exceeded VND4,500 billion, up 59% compared to the same period last year. As a result, SHB recorded a cumulative pre-tax profit of over VND8,900 billion in the first six months, up 30% year-on-year and fulfilling 61% of its annual target — reflecting the bank’s sustainable growth momentum and efficient operations.

OIL & GAS

67,900

1D -0.15%

5D -1.59%

Buy Vol. 1,487,999

Sell Vol. 1,588,279

36,300

1D -0.55%

5D -2.55%

Buy Vol. 4,817,358

Sell Vol. 4,273,617

Global crude oil prices surged more than 3% since yesterday following U.S. pressure on Russia to end the conflict in Ukraine soon.

VINGROUP

109,500

1D -3.27%

5D -4.78%

Buy Vol. 6,386,322

Sell Vol. 6,668,820

91,500

1D -0.65%

5D -0.76%

Buy Vol. 7,925,151

Sell Vol. 8,036,008

28,100

1D 0.36%

5D -3.93%

Buy Vol. 9,443,722

Sell Vol. 8,218,247

VHM: Vinhomes JSC has just released its Q2/2025 consolidated financial report, showing a net profit of VND11,000 billion for the first half of the year, with cash reserves up 69%.

FOOD & BEVERAGE

62,900

1D -0.47%

5D 1.94%

Buy Vol. 8,428,691

Sell Vol. 10,331,176

73,000

1D 1.11%

5D -5.56%

Buy Vol. 15,269,416

Sell Vol. 13,399,822

47,600

1D 0.53%

5D -2.06%

Buy Vol. 3,040,269

Sell Vol. 3,039,857

MWG: Mobile World Investment Corporation has just reported its Q2/2025 financials, with net revenue reaching VND37,620 billion, up over 10% YoY, and a record-breaking net profit of VND1,657.5 billion, up more than 41%.

OTHERS

69,000

1D 1.32%

5D -0.29%

Buy Vol. 900,932

Sell Vol. 943,808

49,550

1D -0.10%

5D -5.44%

Buy Vol. 1,319,842

Sell Vol. 936,397

118,700

1D 0.34%

5D 9.10%

Buy Vol. 3,825,321

Sell Vol. 3,248,029

106,100

1D 0.09%

5D -5.10%

Buy Vol. 12,406,573

Sell Vol. 9,752,264

67,100

1D 0.75%

5D -3.45%

Buy Vol. 19,386,195

Sell Vol. 20,472,198

29,500

1D 0.00%

5D -4.99%

Buy Vol. 7,880,512

Sell Vol. 7,571,972

33,900

1D 1.80%

5D 5.12%

Buy Vol. 101,173,489

Sell Vol. 96,681,327

25,400

1D 0.20%

5D -3.79%

Buy Vol. 86,536,579

Sell Vol. 86,011,731

FPT: Proprietary trading desks net bought FPT heavily yesterday, with a total value exceeding VND230 billion.

Market by numbers

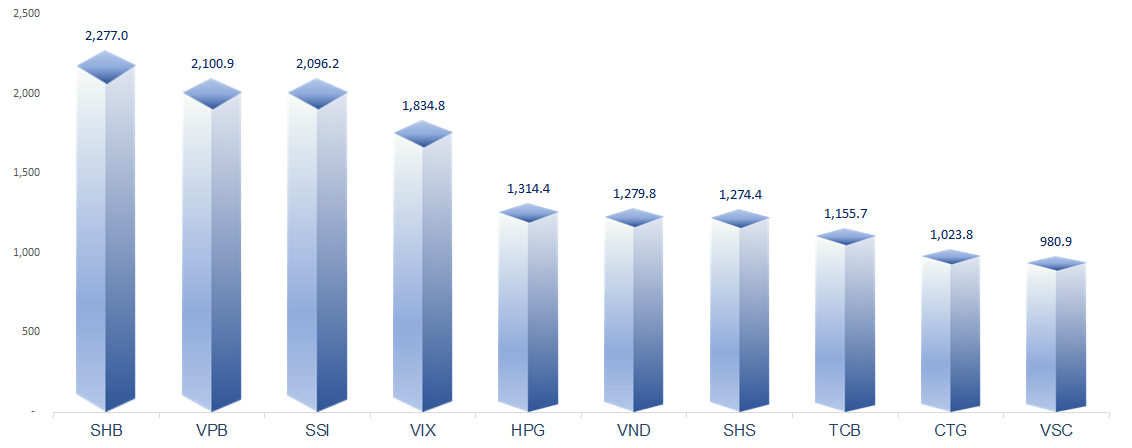

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

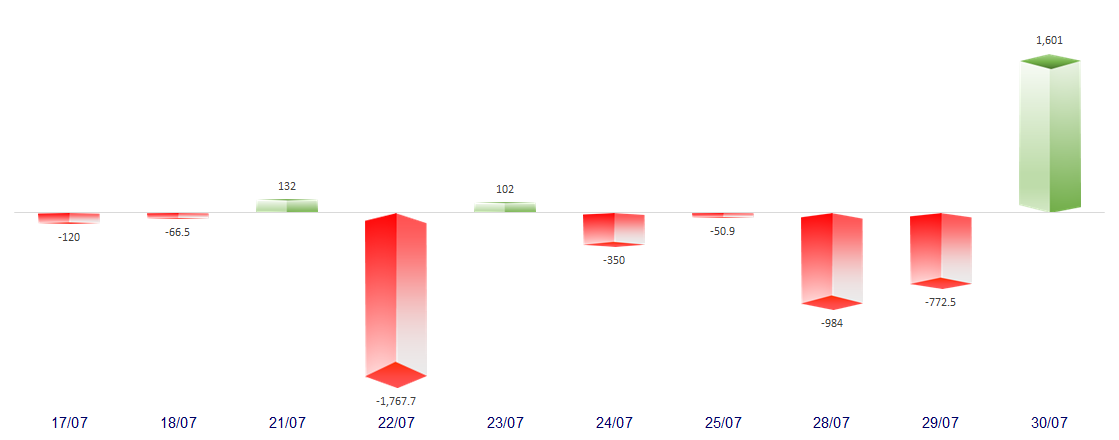

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

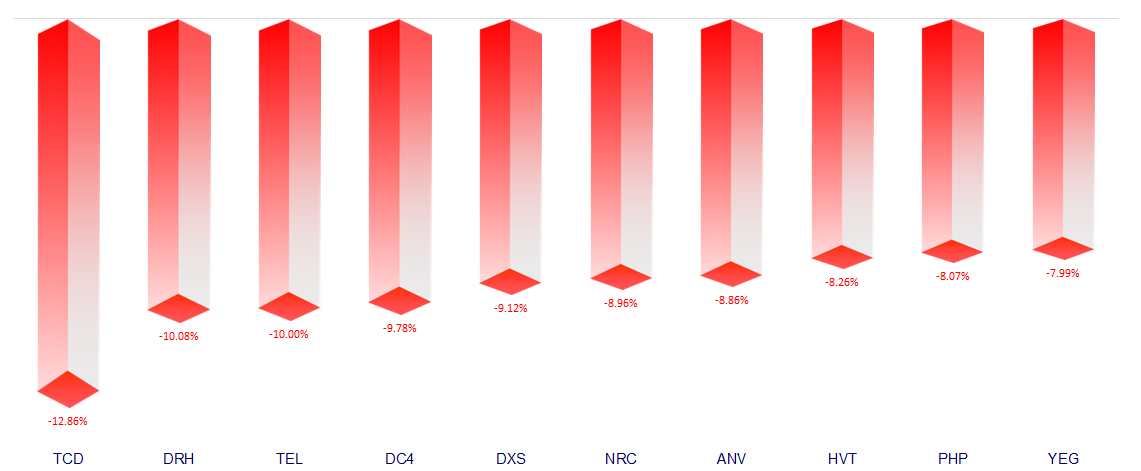

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.